Market brief 07/11/2025

VIETNAM STOCK MARKET

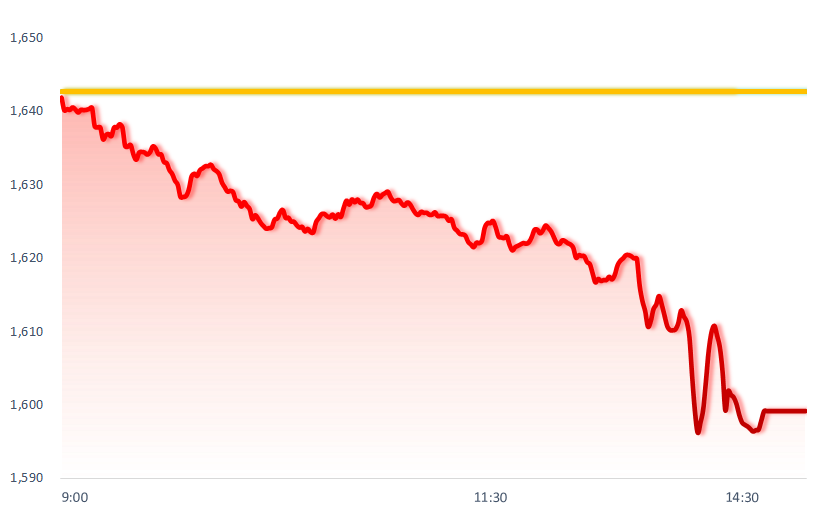

1,599.10

1D -2.65%

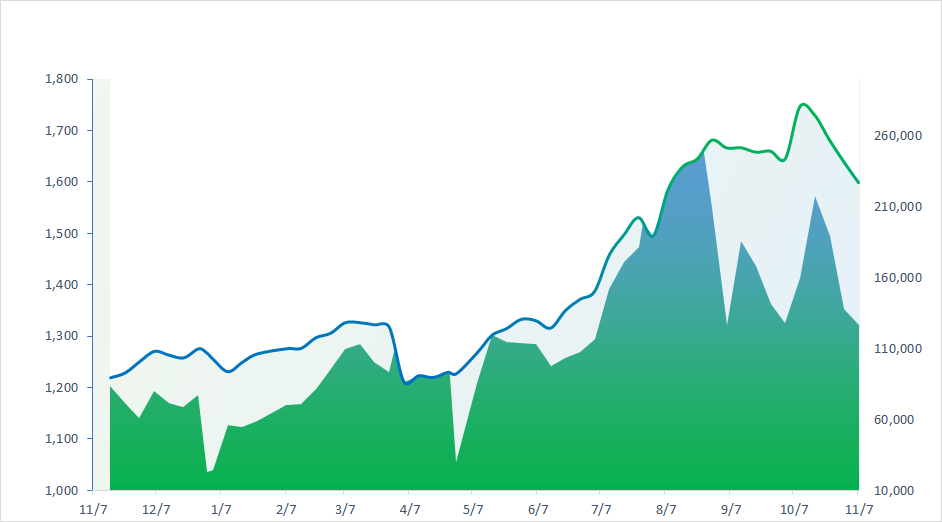

YTD 26.23%

261.11

1D -1.89%

YTD 14.81%

1,824.71

1D -2.40%

YTD 35.69%

116.75

1D 0.46%

YTD 22.82%

-1,367.90

1D 0.00%

YTD 0.00%

27,933.69

1D 37.65%

YTD 54.07%

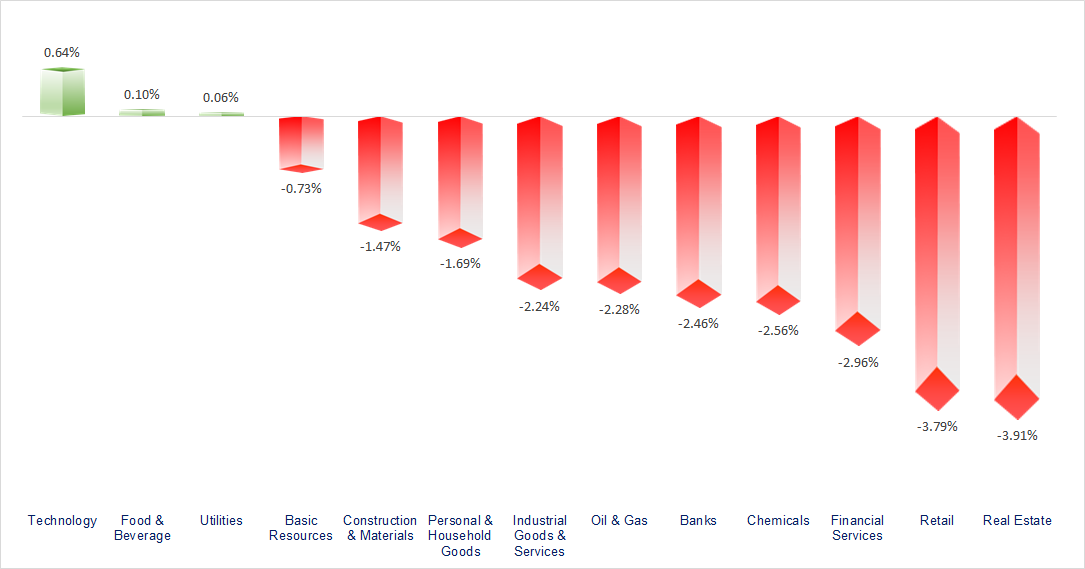

VN-Index fell below the 1,600-point threshold under strong correction pressure from large-cap stocks. Most sectors recorded negative movements today, with the most significant declines seen in the Vingroup group, Banking, Securities, and Real Estate sectors.

ETF & DERIVATIVES

32,400

1D -2.35%

YTD 37.99%

22,120

1D -3.87%

YTD 35.87%

22,860

1D -3.54%

YTD 36.89%

28,250

1D -3.75%

YTD 40.55%

29,310

1D -3.01%

YTD 32.62%

37,800

1D -2.28%

YTD 12.77%

25,200

1D -2.14%

YTD 40.63%

1,828

1D -2.07%

YTD 0.00%

1,821

1D -2.39%

YTD 0.00%

1,815

1D -2.73%

YTD 0.00%

1,825

1D -2.68%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

50,276.37

1D -1.19%

YTD 26.02%

3,997.56

1D -0.25%

YTD 19.27%

26,241.83

1D -0.92%

YTD 30.82%

3,953.76

1D -1.81%

YTD 64.78%

83,216.28

1D -0.11%

YTD 5.91%

4,492.24

1D 0.16%

YTD 18.60%

1,302.91

1D -0.79%

YTD -6.95%

64.30

1D 1.15%

YTD -14.32%

