Market brief 18/08/2025

VIETNAM STOCK MARKET

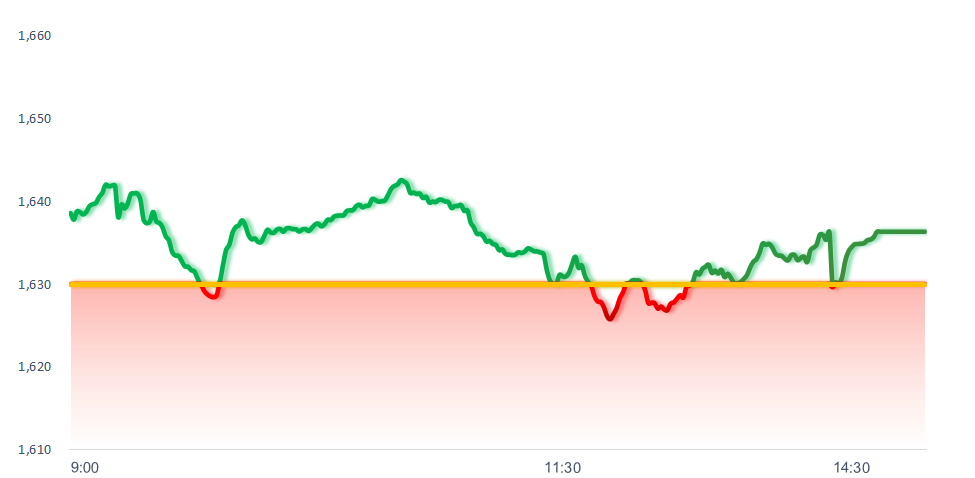

1,636.37

1D 0.39%

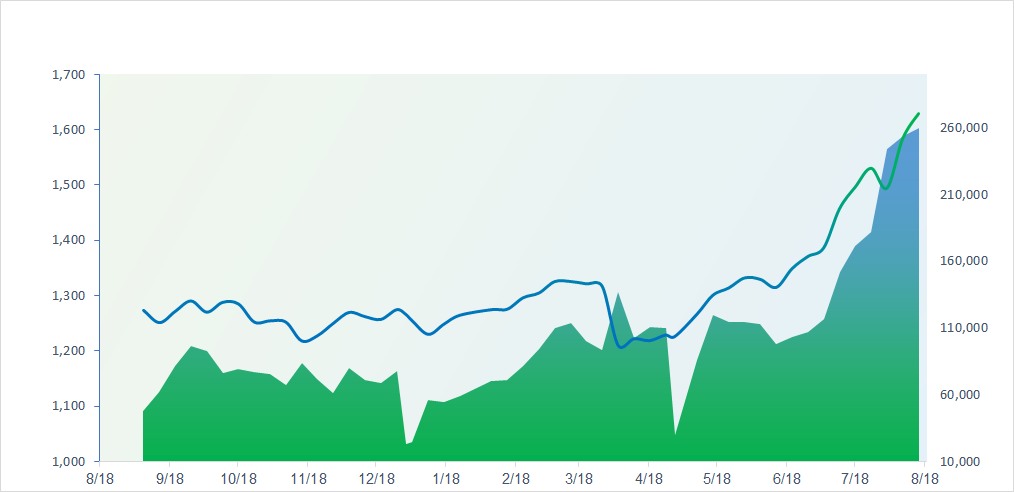

YTD 29.18%

283.87

1D 0.54%

YTD 24.82%

1,786.37

1D 0.17%

YTD 32.84%

108.97

1D -0.58%

YTD 14.63%

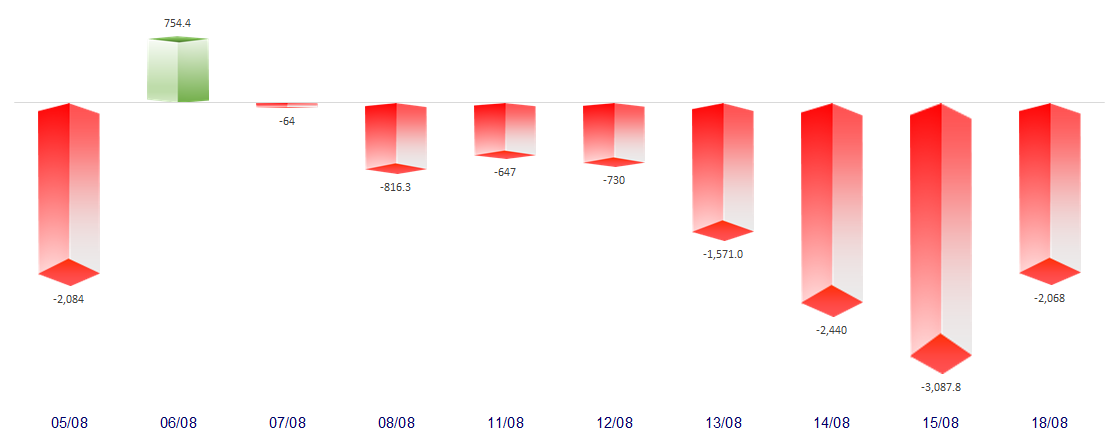

-2,068.28

1D 0.00%

