Market brief 28/10/2025

VIETNAM STOCK MARKET

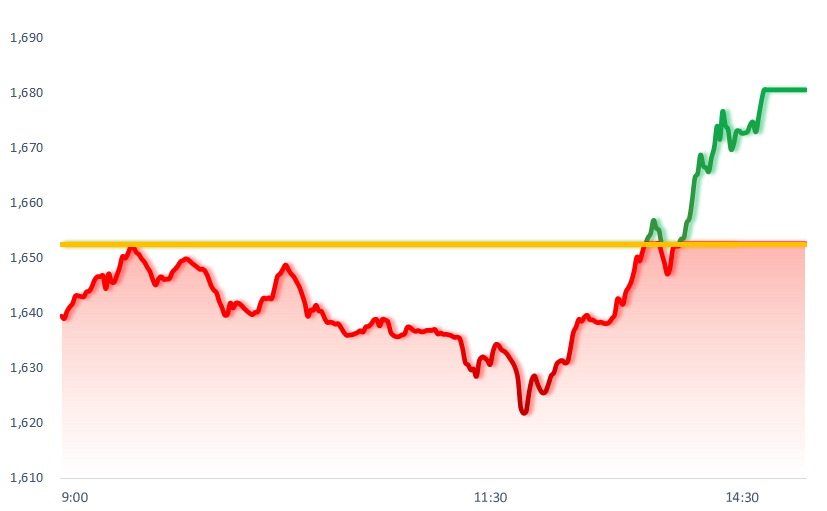

1,680.50

1D 1.69%

YTD 32.66%

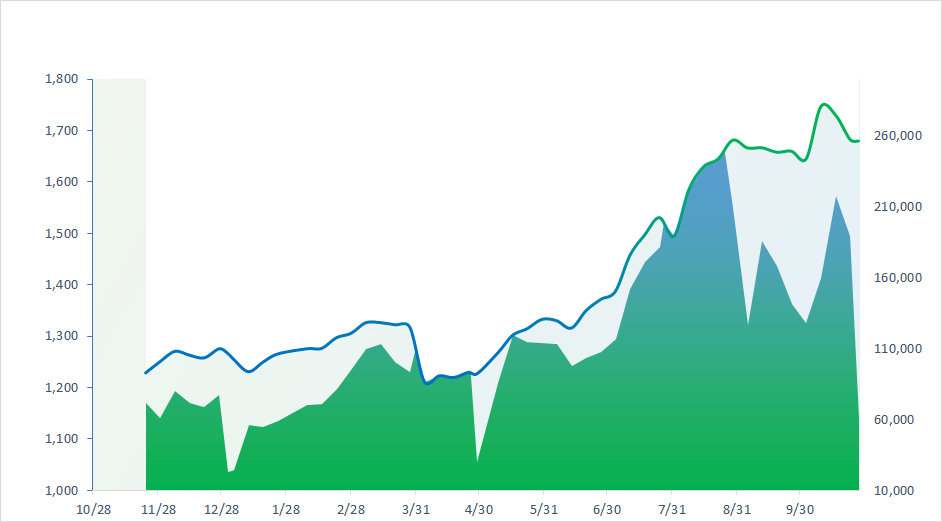

266.78

1D 0.54%

YTD 17.30%

1,949.28

1D 2.55%

YTD 44.95%

110.96

1D -0.25%

YTD 16.73%

1,455.35

1D 0.00%

YTD 0.00%

32,675.60

1D -2.75%

YTD 80.22%

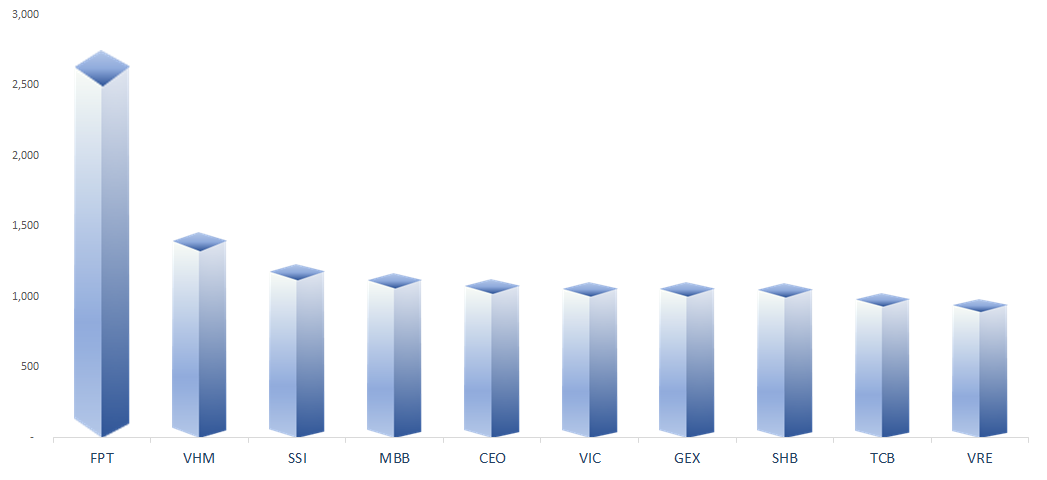

VN-Index reversed course and surged nearly 60 points during the session, driven by a broad-based rally across multiple sectors. Most industries showed positive movements today, with notable gains in Technology, Retail, Banking, and Real Estate stocks.

ETF & DERIVATIVES

34,400

1D 1.47%

YTD 46.51%

23,600

1D 1.33%

YTD 44.96%

24,230

1D 0.41%

YTD 45.09%

29,500

1D 0.00%

YTD 46.77%

31,300

1D 0.97%

YTD 41.63%

38,500

1D 0.00%

YTD 14.86%

25,300

1D -2.32%

YTD 41.18%

1,941

1D 2.61%

YTD 0.00%

1,934

1D 2.36%

YTD 0.00%

1,930

1D 1.58%

YTD 0.00%

1,935

1D 2.39%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

50,219.18

1D -0.58%

YTD 25.88%

3,988.22

1D -0.22%

YTD 18.99%

26,346.14

1D -0.33%

YTD 31.34%

4,010.41

1D -0.80%

YTD 67.14%

84,634.87

1D -0.17%

YTD 7.71%

4,450.36

1D 0.23%

YTD 17.50%

1,314.28

1D -0.70%

YTD -6.14%

63.99

1D -1.39%

YTD -14.74%

3,903.73

1D -2.65%

YTD 48.15%

