Market brief 13/11/2025

VIETNAM STOCK MARKET

1,631.44

1D -0.03%

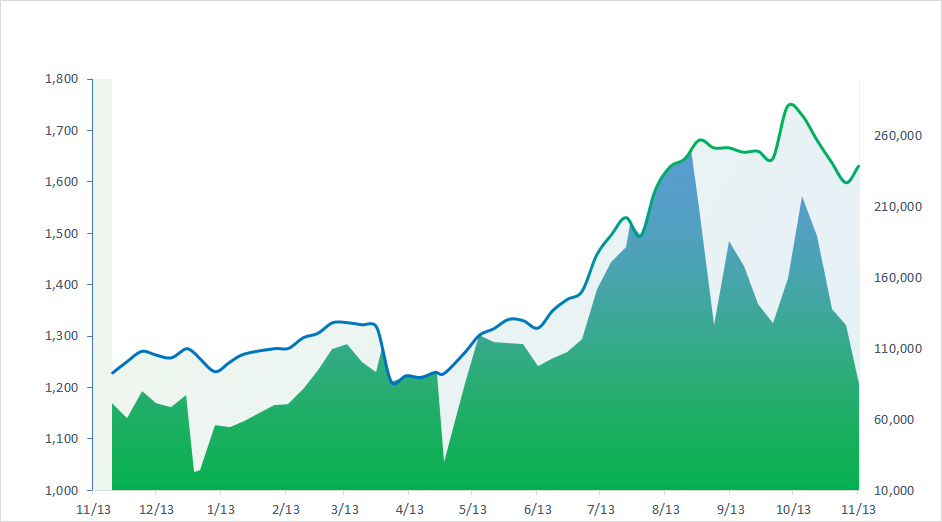

YTD 28.79%

266.29

1D 7.90%

YTD 17.09%

1,864.23

1D -0.43%

YTD 38.63%

120.04

1D 0.27%

YTD 26.28%

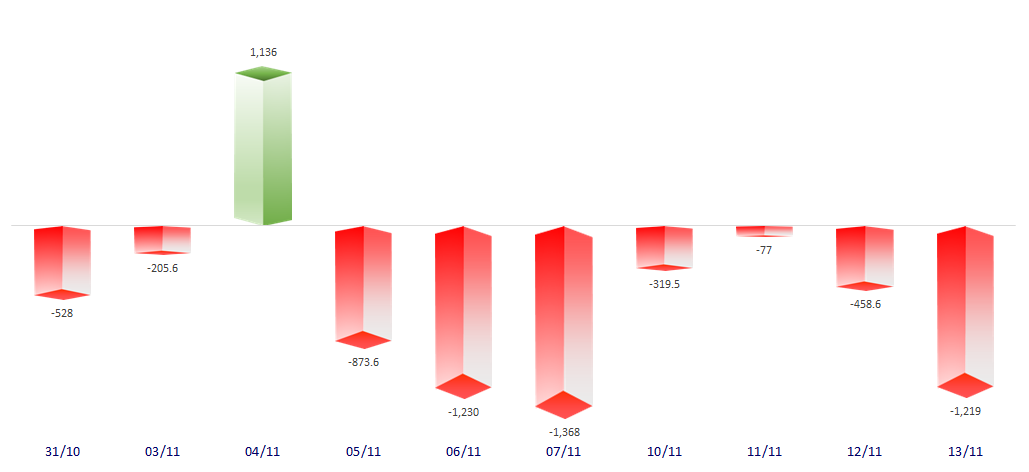

-1,218.75

1D 0.00%

YTD 0.00%

24,653.80

1D 2.09%

YTD 35.98%

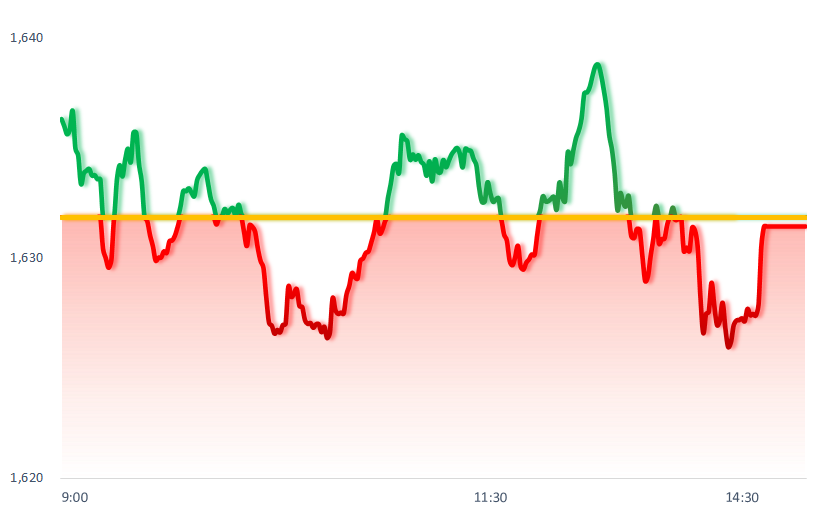

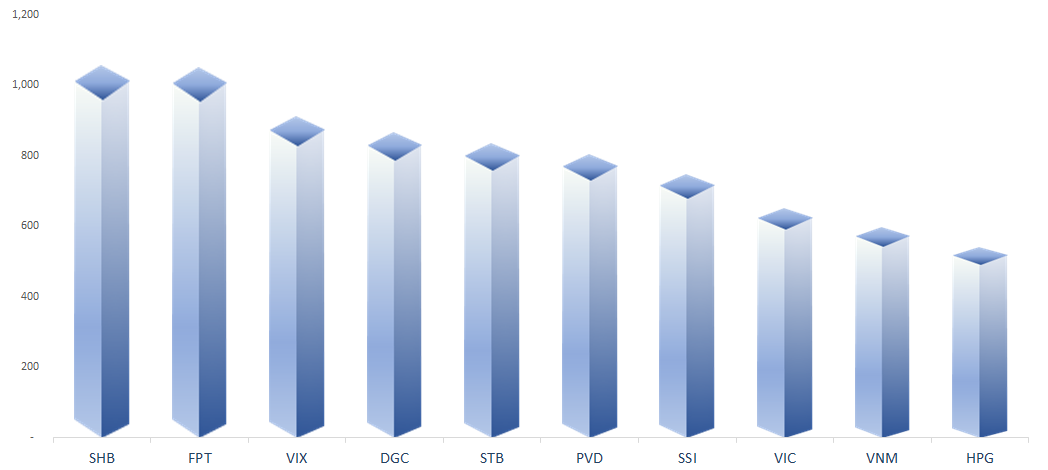

VN-Index posted a slight decline today on low liquidity, despite net foreign outflows exceeding VND1.2 trillion. The Chemicals, Oil & Gas, and F&B sectors were the strongest performers of the session, while Banking, Securities, and Technology stocks traded rather sluggishly.

ETF & DERIVATIVES

32,850

1D -0.90%

YTD 39.91%

22,420

1D -1.71%

YTD 37.71%

23,420

1D -0.55%

YTD 40.24%

28,000

1D -1.75%

YTD 39.30%

29,800

1D 0.13%

YTD 34.84%

38,230

1D 0.74%

YTD 14.05%

25,690

1D 0.16%

YTD 43.36%

1,863

1D -0.41%

YTD 0.00%

1,855

1D -0.68%

YTD 0.00%

1,846

1D -1.31%

YTD 0.00%

1,857

1D 0.92%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

51,281.83

1D 0.43%

YTD 28.54%

4,029.50

1D 0.73%

YTD 20.22%

27,073.03

