Market brief 03/12/2025

VIETNAM STOCK MARKET

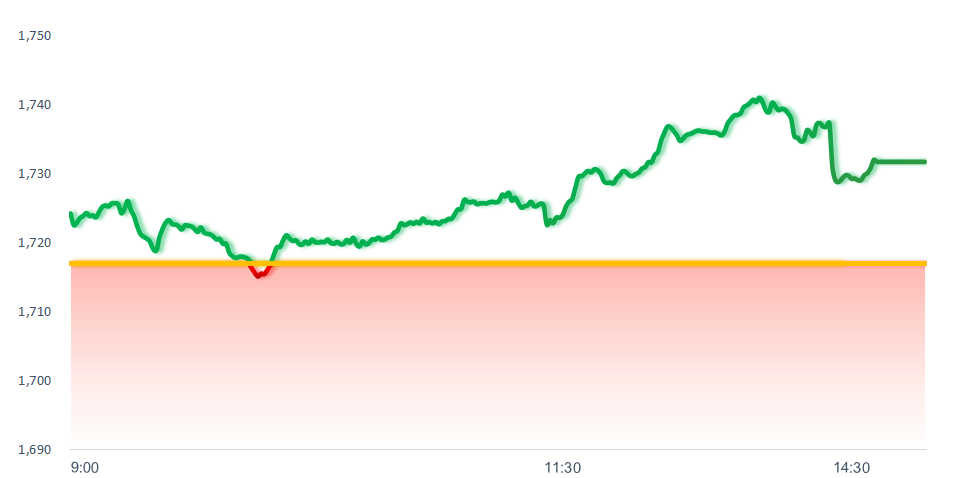

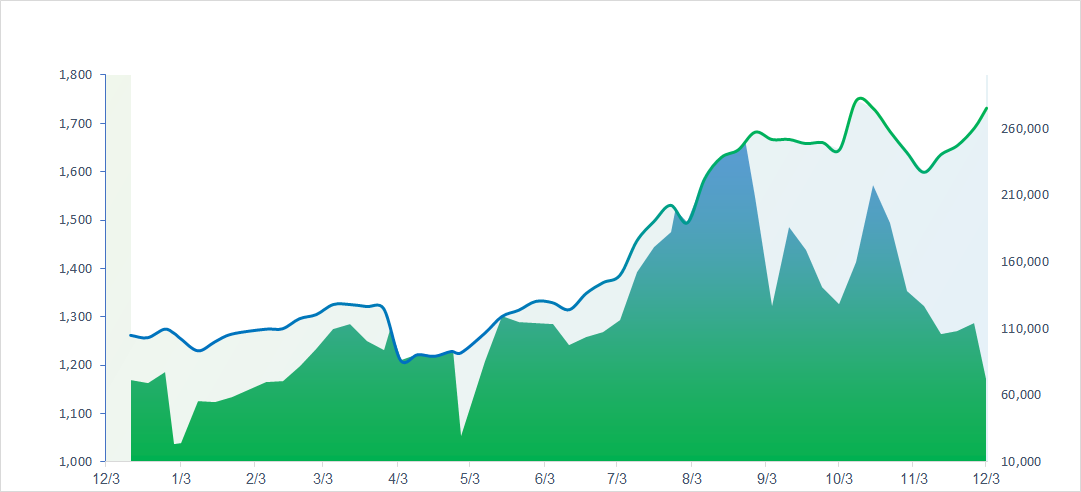

1,731.77

1D 0.86%

YTD 36.71%

259.67

1D 0.31%

YTD 14.18%

1,971.99

1D 1.12%

YTD 46.64%

120.38

1D -77.41%

YTD 26.64%

3,592.79

1D 0.00%

YTD 0.00%

30,423.00

1D 25.08%

YTD 67.80%

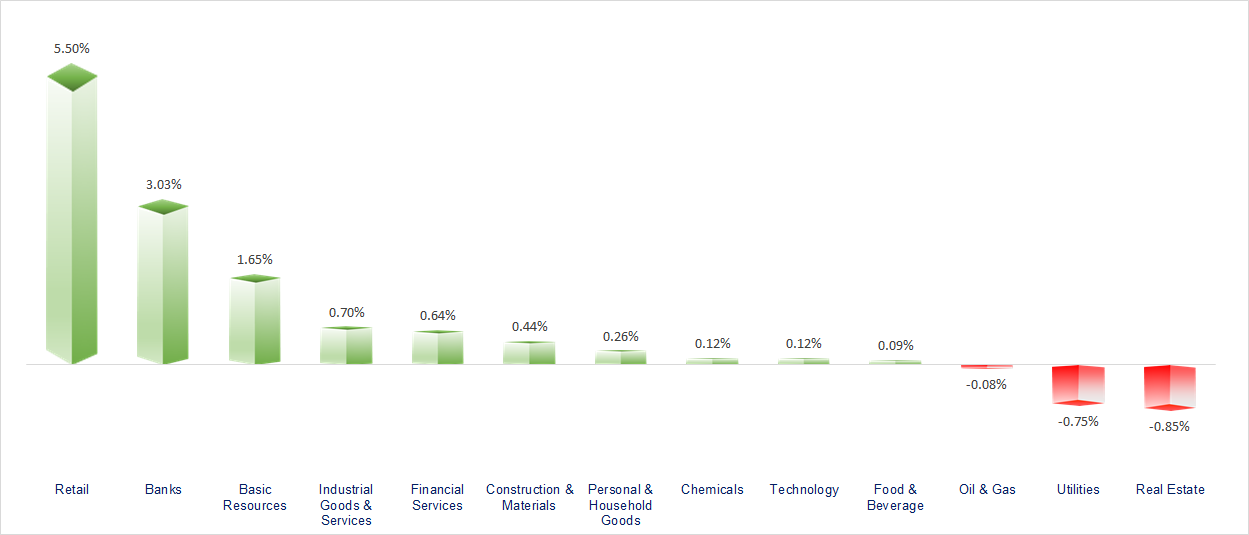

VN-Index recorded its fourth consecutive gaining session as the Banking and Retail sectors surged strongly today. Many sectors advanced simultaneously, with Retail and Banking being the most positive performers. Meanwhile, the Vin group and Oil & Gas sectors showed rather lackluster movements.

ETF & DERIVATIVES

34,950

1D 1.60%

YTD 48.85%

24,000

1D 0.84%

YTD 47.42%

24,610

1D 1.90%

YTD 47.37%

28,500

1D 0.04%

YTD 41.79%

30,380

1D 2.46%

YTD 37.47%

38,520

1D 1.66%

YTD 14.92%

25,900

1D 0.94%

YTD 44.53%

1,972

1D 1.53%

YTD 0.00%

1,972

1D 2.29%

YTD 0.00%

1,969

1D 1.13%

YTD 0.00%

1,974

1D 2.62%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

49,864.68

1D 1.14%

YTD 24.99%

3,878.00

1D -0.51%

YTD 15.70%

25,760.73

1D -1.28%

YTD 28.42%

4,036.30

1D 1.04%

YTD 68.21%

85,106.81

1D -0.96%

YTD 8.31%

4,554.52

1D 0.36%

YTD 20.25%

1,274.82

1D -0.22%

YTD -8.96%

63.30

1D 1.36%

YTD -15.66%

4,199.15

1D -0.16%

YTD 59.36%

