Market brief 30/10/2025

VIETNAM STOCK MARKET

1,669.57

1D -0.96%

YTD 31.80%

266.96

1D -0.40%

YTD 17.38%

1,925.18

1D -1.26%

YTD 43.16%

113.42

1D 0.69%

YTD 19.31%

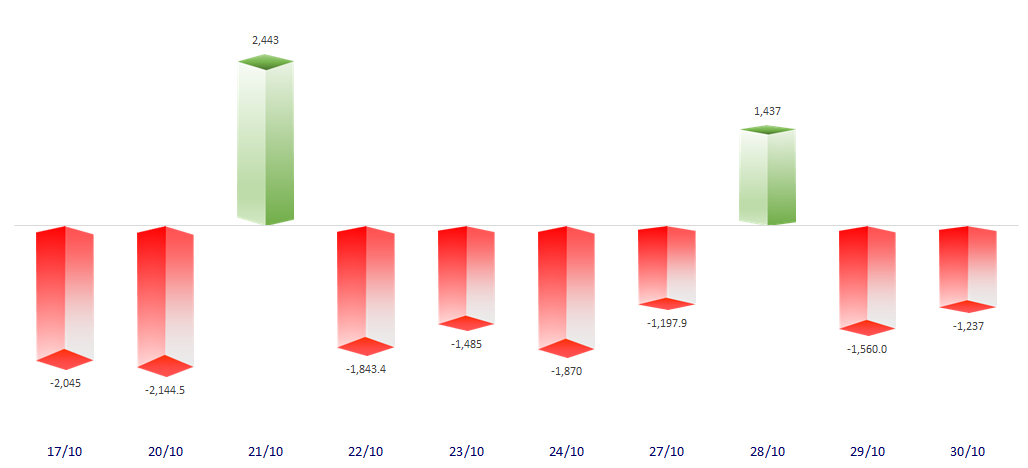

-1,237.26

1D 0.00%

YTD 0.00%

26,351.96

1D -6.87%

YTD 45.34%

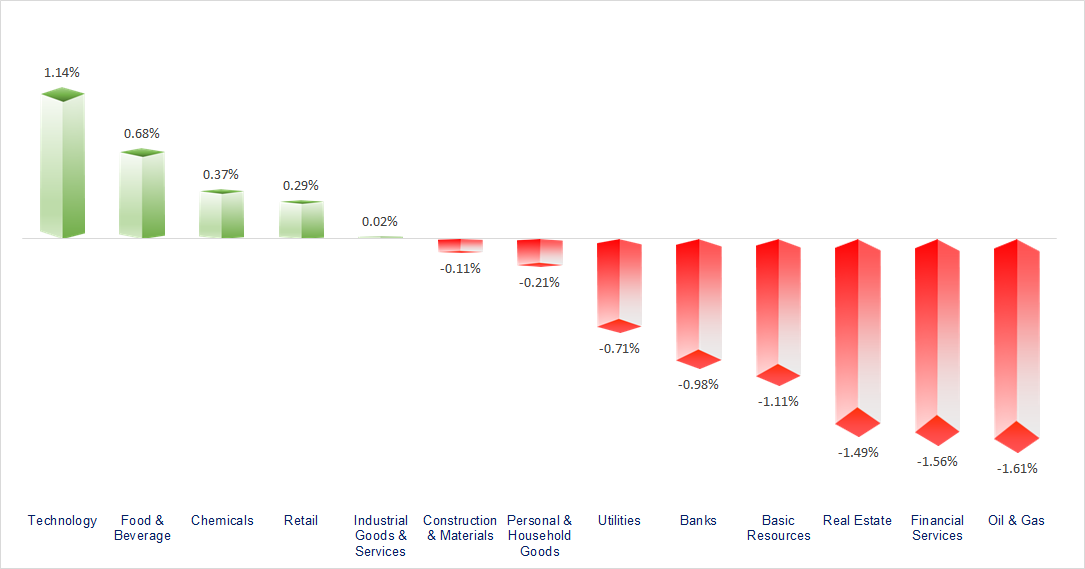

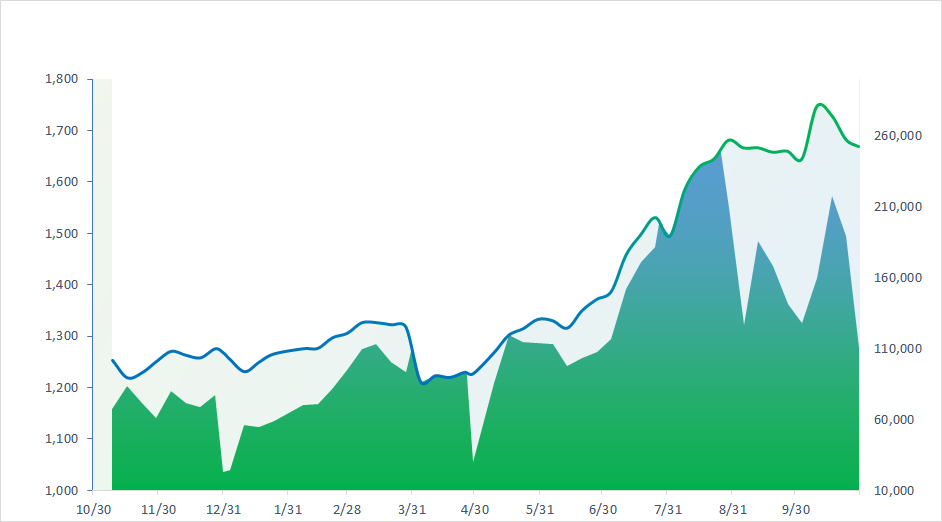

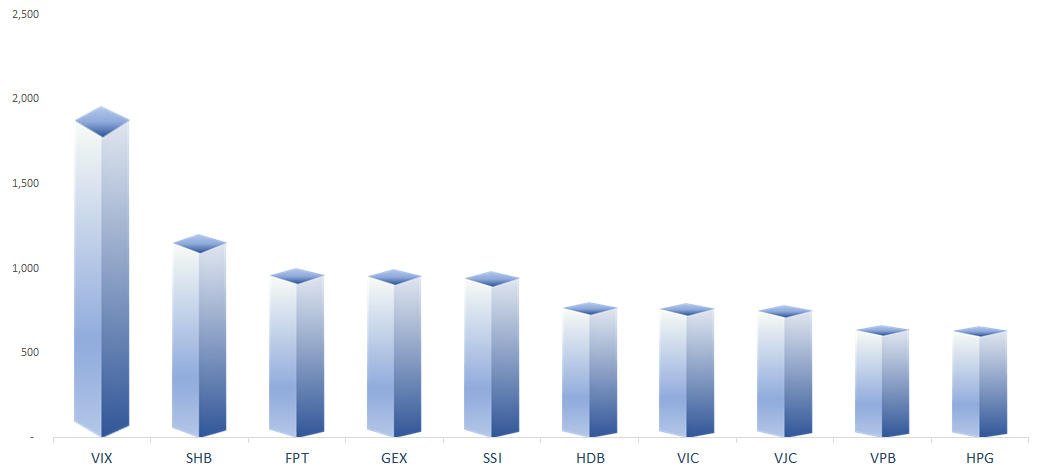

VN-Index dropped more than 16 points amid dwindling liquidity, with total trading value reaching just over VND23 trillion for the session. The Securities, Oil & Gas, and Real Estate sectors were the most negative groups in the market today. In contrast, the Technology, F&B, and Chemicals sectors showed relatively positive performance.

ETF & DERIVATIVES

34,420

1D -0.38%

YTD 46.59%

23,400

1D -0.85%

YTD 43.73%

24,300

1D 0.29%

YTD 45.51%

29,300

1D 0.34%

YTD 45.77%

31,460

1D -0.57%

YTD 42.35%

39,440

1D 1.13%

YTD 17.66%

25,300

1D -0.35%

YTD 41.18%

1,927

1D -1.03%

YTD 0.00%

1,921

1D -0.40%

YTD 0.00%

1,920

1D -1.28%

YTD 0.00%

1,924

1D -0.87%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

51,325.61

1D 0.04%

YTD 28.65%

3,986.90

1D -0.73%

YTD 18.95%

26,282.69

1D -0.24%

YTD 31.03%

4,086.89

1D 0.14%

YTD 70.32%

84,446.25

1D -0.66%

YTD 7.47%

4,437.44

1D -0.06%

YTD 17.16%

1,314.65

1D -0.08%

YTD -6.11%

64.08

1D -0.34%

YTD -14.62%

3,997.91

1D 1.06%

YTD 51.72%

Asian stock markets traded mixed today as cautious signals from the U.S. Federal Reserve regarding future interest rate cuts weighed on investor sentiment. The most notable news late in the afternoon came after the meeting between U.S. President Donald Trump and Chinese President Xi Jinping. Specifically, Mr. Trump announced a reduction of the Fentanyl Tariff to 10%, China would immediately purchase U.S. soybeans, and the overall tariff rate on Chinese goods would be reduced from 57% to 47%.

