Market brief 17/10/2025

VIETNAM STOCK MARKET

1,731.19

1D -2.02%

YTD 36.66%

276.11

1D -0.35%

YTD 21.40%

1,977.14

1D -2.23%

YTD 47.03%

112.67

1D 0.27%

YTD 18.53%

-2,044.61

1D 0.00%

YTD 0.00%

45,648.00

1D 4.76%

YTD 151.77%

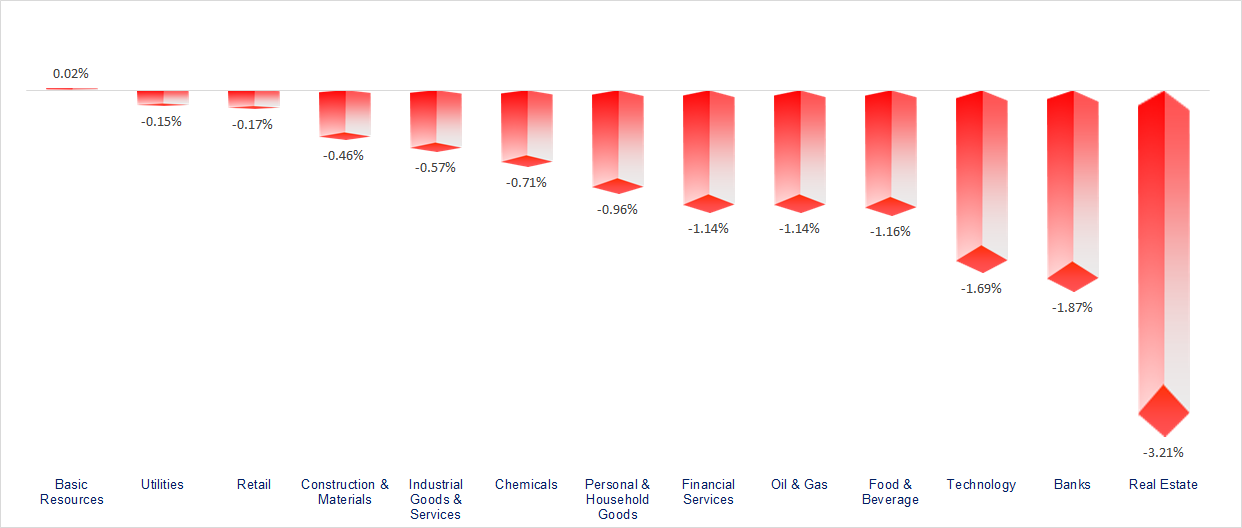

N-Index recorded its second distribution session, dropping more than 35 points due to strong correction pressure from Vingroup stocks. Most sectors ended the session lower, with Real Estate, Banking, and Technology being the most negatively affected groups.