Asian stock markets traded mixed in today’s session. Notably, the Nikkei saw the strongest performance, rising more than 1.1% to 49,864.68 points, mainly driven by Technology stocks. In contrast, Hong Kong’s Hang Seng Index was the weakest, losing nearly 1.3% to 25,760.73 points.

VIETNAM ECONOMY

7.48%

1D (bps) 26

YTD (bps) 351

4.60%

3.34%

1D (bps) 1

YTD (bps) 86

3.83%

YTD (bps) 98

26,410

1D (%) 0.00%

YTD (%) 3.36%

31,468

1D (%) 0.23%

YTD (%) 15.41%

3,791

1D (%) 0.06%

YTD (%) 6.46%

The domestic gold market today saw a recovery in SJC gold bars after yesterday’s steep decline. Meanwhile, gold rings remained mostly unchanged, while 24K and 18K jewelry gold continued to decline across many retailers.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- OECD: Vietnam’s economy is expected to maintain its recovery momentum throughout 2026–2027;

- Chief Justice of the Supreme People’s Court: Strict handling of cases involving evasion of social insurance contributions;

- Positive signals emerge regarding wage policy starting January 1, 2026;

- The United Nations faces budget difficulties;

- President Putin issues a stern warning over attacks on oil tankers in the Black Sea;

- Mr. Trump reveals he has selected his nominee for Fed Chair, emphasizing that lowering interest rates is a priority.

