Market brief 04/12/2025

VIETNAM STOCK MARKET

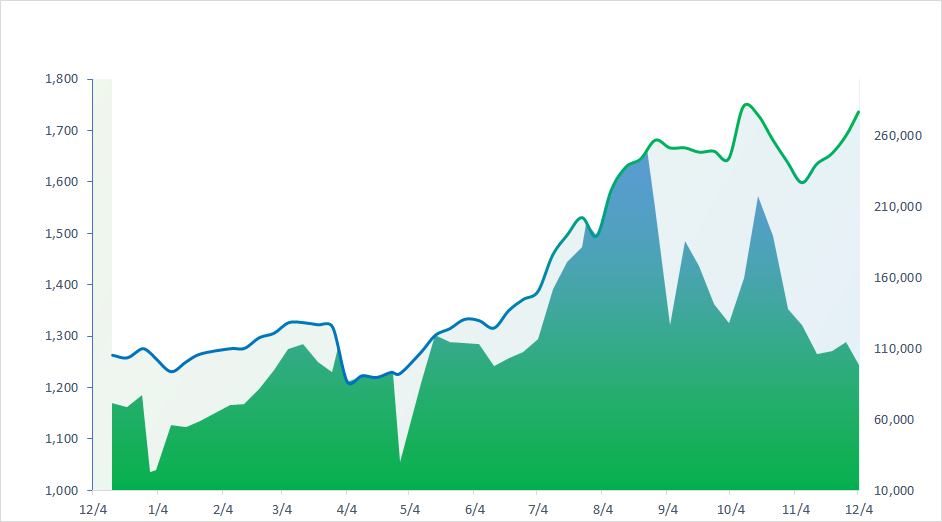

1,737.24

1D 0.32%

YTD 37.14%

262.31

1D 1.02%

YTD 15.34%

1,979.53

1D 0.38%

YTD 47.20%

120.94

1D -82.31%

YTD 27.22%

1,085.66

1D 0.00%

YTD 0.00%

28,906.45

1D -4.98%

YTD 59.43%

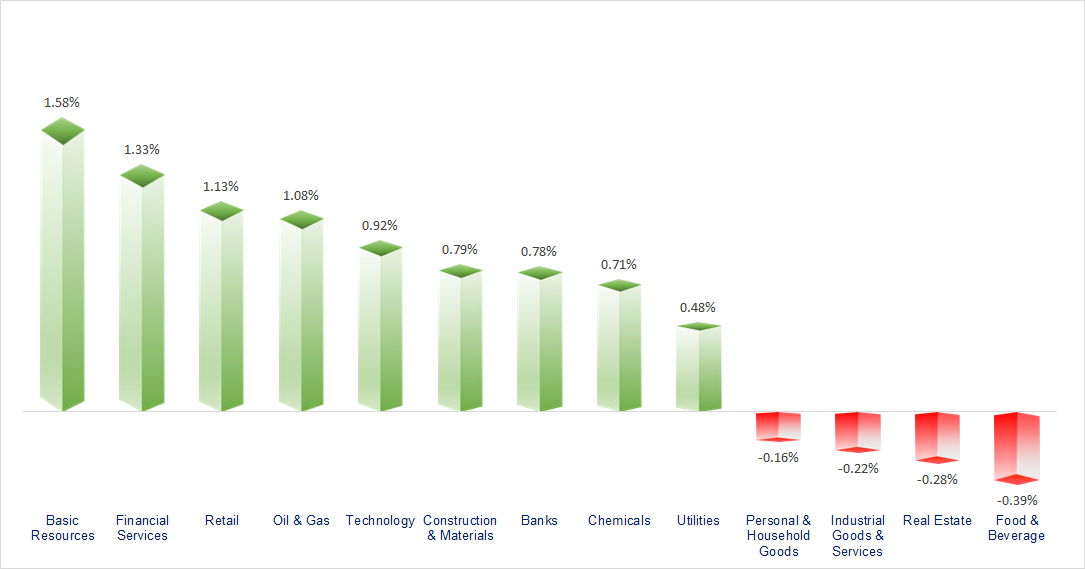

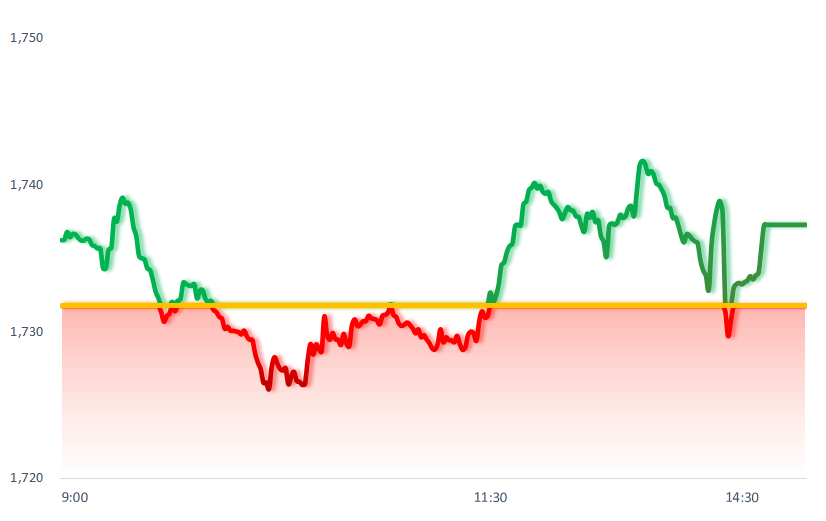

VN-Index recorded its seventh consecutive gaining session as liquidity continued to spread across various sectors such as Real Estate, Steel, and Securities. Many industry groups advanced today, with Securities, Steel, and Retail being the most positive performers. Meanwhile, the Vingroup ecosystem and F&B stocks saw rather lackluster movements.

ETF & DERIVATIVES

35,000

1D 0.14%

YTD 49.06%

24,000

1D 0.00%

YTD 47.42%

24,750

1D 0.57%

YTD 48.20%

28,500

1D 0.00%

YTD 41.79%

30,800

1D 1.38%

YTD 39.37%

38,650

1D 0.34%

YTD 15.30%

25,700

1D -0.77%

YTD 43.42%

1,977

1D 0.25%

YTD 0.00%

1,975

1D 0.20%

YTD 0.00%

1,971

1D -0.06%

YTD 0.00%

1,969

1D -0.26%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

51,028.42

1D 2.33%

YTD 27.91%

3,875.79

1D -0.06%

YTD 15.63%

25,935.90

1D 0.68%

YTD 29.30%

4,028.51

1D -0.19%

YTD 67.89%

85,265.31

1D 0.19%

YTD 8.51%

4,535.14

1D -0.43%

YTD 19.74%

1,273.77

1D -0.08%

YTD -9.03%

62.96

1D 0.18%

YTD -16.11%

4,197.51

1D -0.39%

YTD 59.30%

