Market brief 31/10/2025

VIETNAM STOCK MARKET

1,639.65

1D -1.79%

YTD 29.43%

265.85

1D -0.42%

YTD 16.89%

1,885.36

1D -2.07%

YTD 40.20%

113.46

1D 0.04%

YTD 19.36%

-527.55

1D 0.00%

YTD 0.00%

30,098.00

1D 14.22%

YTD 66.00%

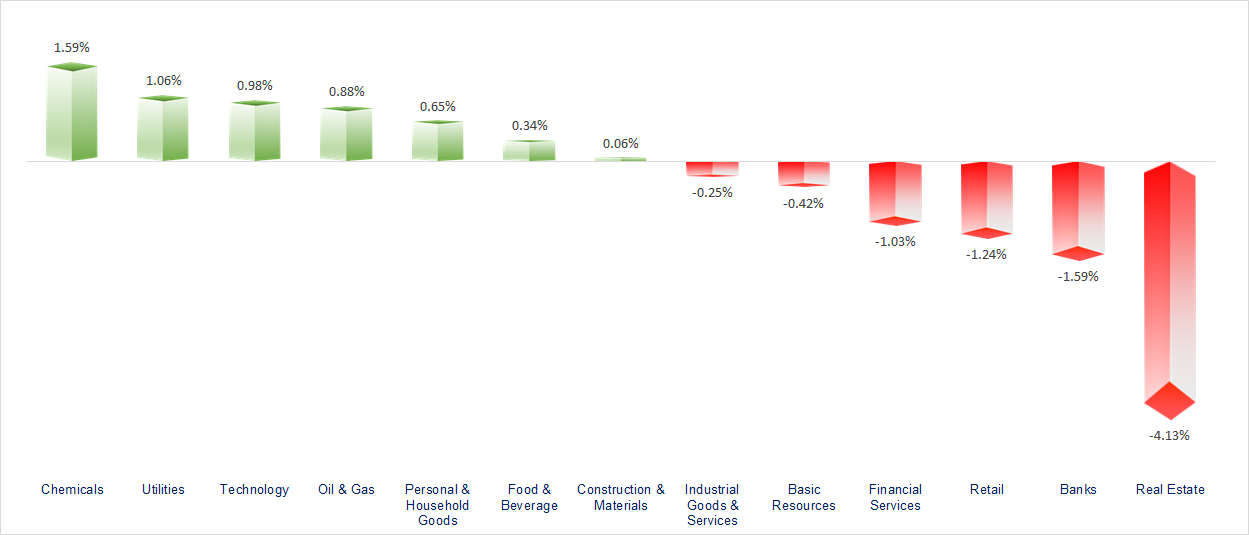

VN-Index fell sharply by nearly 30 points, driven by late-session declines in Vingroup-related stocks and banking shares. The Chemicals, Technology, and Oil & Gas sectors were among the top gainers today, while Real Estate, Banking, and Retail sectors showed weak performance.