YTD 0.00%

49,697.00

1D -24.67%

YTD 174.10%

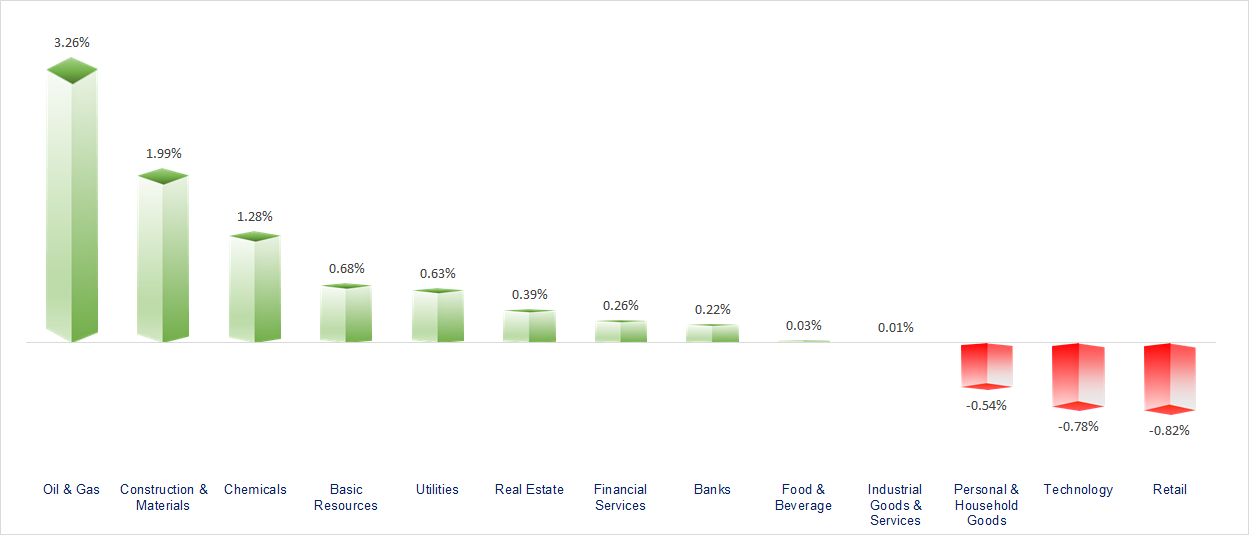

VN-Index rebounded today despite continued net selling of more than VND2,000 billion by foreign investors. Oil & Gas, Construction, and Chemicals were the leading gainers, while Retail and Technology stocks remained sluggish.

