Market brief 16/10/2025

VIETNAM STOCK MARKET

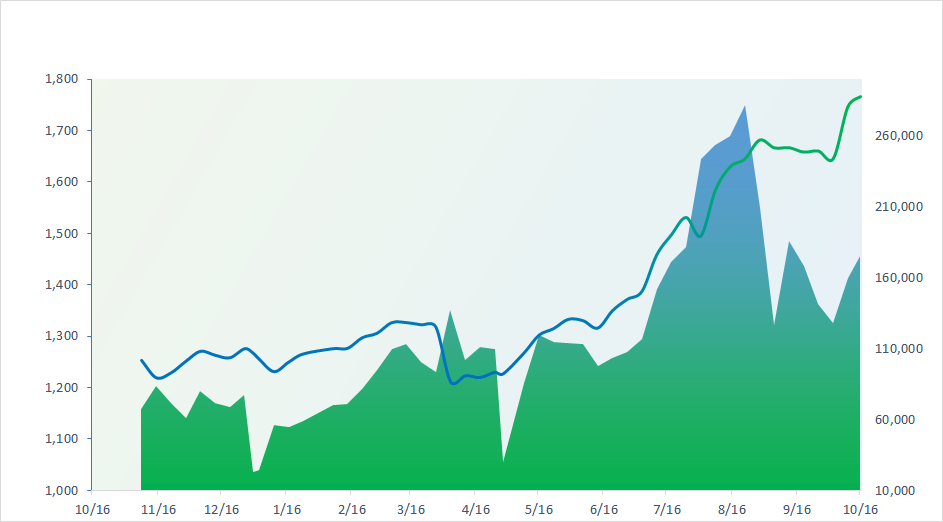

1,766.85

1D 0.51%

YTD 39.48%

277.08

1D 0.35%

YTD 21.83%

2,022.27

1D 0.63%

YTD 50.38%

112.37

1D 0.04%

YTD 18.21%

420.52

1D 0.00%

YTD 0.00%

43,575.03

1D 5.95%

YTD 140.34%

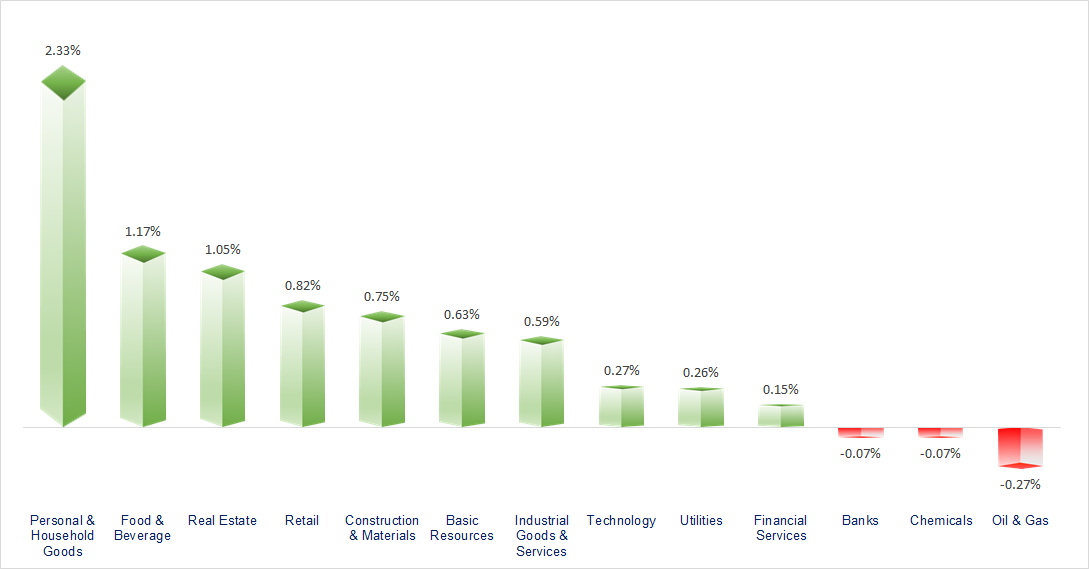

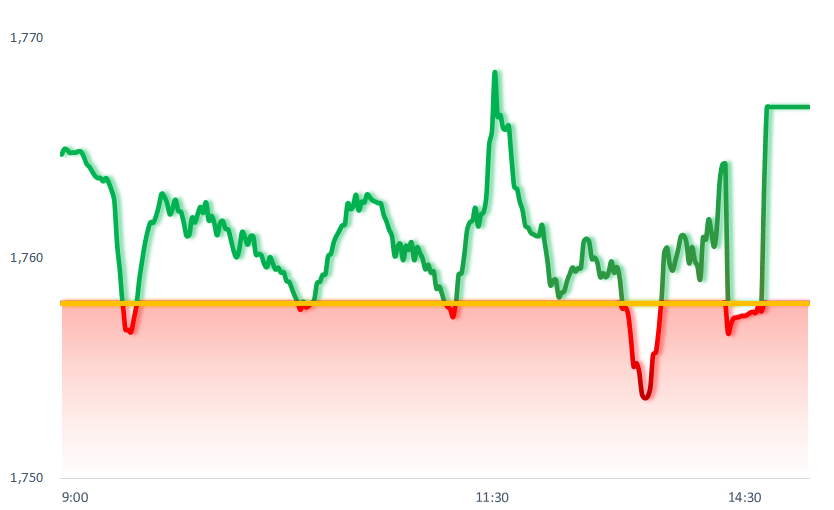

VN-Index rebounded and closed over 12 points higher, driven by the strong performance of real estate stocks and renewed net buying from foreign investors. Real Estate, F&B, and Resources were the top-performing sectors during the session, while Technology, Chemicals, and Oil & Gas showed rather lackluster movements.

ETF & DERIVATIVES

35,600

1D 0.85%

YTD 51.62%

24,450

1D -0.16%

YTD 50.18%

25,250

1D 0.00%

YTD 51.20%

30,200

1D 0.67%

YTD 50.25%

34,600

1D -0.43%

YTD 56.56%

39,900

1D -0.08%

YTD 19.03%

27,950

1D 3.52%

YTD 55.97%

2,013

1D -0.46%

YTD 0.00%

2,009

1D -0.34%

YTD 0.00%

2,007

1D -0.38%

YTD 0.00%

1,982

1D -0.10%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

48,277.74

1D 1.27%

YTD 21.01%

3,916.23

1D 0.10%

YTD 16.84%

25,888.51

1D -0.09%

YTD 29.06%

3,748.37

1D 2.49%

YTD 56.22%

83,467.66

1D 1.04%

YTD 6.23%

4,356.20

1D -0.28%

YTD 15.01%

1,291.46

1D 0.37%

YTD -7.77%

62.10

1D 0.31%

YTD -17.26%

4,237.32

