Market brief 28/11/2025

VIETNAM STOCK MARKET

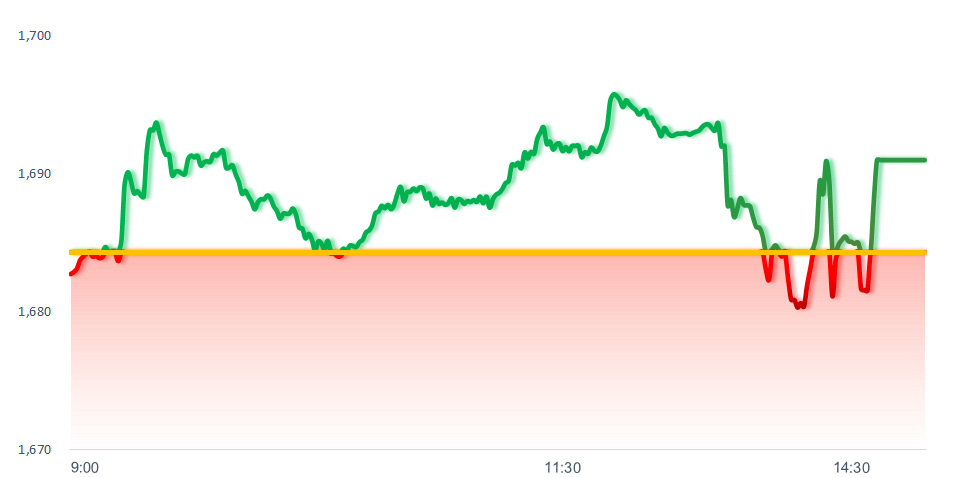

1,690.99

1D 0.40%

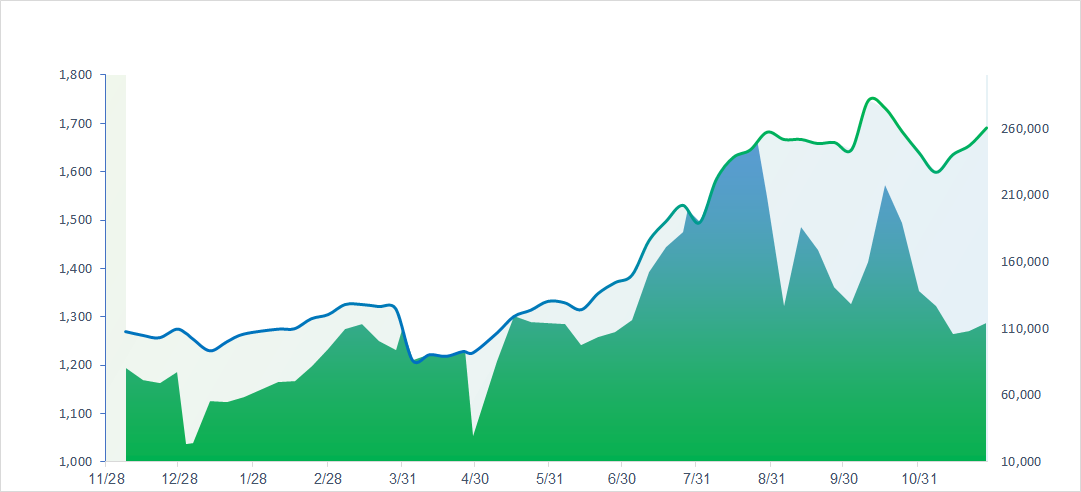

YTD 33.49%

259.91

1D -0.58%

YTD 14.28%

1,923.92

1D 0.14%

YTD 43.07%

119.22

1D -77.88%

YTD 25.42%

344.63

1D 0.00%

YTD 0.00%

25,555.00

1D 12.93%

YTD 40.95%

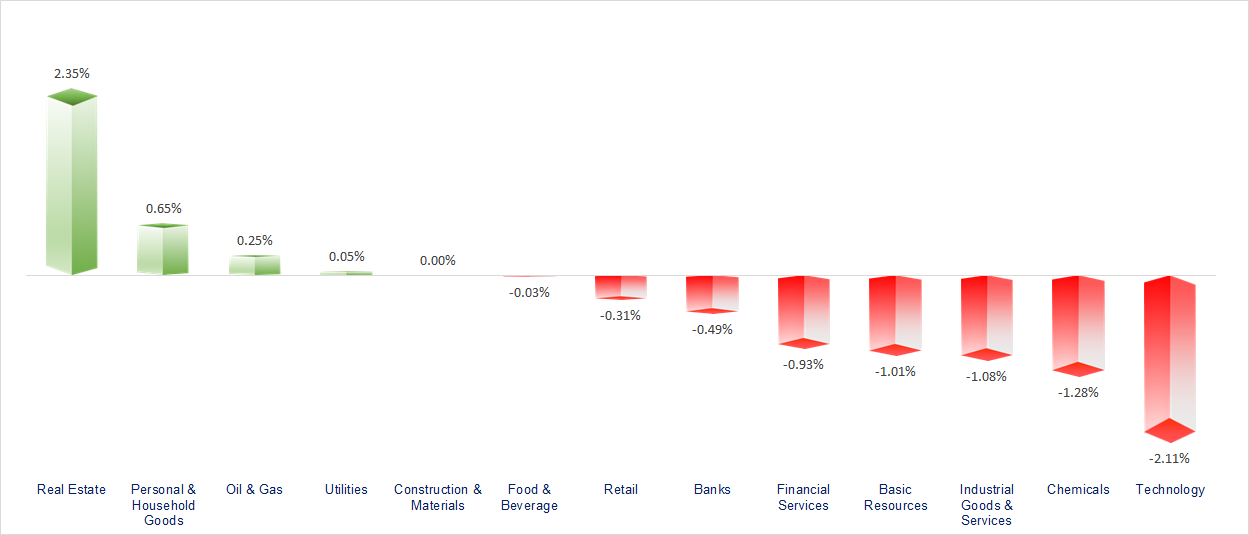

VN-Index edged up more than 6 points thanks to capital inflows boosting key stocks such as the Vin group and VNM. The Vin group and Oil & Gas were the most positive performers in today’s session. In contrast, the Technology, Steel, Banking, and Securities sectors showed rather lackluster movements.

ETF & DERIVATIVES

33,770

1D -0.53%

YTD 43.82%

23,400

1D 1.30%

YTD 43.73%

23,500

1D -2.08%

YTD 40.72%

28,000

1D -1.41%

YTD 39.30%

29,610

1D -0.54%

YTD 33.98%

37,470

1D -0.66%

YTD 11.78%

25,590

1D 1.35%

YTD 42.80%

1,923

1D 0.30%

YTD 0.00%

1,915

1D -0.14%

YTD 0.00%

1,917

1D -0.19%

YTD 0.00%

1,911

1D -0.38%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

50,253.91

1D 0.17%

YTD 25.97%

3,888.60

1D 0.34%

YTD 16.02%

25,858.89

1D -0.34%

YTD 28.91%

3,926.59

1D -1.51%

YTD 63.64%

85,741.22

1D 0.02%

YTD 9.12%

4,530.89

1D 0.48%

YTD 19.62%

1,252.82

1D 0.01%

YTD -10.53%

63.00

1D 0.21%

YTD -16.06%

4,163.00

1D -0.67%

YTD 57.99%

Asian stock markets moved mixed in today’s session. Notably, the Kospi index saw the sharpest correction, falling more than 1.5% to 3,926.59 points. Meanwhile, Japan’s Nikkei 225 reversed and gained nearly 0.2% to 50,253.91 points despite Tokyo’s November CPI rising 2.8% year-on-year. Commodity futures such as Oil and Silver — particularly Gold prices — experienced unusual volatility following a data center incident at the Chicago Mercantile Exchange (CME).

