Market brief 17/11/2025

VIETNAM STOCK MARKET

1,654.42

1D 1.16%

YTD 30.60%

268.69

1D 0.40%

YTD 18.14%

1,893.54

1D 1.18%

YTD 40.81%

120.88

1D 0.62%

YTD 27.16%

-975.47

1D 0.00%

YTD 0.00%

24,054.00

1D 3.14%

YTD 32.67%

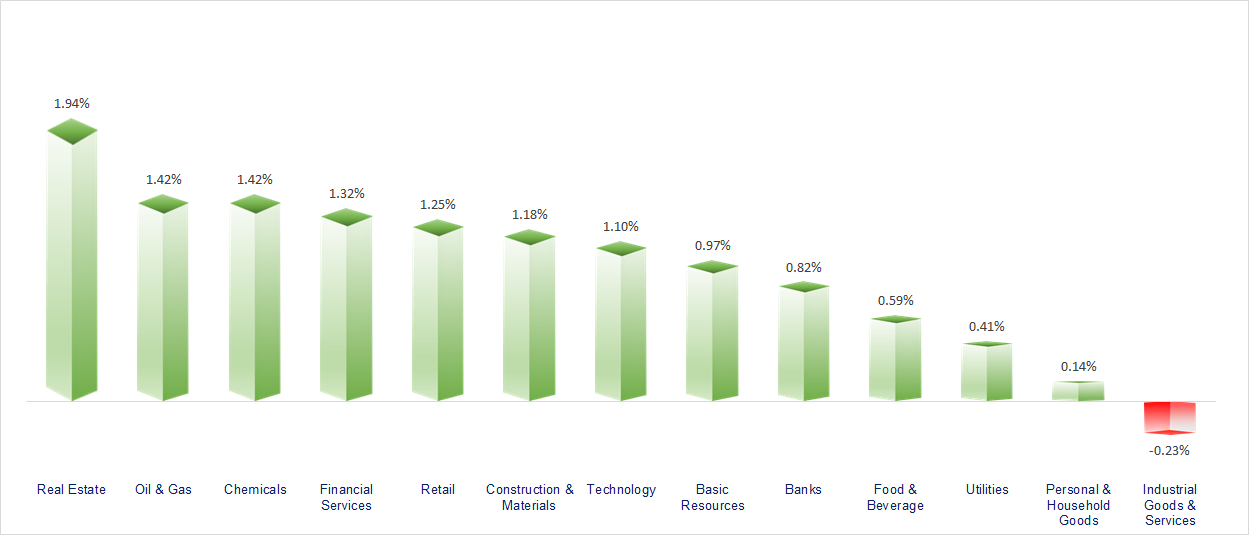

VN-Index simultaneously surged, led by real estate stocks. Most stock groups showed positive movements in today’s trading session. The most notable gainers were Real Estate, Oil & Gas, and Chemicals sectors.

