Market brief 25/08/2025

VIETNAM STOCK MARKET

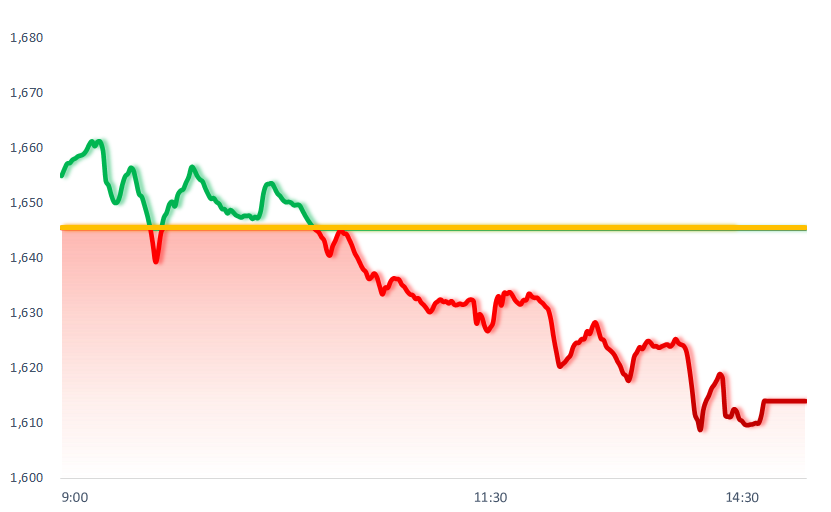

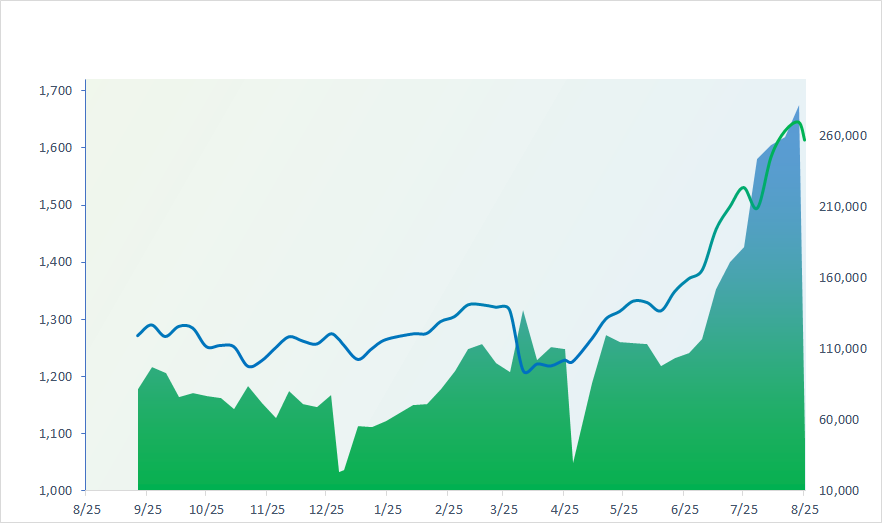

1,614.03

1D -1.91%

YTD 27.41%

266.58

1D -2.17%

YTD 17.21%

1,783.12

1D -1.70%

YTD 32.60%

108.58

1D -0.62%

YTD 14.22%

-1,788.23

1D 0.00%

YTD 0.00%

46,052.58

1D -32.96%

YTD 154.00%

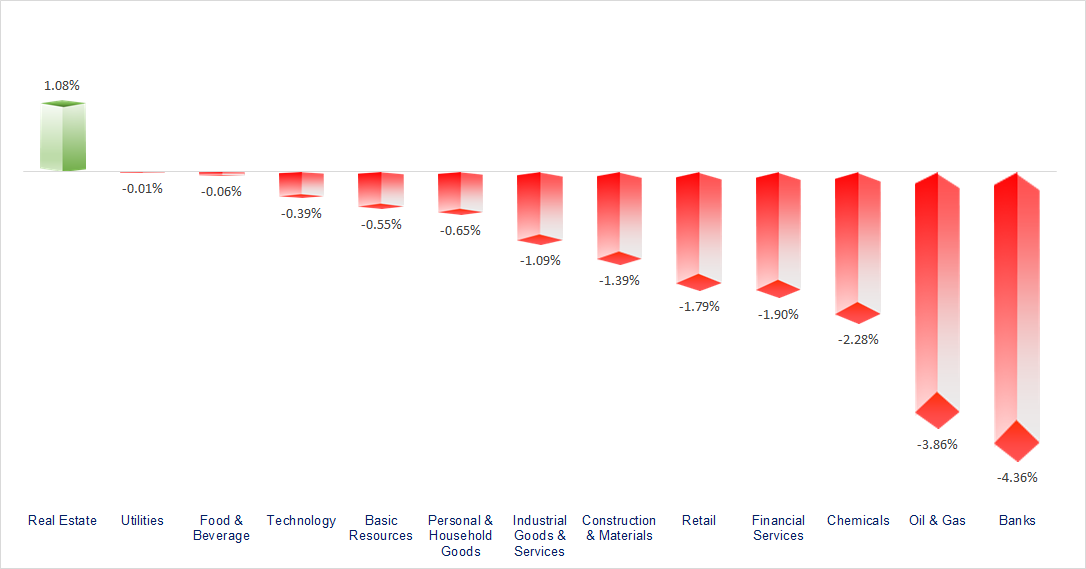

VN-Index posted a second consecutive sharp decline, pressured by the banking sector as many bank stocks hit their floor prices. Most sectors closed lower today, except for the Vingroup-related group and the insurance sector, which showed relatively positive performance.

ETF & DERIVATIVES

31,750

1D -1.24%

YTD 35.22%

21,680

1D -2.34%

YTD 33.17%

22,700

1D -0.44%

YTD 35.93%

27,010

1D -3.54%

YTD 34.38%

32,890

1D -3.55%

YTD 48.82%

37,650

1D -3.46%

YTD 12.32%

24,400

1D -2.01%

YTD 36.16%

1,775

1D -1.55%

YTD 0.00%

1,783

1D -1.22%

YTD 0.00%

1,773

1D -1.24%

YTD 0.00%

1,766

1D -1.34%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

42,807.82

1D 0.41%

YTD 7.30%

3,883.56

1D 1.51%

YTD 15.87%

25,829.91

1D 1.94%

YTD 28.77%

3,209.86

1D 1.30%

YTD 33.77%

81,651.31

1D 0.42%

YTD 3.92%

4,256.49

1D 0.08%

YTD 12.38%

1,262.67

1D 0.74%

YTD -9.82%

67.62

1D 0.61%

YTD -9.90%

3,367.84

1D 0.08%

YTD 27.81%