VIETNAM ECONOMY

5.30%

1D (bps) -50

YTD (bps) 133

4.60%

3.47%

1D (bps) -2

YTD (bps) 99

3.65%

1D (bps) -18

YTD (bps) 80

26,412

1D (%) 0.01%

YTD (%) 3.37%

31,334

1D (%) -0.20%

YTD (%) 14.92%

3,786

1D (%) -0.05%

YTD (%) 6.32%

Today, the domestic gold market recorded a strong rise after a previously quiet trading session. SJC gold bars surged to 154.2 million VND/tael, while gold rings and jewelry gold simultaneously increased by 400,000–800,000 VND/tael across many major distributors.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Cut 50 conditional business sectors and lines of business;

- The Politburo assigned Mr. Vu Dai Thang as Deputy Secretary of the Hanoi Party Committee;

- Hanoi set a new record with nearly 31 million tourist arrivals;

- Trading in futures and options at the CME was temporarily halted due to a data center incident;

- The largest U.S. bank reversed its forecast, indicating the Fed will cut interest rates at both the December and January meetings;

- Nearly one-quarter of listed Chinese companies reported losses in the first nine months of the year, the highest level since 2002.

VN30

BANK

57,400

1D -0.86%

5D -2.71%

Buy Vol. 5,108,844

Sell Vol. 5,421,216

37,100

1D -1.20%

5D -1.33%

Buy Vol. 1,492,061

Sell Vol. 2,804,669

49,000

1D 0.31%

5D -0.20%

Buy Vol. 7,776,810

Sell Vol. 7,974,672

33,750

1D 0.00%

5D -1.46%

Buy Vol. 28,844,331

Sell Vol. 34,400,312

29,250

1D 0.52%

5D 2.45%

Buy Vol. 20,702,427

Sell Vol. 21,785,721

23,250

1D -1.06%

5D 0.22%

Buy Vol. 22,265,710

Sell Vol. 23,857,318

32,000

1D 0.00%

5D 2.56%

Buy Vol. 19,196,384

Sell Vol. 19,621,043

17,300

1D -0.29%

5D 0.29%

Buy Vol. 7,420,725

Sell Vol. 11,026,174

48,600

1D -1.42%

5D -5.26%

Buy Vol. 9,104,722

Sell Vol. 10,354,742

18,500

1D -0.80%

5D -0.27%

Buy Vol. 9,669,589

Sell Vol. 12,993,508

24,250

1D -0.41%

5D -1.82%

Buy Vol. 10,460,339

Sell Vol. 9,856,310

16,800

1D 0.30%

5D 0.90%

Buy Vol. 105,289,158

Sell Vol. 103,736,582

17,300

1D -0.29%

5D 0.87%

Buy Vol. 3,479,667

Sell Vol. 4,447,751

48,600

1D -1.42%

5D 0.10%

Buy Vol. 3,024,721

Sell Vol. 2,866,162

MSB: According to the latest assessment just released by Moody’s Ratings (Moody’s), Vietnam Maritime Commercial Joint Stock Bank has had its long-term deposit rating and long-term issuer rating upgraded from B1 to Ba3, while its Baseline Credit Assessment (BCA) has been raised from b2 to b1.

OIL & GAS

63,400

1D 0.63%

5D 2.42%

Buy Vol. 1,851,390

Sell Vol. 2,368,436

33,900

1D -0.29%

5D -0.15%

Buy Vol. 1,632,744

Sell Vol. 2,359,676

GAS: PV GAS has seen net foreign buying for 3 consecutive sessions with a total value of nearly VND 50 billion.

VINGROUP

260,400

1D 5.00%

5D 13.37%

Buy Vol. 18,837,448

Sell Vol. 17,199,289

102,900

1D 0.39%

5D 3.63%

Buy Vol. 5,407,332

Sell Vol. 5,305,243

34,250

1D 1.78%

5D 6.37%

Buy Vol. 14,286,149

Sell Vol. 14,899,313

VIC: The CEO of Vingroup has proposed borrowing 80% of the investment capital for the North–South High-Speed Railway project, to be repaid over 30 years.