Across Asia, many stock indices that had recently hit new highs began to enter a correction phase. In Tokyo, Japanese stocks opened lower after Japan’s new Prime Minister Sanae Takaichi met with U.S. President Donald Trump to discuss defense cooperation, trade, and a previously signed USD550 billion investment package. In South Korea, the KOSPI index dropped 0.8%, although investor sentiment was supported by data showing that Q3 2025 economic growth exceeded expectations, thanks to a strong recovery in consumer spending and exports.

VIETNAM ECONOMY

5.45%

1D (bps) -55

YTD (bps) 148

4.60%

3.29%

1D (bps) 2

YTD (bps) 82

3.65%

1D (bps) 3

YTD (bps) 81

26,349

1D (%) -0.01%

YTD (%) 3.12%

31,469

1D (%) 0.18%

YTD (%) 15.42%

3,766

1D (%) 0.33%

YTD (%) 5.76%

Domestically, gold prices in Vietnam continued to plunge sharply across the board. At major retailers including SJC, PNJ, Bao Tin Minh Chau, and Mi Hong, gold bar prices fell 2.3 million VND/tael in both buying and selling directions. Plain gold rings and 24K jewelry recorded the steepest declines, losing nearly 4 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- HSBC raises Vietnam’s GDP growth forecast for 2025–2026;

- Over 5 million household businesses will stop paying lump-sum taxes starting from 2026;

- Saudi Arabian enterprises see Vietnam as a highly promising destination for technology investment;

- Donald Trump’s policies trigger a massive capital outflow from Asia’s fourth-largest economy;

- Russia’s second-largest oil group announces plans to sell its overseas assets;

- Nikkei reports that Toyota is making a major bet, investing USD360 million to produce hybrid cars in Vietnam.