1D 0.56%

YTD 34.97%

4,170.63

1D 0.49%

YTD 73.81%

84,503.32

1D 0.04%

YTD 7.54%

4,575.91

1D 0.15%

YTD 20.81%

1,287.44

1D 0.20%

YTD -8.05%

62.50

1D -0.32%

YTD -16.72%

4,232.50

1D 1.11%

YTD 60.62%

Asian markets mostly advanced today after reports that President Donald Trump signed the budget bill, officially reopening the U.S. government. Specifically, China’s Shanghai Composite Index rose by more than 0.7% to close at 4,029.5 points, while Hong Kong’s Hang Seng Index gained over 0.5% to finish at 27,073.03 points.

VIETNAM ECONOMY

5.40%

1D (bps) -70

YTD (bps) 143

4.60%

3.28%

1D (bps) -4

YTD (bps) 81

3.60%

1D (bps) -10

YTD (bps) 75

26,381

1D (%) -0.02%

YTD (%) 3.25%

31,305

1D (%) 0.09%

YTD (%) 14.81%

3,764

1D (%) 0.15%

YTD (%) 5.71%

Today, the Ministry of Industry and Trade and the Ministry of Finance jointly adjusted domestic fuel prices. Notably, prices of most gasoline and oil products increased, except for mazut, which fell by nearly 250 VND/kilogram.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- General Secretary To Lam inspected progress at the Long Thanh International Airport project;