VN30

BANK

58,900

1D 2.26%

5D 1.38%

Buy Vol. 9,587,485

Sell Vol. 8,370,719

38,400

1D 4.21%

5D 2.81%

Buy Vol. 6,812,320

Sell Vol. 6,427,805

52,000

1D 6.01%

5D 6.34%

Buy Vol. 46,937,939

Sell Vol. 28,369,838

34,900

1D 2.05%

5D 3.10%

Buy Vol. 25,025,836

Sell Vol. 28,513,830

30,250

1D 4.67%

5D 4.31%

Buy Vol. 47,110,653

Sell Vol. 50,675,369

24,550

1D 4.25%

5D 5.59%

Buy Vol. 101,227,608

Sell Vol. 84,082,201

32,250

1D 0.78%

5D -0.15%

Buy Vol. 25,802,273

Sell Vol. 28,292,182

17,350

1D 1.46%

5D -0.29%

Buy Vol. 28,927,762

Sell Vol. 31,156,990

49,700

1D 0.61%

5D -0.50%

Buy Vol. 12,910,630

Sell Vol. 14,060,888

18,800

1D 1.90%

5D 1.90%

Buy Vol. 21,894,166

Sell Vol. 21,920,487

24,450

1D 2.09%

5D 1.03%

Buy Vol. 26,986,474

Sell Vol. 21,142,373

17,350

1D 2.06%

5D 3.89%

Buy Vol. 150,995,351

Sell Vol. 125,727,844

17,750

1D 2.90%

5D 2.90%

Buy Vol. 5,247,436

Sell Vol. 3,934,564

48,600

1D 2.32%

5D -2.02%

Buy Vol. 2,739,496

Sell Vol. 1,851,086

CTG: CTG at one point hit the ceiling price today after VietinBank received approval from the State Bank of Vietnam to increase its charter capital by VND 24 trillion through a share issuance to pay dividends.

OIL & GAS

64,500

1D -2.42%

5D 4.03%

Buy Vol. 1,581,181

Sell Vol. 2,594,852

34,600

1D -0.72%

5D 2.22%

Buy Vol. 2,526,574

Sell Vol. 4,323,693

Brent oil prices had rebounded more than 1.2% by late afternoon today following a sharp decline in the previous session.

VINGROUP

269,400

1D -2.04%

5D 9.96%

Buy Vol. 8,287,417

Sell Vol. 9,182,591

106,800

1D 0.00%

5D 4.60%

Buy Vol. 5,891,338

Sell Vol. 6,879,475

34,500

1D -1.15%

5D 1.92%

Buy Vol. 12,154,658

Sell Vol. 14,990,307

VIC: Vingroup has issued 10,000 bonds under the code VIC12511, with a face value of VND 100 million per bond, totaling VND 1,000 billion in issuance value. The bonds have a 36-month term.

FOOD & BEVERAGE

64,600

1D -0.62%

5D 2.87%

Buy Vol. 9,127,947

Sell Vol. 10,092,047

80,600

1D 2.54%

5D 2.54%

Buy Vol. 18,925,990

Sell Vol. 19,795,964

51,900

1D -0.95%

5D 11.61%

Buy Vol. 4,556,949

Sell Vol. 6,162,804

MSN: Tomorrow, December 4, Masan Consumer will officially announce its listing information on HOSE.

OTHERS

65,900

1D -0.60%

5D -0.75%

Buy Vol. 356,829

Sell Vol. 464,014

97,000

1D 0.21%

5D 1.25%

Buy Vol. 2,490,232

Sell Vol. 4,502,303

214,000

1D -1.79%

5D 2.98%

Buy Vol. 2,808,605

Sell Vol. 3,238,520

96,600

1D 0.00%

5D -1.41%

Buy Vol. 9,550,790

Sell Vol. 10,065,694

84,700

1D 5.88%

5D 5.61%

Buy Vol. 21,250,663

Sell Vol. 19,879,629

27,700

1D -0.18%

5D 0.73%

Buy Vol. 3,404,343

Sell Vol. 4,010,347

32,350

1D 0.15%

5D -4.85%

Buy Vol. 36,890,795

Sell Vol. 35,620,067

26,800

1D 1.13%

5D -1.11%

Buy Vol. 42,279,988

Sell Vol. 38,269,886

GVR: Vietnam Rubber Group (GVR) is preparing to commence construction of the Hiep Thanh Industrial Park – phase 1, covering more than 495 hectares in Tay Ninh. This industrial park has a total planned area of over 495 hectares with an investment value of VND 2,350 billion.