ETF & DERIVATIVES

34,900

1D -1.97%

YTD 48.64%

24,190

1D -1.06%

YTD 48.59%

25,290

1D 0.16%

YTD 51.44%

29,490

1D -2.35%

YTD 46.72%

33,710

1D -2.57%

YTD 52.53%

39,510

1D -0.98%

YTD 17.87%

28,500

1D 1.97%

YTD 59.04%

1,968

1D -2.02%

YTD 0.00%

1,970

1D -0.63%

YTD 0.00%

1,940

1D -3.32%

YTD 0.00%

1,950

1D -4.49%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

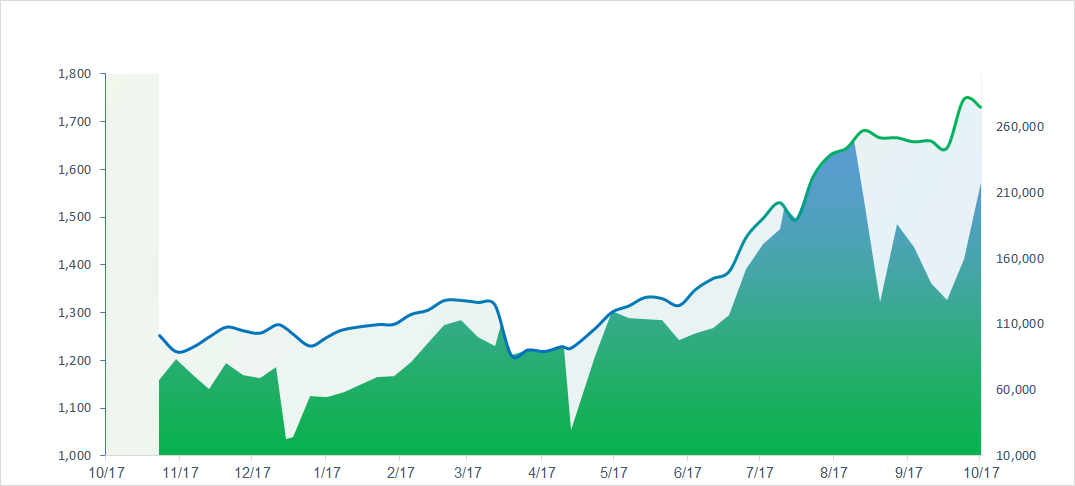

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

47,582.15

1D -1.44%

YTD 19.27%

3,839.76

1D -1.95%

YTD 14.56%

25,247.10

1D -2.48%

YTD 25.86%

3,748.89

1D 0.01%

YTD 56.24%

83,952.19

1D 0.58%

YTD 6.84%

4,328.93

1D -0.63%

YTD 14.29%

1,274.61

1D -1.30%

YTD -8.97%

60.99

1D -0.11%

YTD -18.73%

4,322.00

1D -0.10%

YTD 64.02%

Asian stock markets mostly declined today, led by Hong Kong’s Hang Seng Index, which fell more than 2.4% to 25,247.1 points, followed by China’s Shanghai Composite, which lost nearly 2% to 3,839.76 points.

VIETNAM ECONOMY

5.45%

1D (bps) -41

YTD (bps) 148

4.60%

3.23%

1D (bps) -3

YTD (bps) 75

3.60%

1D (bps) 3

YTD (bps) 75

26,356

1D (%) -0.03%

YTD (%) 3.15%

31,631

1D (%) 0.42%

YTD (%) 16.01%

3,756

1D (%) 0.06%

YTD (%) 5.49%

Meanwhile, domestic gold prices surged sharply today as global gold continued its rally, approaching USD 4,400/oz. Notably, at Bảo Tín Minh Châu, both plain 24K gold rings and 24K jewelry exceeded VND 158 million per tael, about VND 5.3–5.5 million higher than SJC gold bars, setting a new all-time record.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Finance finalizes regulations on business household management following the abolition of the fixed tax regime;

- Vietnam may soon welcome a world-class mega project;

- Nearly USD 8 billion in remittances recently flowed into Ho Chi Minh City;

- U.S. President Donald Trump announces plans to meet Russian President Vladimir Putin in Hungary;

- An organization representing 300,000 U.S. businesses files a lawsuit against President Trump;

- The AI startup bubble is on the verge of bursting — the top 10 companies have added USD 1 trillion in value in just one year, yet most remain unprofitable.