4,003.75

1D 0.14%

YTD 51.94%

Most Asian stock markets on November 7 followed Wall Street’s downturn, as investors weighed the weak U.S. employment data against signals that the Federal Reserve (Fed) may not continue cutting interest rates this year. The Chinese market turned sharply red after data showed October exports fell 1.1% year-on-year.

VIETNAM ECONOMY

5.90%

1D (bps) -10

YTD (bps) 193

4.60%

3.33%

1D (bps) 2

YTD (bps) 85

3.70%

1D (bps) 1

YTD (bps) 85

26,358

1D (%) 0.01%

YTD (%) 3.16%

31,139

1D (%) 0.21%

YTD (%) 14.20%

3,755

1D (%) 0.04%

YTD (%) 5.45%

Today, the State Bank of Vietnam conducted a term purchase operation with a total value of nearly VND18,000 billion, applying a 4% interest rate across all maturities of 7 days, 14 days, 28 days, and 91 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam recorded a trade surplus of USD19.56 billion after 10 months;

- The Government proposed to adjust and expand four national growth driver regions;

- Hanoi’s budget revenue reached over VND564 trillion after 10 months;

- U.S. labor market received bad news: a layoff indicator hit a 22-year high;

- America’s USD40 billion gamble to compete with China in its “backyard”;

- Indonesia will end diesel imports by early 2026.