Asian markets also rallied strongly as investors welcomed signs that the Fed may start cutting interest rates. Notably, South Korea’s Kospi rose 1.3%, fueled by optimism ahead of the summit between President Lee Jae Myung and U.S. President Donald Trump, taking place today in Washington.

VIETNAM ECONOMY

4.92%

1D (bps) -4

YTD (bps) 95

4.60%

2.96%

1D (bps) -4

YTD (bps) 48

3.43%

1D (bps) 8

YTD (bps) 58

26,480

1D (%) -0.26%

YTD (%) 3.64%

31,548

1D (%) 0.56%

YTD (%) 15.70%

3,728

1D (%) -0.12%

YTD (%) 4.69%

On August 25, USD exchange rates at commercial banks dropped below VND26,500 after the State Bank of Vietnam (SBV) began offering 180-day, cancellable forward FX sales at a rate of 26,550 VND/USD. In total, participating banks are expected to purchase forward USD contracts worth over USD800 million.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- FDI inflows into Ho Chi Minh City surged following recent mergers;

- Vietnam’s economy after 40 years of reform: A remarkable growth journey;

- Infrastructure push: Multiple projects launched to improve connectivity between HCMC and Long Thanh Airport;

- President Trump’s policy moves ahead of the midterm elections;

- China risk alert: Asset bubble concerns grow as its stock market and economy diverge;

- Tariffs seen as a short-term “painkiller” for the U.S. federal budget.