VIETNAM ECONOMY

3.24%

1D (bps) -98

YTD (bps) -73

4.60%

3.22%

1D (bps) -1

YTD (bps) 74

3.75%

YTD (bps) 90

26,345

1D (%) 0.00%

YTD (%) 3.11%

31,376

1D (%) -0.31%

YTD (%) 15.07%

3,763

1D (%) -0.11%

YTD (%) 5.69%

According to the latest decision from the Ministry of Industry and Trade and the Ministry of Finance, domestic gasoline prices were sharply increased on October 30. Specifically, E5RON92 rose by 710 VND/liter to a maximum of 19,760 VND/liter, about VND728 lower than RON95. Meanwhile, RON95 increased by 762 VND/liter to a maximum of 20,488 VND/liter.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam is preparing to welcome a new wave of billion-dollar investments into the industrial real estate sector;

- Deputy Prime Minister: Gold prices surged, with total transactions in the first nine months of 2025 reaching approximately VND23.3 trillion;

- Vietnam and Singapore signed a Memorandum of Understanding on rice trade;

- Following his meeting with President Xi, Mr. Trump immediately announced tariff reductions on Chinese goods;

- Mr. Trump also revealed a trade breakthrough with South Korea during his Asia tour;

- Hungarian Prime Minister seeks to reverse U.S. sanctions on Russian oil.

VN30

BANK

60,600

1D -0.16%

5D 1.34%

Buy Vol. 3,028,395

Sell Vol. 5,319,909

37,900

1D 0.26%

5D 2.71%

Buy Vol. 4,220,649

Sell Vol. 5,049,714

49,200

1D -0.91%

5D -1.01%

Buy Vol. 7,827,789

Sell Vol. 8,963,717

35,700

1D -1.92%

5D -4.16%

Buy Vol. 16,451,849

Sell Vol. 17,827,016

29,200

1D -2.18%

5D -2.67%

Buy Vol. 31,724,429

Sell Vol. 34,043,983

23,950

1D -1.64%

5D -4.96%

Buy Vol. 44,348,923

Sell Vol. 37,353,855

33,400

1D 0.00%

5D 1.21%

Buy Vol. 32,210,187

Sell Vol. 36,395,279

17,150

1D -0.79%

5D 1.16%

Buy Vol. 9,027,020

Sell Vol. 11,684,510

56,900

1D -0.52%

5D 2.34%

Buy Vol. 5,721,441

Sell Vol. 7,484,573

18,750

1D -1.32%

5D 1.35%

Buy Vol. 8,118,364

Sell Vol. 10,298,509

25,100

1D -1.18%

5D 0.60%

Buy Vol. 15,442,347

Sell Vol. 14,522,337

16,900

1D 0.60%

5D 1.20%

Buy Vol. 123,141,222

Sell Vol. 116,171,793

17,900

1D -0.28%

5D -1.38%

Buy Vol. 3,870,931

Sell Vol. 3,822,199

52,000

1D -3.53%

5D 1.36%

Buy Vol. 7,284,266

Sell Vol. 5,490,773

STB: Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank – STB) released its consolidated Q3 financial report, posting a pre-tax profit of VND3,657 billion, up 32.9% year-on-year. Post-tax profit reached VND2,901 billion, up 31.8% over the same period.

OIL & GAS

59,700

1D -0.83%

5D -0.17%

Buy Vol. 790,010

Sell Vol. 1,101,383

34,550

1D 0.14%

5D 0.88%

Buy Vol. 1,603,182

Sell Vol. 2,073,947

As of 5:00 p.m today, Brent crude oil prices fell by more than 0.3% to 64.08 USD/barrel.

VINGROUP

204,100

1D -3.73%

5D -5.07%

Buy Vol. 6,670,750

Sell Vol. 5,705,367

104,000

1D 0.19%

5D -9.57%

Buy Vol. 8,458,962

Sell Vol. 6,216,231

34,600

1D -3.76%

5D -12.18%

Buy Vol. 16,221,116

Sell Vol. 15,986,895

VHM: In Q3/2025, Vinhomes recorded net revenue and post-tax profit of VND16,420 billion and VND4,436 billion, respectively — both down more than 50% year-on-year.

FOOD & BEVERAGE

57,100

1D -0.70%

5D 0.88%

Buy Vol. 3,543,574

Sell Vol. 4,793,978

79,300

1D 0.13%

5D 1.41%

Buy Vol. 9,300,357

Sell Vol. 12,640,087

45,700

1D -0.11%

5D 0.55%

Buy Vol. 1,001,692

Sell Vol. 1,285,244

SAB: Post-tax profit in Q3/2025 reached VND1,403 billion, up 21% year-on-year.