Following the rally on Wall Street, Asian equities also traded predominantly in positive territory, led by Japan’s Nikkei 225. The index closed up 2.33%, driven by strong interest in Renesas Electronics, which jumped more than 6% after reports that California-based semiconductor firm SiTime Corp. is in talks to acquire the Japanese chipmaker’s timing-device division.

VIETNAM ECONOMY

7.00%

1D (bps) -47

YTD (bps) 303

4.60%

3.41%

1D (bps) 7

YTD (bps) 93

3.77%

1D (bps) -6

YTD (bps) 92

26,409

1D (%) 0.00%

YTD (%) 3.36%

31,543

1D (%) 0.24%

YTD (%) 15.69%

3,793

1D (%) 0.05%

YTD (%) 6.51%

In the domestic bullion market, gold prices reversed and declined broadly. SJC gold fell to 154.5 million VND/tael after a slight rebound in the previous session, while plain gold rings and 24K–18K jewelry products simultaneously dropped by 200,000–600,000 VND/tael at major retailers.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- A country with a USD16 billion GDP seeks to attract major Vietnamese corporations;

- OECD: Vietnam’s economy expected to show strong momentum in 2025;

- FTSE executive: Vietnam to be officially included in the FTSE Global Benchmark index basket in September 2026;

- Russia takes an unprecedented action;

- Real estate slump, weak consumption, and simmering deflation: China enters 2026 with mounting concerns;

- Russia announces the figure of 6.3 million, with Vietnam leading in one key indicator.

