Morning brief 18/09/2025

GLOBAL MARKET

46,018.32

1D 0.57%

YTD 8.17%

6,600.43

1D -0.10%

YTD 12.22%

22,261.33

1D -0.33%

YTD 15.28%

15.72

1D -3.91%

9,208.37

1D 0.14%

YTD 12.67%

23,359.18

1D 0.13%

YTD 17.33%

7,786.98

1D -0.40%

YTD 5.50%

67.69

1D -0.46%

YTD -9.81%

3,659.00

1D -0.19%

YTD 38.86%

Dow Jones Index gained while the S&P 500 slipped slightly in a volatile session on Wednesday (Sept 17), after the U.S. Federal Reserve cut interest rates as expected. Fed Chair Jerome Powell cooled market excitement by signaling that this move was not the beginning of a long-term rate-cutting cycle. Tech stocks, which had risen strongly earlier, led the declines as investors took profits. Shares of Nvidia, Oracle, Palantir, and Broadcom all fell.

VIETNAM ECONOMY

4.59%

1D (bps) 10

YTD (bps) 62

4.60%

3.12%

1D (bps) 2

YTD (bps) 64

3.46%

1D (bps) -9

YTD (bps) 62

26,457

1D (%) -0.04%

YTD (%) 3.55%

32,073

1D (%) 0.78%

YTD (%) 17.63%

3,766

1D (%) 0.02%

YTD (%) 5.76%

Federal Open Market Committee (FOMC) lowered rates by 25 basis points to a range of 4%–4.25%. Alongside the cut, the Fed released its "dot-plot," a key tool showing individual policymakers’ future rate forecasts. The plot revealed that a majority (10 out of 19 members) expect two more cuts in 2025, likely in October and December.

VIETNAM STOCK MARKET

1,670.97

1D -0.59%

YTD 31.91%

277.63

1D -0.48%

YTD 22.07%

1,868.85

1D -0.35%

YTD 38.97%

111.78

1D 0.41%

YTD 17.59%

-117.05

37,143.00

1D -16.41%

YTD 104.86%

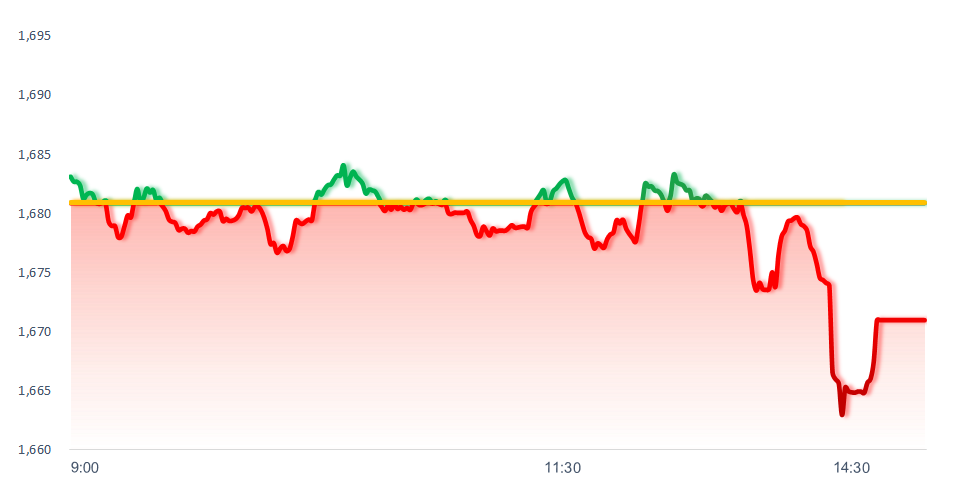

VN-Index lost nearly 10 points, closing at the session’s low as buying demand faded. Proprietary trading desks of securities firms turned net buyers with VND 93 billion on Sept 17, focusing on HPG (VND 118 billion), GEX (VND 44 billion), MWG (VND 31 billion), and ACB (VND 25 billion). In contrast, they net sold FPT (VND 121 billion) and SHB (VND 74 billion).

INTRADAY

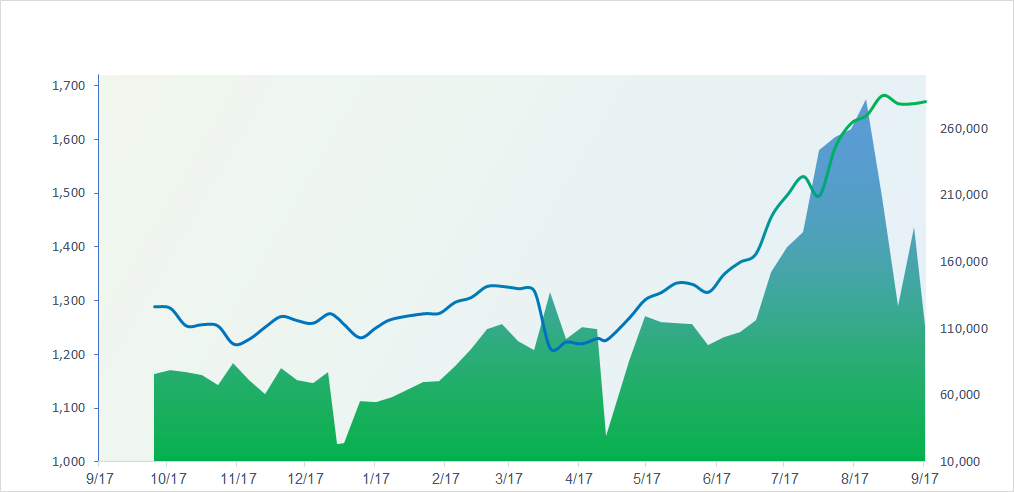

VN30 (12M)

SELECTED NEWS

- Prime Minister: Ensure 100% disbursement of public investment capital;

- The Prime Minister requested a solution for the operation plan of Tan Son Nhat – Long Thanh airports;

- Vietnam’s first mega-project in history is being urgently implemented, with an initial allocation of VND 3,236 billion;

- The U.S. has reduced tariffs on imported cars from Japan to 15% starting September 16;

- China has banned its tech companies from purchasing Nvidia’s AI chips;

- Oil prices fell on concerns over demand in the U.S.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.