OTHERS

66,900

1D 0.30%

5D 2.29%

Buy Vol. 295,466

Sell Vol. 516,693

93,600

1D -0.85%

5D 2.86%

Buy Vol. 2,607,608

Sell Vol. 3,202,085

195,500

1D 0.21%

5D 6.25%

Buy Vol. 4,974,104

Sell Vol. 5,508,744

102,700

1D 0.98%

5D 8.11%

Buy Vol. 14,427,445

Sell Vol. 21,924,302

83,900

1D -0.24%

5D -2.10%

Buy Vol. 8,518,824

Sell Vol. 10,402,146

28,350

1D 0.89%

5D 8.62%

Buy Vol. 5,544,408

Sell Vol. 6,577,591

34,850

1D -2.11%

5D -7.07%

Buy Vol. 42,144,503

Sell Vol. 44,594,415

26,900

1D -1.28%

5D 1.51%

Buy Vol. 37,476,748

Sell Vol. 49,554,778

FPT: FPT Digital Retail Joint Stock Company (FRT) recorded Q3/2025 net revenue of VND13,109 billion, up 26.4% year-on-year, while post-tax profit surged more than 60% year-on-year to over VND265 billion.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

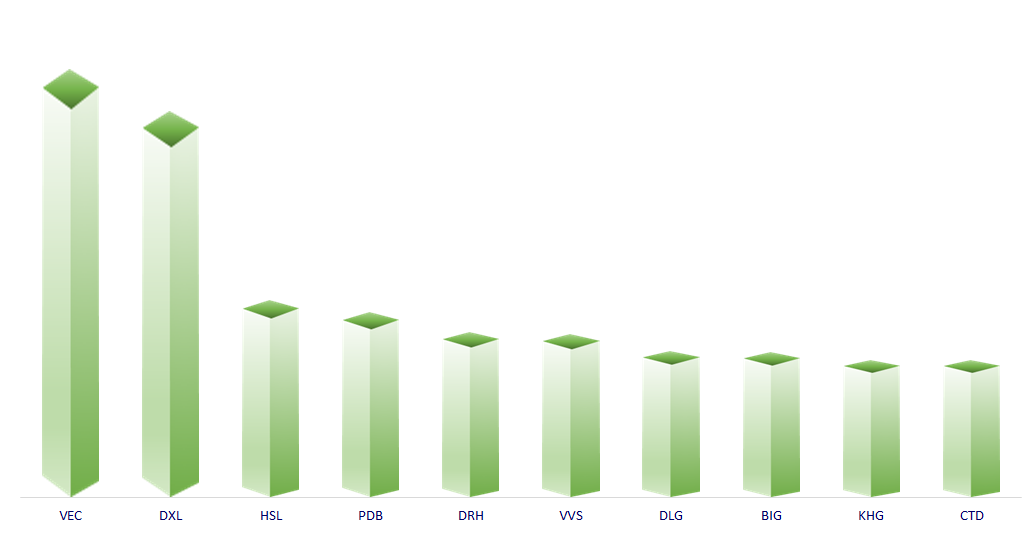

TOP INCREASES 3 CONSECUTIVE SESSIONS

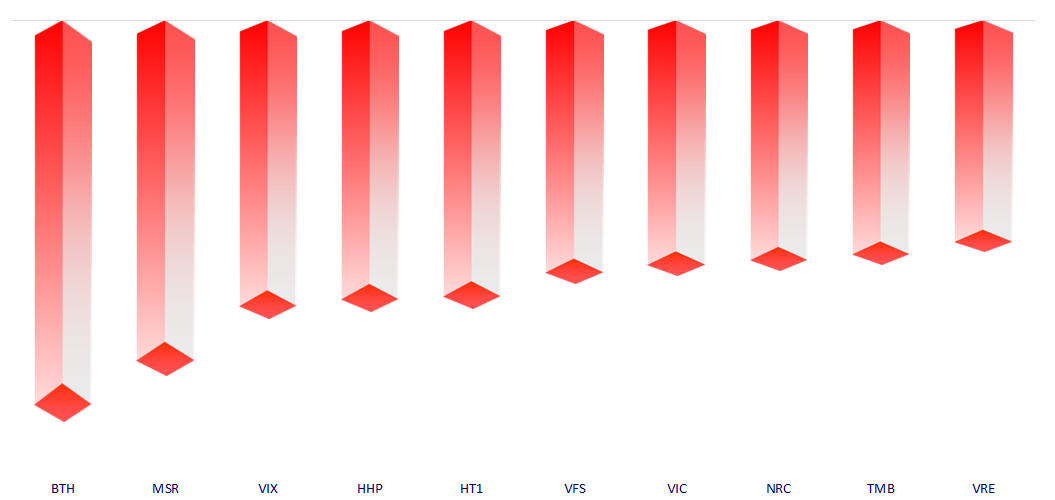

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.