1D 0.20%

YTD 60.81%

Most Asian stock markets advanced in today's trading session (October 16), as investors continued to expect that the U.S. Federal Reserve will proceed with interest rate cuts later this year. Gains were mainly supported by the technology sector, particularly semiconductor stocks, following strong rallies in the U.S. market.

VIETNAM ECONOMY

5.86%

1D (bps) 82

YTD (bps) 189

4.60%

3.25%

1D (bps) 12

YTD (bps) 78

3.57%

1D (bps) -6

YTD (bps) 72

26,364

1D (%) -0.02%

YTD (%) 3.18%

31,498

1D (%) 0.29%

YTD (%) 15.52%

3,754

1D (%) -0.06%

YTD (%) 5.42%

Domestic fuel prices were adjusted on the afternoon of October 16. Gasoline prices edged up slightly, while diesel and kerosene declined. Specifically, Ron95-III rose by 174 VND/liter to 19,903 VND/liter, while kerosene dropped by 28 VND/liter to 18,406 VND/liter.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hai Phong plans to establish a 6,300-hectare coastal free trade zone;

- Installation of navigation systems completed at Long Thanh International Airport;

- Vietnam needs over VND485 trillion to develop its airport system by 2030;

- U.S. economy loses USD15 billion per day during government shutdown;

- Trump signals tougher stance on China;

- U.S. and U.K. impose dual sanctions to tighten pressure on Russian oil.

