Market brief 11/11/2025

VIETNAM STOCK MARKET

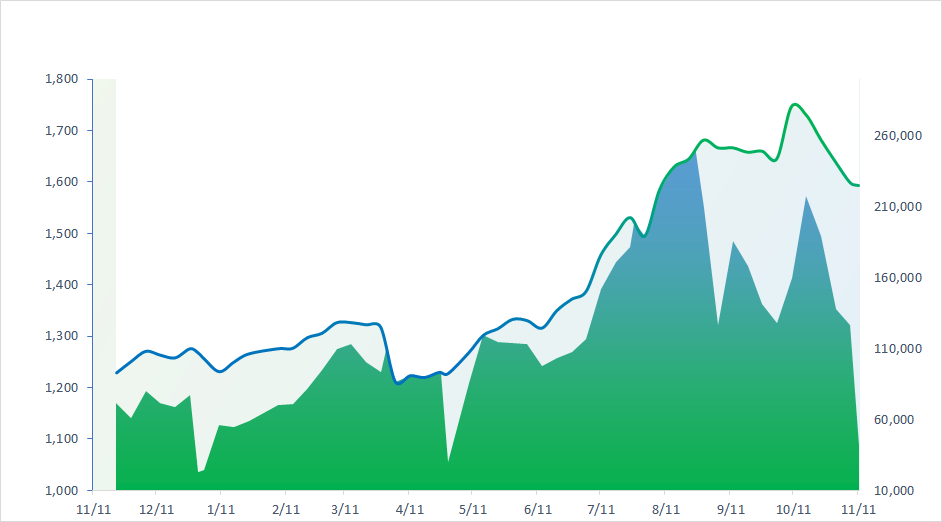

1,593.61

1D 0.83%

YTD 25.80%

261.08

1D 1.12%

YTD 14.80%

1,821.60

1D 0.97%

YTD 35.46%

117.85

1D 0.34%

YTD 23.97%

-76.91

1D 0.00%

YTD 0.00%

21,775.45

1D -8.23%

YTD 20.10%

VN-Index rebounded today, driven by strong buying interest in stocks that could potentially be added to the FTSE Global All Cap Index. Most sectors posted positive performance, with the F&B, Securities, and Retail groups standing out as top gainers.

ETF & DERIVATIVES

32,330

1D 0.43%

YTD 37.69%

22,200

1D -0.27%

YTD 36.36%

23,000

1D 0.13%

YTD 37.72%

28,010

1D -0.14%

YTD 39.35%

29,150

1D 0.45%

YTD 31.90%

37,100

1D 0.00%

YTD 10.68%

25,690

1D 0.00%

YTD 43.36%

1,815

1D 0.76%

YTD 0.00%

1,810

1D 0.57%

YTD 0.00%

1,808

1D 0.44%

YTD 0.00%

1,803

1D 0.31%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

50,842.93

1D -0.14%

YTD 27.44%

4,002.76

1D -0.39%

YTD 19.42%

26,696.41

1D 0.18%

YTD 33.09%

4,106.39

1D 0.81%

YTD 71.14%

83,871.32

1D 0.40%

YTD 6.74%

4,542.20

1D 1.20%

YTD 19.92%

1,300.47

1D -0.44%

YTD -7.12%

64.20

1D 0.53%

YTD -14.46%

4,143.42

1D 0.07%

YTD 57.24%

Several Asian stock markets turned lower on November 11, as the earlier rally — fueled by hopes that the U.S. government shutdown might soon end — lost momentum later in the session. In Tokyo, the Nikkei 225 slipped 0.1%, while in Shanghai, the Shanghai Composite Index declined 0.4%. Similarly, South Korea’s Kospi Index, which had gained more than 2% at one point during the session, pared most of its advance to close up only 0.8%.

