Market brief 03/11/2025

VIETNAM STOCK MARKET

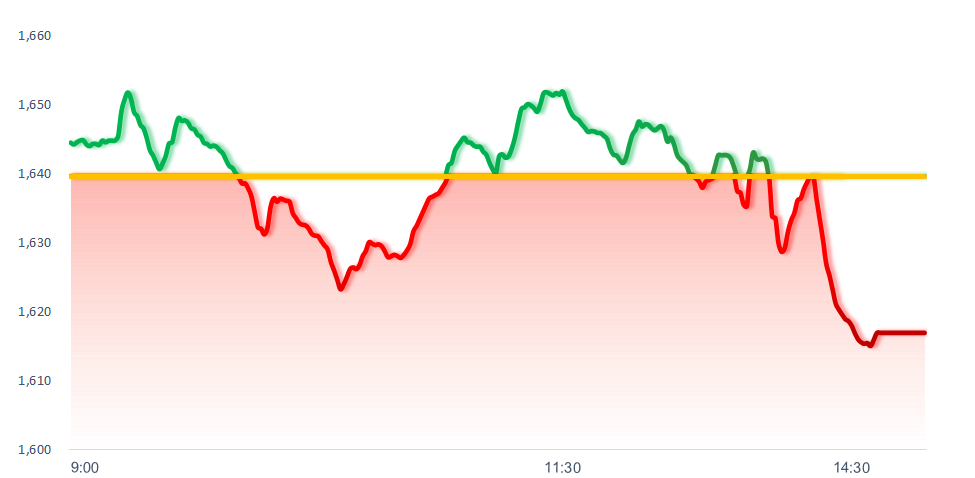

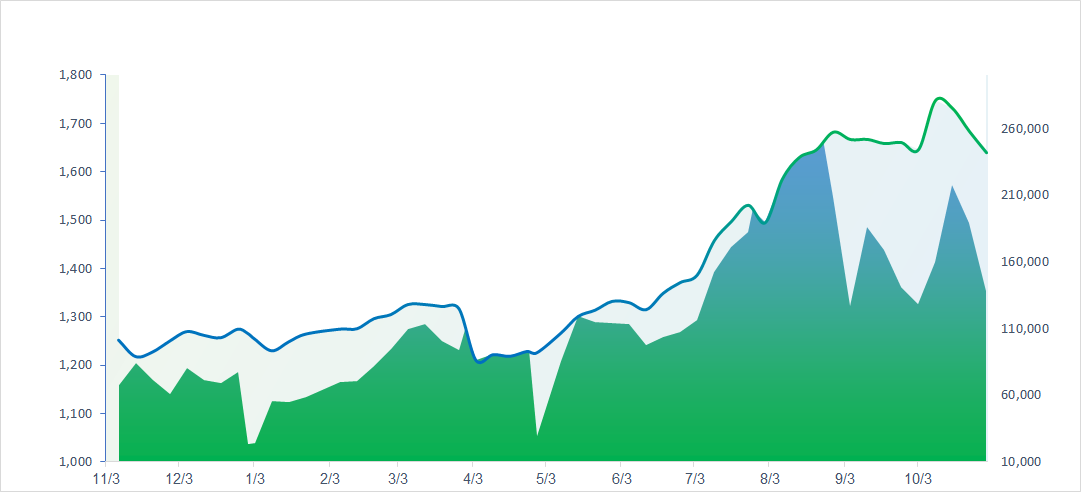

1,617.00

1D -1.38%

YTD 27.65%

259.18

1D -2.51%

YTD 13.96%

1,857.64

1D -1.47%

YTD 38.14%

114.63

1D 1.03%

YTD 20.59%

-205.59

1D 0.00%

YTD 0.00%

33,080.00

1D 9.91%

YTD 82.45%

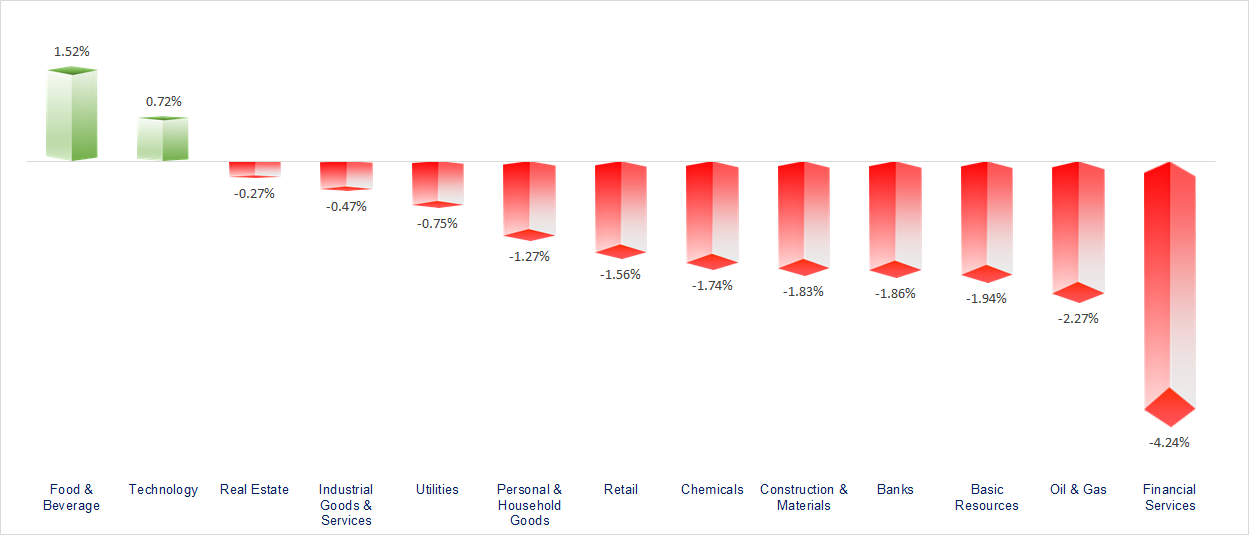

VN-Index lost more than 22 points as Banking, Real Estate, and Securities stocks fell sharply toward the end of the session. Meanwhile, the Food & Beverage (F&B) and Technology sectors were the top performers today. In contrast, Securities and Oil & Gas sectors showed lackluster movements.

ETF & DERIVATIVES

33,200

1D -2.72%

YTD 41.40%

22,600

1D -2.33%

YTD 38.82%

23,970

1D -1.24%

YTD 43.53%

29,000

1D -1.93%

YTD 44.28%

30,100

1D -2.90%

YTD 36.20%

38,890

1D -0.66%

YTD 16.02%

25,800

1D 0.43%

YTD 43.97%

1,860

1D -1.69%

YTD 0.00%

1,860

1D -1.17%

YTD 0.00%

1,860

1D -1.38%

YTD 0.00%

1,859

1D -1.57%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

52,411.34

1D 0.00%

YTD 31.37%

3,976.52

1D 0.55%

YTD 18.64%

26,158.36

1D 0.97%

YTD 30.41%

4,221.87

1D 2.78%

YTD 75.95%

83,978.49

1D 0.06%

YTD 6.88%

4,444.33

1D 0.35%

YTD 17.34%

1,308.86

1D -0.05%

YTD -6.52%

64.50

1D -0.42%

YTD -14.06%

4,001.00

1D -0.03%

YTD 51.84%