ETF & DERIVATIVES

34,130

1D -0.84%

YTD 45.36%

23,140

1D -1.11%

YTD 42.14%

24,270

1D -0.12%

YTD 45.33%

29,570

1D 0.92%

YTD 47.11%

31,000

1D -1.46%

YTD 40.27%

39,150

1D -0.74%

YTD 16.80%

25,690

1D 1.54%

YTD 43.36%

1,892

1D -1.82%

YTD 0.00%

1,886

1D -1.77%

YTD 0.00%

1,882

1D -2.05%

YTD 0.00%

1,888

1D -1.84%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

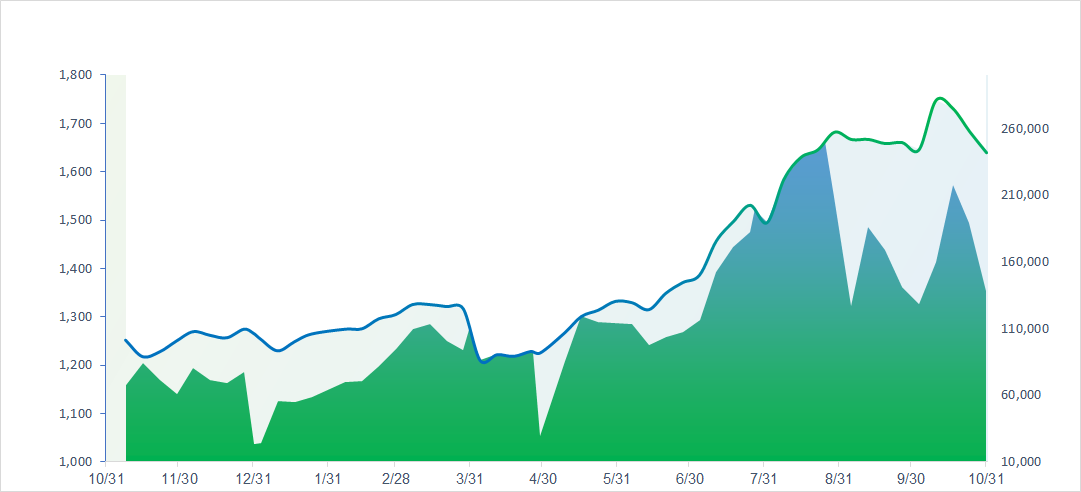

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

52,411.34

1D 2.12%

YTD 31.37%

3,954.79

1D -0.81%

YTD 17.99%

25,906.65

1D -1.43%

YTD 29.15%

4,107.50

1D 0.50%

YTD 71.18%

83,932.17

1D -0.61%

YTD 6.82%

4,428.62

1D -0.20%

YTD 16.92%

1,309.50

1D -0.39%

YTD -6.48%

63.92

1D -0.70%

YTD -14.83%

4,006.09

1D -0.46%

YTD 52.03%

Asian equities showed mixed movements following the meeting between U.S. President Donald Trump and Chinese President Xi Jinping. Notably, Japan’s Nikkei 225 continued its record-breaking rally, rising more than 2% to close at 52,411.34 points, while Hong Kong’s Hang Seng Index dropped 1.4% to 25,906.65 points.

VIETNAM ECONOMY

4.58%

1D (bps) 134

YTD (bps) 61

4.60%

3.23%

1D (bps) 1

YTD (bps) 75

3.74%

1D (bps) -1

YTD (bps) 89

26,347

1D (%) 0.01%

YTD (%) 3.12%

31,215

1D (%) -0.51%

YTD (%) 14.48%

3,760

1D (%) -0.10%

YTD (%) 5.57%

Domestic gold prices rebounded strongly across the board after a steep decline in the previous session. Gold bars, plain rings, and jewelry all rose between 700,000 and 2.7 million VND/tael. Gold rings led the rally, surging to a record high of 149.2 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ho Chi Minh City must disburse more than VND 600 billion in public investment every day;

- Prime Minister Pham Minh Chinh spoke about the timing of salary increases in 2026;

- Ho Chi Minh City’s budget revenue reached VND 652 trillion in the first 10 months of the year;

- The U.S. Senate has passed a resolution to end President Trump’s global tariffs;

- China announced key areas of consensus with the U.S. on economic and trade cooperation;

- The European Central Bank (ECB) decided to keep interest rates unchanged, leaving all monetary policy options open.