ETF & DERIVATIVES

33,380

1D 1.15%

YTD 42.16%

22,940

1D 1.06%

YTD 40.91%

23,790

1D 1.67%

YTD 42.46%

28,010

1D 0.04%

YTD 39.35%

30,000

1D 1.01%

YTD 35.75%

38,310

1D 0.05%

YTD 14.29%

25,690

1D 0.35%

YTD 43.36%

1,895

1D 1.36%

YTD 0.00%

1,891

1D 1.40%

YTD 0.00%

1,881

1D 0.86%

YTD 0.00%

1,880

1D 1.48%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

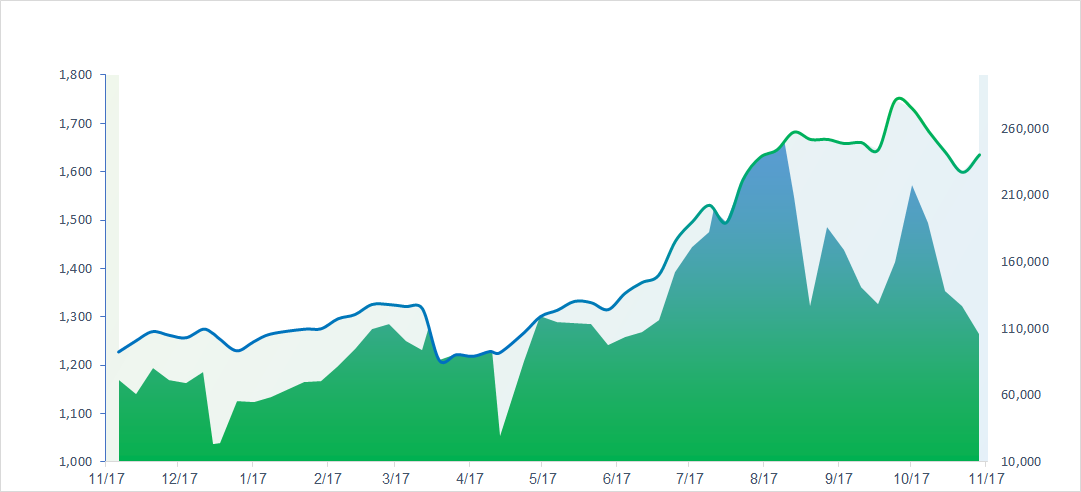

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

50,323.91

1D -0.10%

YTD 26.14%

3,972.03

1D -0.46%

YTD 18.51%

26,384.28

1D -0.71%

YTD 31.53%

4,089.25

1D 1.94%

YTD 70.42%

84,950.95

1D 0.32%

YTD 8.11%

4,543.59

1D -0.05%

YTD 19.96%

1,280.07

1D 0.85%

YTD -8.58%

64.47

1D 0.12%

YTD -14.10%

4,073.69

1D -0.14%

YTD 54.60%

Asian stock markets moved mixed today amid lingering concerns that the Federal Reserve (Fed) may not cut interest rates as expected next month, while fears of an asset bubble continued to weigh on market sentiment.

VIETNAM ECONOMY

4.60%

1D (bps) 10

YTD (bps) 63

4.60%

3.29%

1D (bps) -3

YTD (bps) 81

3.56%

1D (bps) -11

YTD (bps) 72

26,376

1D (%) -0.01%

YTD (%) 3.23%

31,376

1D (%) -0.22%

YTD (%) 15.07%

3,771

1D (%) -0.07%

YTD (%) 5.90%

Today, the domestic gold market remained quiet as SJC gold bars and plain rings stayed unchanged after a sharp drop over the weekend. Specifically, after the steep fall at the end of last week, SJC gold bar prices stabilized across all major enterprises. At Saigon Jewelry Company (SJC), Doji Group, Phu Quy, PNJ system, and Mi Hong, buying and selling prices were unchanged from the November 15 session — with buying prices ranging from 148 to 149.8 million VND/tael, and selling prices anchored at 151 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Home Affairs rejects rumors that Vietnam will merge provinces and cities down to 16;

- Hanoi: Transitioning to green vehicles is a sensitive issue, but cannot be delayed;

- Proposal to provide free annual health check-ups for citizens based on priority groups starting from 2026;

- President Trump supports a 500% tariff on countries purchasing Russian energy;

- Japan’s economy records negative growth for the first time in over a year;

- The EU plans to cut its 2026 economic growth forecast.