VN30

BANK

61,900

1D -1.59%

5D -3.58%

Buy Vol. 8,203,881

Sell Vol. 9,436,363

39,050

1D -1.76%

5D -4.16%

Buy Vol. 5,778,311

Sell Vol. 7,907,025

52,200

1D -2.97%

5D -4.67%

Buy Vol. 23,744,742

Sell Vol. 22,656,223

40,650

1D -1.45%

5D 3.30%

Buy Vol. 24,139,686

Sell Vol. 30,937,788

31,950

1D -3.77%

5D -0.47%

Buy Vol. 62,298,220

Sell Vol. 69,939,475

27,100

1D -0.37%

5D -1.28%

Buy Vol. 82,410,476

Sell Vol. 72,140,209

32,500

1D -2.69%

5D 2.04%

Buy Vol. 25,966,597

Sell Vol. 34,335,864

19,250

1D -2.53%

5D -1.79%

Buy Vol. 27,232,365

Sell Vol. 40,415,658

59,000

1D -0.84%

5D -2.32%

Buy Vol. 9,794,732

Sell Vol. 9,100,434

19,700

1D -1.50%

5D -3.19%

Buy Vol. 17,813,106

Sell Vol. 21,160,837

25,750

1D -2.09%

5D -4.45%

Buy Vol. 22,189,813

Sell Vol. 25,740,180

18,100

1D -0.28%

5D 0.56%

Buy Vol. 170,737,802

Sell Vol. 188,343,842

18,450

1D -2.89%

5D -5.14%

Buy Vol. 6,956,949

Sell Vol. 8,836,560

49,500

1D -3.51%

5D -4.07%

Buy Vol. 6,179,198

Sell Vol. 4,716,081

According to data recently released by the State Bank of Vietnam (SBV), total customer deposits—including both individuals and economic organizations—at credit institutions reached nearly VND 15.73 quadrillion by the end of July, down VND 73.4 trillion (equivalent to 0.47%) compared with the previous month. Of this, corporate deposits totaled over VND 7.978 quadrillion, up 4.04% compared with the end of 2024, but down VND 127.5 trillion (or 1.57%) from the end of June. This marks the first decline in corporate deposits after five consecutive months of growth since February 2025.

OIL & GAS

58,600

1D -0.17%

5D -3.78%

Buy Vol. 797,370

Sell Vol. 549,917

33,550

1D -0.45%

5D -1.47%

Buy Vol. 3,269,341

Sell Vol. 2,794,374

Global crude oil prices briefly fell by more than 1% today but later rebounded slightly, ending the session up 0.2%.

VINGROUP

204,000

1D -4.27%

5D 6.25%

Buy Vol. 6,947,367

Sell Vol. 8,121,789

116,000

1D -4.92%

5D -5.69%

Buy Vol. 16,138,595

Sell Vol. 15,771,585

41,000

1D -5.53%

5D 1.61%

Buy Vol. 27,779,679

Sell Vol. 27,334,474

Three Vingroup stocks — VIC, VRE, and VHM — declined sharply during the session, dragging the VN-Index down by as much as 16 points.

FOOD & BEVERAGE

58,800

1D -3.92%

5D -1.35%

Buy Vol. 9,321,120

Sell Vol. 11,865,456

88,000

1D -0.23%

5D 4.64%

Buy Vol. 44,669,331

Sell Vol. 46,401,156

45,250

1D 0.11%

5D -1.31%

Buy Vol. 1,669,816

Sell Vol. 1,254,091

The Government Inspectorate concluded that companies under Masan Group had misused funds raised from corporate bond issuances (TPDN), spending them for purposes inconsistent with the original issuance objectives.

OTHERS

65,900

1D 0.61%

5D -0.30%

Buy Vol. 602,402

Sell Vol. 560,238

93,200

1D -1.89%

5D -1.17%

Buy Vol. 1,551,000

Sell Vol. 2,013,031

175,000

1D 0.86%

5D 31.28%

Buy Vol. 5,441,615

Sell Vol. 6,130,965

88,100

1D -1.89%

5D -8.32%

Buy Vol. 11,387,293

Sell Vol. 12,561,434

84,500

1D 0.00%

5D 3.05%

Buy Vol. 12,962,496

Sell Vol. 14,535,624

27,100

1D -0.37%

5D -3.39%

Buy Vol. 3,793,799

Sell Vol. 3,494,718

40,800

1D -1.33%

5D 0.25%

Buy Vol. 49,598,307

Sell Vol. 60,470,320

28,000

1D -0.88%

5D -5.41%

Buy Vol. 70,455,423

Sell Vol. 80,886,533

BCM: The Board of Directors of Becamex IDC Corporation approved the second private bond issuance plan for 2025, with a total value of up to VND 2,000 billion. The bonds will be non-convertible, non-warranted, and secured by assets, to be issued domestically in book-entry form.