ETF & DERIVATIVES

31,400

1D -0.32%

YTD 33.73%

21,650

1D 0.19%

YTD 32.99%

22,470

1D 0.31%

YTD 34.55%

26,900

1D -0.22%

YTD 33.83%

33,000

1D 0.46%

YTD 49.32%

38,500

1D -0.93%

YTD 14.86%

24,110

1D 0.00%

YTD 34.54%

1,781

1D -0.03%

YTD 0.00%

1,759

1D 0.21%

YTD 0.00%

1,778

1D 0.20%

YTD 0.00%

1,760

1D 0.06%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

43,714.31

1D 0.77%

YTD 9.57%

3,728.03

1D 0.85%

YTD 11.23%

25,176.85

1D -0.37%

YTD 25.51%

3,177.28

1D -1.50%

YTD 32.41%

81,273.75

1D 0.84%

YTD 3.43%

4,187.38

1D -1.02%

YTD 10.55%

1,242.31

1D -1.36%

YTD -11.28%

65.92

1D 0.11%

YTD -12.17%

3,349.00

1D 0.41%

YTD 27.09%

Asian stock markets ended mixed. Japan’s Nikkei extended last week’s rally, closing up 0.77% at a record high, boosted by a weaker yen that lifted auto stocks such as Toyota and Honda. In contrast, South Korea’s Kospi fell more than 1.5% to around 3,177 points.

VIETNAM ECONOMY

4.50%

1D (bps) -6

YTD (bps) 53

4.60%

2.93%

1D (bps) -4

YTD (bps) 46

3.40%

1D (bps) 8

YTD (bps) 55

26,470

1D (%) 0.08%

YTD (%) 3.60%

31,547

1D (%) 0.22%

YTD (%) 15.70%

3,718

1D (%) 0.04%

YTD (%) 4.42%

The domestic gold market turned vibrant again after a quiet weekend. Gold bars unexpectedly hit a new record, officially reaching 125 million VND/tael, while plain gold rings and jewelry rebounded strongly with gains ranging from 200,000 to 400,000 VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hanoi inaugurates and breaks ground on 10 infrastructure projects;

- The Ministry of Home Affairs proposes salary classification for newly recruited civil servants;

- Vietnam’s shrimp exports to the U.S. fell 29% in July;

- Fed Chair may “disappoint” Wall Street at the Jackson Hole event;

- President Zelensky insists on no “territorial concessions,” while the U.S. Secretary of State issues a sharp warning;

- U.S.–EU trade deal “stalled” due to digital regulations.

VN30

BANK

64,500

1D 0.31%

5D 3.20%

Buy Vol. 12,373,267

Sell Vol. 13,703,408

40,800

1D -0.49%

5D 1.49%

Buy Vol. 12,258,106

Sell Vol. 12,876,024

48,500

1D -1.02%

5D 2.11%

Buy Vol. 19,592,364

Sell Vol. 17,249,431

37,950

1D 0.93%

5D 0.53%

Buy Vol. 36,900,022

Sell Vol. 38,818,527

32,000

1D 2.89%

5D 8.11%

Buy Vol. 78,173,767

Sell Vol. 61,941,149

27,800

1D -1.59%

5D 16.47%

Buy Vol. 88,670,534

Sell Vol. 77,363,191

30,500

1D -1.61%

5D 9.32%

Buy Vol. 38,051,116

Sell Vol. 38,411,004

20,150

1D 3.33%

5D 3.07%

Buy Vol. 85,144,433

Sell Vol. 102,226,914

52,800

1D -2.04%

5D -1.68%

Buy Vol. 18,358,891

Sell Vol. 20,294,188

20,100

1D -1.23%

5D -0.99%

Buy Vol. 15,109,399

Sell Vol. 18,357,068

27,050

1D 1.88%

5D 10.86%

Buy Vol. 44,614,810

Sell Vol. 41,253,138

18,850

1D 2.16%

5D 11.52%

Buy Vol. 174,530,056

Sell Vol. 329,023,594

20,600

1D -0.24%

5D 0.49%

Buy Vol. 11,932,299

Sell Vol. 11,985,756

40,100

1D 2.82%

5D 12.01%

Buy Vol. 9,083,272

Sell Vol. 6,249,410

TCB: The IPO shares of TCBS (Techcom Securities JSC) will officially be offered for sale starting at 8:00 AM tomorrow and closing at 4:00 PM on September 8, 2025.