VN30

BANK

59,600

1D -1.65%

5D 0.17%

Buy Vol. 4,225,997

Sell Vol. 5,022,122

37,400

1D -1.32%

5D 1.36%

Buy Vol. 4,089,498

Sell Vol. 4,297,240

49,000

1D -0.41%

5D -1.61%

Buy Vol. 13,547,817

Sell Vol. 17,646,827

35,100

1D -1.68%

5D -2.77%

Buy Vol. 24,648,503

Sell Vol. 18,300,008

28,700

1D -1.71%

5D -1.71%

Buy Vol. 28,420,377

Sell Vol. 25,349,975

23,600

1D -1.46%

5D -3.28%

Buy Vol. 38,431,060

Sell Vol. 30,673,185

32,000

1D -4.19%

5D -2.14%

Buy Vol. 29,611,561

Sell Vol. 35,430,427

16,650

1D -2.92%

5D -2.33%

Buy Vol. 18,846,891

Sell Vol. 16,819,482

55,500

1D -2.46%

5D 1.83%

Buy Vol. 8,823,122

Sell Vol. 9,686,867

18,550

1D -1.07%

5D 0.27%

Buy Vol. 9,862,967

Sell Vol. 8,398,255

25,500

1D 1.59%

5D 2.00%

Buy Vol. 27,292,907

Sell Vol. 22,636,670

16,450

1D -2.66%

5D 0.92%

Buy Vol. 80,348,647

Sell Vol. 100,995,340

17,700

1D -1.12%

5D -1.67%

Buy Vol. 6,034,839

Sell Vol. 5,400,275

50,700

1D -2.50%

5D -2.87%

Buy Vol. 3,904,825

Sell Vol. 4,002,719

CTG (VietinBank): VietinBank impressed the market with its pre-tax profit in Q3/2025 rising 62% year-over-year, reaching over VND 10.6 trillion. Cumulative 9-month profit increased 51% compared to the same period last year, marking the highest growth rate among major banks.

OIL & GAS

61,600

1D 3.18%

5D 3.36%

Buy Vol. 2,067,711

Sell Vol. 2,243,278

34,550

1D 0.00%

5D 0.73%

Buy Vol. 6,054,161

Sell Vol. 7,583,812

Government issued a Resolution to address difficulties related to the delegation of approval authority for activities in oil and gas sector.

VINGROUP

191,000

1D -6.42%

5D -12.79%

Buy Vol. 11,105,440

Sell Vol. 9,179,670

99,200

1D -4.62%

5D -13.36%

Buy Vol. 9,944,257

Sell Vol. 9,733,960

33,300

1D -3.76%

5D -14.18%

Buy Vol. 24,299,060

Sell Vol. 23,930,634

VIC: Consolidated net revenue in the first nine months of 2025 reached VND 169.6 trillion, up 34% year-over-year. Consolidated post-tax profit reached VND 7.57 trillion, 1.9 times higher than the same period in 2024.

FOOD & BEVERAGE

57,600

1D 0.88%

5D -0.86%

Buy Vol. 4,450,430

Sell Vol. 5,326,923

79,600

1D 0.38%

5D 0.38%

Buy Vol. 10,356,422

Sell Vol. 13,213,973

45,850

1D 0.33%

5D 1.55%

Buy Vol. 1,002,148

Sell Vol. 1,517,725

VNM: In Q3/2025, consolidated pre-tax and post-tax profit reached VND3.13 trillion and VND2.51 trillion, respectively, up 6.2% and 4.5% YoY. 9-month results recorded VND8.17 trillion pre-tax and VND6.59 trillion post-tax profit.

OTHERS

66,000

1D -1.35%

5D 0.30%

Buy Vol. 267,744

Sell Vol. 543,990

96,000

1D 2.56%

5D 3.90%

Buy Vol. 4,930,843

Sell Vol. 5,936,162

187,000

1D -4.35%

5D 3.89%

Buy Vol. 3,983,851

Sell Vol. 4,561,898

103,900

1D 1.17%

5D 6.35%

Buy Vol. 21,761,351

Sell Vol. 26,546,577

82,600

1D -1.55%

5D -3.62%

Buy Vol. 14,654,898

Sell Vol. 17,683,304

29,050

1D 2.47%

5D 9.42%

Buy Vol. 9,997,513

Sell Vol. 12,517,370

34,300

1D -1.58%

5D -4.72%

Buy Vol. 43,608,672

Sell Vol. 42,943,601

26,700

1D -0.74%

5D 1.14%

Buy Vol. 33,445,968

Sell Vol. 38,460,781

MWG: Foreign investors recorded their fourth consecutive net buying session in MWG shares, with a net inflow of VND 93 billion today.