FOOD & BEVERAGE

64,000

1D 3.23%

5D 6.84%

Buy Vol. 17,180,025

Sell Vol. 20,391,831

77,400

1D -1.40%

5D -0.13%

Buy Vol. 6,630,187

Sell Vol. 9,322,132

46,400

1D 0.00%

5D -0.64%

Buy Vol. 792,131

Sell Vol. 1,332,663

VNM: Vietnam Dairy Products JSC was net bought by foreign investors with a value of VND 241.6 billion, equivalent to 3.8 million shares. This is the 19th consecutive net-buying session in VNM, totaling more than VND 1,600 billion.

OTHERS

66,600

1D 0.30%

5D -0.60%

Buy Vol. 369,123

Sell Vol. 507,815

94,300

1D -0.74%

5D -2.58%

Buy Vol. 1,581,316

Sell Vol. 2,432,962

203,500

1D 0.74%

5D 4.57%

Buy Vol. 2,113,395

Sell Vol. 2,190,178

97,100

1D -2.41%

5D -3.67%

Buy Vol. 10,414,015

Sell Vol. 12,916,890

79,900

1D -0.13%

5D -0.13%

Buy Vol. 5,611,907

Sell Vol. 7,089,558

27,300

1D -2.15%

5D -1.80%

Buy Vol. 3,084,898

Sell Vol. 4,399,636

32,800

1D -1.20%

5D -4.37%

Buy Vol. 42,604,510

Sell Vol. 44,298,906

26,550

1D -1.30%

5D -3.10%

Buy Vol. 40,142,199

Sell Vol. 44,438,580

MWG: Mr. Vu Dang Linh – General Director of Mobile World Investment Corporation – said that Bach Haa Xanh’s (BHX) revenue has not met expectations. The consumer goods market in Vietnam in general is almost flat, with very low growth. In addition, external factors such as rain, storms, and flooding have also had an impact. Although revenue has not met expectations, profit is fairly solid; in Q3 BHX earned about VND 200 billion in profit. Mr. Linh said BHX’s profit this year will not be less than VND 600 billion. The plan for 2026 is still being developed.