VN30

BANK

59,300

1D -1.66%

5D -0.50%

Buy Vol. 5,537,172

Sell Vol. 5,862,101

37,500

1D -2.60%

5D 0.27%

Buy Vol. 4,762,667

Sell Vol. 6,111,673

49,000

1D -4.11%

5D 0.00%

Buy Vol. 17,902,438

Sell Vol. 19,723,305

33,000

1D -1.79%

5D -5.98%

Buy Vol. 22,343,968

Sell Vol. 21,865,872

27,500

1D -3.51%

5D -4.18%

Buy Vol. 37,722,131

Sell Vol. 31,237,743

23,300

1D -1.69%

5D -1.27%

Buy Vol. 38,790,497

Sell Vol. 36,924,026

30,000

1D -0.33%

5D -6.25%

Buy Vol. 32,710,118

Sell Vol. 29,195,168

16,500

1D -2.37%

5D -0.90%

Buy Vol. 15,006,972

Sell Vol. 18,926,921

48,350

1D -6.84%

5D -12.88%

Buy Vol. 30,796,475

Sell Vol. 26,917,870

18,300

1D -1.35%

5D -1.35%

Buy Vol. 6,458,690

Sell Vol. 8,495,958

24,900

1D -1.58%

5D -2.35%

Buy Vol. 20,606,512

Sell Vol. 19,607,824

15,300

1D -3.47%

5D -6.99%

Buy Vol. 148,024,265

Sell Vol. 123,278,775

17,200

1D -1.43%

5D -2.82%

Buy Vol. 9,627,835

Sell Vol. 9,823,462

49,300

1D -4.27%

5D -2.76%

Buy Vol. 4,286,035

Sell Vol. 4,450,386

LPB: Lien Viet Post Bank (LPB) has announced a Board of Directors resolution approving the plan to hold an extraordinary general meeting of shareholders in 2025. The record date for shareholder eligibility is November 25, 2025.

OIL & GAS

62,900

1D 1.29%

5D 2.11%

Buy Vol. 1,844,636

Sell Vol. 2,162,050

34,000

1D -2.16%

5D -1.59%

Buy Vol. 3,797,930

Sell Vol. 4,284,472

As of 5:00 PM today, Brent crude oil prices recovered by more than 0.3%, reaching 64.3 USD/barrel.

VINGROUP

199,700

1D -3.90%

5D 4.55%

Buy Vol. 5,048,676

Sell Vol. 5,367,153

92,000

1D -6.98%

5D -7.26%

Buy Vol. 12,053,581

Sell Vol. 13,277,967

31,350

1D -2.03%

5D -5.86%

Buy Vol. 21,097,228

Sell Vol. 19,676,271

VHM: Vinhomes shares hit the floor price, breaking below the two-month bottom.

FOOD & BEVERAGE

57,600

1D -0.69%

5D 0.00%

Buy Vol. 5,742,679

Sell Vol. 6,142,978

76,800

1D -2.54%

5D -3.52%

Buy Vol. 11,041,651

Sell Vol. 11,733,317

46,100

1D -0.11%

5D 0.55%

Buy Vol. 1,091,968

Sell Vol. 1,315,480

VNM: Foreign investors maintained a net-buying streak for three consecutive sessions in VNM shares, with a net inflow of over VND39 billion today.

