Morning brief 29/09/2025

GLOBAL MARKET

46,247.29

1D 0.65%

YTD 8.70%

6,643.70

1D 0.59%

YTD 12.96%

22,484.07

1D 0.44%

YTD 16.43%

15.29

1D -8.66%

9,284.83

1D 0.77%

YTD 13.60%

23,739.47

1D 0.87%

YTD 19.24%

7,870.68

1D 0.97%

YTD 6.64%

68.72

1D -0.56%

YTD -8.43%

3,774.00

1D 0.55%

YTD 43.22%

U.S. stocks all moved higher in the final trading session of the week on September 26. The Dow Jones, S&P 500, and Nasdaq Composite rose 0.65%, 0.59%, and 0.44%, respectively. Despite snapping a three-day losing streak, all three major indexes still closed the week in negative territory. The Nasdaq Composite and S&P 500 slipped 0.7% and 0.3%, marking their first weekly decline after three straight weeks of gains. The Dow Jones also lost 0.2% for the week.

VIETNAM ECONOMY

4.36%

1D (bps) -26

YTD (bps) 39

4.60%

3.16%

1D (bps) -1

YTD (bps) 68

3.48%

1D (bps) -2

YTD (bps) 64

26,453

1D (%) 0.01%

YTD (%) 3.53%

31,600

1D (%) -0.73%

YTD (%) 15.90%

3,760

1D (%) -0.11%

YTD (%) 5.59%

In the U.S., the core Personal Consumption Expenditures (PCE) price index for August rose 2.9% year-on-year, in line with economists’ forecasts from a Dow Jones survey. The overall PCE index increased 2.7% compared to a year earlier and 0.3% from the prior month, also matching market expectations. Based on this data, investors continue to anticipate that the Federal Reserve will deliver two more 0.25 percentage point rate cuts in its remaining meetings this year.

VIETNAM STOCK MARKET

1,660.70

1D -0.32%

YTD 31.10%

276.06

1D -0.57%

YTD 21.38%

1,852.65

1D -0.32%

YTD 37.77%

110.63

1D 0.13%

YTD 16.38%

-2,162.06

29,919.70

1D -1.40%

YTD 65.02%

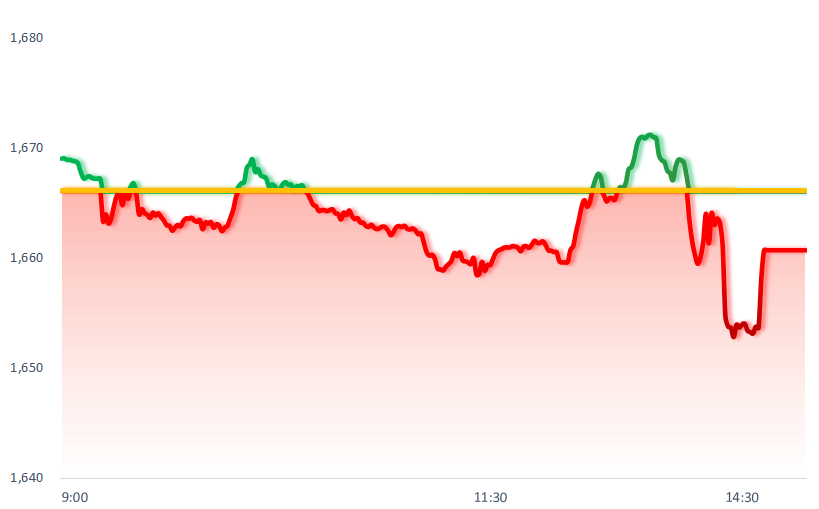

VN-Index swung sharply during the afternoon session on September 26, pressured mainly by banking stocks. Proprietary trading desks continued to net-sell VND 408 billion, with heavy selling in VPB (VND 302 billion), FPT (VND 32 billion), and HAG (VND 28 billion). In contrast, they net-bought ACB (VND 44 billion) and DC’s VN30 ETF (VND 21 billion).

INTRADAY

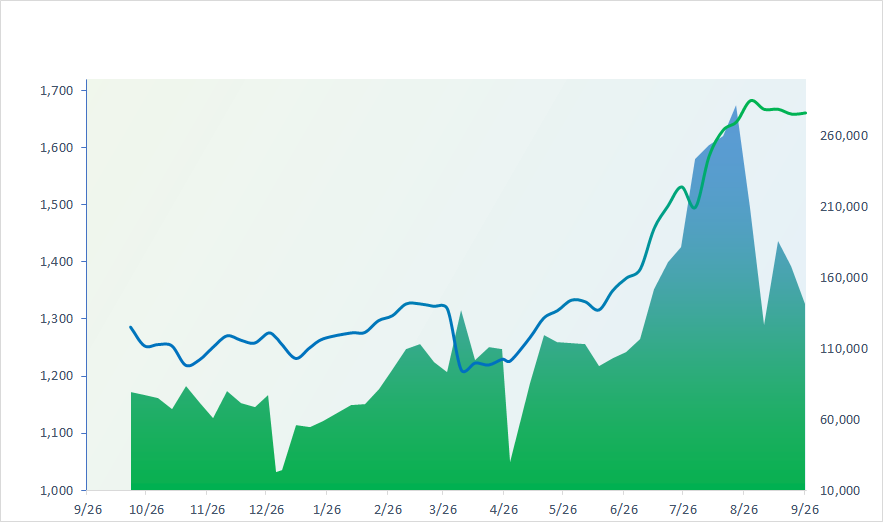

VN30 (12M)

SELECTED NEWS

- The Government has issued a new decree to tighten the management of public investment capital;

- A new proposal has been put forward to allow postponement of exit for businesses with outstanding tax debts;

- Criteria are being defined for key projects under the “Public–Private Co-Nation Building” initiative;

- ASEAN will discuss U.S. tariffs in October;

- Former President Trump is considering imposing tariffs on electronic devices containing chips;

- China has renounced its status as a developing country at the WTO.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.