Asian markets were awash in green today, with both South Korea’s Kospi and Japan’s Nikkei 225 indexes surging over 2%, continuing to set new all-time highs. China’s Shanghai Composite Index also rose 0.5%, despite news that the country’s PMI fell to 49.0 in October, below September’s reading of 49.8.

VIETNAM ECONOMY

5.40%

1D (bps) 82

YTD (bps) 143

4.60%

3.31%

1D (bps) 8

YTD (bps) 83

3.69%

1D (bps) -6

YTD (bps) 84

26,347

1D (%) 0.00%

YTD (%) 3.12%

31,090

1D (%) -0.40%

YTD (%) 14.02%

3,755

1D (%) -0.11%

YTD (%) 5.46%

Global gold prices inched up and traded above the 4,000 USD/oz mark, while the domestic gold market showed divergent movements among product categories. SJC gold bars saw a modest rebound after a period of stagnation, whereas plain gold rings and 24K jewelry showed mixed trends across major brands.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Construction will set a maximum price cap for domestic economy-class airfares;

- Minister of Finance: Many ODA projects are delayed, with procedural times two to three times longer than international norms;

- The Law on Prices will be amended to align with the two-tier local government system and practical price management realities;

- The U.S. Secretary of Energy revealed details of a nuclear weapons test;

- China announced key areas of consensus with the U.S. on economic and trade cooperation;

- Risky loans from the 2008 housing bubble era are making a comeback.