VN30

BANK

60,200

1D 0.33%

5D 2.38%

Buy Vol. 4,124,510

Sell Vol. 3,718,758

38,400

1D 0.13%

5D 2.67%

Buy Vol. 2,538,439

Sell Vol. 4,147,617

48,850

1D 0.62%

5D 1.77%

Buy Vol. 10,068,071

Sell Vol. 8,726,864

35,150

1D 0.14%

5D 5.24%

Buy Vol. 17,284,080

Sell Vol. 16,807,819

28,100

1D 1.08%

5D 2.18%

Buy Vol. 26,108,074

Sell Vol. 26,632,005

23,800

1D 1.28%

5D 3.03%

Buy Vol. 40,109,364

Sell Vol. 28,759,589

30,050

1D 0.67%

5D 1.52%

Buy Vol. 22,432,814

Sell Vol. 25,488,897

17,150

1D 1.18%

5D 3.94%

Buy Vol. 9,350,217

Sell Vol. 10,741,682

48,900

1D 1.77%

5D 0.82%

Buy Vol. 20,760,577

Sell Vol. 16,316,551

18,700

1D 1.08%

5D 2.47%

Buy Vol. 15,253,608

Sell Vol. 14,410,520

25,150

1D 0.80%

5D 1.41%

Buy Vol. 9,304,924

Sell Vol. 8,664,276

16,600

1D 1.53%

5D 8.50%

Buy Vol. 118,417,933

Sell Vol. 103,136,142

17,450

1D 2.65%

5D 3.56%

Buy Vol. 14,495,285

Sell Vol. 13,813,989

50,200

1D 0.60%

5D 3.93%

Buy Vol. 2,443,872

Sell Vol. 1,889,464

Since the beginning of November, around 10 other banks have raised their deposit interest rates. Earlier, several banks had also increased rates in October and early November, including Sacombank, VPBank, SHB, HDBank, GPBank, NCB, BVBank, and Bac A Bank. According to experts, the widespread rate hikes indicate that the race for capital mobilization has heated up again in the fourth quarter of 2025, especially among joint-stock commercial banks, as they seek to get ahead of the year-end surge in capital demand and narrow the gap between deposit and lending growth.

OIL & GAS

63,000

1D 0.32%

5D 2.94%

Buy Vol. 1,257,253

Sell Vol. 2,013,582

34,700

1D 0.58%

5D 2.36%

Buy Vol. 3,620,387

Sell Vol. 3,105,711

E10 gasoline will be widely produced and distributed nationwide starting June 1, 2026.

VINGROUP

217,000

1D 2.84%

5D 9.05%

Buy Vol. 5,201,510

Sell Vol. 6,530,434

95,000

1D 1.17%

5D 9.32%

Buy Vol. 5,680,867

Sell Vol. 6,896,715

32,200

1D 0.31%

5D 8.05%

Buy Vol. 10,178,170

Sell Vol. 13,201,604

VIC: VinMetal Production and Trading JSC has just completed procedures to amend its business registration, raising charter capital from VND 10,000 billion to VND 15,000 billion.

FOOD & BEVERAGE

62,100

1D -1.11%

5D 8.95%

Buy Vol. 6,916,416

Sell Vol. 9,649,974

79,700

1D 2.18%

5D 4.87%

Buy Vol. 9,037,921

Sell Vol. 9,849,219

47,250

1D 0.32%

5D 2.72%

Buy Vol. 1,672,868

Sell Vol. 1,963,777

SAB: January 12, 2026 will be the ex-dividend date for the 2025 interim cash dividend, with a payout ratio of 20%.

OTHERS

68,900

1D 2.07%

5D 4.39%

Buy Vol. 1,147,631

Sell Vol. 1,038,318

99,000

1D -0.40%

5D 8.20%

Buy Vol. 4,669,291

Sell Vol. 6,440,337

179,000

1D 1.47%

5D 1.42%

Buy Vol. 2,783,841

Sell Vol. 3,152,662

101,000

1D 1.00%

5D 4.99%

Buy Vol. 9,995,630

Sell Vol. 13,715,526

82,400

1D 1.23%

5D 7.29%

Buy Vol. 6,875,229

Sell Vol. 7,861,237

29,100

1D 2.46%

5D 5.60%

Buy Vol. 6,695,842

Sell Vol. 9,135,627

35,400

1D 1.29%

5D 5.36%

Buy Vol. 36,913,209

Sell Vol. 33,671,430

27,300

1D 1.49%

5D 3.21%

Buy Vol. 53,899,050

Sell Vol. 60,762,226

FPT: FPT Corporation announced its business results for the first 10 months of 2025, reporting revenue of VND 55,897 billion, up 10% year-on-year. Pre-tax profit reached over VND 10,800 billion, up 17.1%, while net profit came to VND 9,335 billion, up 18.7% from the same period in 2024. Of that, net profit attributable to the parent company’s shareholders was VND 7,822 billion, a nearly 19.1% increase compared to last year.