VN30

BANK

60,000

1D 1.35%

5D 1.18%

Buy Vol. 4,878,889

Sell Vol. 5,141,780

37,100

1D 1.64%

5D 0.13%

Buy Vol. 5,435,299

Sell Vol. 5,554,610

49,000

1D 0.82%

5D -1.90%

Buy Vol. 11,019,453

Sell Vol. 10,480,979

36,000

1D 2.71%

5D -4.38%

Buy Vol. 43,237,025

Sell Vol. 34,780,107

29,450

1D 4.06%

5D -2.97%

Buy Vol. 44,528,810

Sell Vol. 32,419,336

24,000

1D 0.84%

5D -5.14%

Buy Vol. 84,346,554

Sell Vol. 61,908,619

32,200

1D 3.54%

5D -0.46%

Buy Vol. 28,482,034

Sell Vol. 23,903,101

17,950

1D 2.28%

5D -1.37%

Buy Vol. 17,110,648

Sell Vol. 13,460,716

56,800

1D 4.03%

5D 2.16%

Buy Vol. 13,021,891

Sell Vol. 13,140,336

19,200

1D 4.07%

5D 2.95%

Buy Vol. 12,791,720

Sell Vol. 10,200,625

25,400

1D 1.60%

5D 1.60%

Buy Vol. 18,026,172

Sell Vol. 14,363,789

16,350

1D 1.24%

5D -3.82%

Buy Vol. 132,440,178

Sell Vol. 98,389,830

17,750

1D 1.14%

5D -4.31%

Buy Vol. 3,767,522

Sell Vol. 3,569,973

52,800

1D 1.73%

5D 7.76%

Buy Vol. 6,179,453

Sell Vol. 4,505,828

BVB: Viet Capital Bank (BVB) announced its business results for the first nine months of 2025, reporting VND437 billion in pre-tax profit, a 2.4× increase year-on-year, fulfilling 79% of its annual target, with credit growth up 14.1% from the beginning of the year.

OIL & GAS

60,000

1D 1.18%

5D 7.14%

Buy Vol. 997,938

Sell Vol. 1,045,827

34,050

1D -0.29%

5D 2.10%

Buy Vol. 1,258,123

Sell Vol. 1,575,611

Petrolimex plans to receive over 3.7 million PJC shares from its petroleum services arm between Oct 27 and Nov 25.

VINGROUP

220,100

1D 2.85%

5D 8.21%

Buy Vol. 7,031,431

Sell Vol. 7,258,571

107,000

1D 0.47%

5D -3.52%

Buy Vol. 21,516,589

Sell Vol. 17,167,808

36,800

1D 1.94%

5D -5.15%

Buy Vol. 41,284,985

Sell Vol. 37,314,239

VRE: Vincom Retail has completed the transfer of Vincom Center Nguyen Chi Thanh.

FOOD & BEVERAGE

57,400

1D 0.70%

5D 1.59%

Buy Vol. 4,179,761

Sell Vol. 4,508,150

79,000

1D 0.64%

5D 1.28%

Buy Vol. 10,970,916

Sell Vol. 11,526,994

45,450

1D 0.00%

5D 2.25%

Buy Vol. 710,059

Sell Vol. 934,899

Masan High-Tech Materials (MSR) reported a pre-tax profit of VND14 billion in Q3, reversing from a VND292 billion loss in the same period last year.

OTHERS

66,500

1D 1.53%

5D 3.91%

Buy Vol. 379,044

Sell Vol. 488,110

94,000

1D 1.18%

5D 5.38%

Buy Vol. 2,426,557

Sell Vol. 3,486,870

187,500

1D 6.96%

5D 4.17%

Buy Vol. 5,140,083

Sell Vol. 4,395,821

102,200

1D 4.29%

5D 9.89%

Buy Vol. 35,219,140

Sell Vol. 37,911,265

84,200

1D 3.95%

5D 1.45%

Buy Vol. 12,070,188

Sell Vol. 10,536,053

27,550

1D 0.55%

5D 8.46%

Buy Vol. 2,288,101

Sell Vol. 3,024,939

35,850

1D 3.02%

5D -7.12%

Buy Vol. 63,283,397

Sell Vol. 52,493,895

26,800

1D 2.10%

5D 0.00%

Buy Vol. 50,068,706

Sell Vol. 42,490,693

After today’s session, Vietjet (VJC) officially reached an all-time high, with trading volume exceeding 5.7 million shares, the highest in the past five sessions.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