VN30

BANK

59,300

1D -0.50%

5D 0.17%

Buy Vol. 4,545,702

Sell Vol. 5,425,453

37,100

1D -0.80%

5D 1.64%

Buy Vol. 3,498,659

Sell Vol. 4,102,837

48,500

1D -1.02%

5D -0.21%

Buy Vol. 8,702,311

Sell Vol. 9,836,467

33,600

1D -4.27%

5D -4.14%

Buy Vol. 28,056,741

Sell Vol. 30,119,210

27,600

1D -3.83%

5D -2.47%

Buy Vol. 35,017,487

Sell Vol. 32,946,906

23,100

1D -2.12%

5D -2.94%

Buy Vol. 52,949,022

Sell Vol. 43,964,585

30,550

1D -4.53%

5D -1.77%

Buy Vol. 31,701,656

Sell Vol. 33,085,388

16,650

1D 0.00%

5D -0.39%

Buy Vol. 32,271,575

Sell Vol. 32,582,147

52,300

1D -5.77%

5D -4.21%

Buy Vol. 8,190,351

Sell Vol. 9,779,912

18,350

1D -1.08%

5D -0.54%

Buy Vol. 6,898,952

Sell Vol. 7,987,856

25,450

1D -0.20%

5D 1.80%

Buy Vol. 22,655,752

Sell Vol. 23,173,590

15,950

1D -3.04%

5D -1.24%

Buy Vol. 105,747,738

Sell Vol. 131,815,488

17,750

1D 0.28%

5D 1.14%

Buy Vol. 4,686,189

Sell Vol. 4,292,119

50,700

1D 0.00%

5D -2.31%

Buy Vol. 4,236,563

Sell Vol. 3,009,268

BAB: According to its consolidated Q3/2025 financial report, Bac A Bank recorded pre-tax profit of over VND 145 billion, down by half compared to both Q2/2025 and the same period in 2024. In Q3/2025, the bank’s net interest income reached VND 701 billion, down 21% QoQ (from VND 892 billion in Q2/2025) and down 6% YoY (from VND 748 billion in Q3/2024). This marks the sharpest decline since the beginning of the year, reflecting rising funding costs.

OIL & GAS

61,500

1D -0.16%

5D 3.71%

Buy Vol. 1,550,807

Sell Vol. 2,076,870

34,300

1D -0.72%

5D 0.44%

Buy Vol. 1,529,250

Sell Vol. 3,263,294

GAS: In the first nine months of 2025, PV Gas reported net revenue of VND 91.49 trillion, up 16% YoY, and net profit of VND 10.18 trillion, up 19%.

VINGROUP

195,400

1D 2.30%

5D -8.69%

Buy Vol. 6,725,141

Sell Vol. 6,014,280

98,500

1D -0.71%

5D -7.51%

Buy Vol. 8,466,266

Sell Vol. 7,109,762

31,350

1D -5.86%

5D -13.16%

Buy Vol. 26,100,832

Sell Vol. 25,250,992

VIC: At the end of September, Vingroup and the family of Chairman Pham Nhat Vuong established three companies in the event and arts sectors, each with charter capital of VND 10 billion.

FOOD & BEVERAGE

57,300

1D -0.52%

5D 0.53%

Buy Vol. 4,219,789

Sell Vol. 5,512,338

77,000

1D -3.27%

5D -1.91%

Buy Vol. 9,345,399

Sell Vol. 12,760,660

46,300

1D 0.98%

5D 1.87%

Buy Vol. 1,340,862

Sell Vol. 1,988,890

SAB: Foreign investors have been net buyers in 9 of the last 10 sessions of SAB, with a total net purchase value of VND 44 billion.