- The National Assembly approved a target of GDP growth above 10% in 2026, with per capita GDP projected at USD5,400–5,500;

- The Deputy Prime Minister urged faster construction of the expressway linking Vietnam’s USD16 billion airport;

- Continued delays could turn China into “the next Japan";

- Breaking news: U.S. President Donald Trump has signed the budget law, allowing the U.S. government to reopen;

- Neighboring countries intend to shift new debt issuance from U.S. dollars to Chinese yuan;

VN30

BANK

59,800

1D 0.50%

5D -0.83%

Buy Vol. 4,379,290

Sell Vol. 4,724,818

38,300

1D 0.13%

5D -0.52%

Buy Vol. 3,191,206

Sell Vol. 4,148,758

48,850

1D -0.71%

5D -4.40%

Buy Vol. 8,514,383

Sell Vol. 9,427,933

35,100

1D 0.29%

5D 4.46%

Buy Vol. 19,062,979

Sell Vol. 21,293,851

27,750

1D -0.89%

5D -2.63%

Buy Vol. 22,592,297

Sell Vol. 25,568,142

23,500

1D -0.84%

5D -0.84%

Buy Vol. 34,874,554

Sell Vol. 35,414,431

29,950

1D -0.17%

5D -0.50%

Buy Vol. 17,153,890

Sell Vol. 17,295,534

16,950

1D -2.02%

5D 0.30%

Buy Vol. 7,783,412

Sell Vol. 10,135,028

48,700

1D -3.75%

5D -6.17%

Buy Vol. 21,580,159

Sell Vol. 23,362,409

18,550

1D -0.54%

5D 0.00%

Buy Vol. 5,838,219

Sell Vol. 6,790,701

25,100

1D -0.40%

5D -0.79%

Buy Vol. 9,215,380

Sell Vol. 10,845,657

16,350

1D 0.31%

5D 3.15%

Buy Vol. 104,351,760

Sell Vol. 128,257,537

17,150

1D 0.00%

5D -1.72%

Buy Vol. 4,801,579

Sell Vol. 5,356,978

48,900

1D 0.51%

5D -5.05%

Buy Vol. 3,089,449

Sell Vol. 2,019,605

During the November 12 trading session, the State Bank of Vietnam (SBV) significantly reduced the volume of repo offers (OMO operations) to VND10 trillion, down from VND32 trillion on November 11, while continuing to offer repos with a 105-day tenor. Specifically, the SBV offered VND1 trillion for 7 days, VND3 trillion for each of the 14-day, 28-day, and 105-day maturities, all at an interest rate of 4.0%. The results showed no successful bids at 7 days, VND2.235 trillion matched at 14 days, VND2.827 trillion at 28 days, and VND1.717 trillion at 105 days. Meanwhile, VND7.63366 trillion matured from the previous day’s operations.

OIL & GAS

62,900

1D 1.62%

5D 1.29%

Buy Vol. 2,281,157

Sell Vol. 2,634,867

34,500

1D 1.32%

5D -0.72%

Buy Vol. 5,175,440

Sell Vol. 4,638,362

As of 4:30 PM today, Brent crude oil edged down by over 0.3%, trading around 62.5 USD/barrel.

VINGROUP

211,200

1D 0.00%

5D 1.64%

Buy Vol. 3,744,877

Sell Vol. 5,098,909

93,300

1D -0.74%

5D -5.66%

Buy Vol. 5,678,615

Sell Vol. 7,117,925

31,950

1D -2.59%

5D -0.16%

Buy Vol. 7,964,532

Sell Vol. 11,714,012

VIC: Vingroup is preparing to break ground on a mega urban complex valued at nearly USD18 billion in Quang Ninh.

FOOD & BEVERAGE

61,800

1D 3.34%

5D 6.55%

Buy Vol. 16,499,258

Sell Vol. 14,742,779

79,000

1D -0.25%

5D 0.25%

Buy Vol. 6,941,641

Sell Vol. 8,724,321

47,400

1D 0.96%

5D 2.71%

Buy Vol. 1,820,926

Sell Vol. 2,286,710

VNM: Foreign investors recorded net purchases of over VND276 billion in Vinamilk (VNM) shares today.