Market by numbers

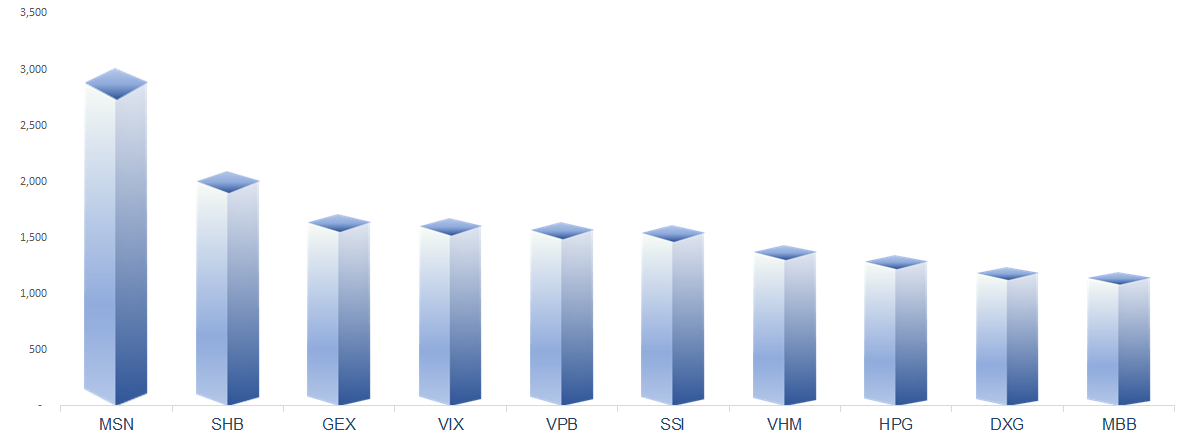

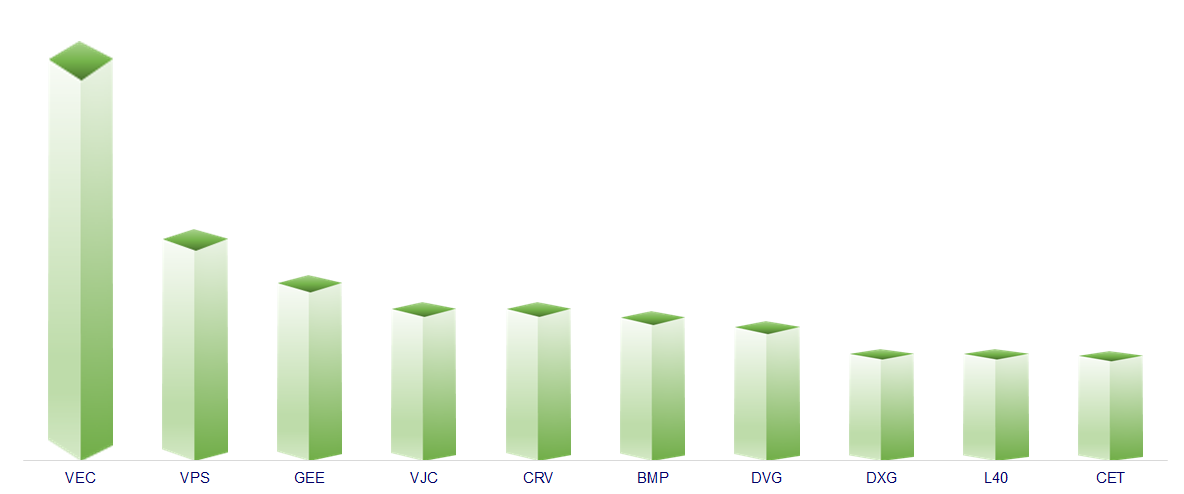

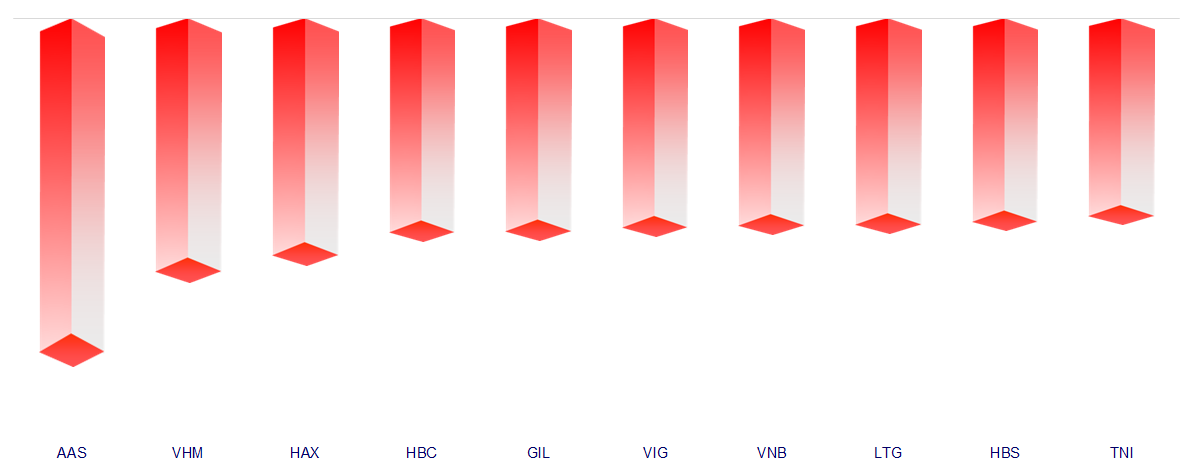