VIETNAM ECONOMY

6.20%

1D (bps) 20

YTD (bps) 223

4.60%

3.32%

1D (bps) 6

YTD (bps) 84

3.69%

1D (bps) -7

YTD (bps) 84

26,373

1D (%) 0.05%

YTD (%) 3.22%

31,165

1D (%) -0.09%

YTD (%) 14.30%

3,753

1D (%) 0.02%

YTD (%) 5.40%

Today (11/11), the domestic gold market continued to rise sharply across all segments. Notably, plain gold rings are now being sold at prices higher than SJC bullion, while 24K jewelry gold led the rally with an impressive gain of up to 3.3 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Breaking: FTSE announces the Vietnam stock basket and expected weightings ahead of potential reclassification;

- Official: Vietnam’s wealthiest city finalizes schedule to lay the foundation for a 12 km metro line worth VND54 trillion;

- Finance Minister discusses an important proposal regarding the national railway system;

- Cambodia balances between China and the U.S., importing from one and exporting to the other, heightening trade dependency risks;

- China pursues its ambition to counter U.S. dominance in global energy supply;

- Fed Governor calls for a 50 bps rate cut in December.

VN30

BANK

58,900

1D 0.17%

5D -2.00%

Buy Vol. 4,096,995

Sell Vol. 4,506,654

38,000

1D 1.60%

5D 0.26%

Buy Vol. 4,005,462

Sell Vol. 4,671,308

48,500

1D 1.04%

5D -2.90%

Buy Vol. 14,746,525

Sell Vol. 11,958,150

33,650

1D 0.75%

5D -3.86%

Buy Vol. 19,246,398

Sell Vol. 16,382,173

27,500

1D 0.00%

5D -6.78%

Buy Vol. 25,699,434

Sell Vol. 21,288,173

23,200

1D 0.43%

5D -3.33%

Buy Vol. 35,574,886

Sell Vol. 27,106,571

29,600

1D 0.00%

5D -4.82%

Buy Vol. 22,094,519

Sell Vol. 20,256,662

16,900

1D 2.42%

5D -2.03%

Buy Vol. 8,622,965

Sell Vol. 7,373,674

49,650

1D 2.37%

5D -7.88%

Buy Vol. 18,278,057

Sell Vol. 15,639,923

18,200

1D -0.27%

5D -3.96%

Buy Vol. 13,177,233

Sell Vol. 12,827,843

24,850

1D 0.20%

5D -4.42%

Buy Vol. 12,052,304

Sell Vol. 10,984,236

15,800

1D 3.27%

5D -3.07%

Buy Vol. 123,525,245

Sell Vol. 86,624,402

16,600

1D -1.48%

5D -6.74%

Buy Vol. 3,916,885

Sell Vol. 4,920,192

47,500

1D -1.66%

5D -8.12%

Buy Vol. 3,496,542

Sell Vol. 2,769,067

According to the draft circular, the State Bank of Vietnam plans to raise the end-of-day gold position limit for credit institutions authorized to produce, export, and import gold bullion, as well as to import raw gold, to 5% of their charter capital. This limit would encompass gold bullion production volumes, export/import turnover, and transactions involving raw gold buying and selling.

OIL & GAS

61,100

1D -0.16%

5D 0.99%

Buy Vol. 961,585

Sell Vol. 1,189,993

33,750

1D -0.44%

5D -1.32%

Buy Vol. 2,273,873

Sell Vol. 2,338,219

As of 5 p.m. today, Brent crude oil recovered 0.3%, reaching 64.2 USD/barrel.

VINGROUP

201,000

1D 1.01%

5D 0.00%

Buy Vol. 5,275,535

Sell Vol. 5,943,906

90,000

1D 3.57%

5D -10.18%

Buy Vol. 13,083,012

Sell Vol. 10,536,604

31,050

1D 4.19%

5D -7.31%

Buy Vol. 16,779,842

Sell Vol. 15,438,737

VIC: Foreign investors made a strong comeback, net-buying VND152 billion worth of VIC shares.

FOOD & BEVERAGE

58,900

1D 3.33%

5D 2.79%

Buy Vol. 9,289,630

Sell Vol. 7,917,991

78,200

1D 2.89%

5D -2.25%

Buy Vol. 14,539,481

Sell Vol. 10,826,573

46,800

1D 1.74%

5D 1.19%

Buy Vol. 2,491,742

Sell Vol. 2,572,628

VNM: Foreign investors also net-bought VND81 billion of VNM shares today.