OTHERS

67,900

1D 1.49%

5D -1.16%

Buy Vol. 769,177

Sell Vol. 824,393

100,000

1D 6.95%

5D 5.26%

Buy Vol. 15,723,156

Sell Vol. 9,302,888

176,300

1D 0.11%

5D -2.54%

Buy Vol. 3,263,629

Sell Vol. 3,579,870

98,900

1D -1.69%

5D -1.30%

Buy Vol. 12,433,795

Sell Vol. 15,322,629

80,100

1D -0.50%

5D -0.25%

Buy Vol. 6,452,765

Sell Vol. 7,810,942

28,500

1D 1.61%

5D 0.72%

Buy Vol. 5,526,736

Sell Vol. 7,246,397

34,950

1D -1.55%

5D 1.90%

Buy Vol. 34,373,204

Sell Vol. 41,037,522

26,550

1D -1.67%

5D 1.72%

Buy Vol. 35,223,945

Sell Vol. 46,409,579

DGC: On November 12, 2025, the Hanoi People’s Committee issued Decision No. 5568/QĐ-UBND, approving the investment policy and developer selection for the Duc Giang Complex Project, which includes public facilities, schools, and residential buildings. The project was proposed by Duc Giang Chemicals Group (DGC) and will be directly implemented by its subsidiary, Duc Giang Real Estate Co., Ltd.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

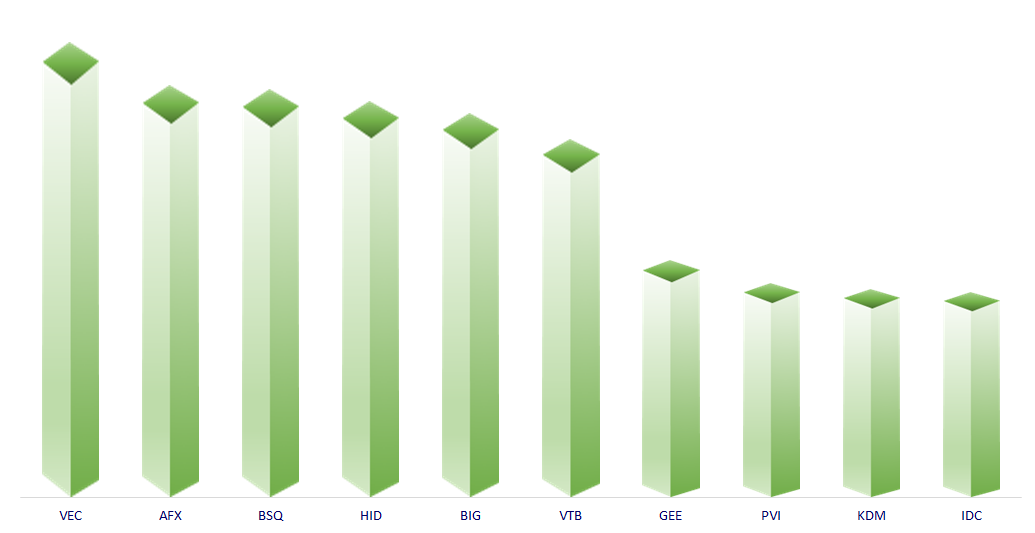

TOP INCREASES 3 CONSECUTIVE SESSIONS

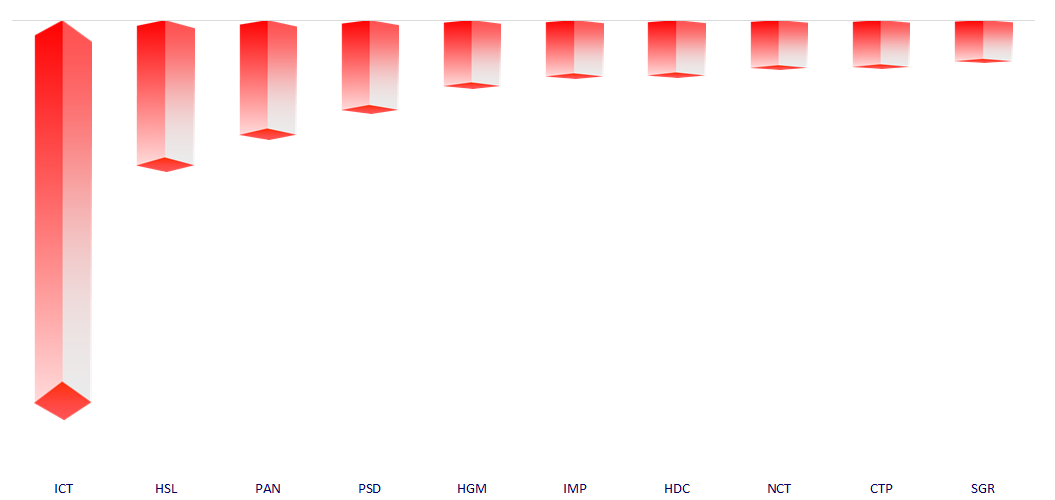

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.