VN30

BANK

58,900

1D 0.00%

5D 1.73%

Buy Vol. 5,309,626

Sell Vol. 5,784,147

38,200

1D -0.52%

5D 1.73%

Buy Vol. 3,511,504

Sell Vol. 4,488,319

52,000

1D 0.00%

5D 6.45%

Buy Vol. 11,580,091

Sell Vol. 14,746,753

35,400

1D 1.43%

5D 4.89%

Buy Vol. 18,775,164

Sell Vol. 21,955,922

30,250

1D 0.00%

5D 3.95%

Buy Vol. 27,429,723

Sell Vol. 36,547,458

25,700

1D 4.68%

5D 9.36%

Buy Vol. 139,721,244

Sell Vol. 121,213,037

32,950

1D 2.17%

5D 2.97%

Buy Vol. 20,080,711

Sell Vol. 29,524,468

17,600

1D 1.44%

5D 1.44%

Buy Vol. 29,850,883

Sell Vol. 29,238,068

50,200

1D 1.01%

5D 1.83%

Buy Vol. 13,601,602

Sell Vol. 16,750,190

18,900

1D 0.53%

5D 1.34%

Buy Vol. 14,420,640

Sell Vol. 15,575,414

24,900

1D 1.84%

5D 2.26%

Buy Vol. 19,966,665

Sell Vol. 19,492,680

17,300

1D -0.29%

5D 3.28%

Buy Vol. 81,730,065

Sell Vol. 125,772,566

17,700

1D -0.28%

5D 2.02%

Buy Vol. 10,885,851

Sell Vol. 11,693,777

49,500

1D 1.85%

5D 0.41%

Buy Vol. 2,243,800

Sell Vol. 2,083,697

In the currency market, the State Bank of Vietnam (SBV) has just announced its FX intervention plan. The SBV will conduct 14-day FX swap operations with credit institutions at a spot bid rate of 23,945 VND/USD and a forward ask rate of 23,955 VND/USD. The maximum swap volume is set at USD500 million. This implies that the SBV aims to provide short-term liquidity support to the market.

OIL & GAS

65,000

1D 0.78%

5D 3.17%

Buy Vol. 1,873,711

Sell Vol. 1,855,882

34,950

1D 1.01%

5D 2.79%

Buy Vol. 3,382,657

Sell Vol. 3,976,421

Today, the Ministries of Industry and Trade raised gasoline prices by 400–500 VND/liter, while several diesel and oil products fell.

VINGROUP

267,000

1D -0.89%

5D 7.66%

Buy Vol. 10,434,558

Sell Vol. 10,481,022

105,200

1D -1.50%

5D 2.63%

Buy Vol. 6,716,174

Sell Vol. 6,741,940

34,400

1D -0.29%

5D 2.23%

Buy Vol. 9,588,350

Sell Vol. 11,237,244

VHM: Vinhomes has announced an average selling price of 22.6 million VND/square meter for social housing at the Trang Cat project.

FOOD & BEVERAGE

63,400

1D -1.86%

5D 2.26%

Buy Vol. 9,595,697

Sell Vol. 10,398,015

79,900

1D -0.87%

5D 1.78%

Buy Vol. 7,755,392

Sell Vol. 10,515,371

50,900

1D -1.93%

5D 9.70%

Buy Vol. 4,713,549

Sell Vol. 4,207,386

MSN: Foreign investors net sold more than VND85 billion worth of MSN shares today.