OTHERS

67,000

1D 1.52%

5D 0.00%

Buy Vol. 536,194

Sell Vol. 579,739

91,800

1D 0.33%

5D -2.96%

Buy Vol. 2,861,284

Sell Vol. 2,618,261

174,900

1D -0.91%

5D -5.87%

Buy Vol. 2,507,350

Sell Vol. 3,029,090

96,100

1D -0.10%

5D -6.97%

Buy Vol. 10,349,076

Sell Vol. 10,724,976

78,000

1D 1.56%

5D -4.65%

Buy Vol. 11,000,601

Sell Vol. 8,449,329

27,900

1D -0.18%

5D -2.96%

Buy Vol. 2,610,951

Sell Vol. 3,683,884

34,850

1D 3.72%

5D 0.29%

Buy Vol. 68,405,515

Sell Vol. 46,644,117

26,600

1D 0.57%

5D -0.56%

Buy Vol. 55,342,099

Sell Vol. 63,544,106

HPG: Hoa Phat plans to IPO its agriculture subsidiary and launch several large-scale projects in December.

Market by numbers

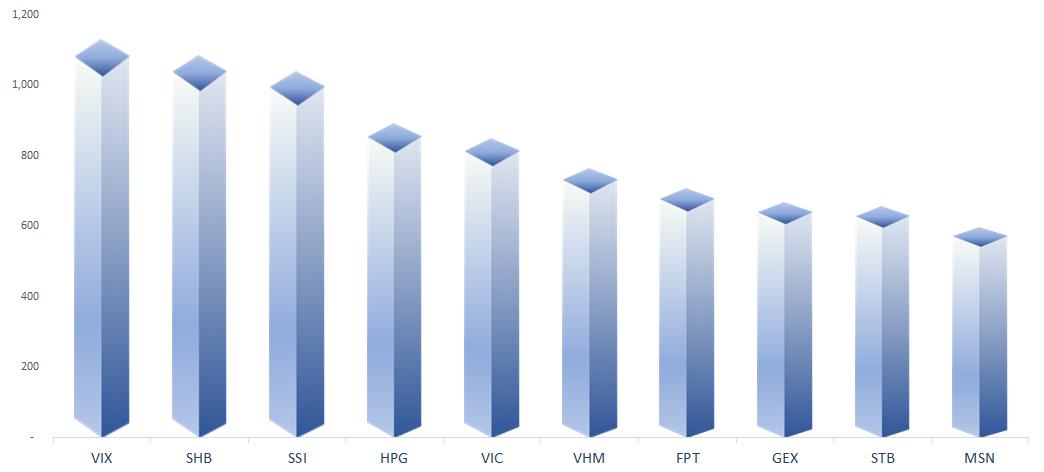

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

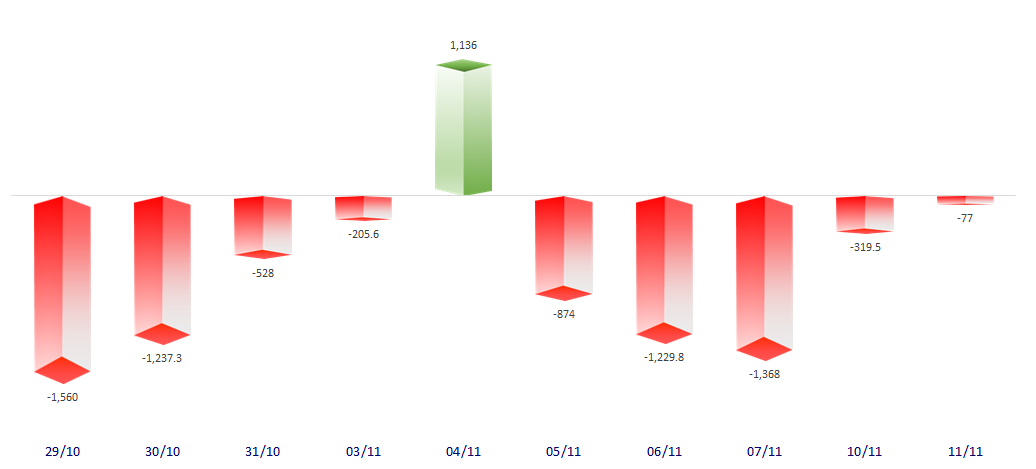

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

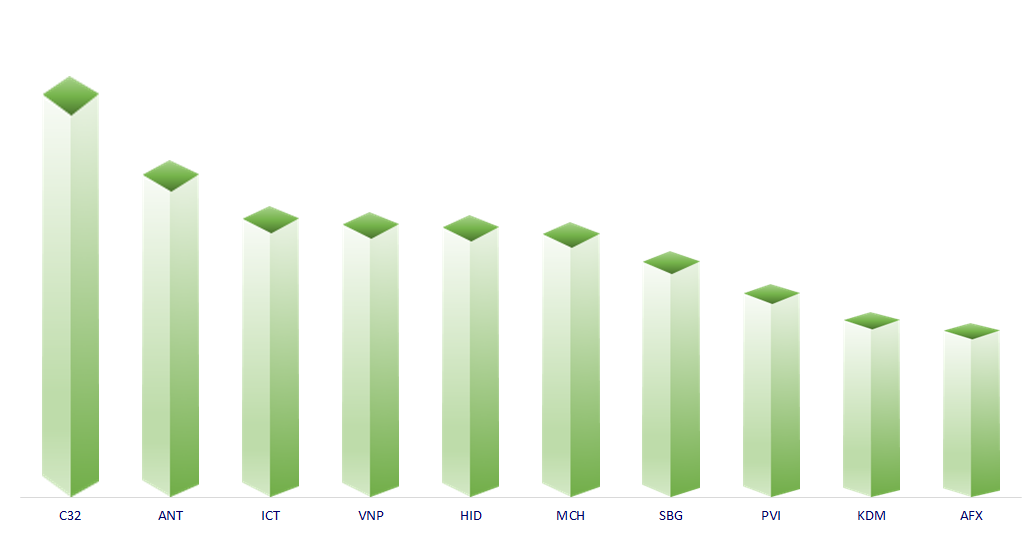

TOP INCREASES 3 CONSECUTIVE SESSIONS

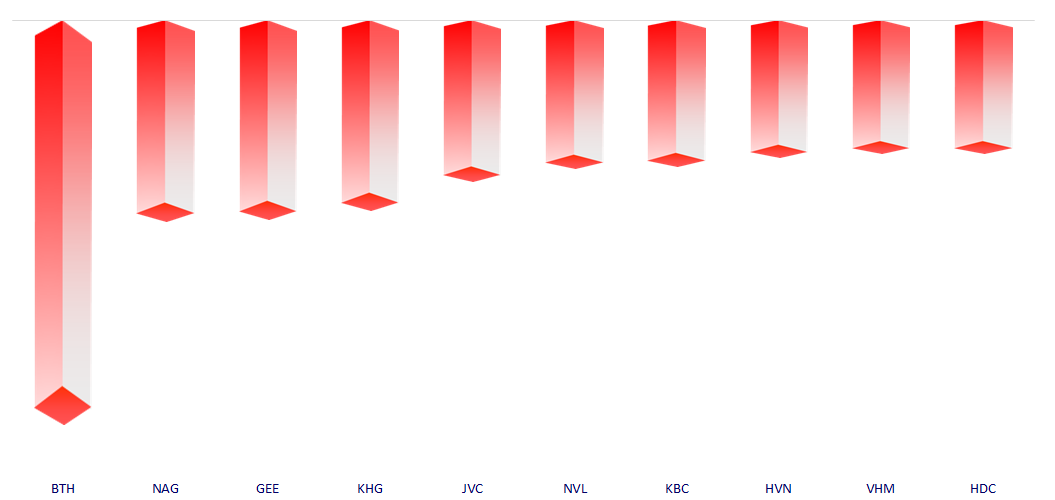

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.