OIL & GAS

70,000

1D 0.43%

5D -0.57%

Buy Vol. 2,156,500

Sell Vol. 3,264,311

38,800

1D 0.78%

5D 2.24%

Buy Vol. 4,556,985

Sell Vol. 7,723,669

Global crude oil prices fell more than 1% after the U.S.–Russia summit, returning to 65.92 USD/barrel.

VINGROUP

118,200

1D 0.00%

5D 2.34%

Buy Vol. 4,652,913

Sell Vol. 6,111,049

93,900

1D -0.11%

5D 0.43%

Buy Vol. 5,634,598

Sell Vol. 7,236,282

29,950

1D -1.16%

5D 2.04%

Buy Vol. 7,296,413

Sell Vol. 9,664,102

On August 15, Vinhomes issued two bond tranches, codes VHM12501 and VHM12502, with a total value of VND15 trillion. Both tranches were issued and completed on the same day, carrying a fixed interest rate of 11% per year.

FOOD & BEVERAGE

60,700

1D -0.49%

5D -1.30%

Buy Vol. 7,415,814

Sell Vol. 8,485,643

83,900

1D 0.96%

5D 2.32%

Buy Vol. 16,507,373

Sell Vol. 14,315,270

47,150

1D -0.74%

5D -2.18%

Buy Vol. 1,644,894

Sell Vol. 1,937,554

SAB: Sabeco has faced continuous net selling by foreign investors, totaling more than VND110 billion over the past 10 sessions.

OTHERS

70,000

1D -0.28%

5D -0.99%

Buy Vol. 634,632

Sell Vol. 929,514

103,400

1D -0.19%

5D -2.73%

Buy Vol. 3,605,077

Sell Vol. 4,263,480

142,400

1D -2.20%

5D 14.84%

Buy Vol. 2,514,772

Sell Vol. 3,266,826

100,500

1D -0.89%

5D -5.55%

Buy Vol. 20,414,242

Sell Vol. 16,658,934

70,000

1D -0.71%

5D -2.91%

Buy Vol. 11,743,667

Sell Vol. 13,106,998

31,750

1D 1.11%

5D -2.61%

Buy Vol. 7,244,770

Sell Vol. 10,178,288

35,800

1D -2.05%

5D -4.53%

Buy Vol. 67,390,474

Sell Vol. 75,876,750

28,400

1D 1.43%

5D 0.89%

Buy Vol. 146,731,450

Sell Vol. 162,760,319

FPT: In MSCI’s August restructuring, FPT shares are expected to be newly added to the MSCI Frontier Market Index.

