Market brief 05/12/2025

VIETNAM STOCK MARKET

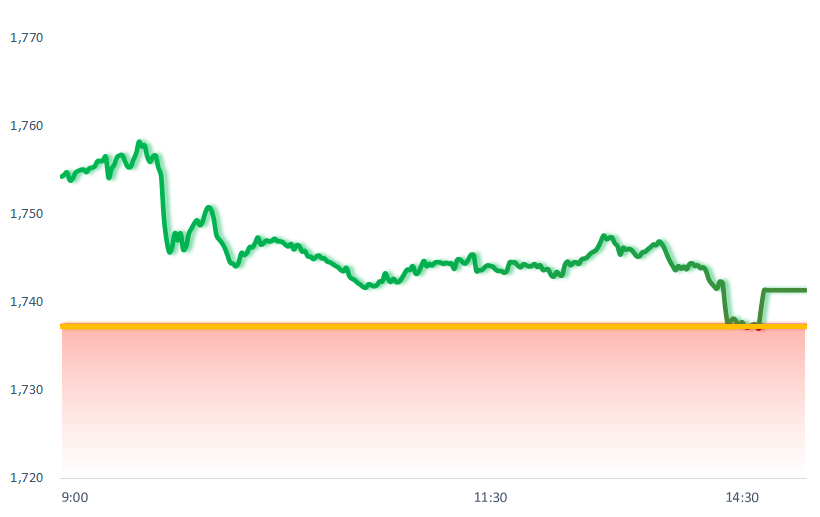

1,741.32

1D 0.23%

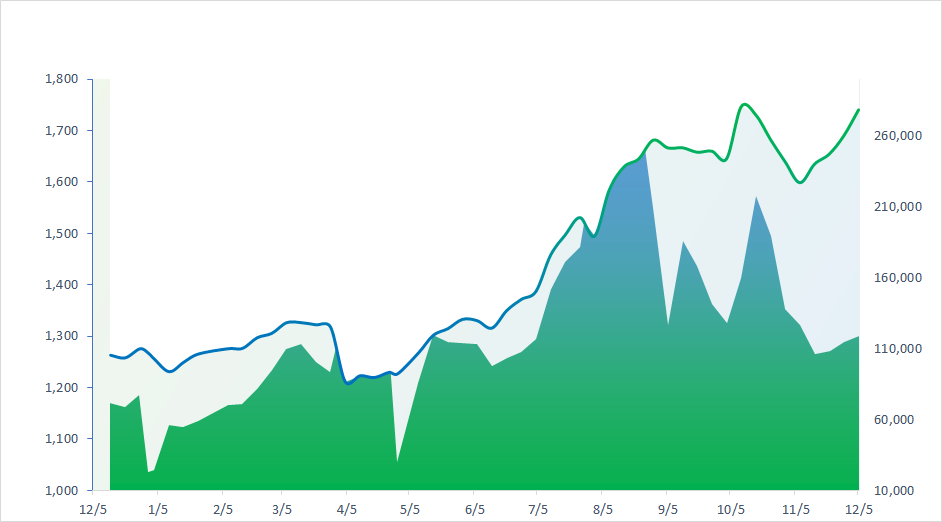

YTD 37.46%

260.65

1D -0.63%

YTD 14.61%

1,975.50

1D -0.20%

YTD 46.90%

120.49

1D -79.19%

YTD 26.75%

-680.48

1D 0.00%

YTD 0.00%

21,866.60

1D -24.35%

YTD 20.60%

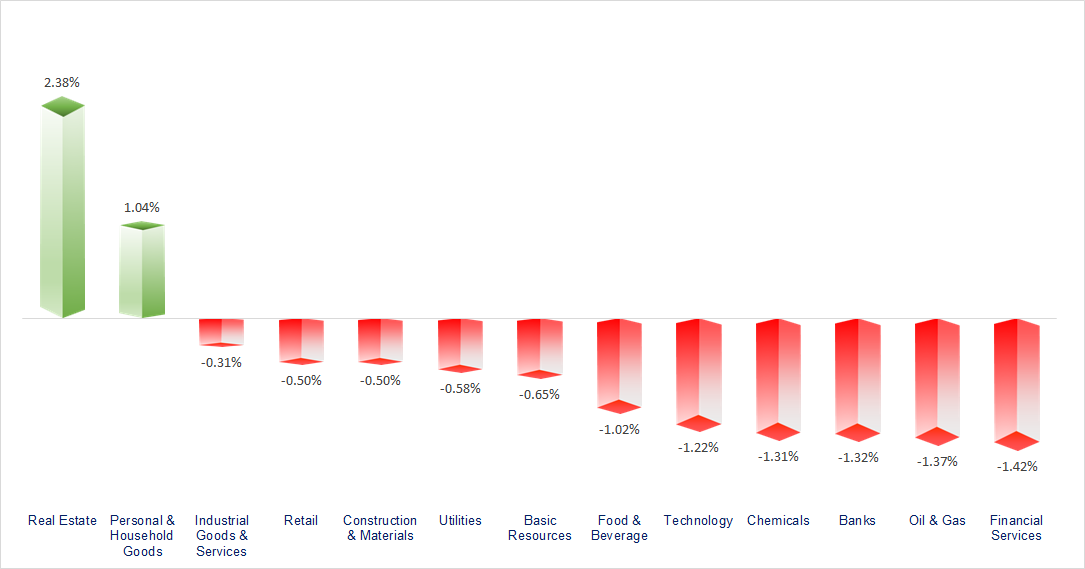

VN-Index showed a “green shell, red core” pattern today as Vingroup stocks hit the ceiling. On the market, only stocks in the Vingroup family showed positive performance. In contrast, most sectors were deep in the red, with notable weakness coming from the securities, oil & gas, and banking groups.

ETF & DERIVATIVES

34,990

1D -0.03%

YTD 49.02%

24,080

1D 0.33%

YTD 47.91%

24,600

1D -0.61%

YTD 47.31%

28,450

1D -0.18%

YTD 41.54%

30,350

1D -1.46%

YTD 37.33%

38,600

1D -0.13%

YTD 15.16%

25,800

1D 0.39%

YTD 43.97%

1,977

1D 0.08%

YTD 0.00%

1,974

1D 0.16%

YTD 0.00%

1,969

1D -0.40%

YTD 0.00%

1,971

1D 0.12%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

50,491.87

1D -1.05%

YTD 26.56%

3,902.81

1D 0.70%

YTD 16.44%

26,085.08

1D 0.58%

YTD 30.04%

4,100.05

1D 1.78%

YTD 70.87%

85,712.37

1D 0.52%

YTD 9.08%

4,531.36

1D -0.08%

YTD 19.64%

1,273.77

1D 0.00%

YTD -9.03%

63.10

1D -0.22%

YTD -15.92%

4,224.74

1D 0.51%

YTD 60.33%