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

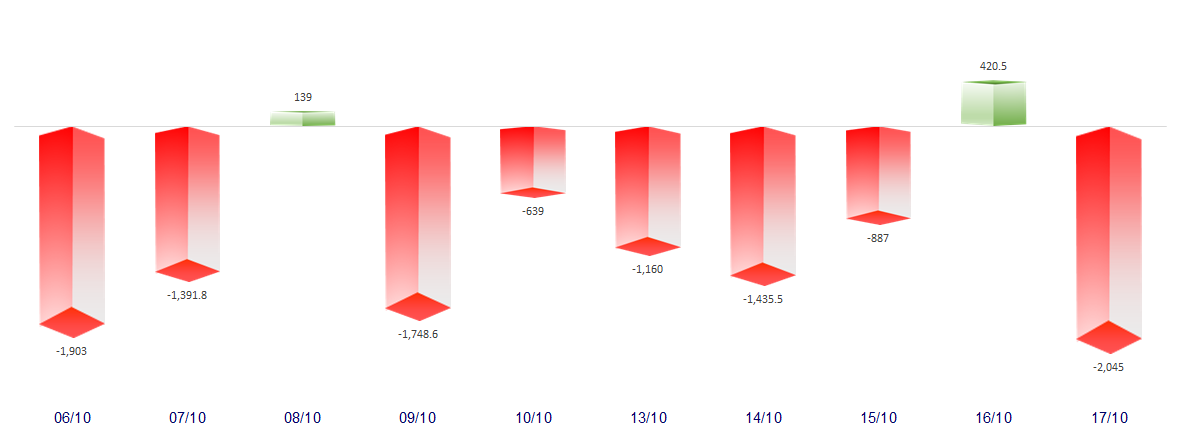

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.