Market by numbers

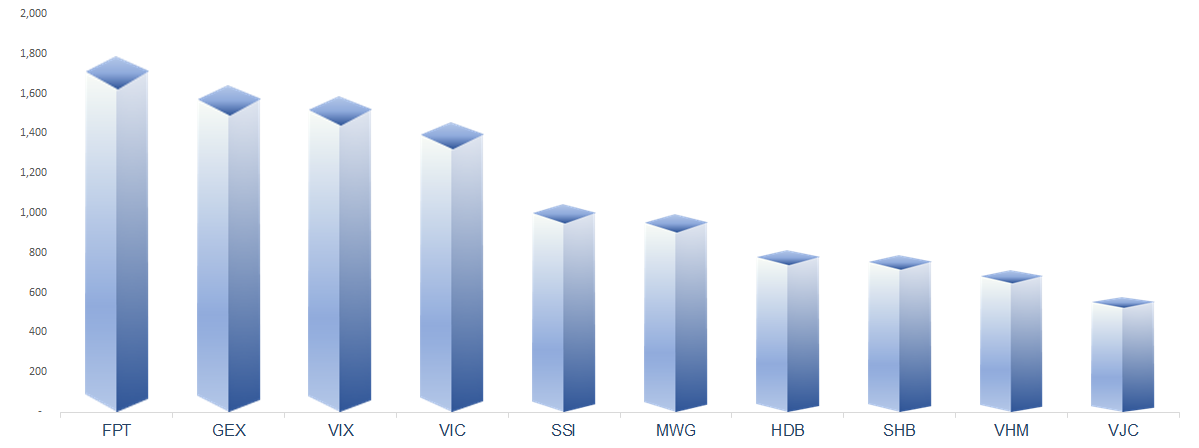

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

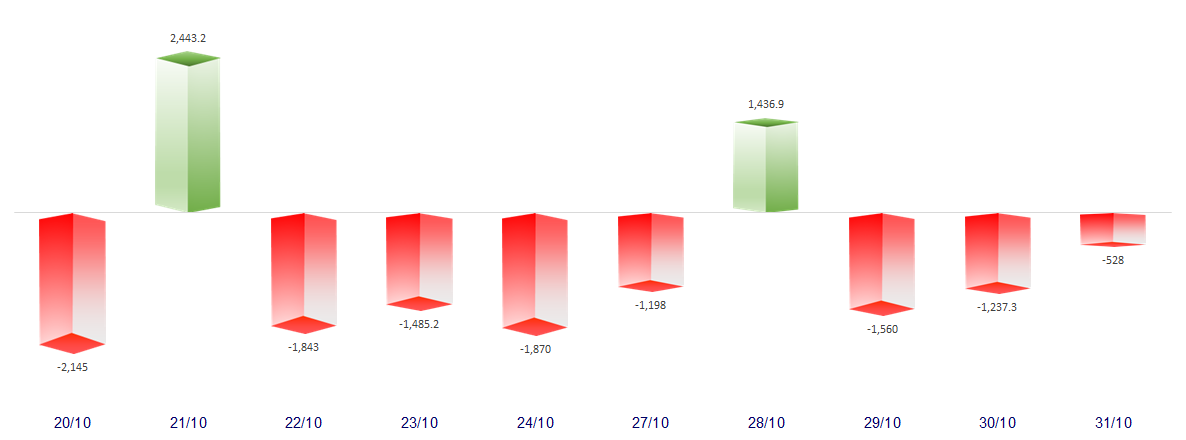

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