VN30

BANK

63,600

1D -1.55%

5D -1.40%

Buy Vol. 11,070,617

Sell Vol. 14,414,425

41,000

1D -5.20%

5D 0.49%

Buy Vol. 16,618,351

Sell Vol. 18,492,357

49,100

1D -3.54%

5D 1.24%

Buy Vol. 21,238,351

Sell Vol. 23,846,239

37,550

1D -3.72%

5D -1.05%

Buy Vol. 54,379,843

Sell Vol. 53,715,812

33,500

1D -6.82%

5D 4.69%

Buy Vol. 83,679,926

Sell Vol. 92,665,599

26,200

1D -2.60%

5D -5.76%

Buy Vol. 95,288,409

Sell Vol. 76,441,516

31,300

1D -3.25%

5D 2.62%

Buy Vol. 31,386,464

Sell Vol. 32,003,480

20,100

1D -6.94%

5D -0.25%

Buy Vol. 78,938,729

Sell Vol. 101,238,694

53,000

1D -4.50%

5D 0.38%

Buy Vol. 27,746,225

Sell Vol. 35,311,040

21,950

1D -6.99%

5D 9.20%

Buy Vol. 49,957,768

Sell Vol. 62,070,140

26,200

1D -5.92%

5D -3.14%

Buy Vol. 46,228,179

Sell Vol. 54,305,132

16,300

1D -5.51%

5D -13.53%

Buy Vol. 179,160,979

Sell Vol. 182,279,866

20,750

1D -6.11%

5D 0.73%

Buy Vol. 6,835,772

Sell Vol. 7,417,678

45,000

1D -4.26%

5D 12.22%

Buy Vol. 8,275,103

Sell Vol. 7,854,064

MBB: Military Commercial Joint Stock Bank (MBB) has announced an increase in its number of voting shares from 6.1 billion to nearly 8.05 billion units, thereby raising its charter capital to VND80.55 trillion. Previously, the bank issued more than 1.95 billion shares as a 32% stock dividend to 115,707 existing shareholders (i.e., shareholders received 32 new shares for every 100 shares held on the record date). The capital for this issuance was sourced from MBB’s undistributed retained earnings from 2024.

OIL & GAS

68,700

1D 1.03%

5D -1.86%

Buy Vol. 1,621,276

Sell Vol. 2,045,972

35,850

1D -0.28%

5D -7.60%

Buy Vol. 3,414,937

Sell Vol. 3,098,217

Oil prices rose on Monday amid fears of Russian supply disruptions from U.S. sanctions and Ukrainian attacks.

VINGROUP

131,000

1D 5.56%

5D 10.83%

Buy Vol. 5,560,301

Sell Vol. 6,038,646

98,400

1D 0.31%

5D 4.79%

Buy Vol. 7,338,005

Sell Vol. 9,120,408

30,000

1D 0.00%

5D 0.17%

Buy Vol. 8,944,035

Sell Vol. 11,008,037

VIC: VIC stock surged over 5.5%, officially reaching a new all-time high.

FOOD & BEVERAGE

58,700

1D 0.00%

5D -3.29%

Buy Vol. 4,872,200

Sell Vol. 5,392,501

79,500

1D -1.85%

5D -5.24%

Buy Vol. 19,881,076

Sell Vol. 19,277,421

45,600

1D -0.44%

5D -3.29%

Buy Vol. 1,689,576

Sell Vol. 1,679,574

MSN: Foreign investors net bought over VND44 billion in MSN today.