Market by numbers

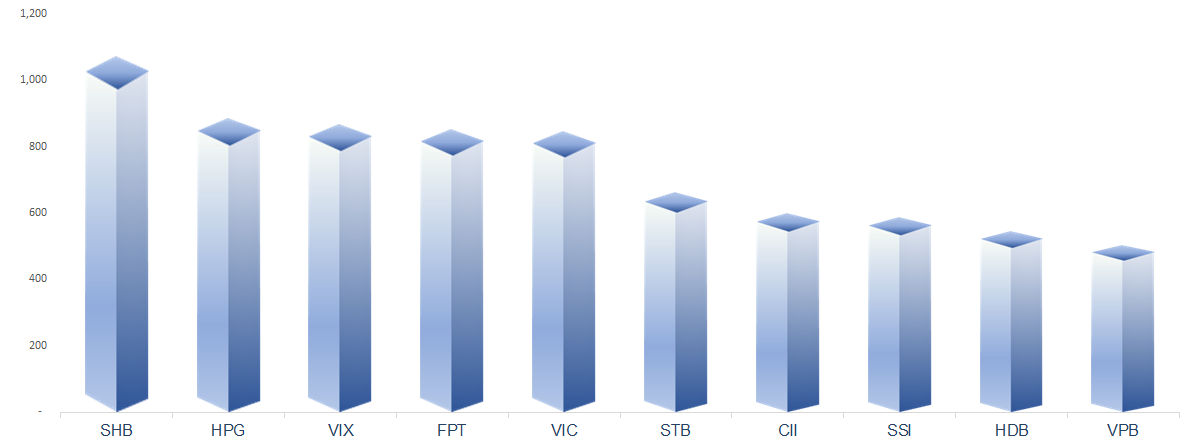

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

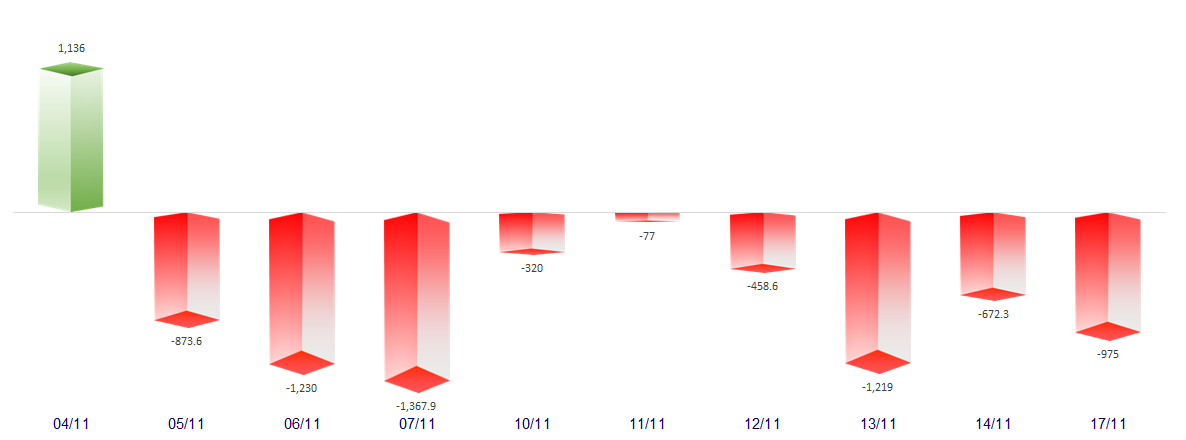

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