OTHERS

68,000

1D -1.02%

5D 3.03%

Buy Vol. 287,909

Sell Vol. 819,032

93,100

1D -2.00%

5D -3.02%

Buy Vol. 2,399,521

Sell Vol. 3,081,729

178,000

1D -1.60%

5D -4.81%

Buy Vol. 2,921,554

Sell Vol. 3,385,647

101,000

1D 0.80%

5D -2.79%

Buy Vol. 9,685,689

Sell Vol. 11,192,600

76,500

1D -4.73%

5D -7.38%

Buy Vol. 12,886,132

Sell Vol. 12,774,321

27,800

1D -3.14%

5D -4.30%

Buy Vol. 5,017,577

Sell Vol. 6,482,704

32,950

1D -3.94%

5D -3.94%

Buy Vol. 56,405,682

Sell Vol. 51,446,220

26,050

1D -0.19%

5D -2.43%

Buy Vol. 88,758,488

Sell Vol. 79,703,776

HPG: The Ministry of Investment, Trade, and Industry of Malaysia announced its findings on the investigation of certain coated steel products originating from China, South Korea, and Vietnam. Notably, Vietnamese steel producers such as HPG, NKG, HSG, and GDA were granted a 0% tax rate, while other producers faced tariffs of up to nearly 58%.