Asian stock markets mostly gained in the final trading session of the week amid mixed signals regarding central banks’ policy directions. The BSE Index rose more than 0.5% after the Reserve Bank of India cut interest rates by 25 basis points to 5.25%. Conversely, the Nikkei 225 dropped 1.1% as growing expectations of a rate hike by the Bank of Japan weighed on market sentiment.

VIETNAM ECONOMY

7.00%

YTD (bps) 303

4.60%

3.41%

1D (bps) 1

YTD (bps) 94

3.79%

1D (bps) 3

YTD (bps) 94

26,408

1D (%) 0.00%

YTD (%) 3.35%

31,519

1D (%) -0.07%

YTD (%) 15.60%

3,790

1D (%) -0.07%

YTD (%) 6.44%

SJC gold bar prices at major retailers continued to decline, marking the second consecutive drop. Specifically, Saigon Jewelry Company (SJC), Doji Group, Phu Quy, PNJ, and Bao Tin Minh Chau all lowered both bid and ask prices by 300,000 VND/tael. Bid prices were adjusted to 151.2–152.2 million VND/tael, while ask prices fell to 154.2 million VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- FDI inflows into Hanoi surged, exceeding USD4 billion;

- This afternoon (Dec 5), the National Assembly will discuss the Specialized Courts Law at the International Financial Center;

- Investment plan for the Can Gio Bridge worth over VND13,000 billion;

- The U.S. government pays more than USD11 billion in interest weekly, with public debt becoming the main economic drag in 2026;

- A Fed rate cut next week would be positive news for Asian currencies;

- China is aggressively buying USD to cool down the rapid appreciation of its local currency.