Market by numbers

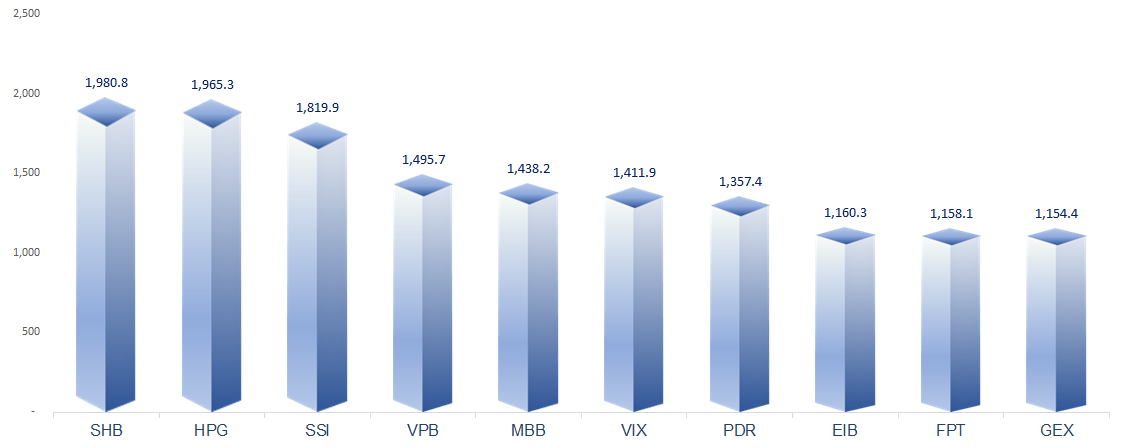

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

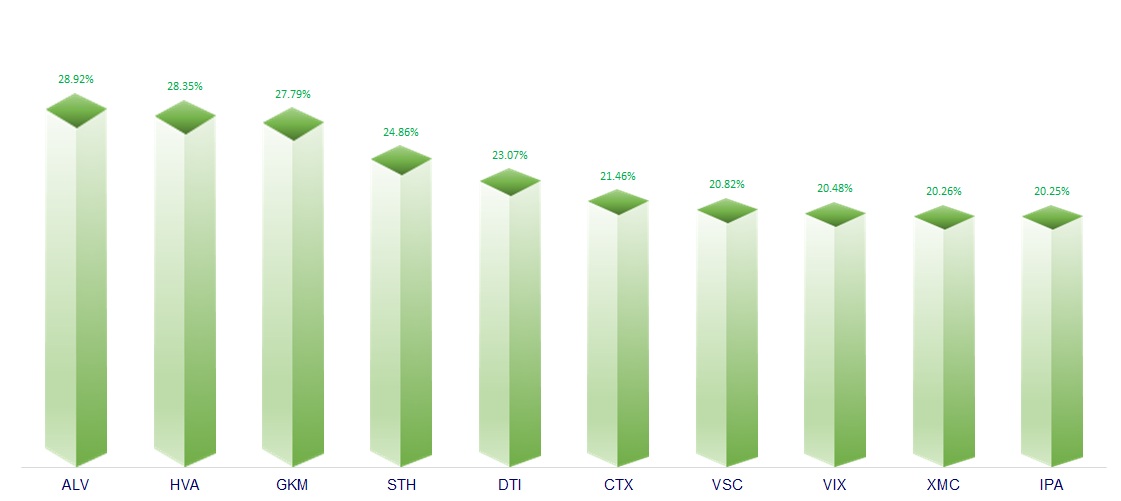

TOP INCREASES 3 CONSECUTIVE SESSIONS

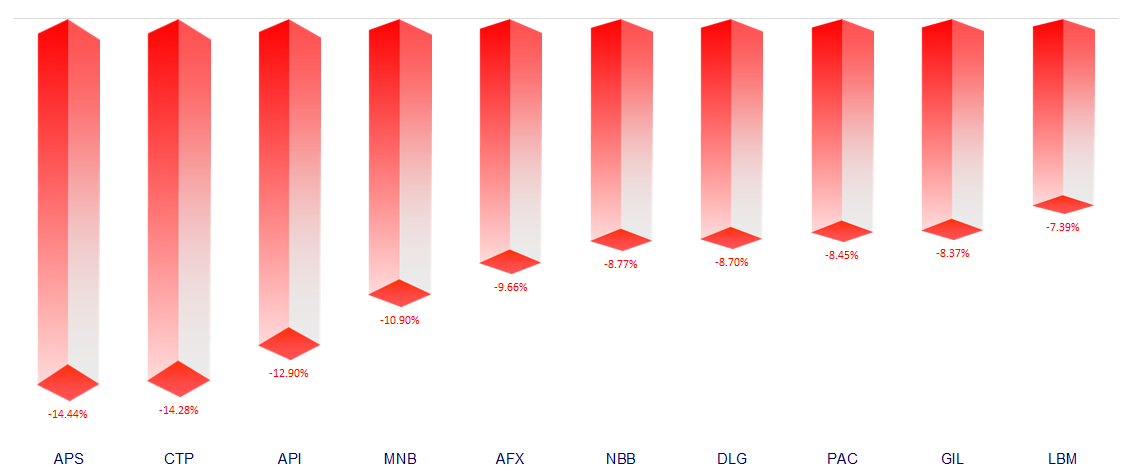

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.