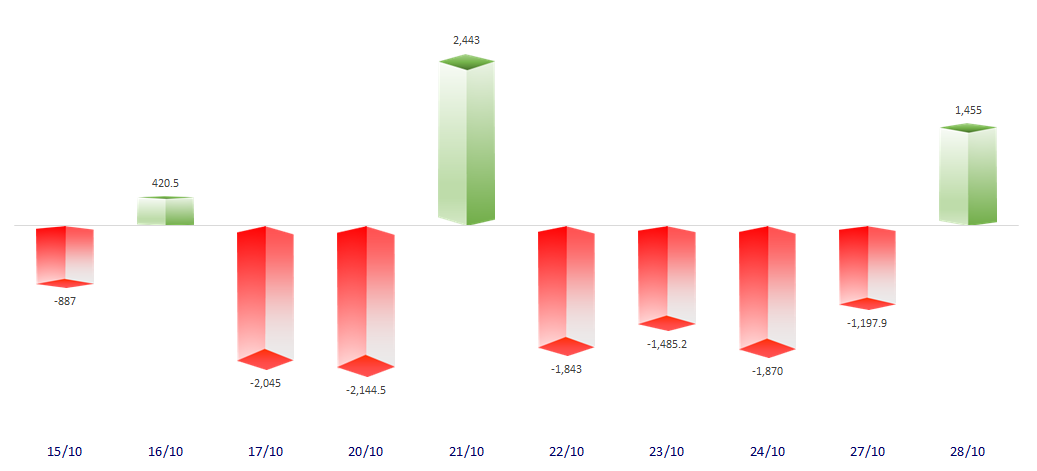

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

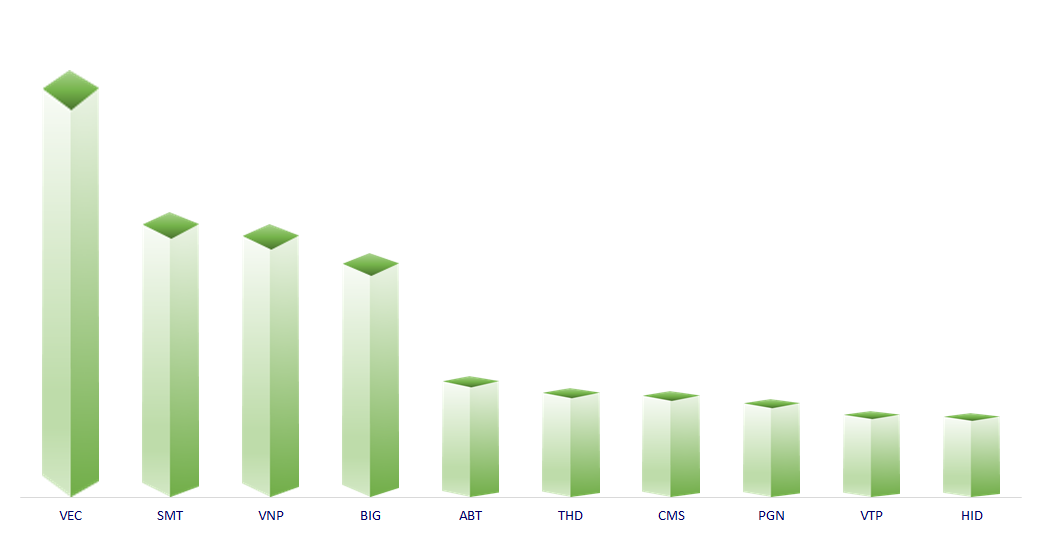

TOP INCREASES 3 CONSECUTIVE SESSIONS

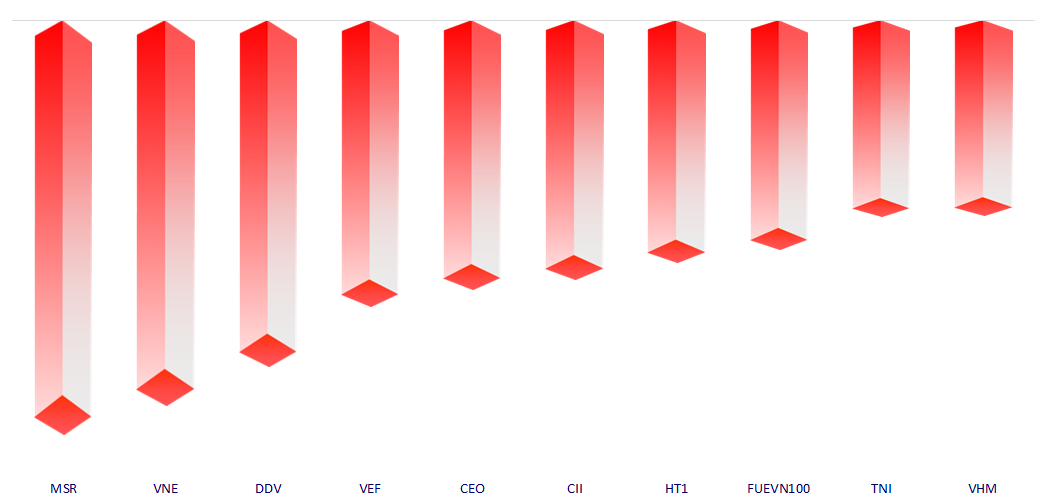

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.