OTHERS

66,000

1D 0.00%

5D 0.76%

Buy Vol. 350,160

Sell Vol. 546,108

95,500

1D -0.52%

5D 2.80%

Buy Vol. 2,962,024

Sell Vol. 4,925,430

183,500

1D -1.87%

5D 4.68%

Buy Vol. 3,842,327

Sell Vol. 4,277,284

105,000

1D 1.06%

5D 7.14%

Buy Vol. 25,848,547

Sell Vol. 34,358,176

81,000

1D -1.94%

5D 0.00%

Buy Vol. 10,280,992

Sell Vol. 12,008,118

28,350

1D -2.41%

5D 3.47%

Buy Vol. 6,971,626

Sell Vol. 10,507,537

32,500

1D -5.25%

5D -6.61%

Buy Vol. 67,671,816

Sell Vol. 71,120,740

26,050

1D -2.43%

5D -0.76%

Buy Vol. 46,010,073

Sell Vol. 48,768,499

GVR: On November 14, Vietnam Rubber Group – JSC will finalize the list of shareholders eligible for the 2024 cash dividend payout. Dividend rate: 4% per share (equivalent to 400 VND/share). With 4 billion shares outstanding, GVR will allocate VND 1.6 trillion for this dividend payment.

Market by numbers

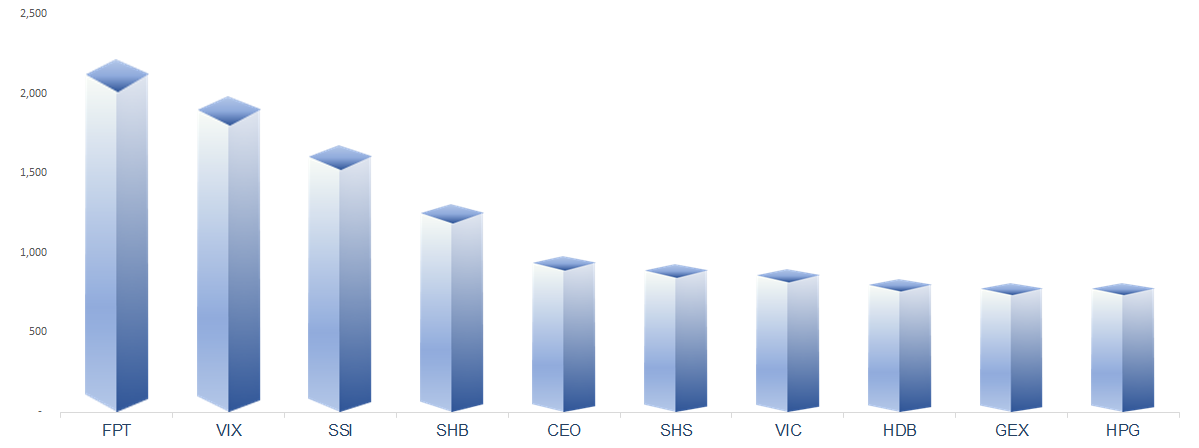

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

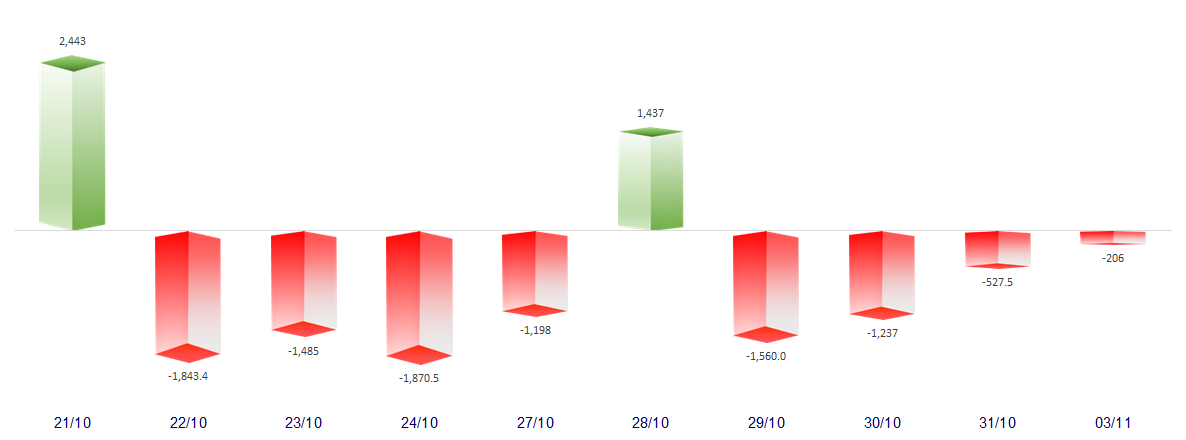

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

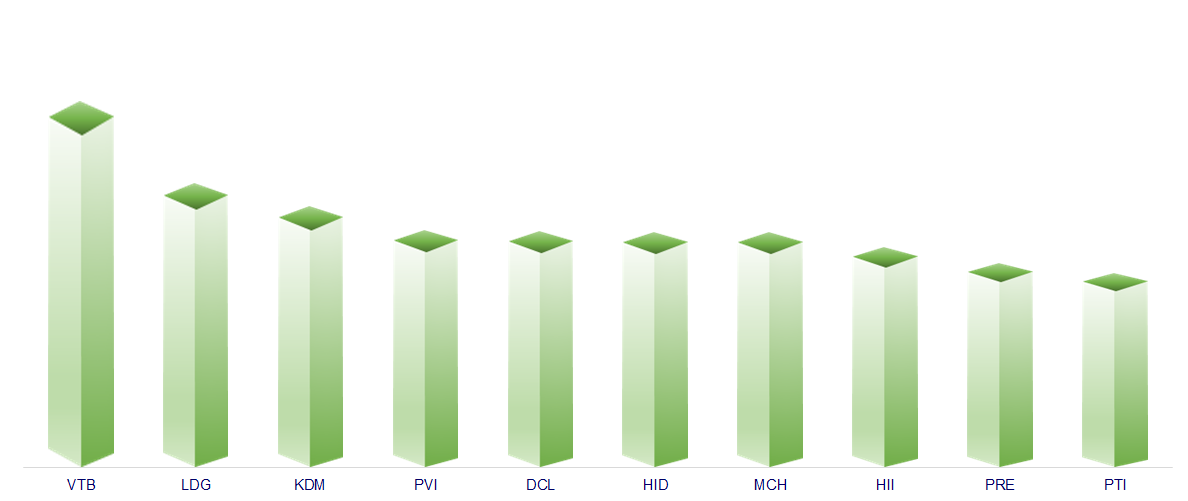

TOP INCREASES 3 CONSECUTIVE SESSIONS

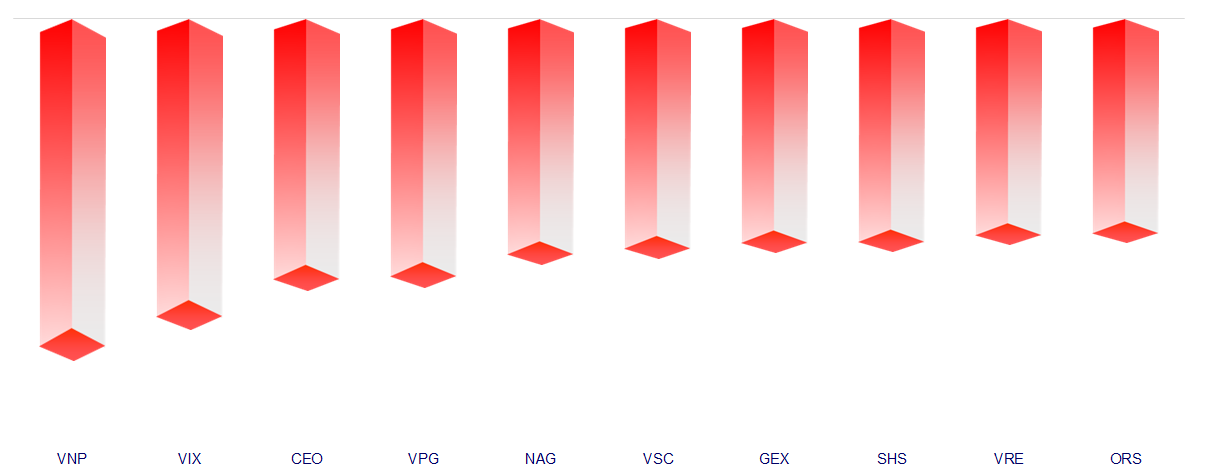

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.