VN30

BANK

62,900

1D 0.64%

5D -1.41%

Buy Vol. 8,555,845

Sell Vol. 6,977,459

39,750

1D 1.02%

5D -1.49%

Buy Vol. 6,967,093

Sell Vol. 7,129,639

53,800

1D -1.82%

5D -1.39%

Buy Vol. 16,197,256

Sell Vol. 15,067,377

41,250

1D 1.10%

5D 5.91%

Buy Vol. 27,090,811

Sell Vol. 31,550,786

33,200

1D -1.48%

5D 3.43%

Buy Vol. 39,076,237

Sell Vol. 57,365,389

27,200

1D -0.18%

5D -0.55%

Buy Vol. 53,776,004

Sell Vol. 55,826,075

33,400

1D 0.91%

5D 5.53%

Buy Vol. 33,254,212

Sell Vol. 34,866,014

19,750

1D 0.25%

5D -1.25%

Buy Vol. 25,058,260

Sell Vol. 32,153,436

59,500

1D -0.83%

5D -0.83%

Buy Vol. 17,242,255

Sell Vol. 15,090,020

20,000

1D -1.23%

5D -1.96%

Buy Vol. 15,762,500

Sell Vol. 15,431,018

26,300

1D 0.00%

5D -2.41%

Buy Vol. 19,760,591

Sell Vol. 22,705,473

18,150

1D -0.27%

5D 1.40%

Buy Vol. 133,902,589

Sell Vol. 199,414,507

19,000

1D 0.00%

5D -0.52%

Buy Vol. 4,949,661

Sell Vol. 5,748,458

51,300

1D -0.58%

5D 0.20%

Buy Vol. 5,456,502

Sell Vol. 5,105,003

BID: On October 15, BIDV (Bank for Investment and Development of Vietnam) finalized the list of shareholders eligible for its 2024 cash dividend payout at a rate of 4.5% – equivalent to 450 VND/share. With over 7.02 billion shares outstanding, the total dividend payout is expected to reach approximately VND3,159 billion. Payment date is scheduled for November 14, 2025.

OIL & GAS

58,700

1D -0.51%

5D -3.61%

Buy Vol. 1,451,543

Sell Vol. 1,273,795

33,700

1D 0.00%

5D -1.17%

Buy Vol. 3,267,164

Sell Vol. 2,369,059

At 5 PM today, Brent crude oil recovered by over 0.3%, trading at 62.1 USD/barrel.

VINGROUP

213,100

1D 1.72%

5D 18.72%

Buy Vol. 6,989,153

Sell Vol. 6,903,534

122,000

1D -1.61%

5D 6.09%

Buy Vol. 14,245,894

Sell Vol. 12,647,618

43,400

1D 3.58%

5D 14.21%

Buy Vol. 27,531,870

Sell Vol. 23,609,411

VIC: On October 16, 2025, VinFast officially announced a strategic partnership agreement with LORET Group to distribute vehicles in France’s overseas territories.