Market by numbers

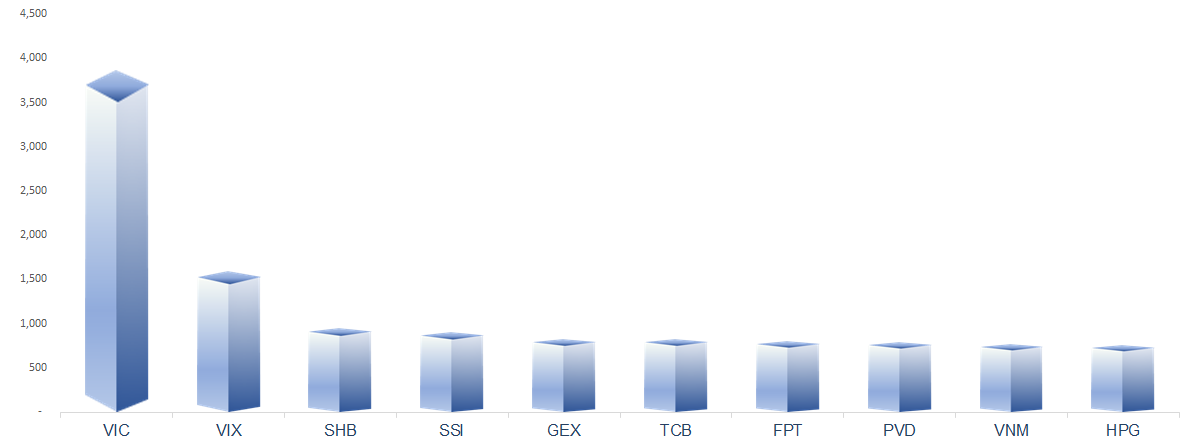

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

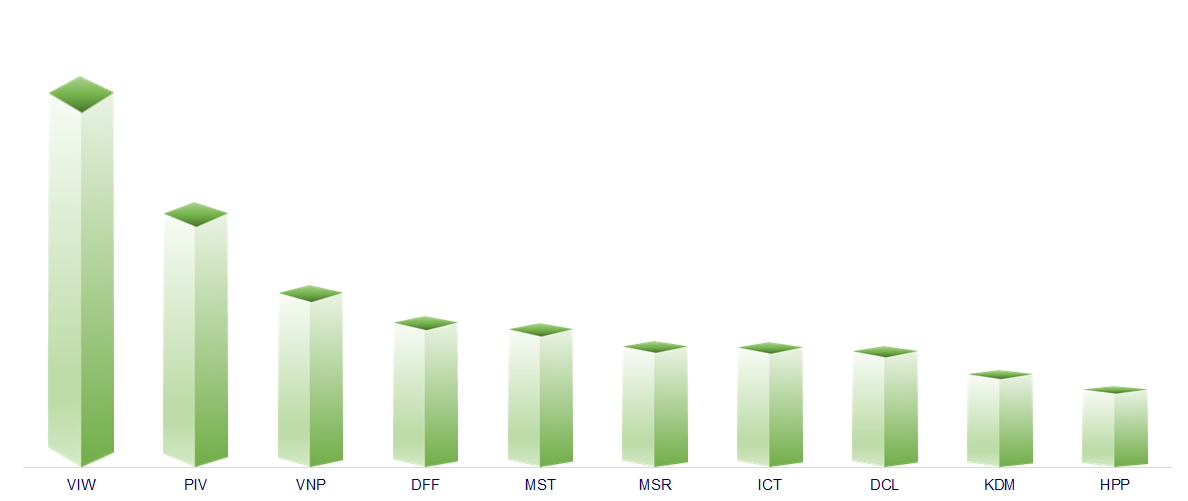

TOP INCREASES 3 CONSECUTIVE SESSIONS

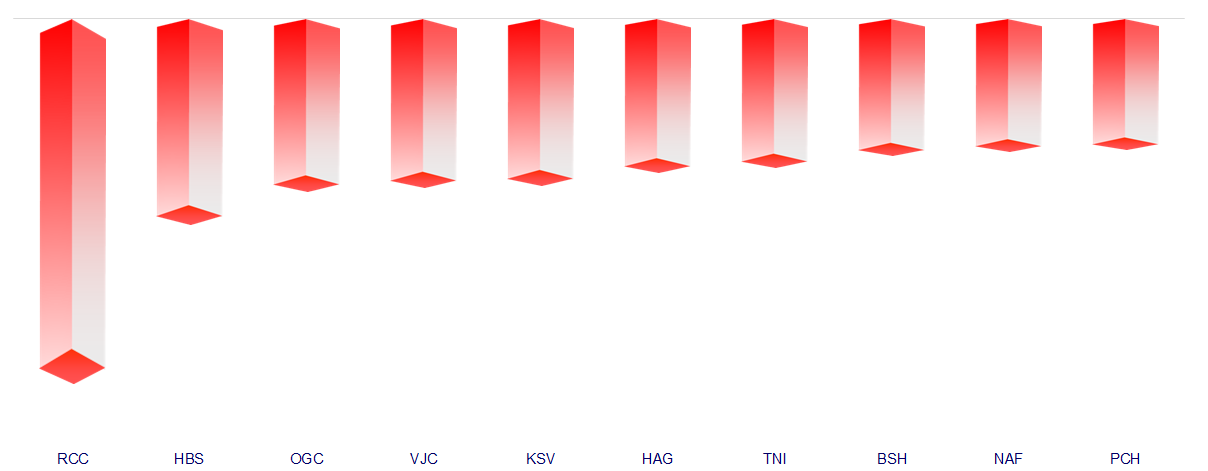

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.