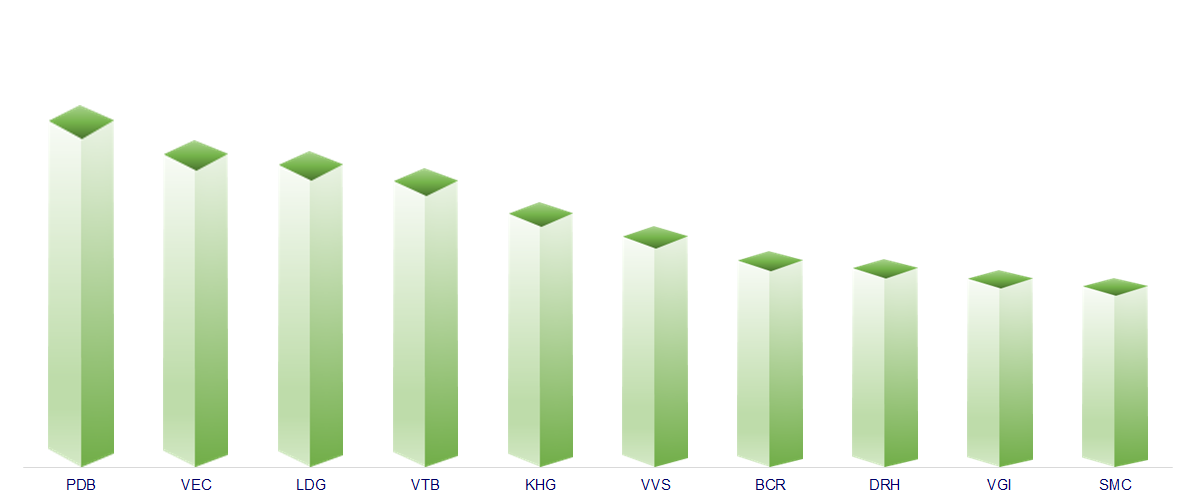

TOP INCREASES 3 CONSECUTIVE SESSIONS

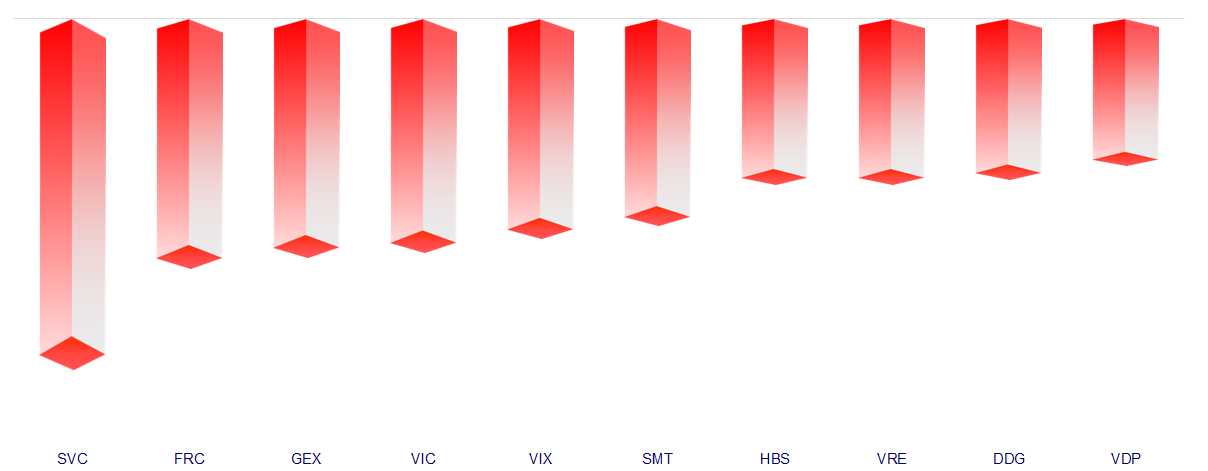

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.