VN30

BANK

58,300

1D -1.02%

5D 1.57%

Buy Vol. 6,126,504

Sell Vol. 5,753,123

37,800

1D -1.05%

5D 1.89%

Buy Vol. 2,961,673

Sell Vol. 4,078,166

51,500

1D -0.96%

5D 5.10%

Buy Vol. 14,439,411

Sell Vol. 11,931,134

34,700

1D -1.98%

5D 2.81%

Buy Vol. 10,736,909

Sell Vol. 13,745,813

29,850

1D -1.32%

5D 2.05%

Buy Vol. 22,498,933

Sell Vol. 30,638,536

25,150

1D -2.14%

5D 8.17%

Buy Vol. 53,425,925

Sell Vol. 64,418,153

32,950

1D 0.00%

5D 2.97%

Buy Vol. 13,592,907

Sell Vol. 18,428,431

17,400

1D -1.14%

5D 0.58%

Buy Vol. 14,011,736

Sell Vol. 20,196,024

49,200

1D -1.99%

5D 1.23%

Buy Vol. 8,711,197

Sell Vol. 13,163,332

18,650

1D -1.32%

5D 0.81%

Buy Vol. 9,062,612

Sell Vol. 11,449,982

24,350

1D -2.21%

5D 0.41%

Buy Vol. 12,827,144

Sell Vol. 14,456,499

16,750

1D -3.18%

5D -0.30%

Buy Vol. 89,599,809

Sell Vol. 131,011,157

17,700

1D 0.00%

5D 2.31%

Buy Vol. 3,831,642

Sell Vol. 4,142,368

48,100

1D -2.83%

5D -1.03%

Buy Vol. 1,808,928

Sell Vol. 1,607,755

The State Bank of Vietnam has raised the OMO collateralized lending rate to 4.5% per year from the 4% level maintained since September 2024. Additionally, the SBV announced a 14-day FX swap operation with credit institutions, with a spot buying rate of 23,945 VND/USD and a forward selling rate of 23,955 VND/USD. The maximum swap volume is USD500 million.

OIL & GAS

64,000

1D -1.54%

5D 0.95%

Buy Vol. 1,285,013

Sell Vol. 1,438,288

34,400

1D -1.57%

5D 1.47%

Buy Vol. 2,003,939

Sell Vol. 2,923,713

As of 5:00 PM today, Brent crude oil fell nearly 0.2% to 63.1 USD/barrel.

VINGROUP

142,800

1D 6.97%

5D 9.68%

Buy Vol. 13,816,907

Sell Vol. 8,895,992

107,000

1D 1.71%

5D 3.98%

Buy Vol. 8,114,271

Sell Vol. 8,934,056

33,800

1D -1.74%

5D -1.31%

Buy Vol. 11,338,734

Sell Vol. 14,450,504

VIC: Today is the ex-rights trading date for receiving a 1:1 stock dividend.

FOOD & BEVERAGE

63,400

1D 0.00%

5D -0.94%

Buy Vol. 6,666,602

Sell Vol. 6,585,191

78,200

1D -2.13%

5D 1.03%

Buy Vol. 8,447,675

Sell Vol. 11,058,868

49,800

1D -2.16%

5D 7.33%

Buy Vol. 3,922,320

Sell Vol. 3,626,183

MSN: Foreign investors net sold more than VND55 billion of MSN shares today.

OTHERS

66,000

1D -0.45%

5D -0.90%

Buy Vol. 380,624

Sell Vol. 398,809

95,000

1D -2.06%

5D 0.74%

Buy Vol. 1,926,715

Sell Vol. 3,668,093

207,500

1D 0.73%

5D 1.97%

Buy Vol. 3,468,556

Sell Vol. 3,232,691

96,200

1D -1.33%

5D 0.10%

Buy Vol. 8,180,905

Sell Vol. 9,671,029

85,100

1D -0.82%

5D 6.51%

Buy Vol. 10,334,576

Sell Vol. 10,889,405

27,400

1D -1.62%

5D 0.37%

Buy Vol. 6,124,604

Sell Vol. 6,885,082

32,250

1D -1.68%

5D -1.68%

Buy Vol. 67,527,139

Sell Vol. 72,910,270

27,000

1D -1.10%

5D 1.69%

Buy Vol. 30,397,371

Sell Vol. 42,122,889

SSI: December 8 will be the ex-rights trading date for subscribing to the new share issuance at a 5:1 ratio, priced at 15,000 VND/share.