Market by numbers

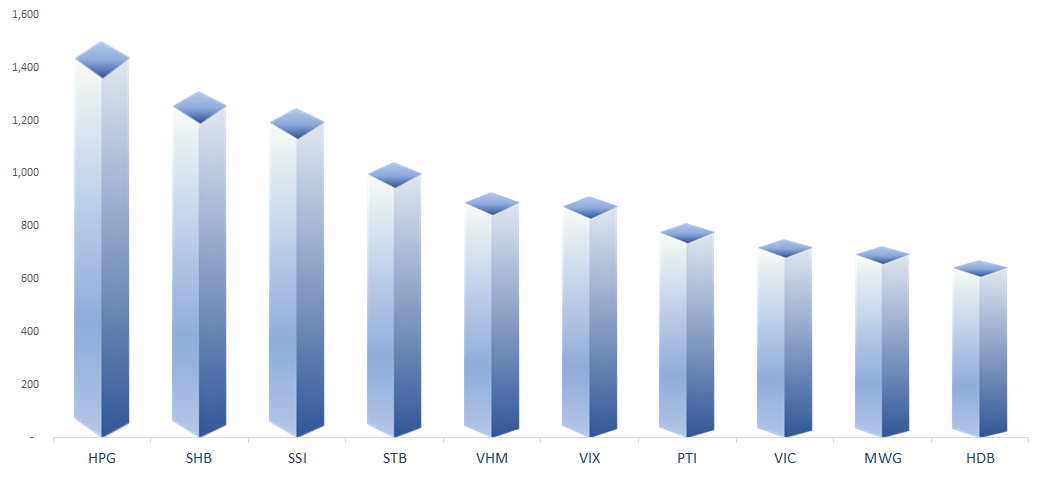

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

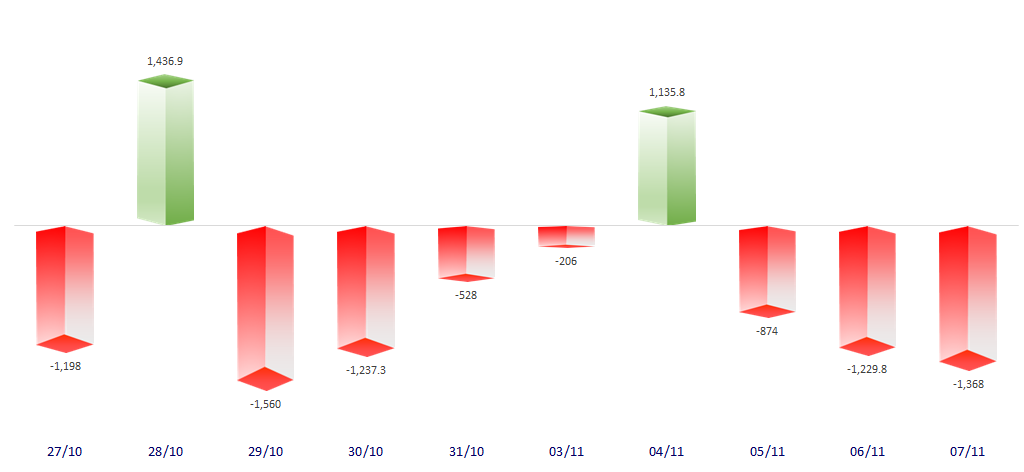

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

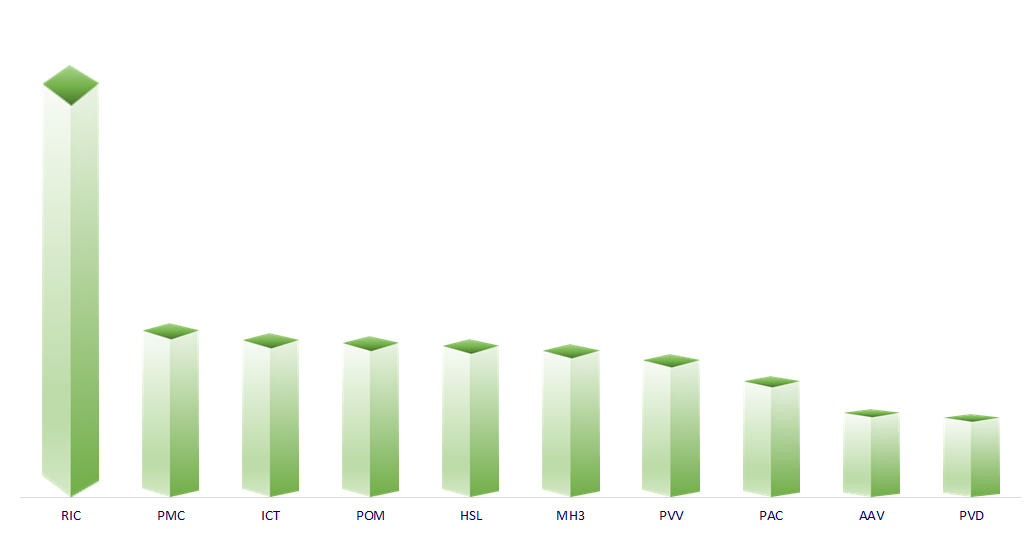

TOP INCREASES 3 CONSECUTIVE SESSIONS

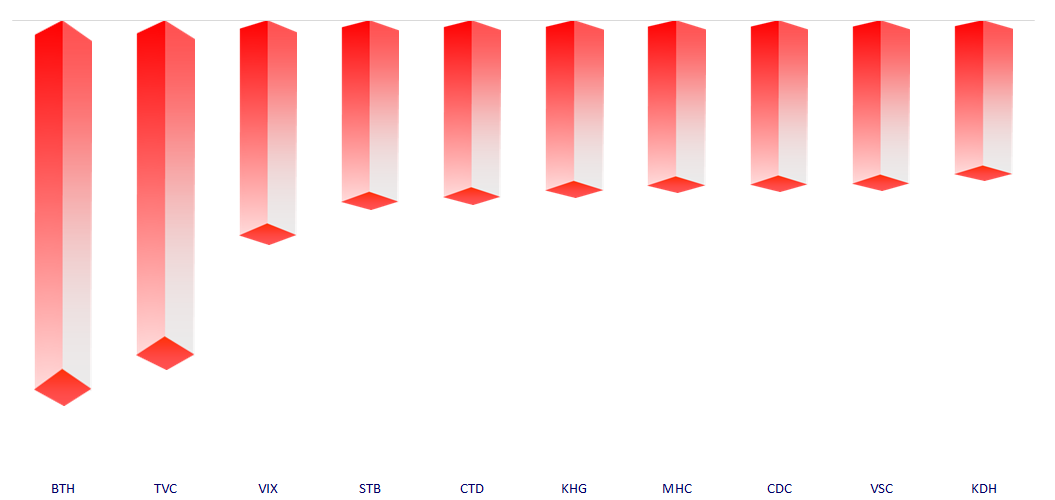

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.