OTHERS

66,300

1D 0.61%

5D -0.15%

Buy Vol. 332,432

Sell Vol. 493,615

97,000

1D 0.00%

5D 2.11%

Buy Vol. 3,090,204

Sell Vol. 4,467,829

206,000

1D -3.74%

5D 1.98%

Buy Vol. 3,066,949

Sell Vol. 3,572,178

97,500

1D 0.93%

5D -0.99%

Buy Vol. 10,855,005

Sell Vol. 14,196,126

85,800

1D 1.30%

5D 7.25%

Buy Vol. 11,788,349

Sell Vol. 14,005,026

27,850

1D 0.54%

5D -0.18%

Buy Vol. 3,351,364

Sell Vol. 5,475,043

32,800

1D 1.39%

5D -1.20%

Buy Vol. 53,473,589

Sell Vol. 57,594,603

27,300

1D 1.87%

5D 1.49%

Buy Vol. 68,409,431

Sell Vol. 62,796,309

HPG: Hoa Tam Industrial Infrastructure Development JSC – a subsidiary of Hoa Phat Group (HPG) – is conducting environmental impact assessment (EIA) consultations for Phase 1 of the Hoa Tam Industrial Park project in Hoa Xuan Commune, Krong Nang District, Dak Lak Province.

Market by numbers

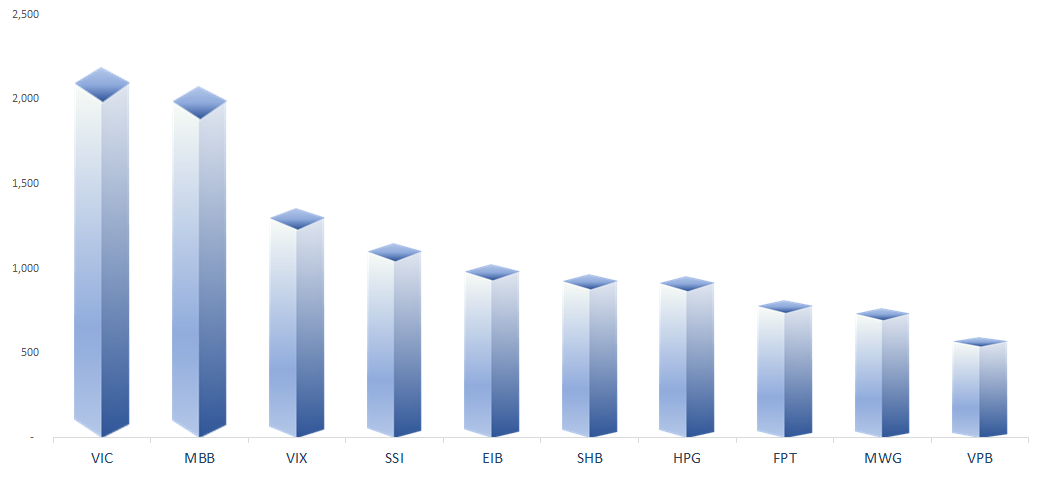

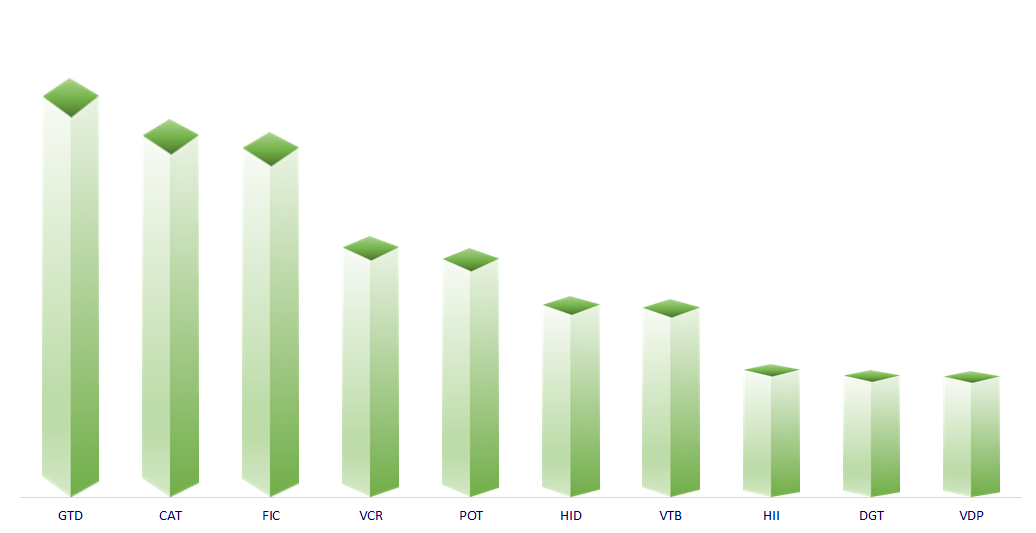

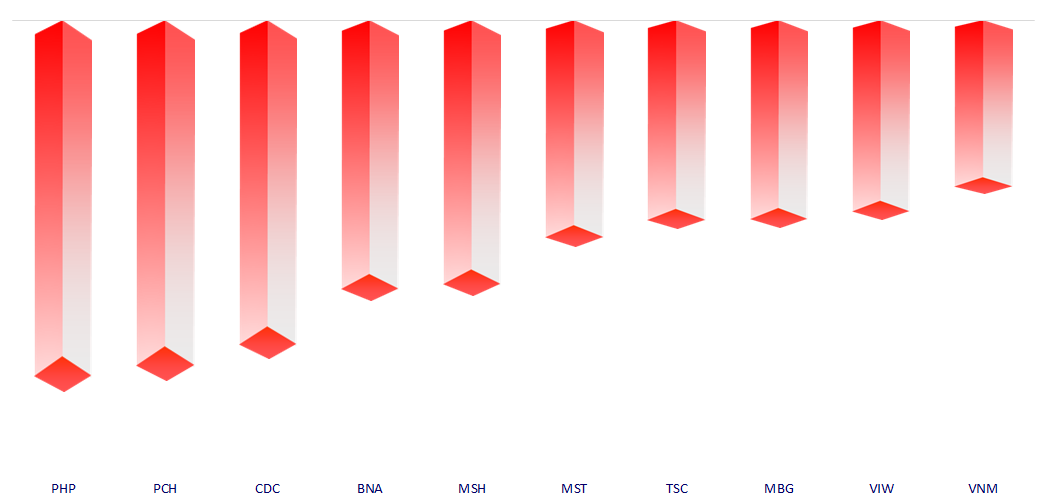

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

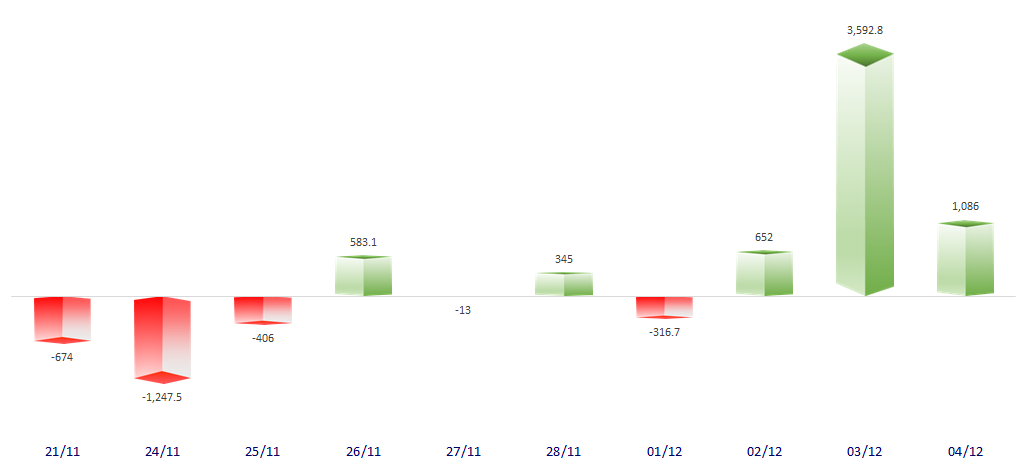

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.