FOOD & BEVERAGE

61,200

1D 0.74%

5D 1.86%

Buy Vol. 8,983,552

Sell Vol. 10,330,799

88,200

1D 6.91%

5D 6.14%

Buy Vol. 82,174,550

Sell Vol. 62,475,586

45,200

1D -0.11%

5D -0.88%

Buy Vol. 911,739

Sell Vol. 1,037,114

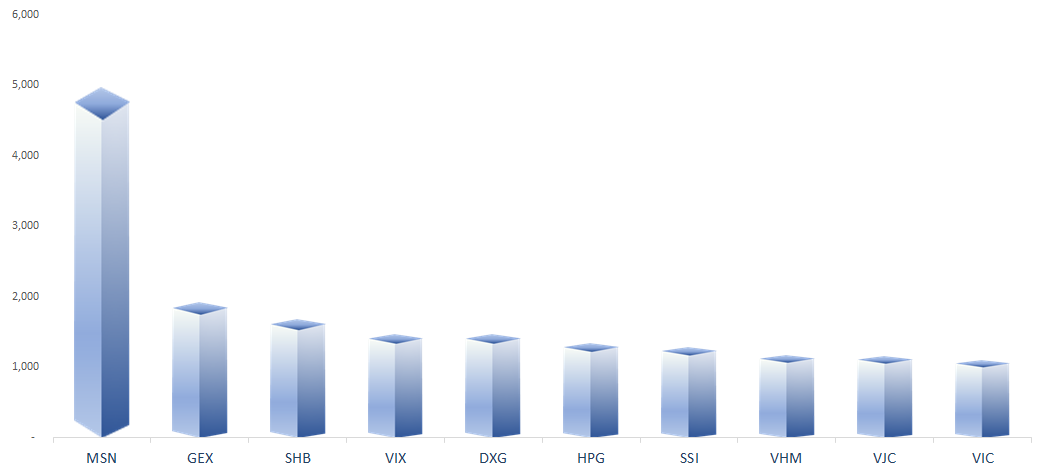

MSN: Masan shares hit the daily ceiling limit after SK Invest disclosed a share sale with prices ranging from 78,000 to 79,300 VND/share.

OTHERS

65,500

1D 1.55%

5D -1.21%

Buy Vol. 657,880

Sell Vol. 620,996

95,000

1D 0.00%

5D 1.60%

Buy Vol. 2,085,861

Sell Vol. 2,285,677

173,500

1D 6.38%

5D 30.35%

Buy Vol. 9,268,968

Sell Vol. 9,138,134

89,800

1D 0.22%

5D -4.67%

Buy Vol. 13,933,992

Sell Vol. 12,147,374

84,500

1D 1.44%

5D 3.68%

Buy Vol. 9,921,478

Sell Vol. 10,307,796

27,200

1D -0.91%

5D -2.86%

Buy Vol. 6,423,877

Sell Vol. 5,378,780

41,350

1D -0.24%

5D 1.72%

Buy Vol. 42,612,031

Sell Vol. 54,147,238

28,250

1D 0.00%

5D -2.42%

Buy Vol. 77,878,584

Sell Vol. 82,293,105

DGC: At the 2025 Lam Dong Investment Promotion Conference, Duc Giang Chemicals Group signed a Memorandum of Understanding with the Lam Dong People’s Committee to begin studies for a Bauxite – Alumin – Aluminum Complex, with an estimated investment of USD2.3 billion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