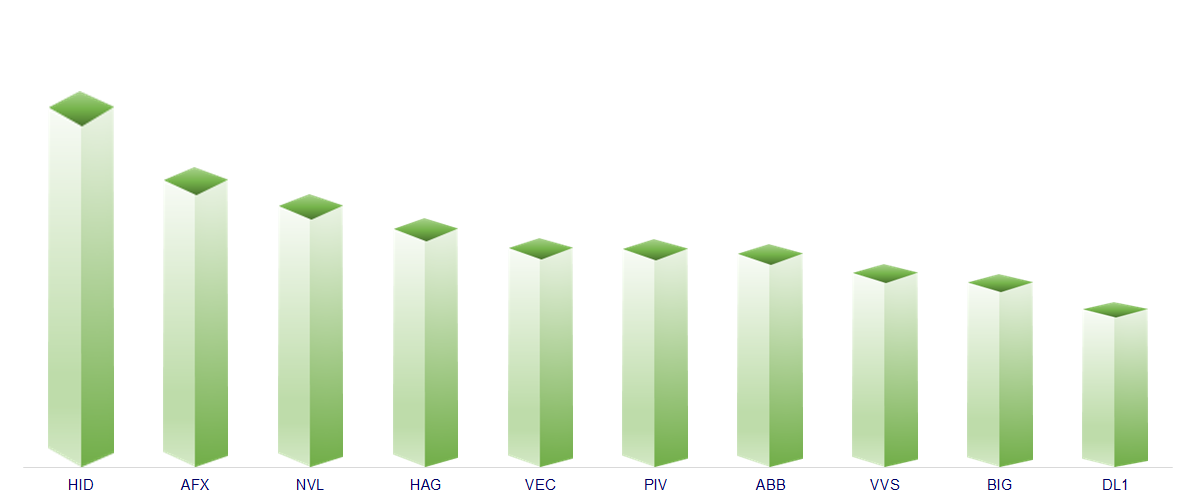

TOP INCREASES 3 CONSECUTIVE SESSIONS

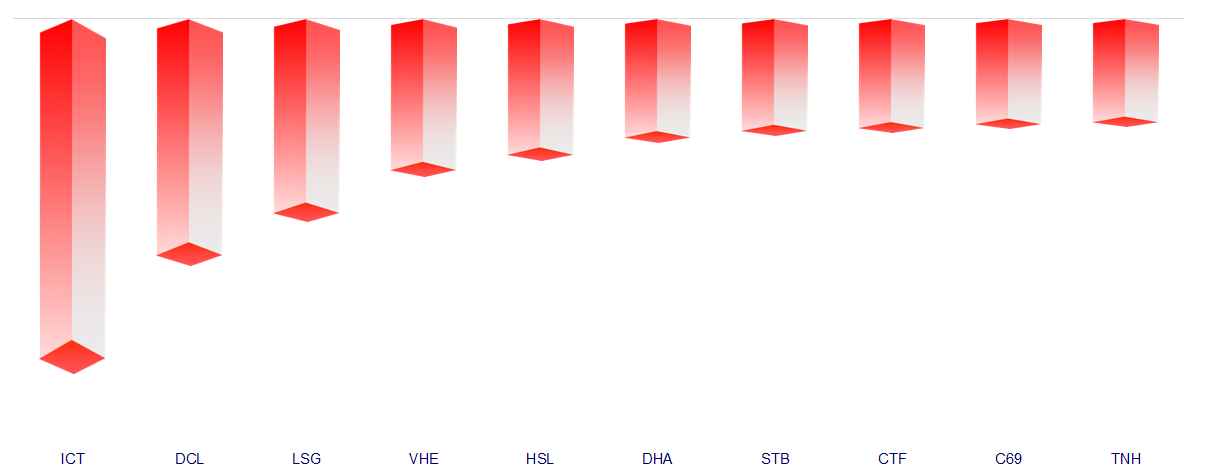

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.