OTHERS

65,000

1D -2.26%

5D -7.14%

Buy Vol. 682,369

Sell Vol. 742,384

97,000

1D -1.82%

5D -6.19%

Buy Vol. 3,470,436

Sell Vol. 3,046,365

142,500

1D 1.79%

5D 0.07%

Buy Vol. 3,444,392

Sell Vol. 3,246,339

98,800

1D -0.20%

5D -1.69%

Buy Vol. 11,031,849

Sell Vol. 13,994,513

68,800

1D -2.13%

5D -1.71%

Buy Vol. 10,211,324

Sell Vol. 10,940,568

28,400

1D -3.73%

5D -10.55%

Buy Vol. 7,054,658

Sell Vol. 7,256,627

36,650

1D 2.52%

5D 2.37%

Buy Vol. 110,166,025

Sell Vol. 101,479,282

25,950

1D -0.19%

5D -8.63%

Buy Vol. 109,093,685

Sell Vol. 98,813,875

FPT: On August 24, FPT Corporation inaugurated a new education complex in An Van Duong urban area (Hue City), designed for 20,000 learners, and welcomed its first students for the 2025–2026 school year.

Market by numbers

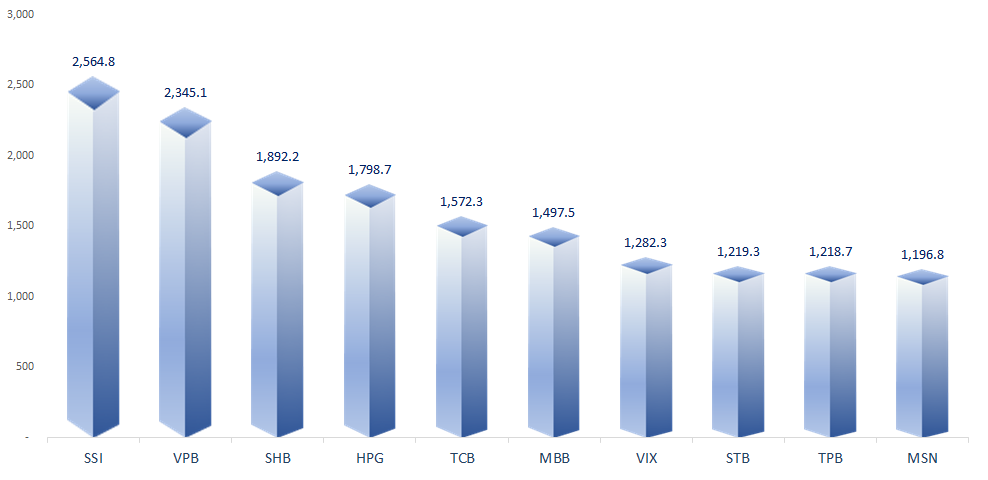

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

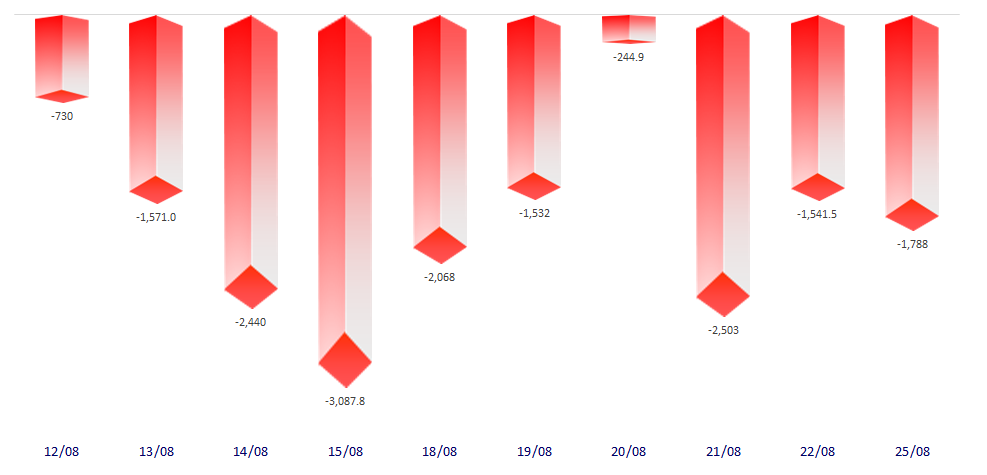

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

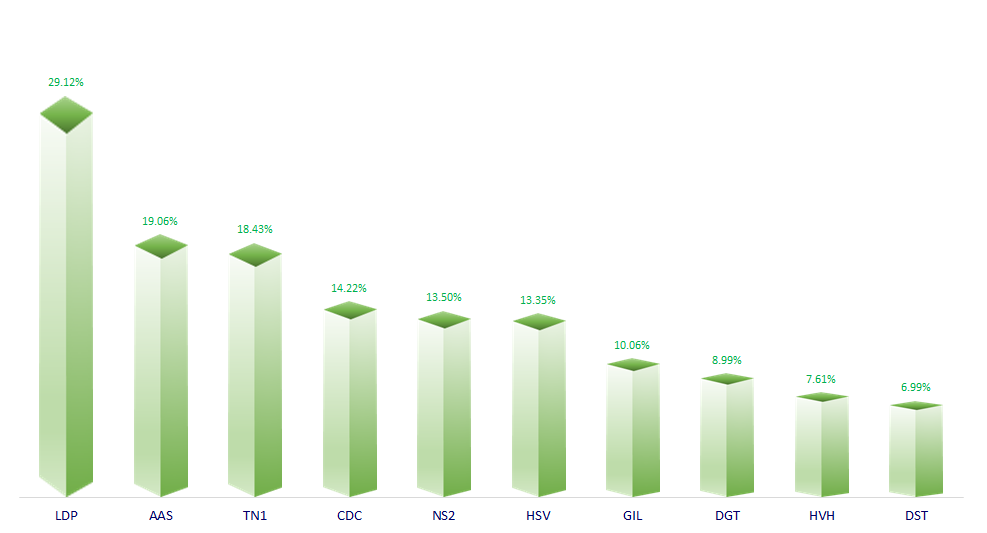

TOP INCREASES 3 CONSECUTIVE SESSIONS

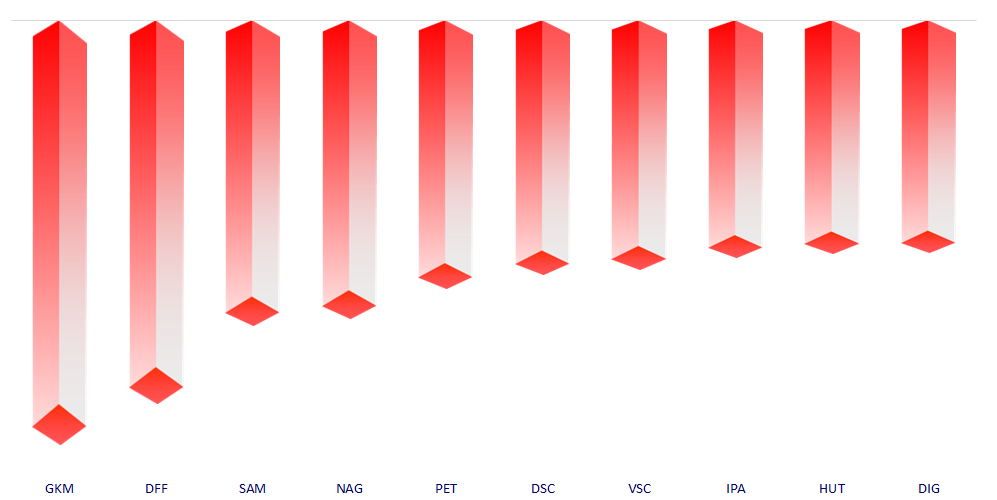

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.