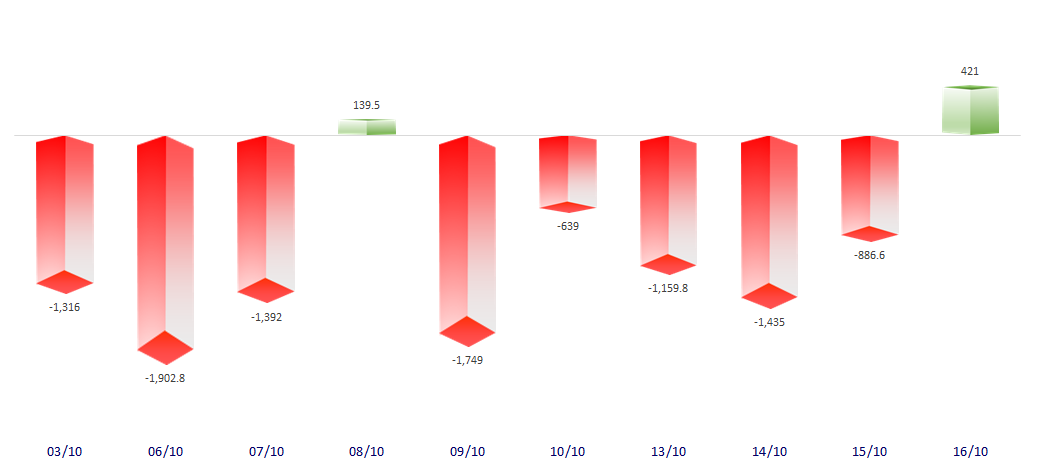

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

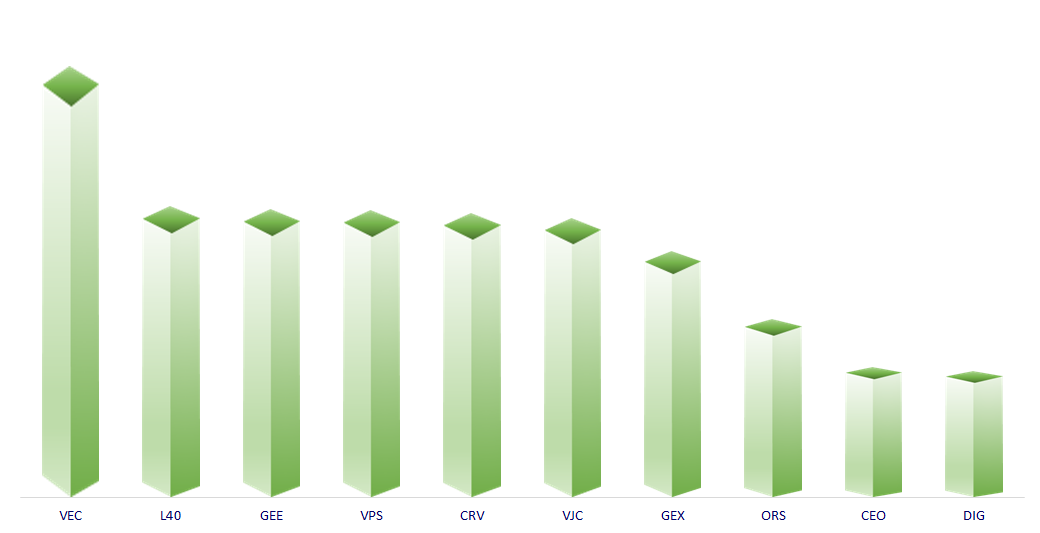

TOP INCREASES 3 CONSECUTIVE SESSIONS

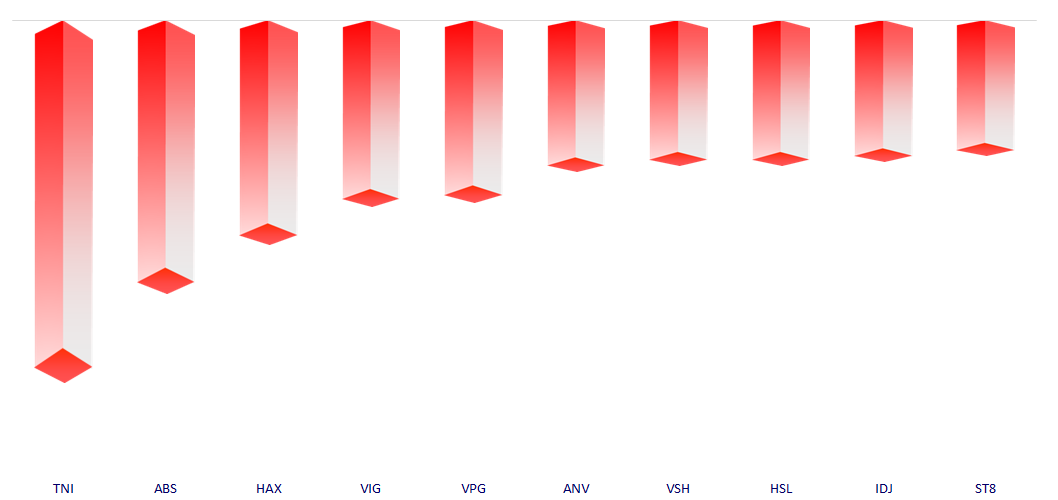

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.