Market by numbers

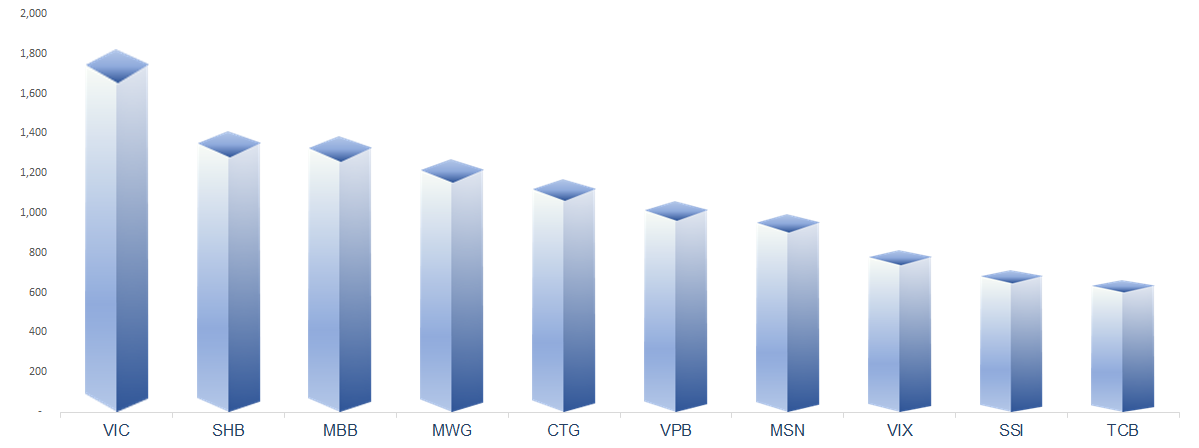

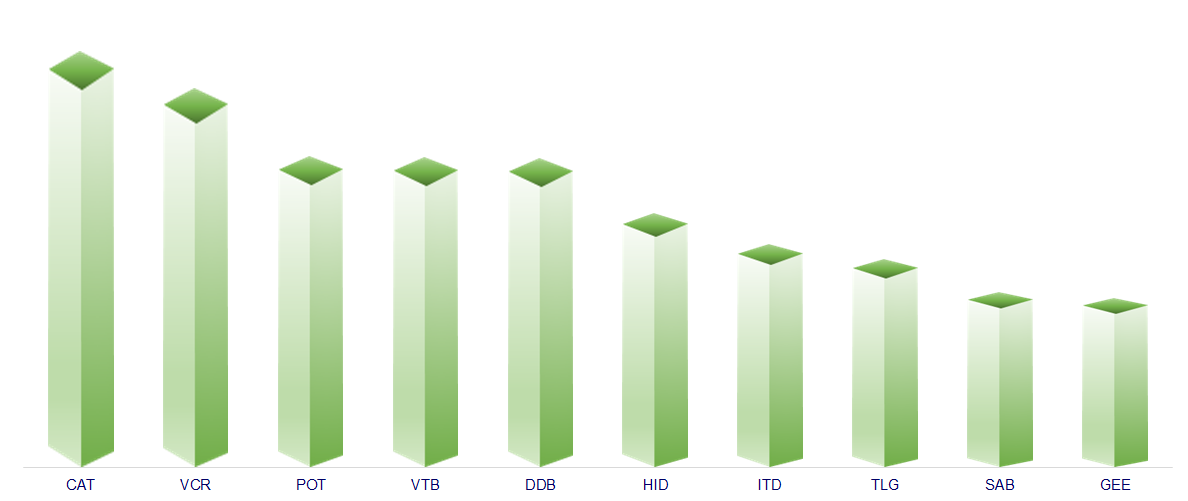

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

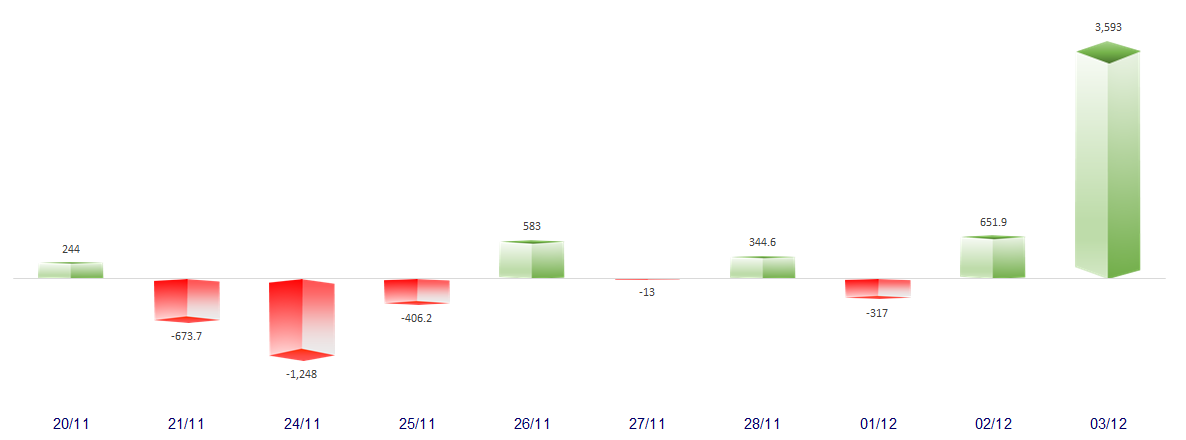

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.