Market by numbers

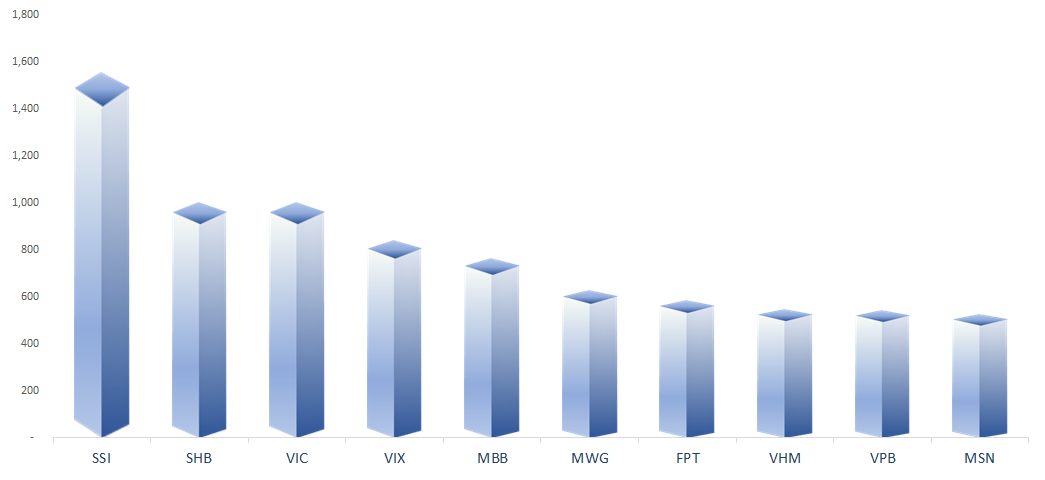

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

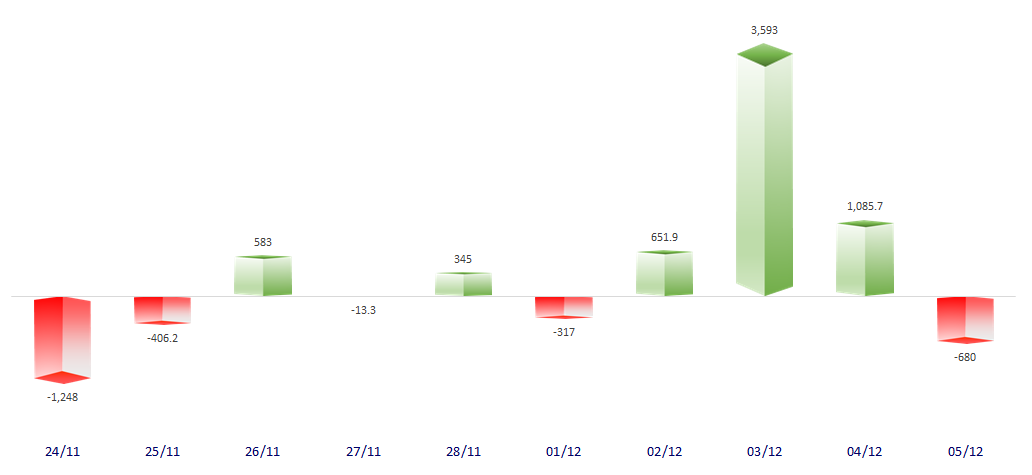

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

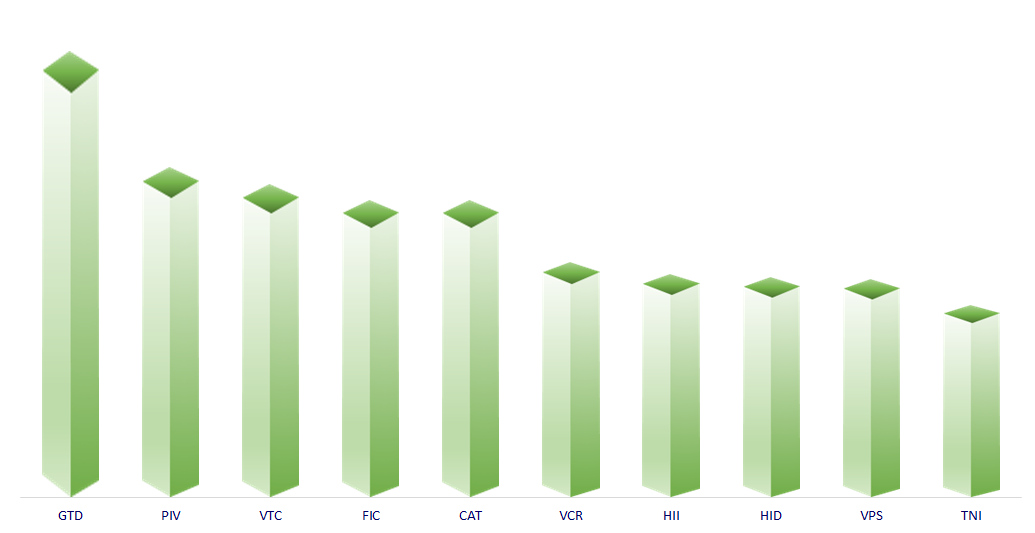

TOP INCREASES 3 CONSECUTIVE SESSIONS

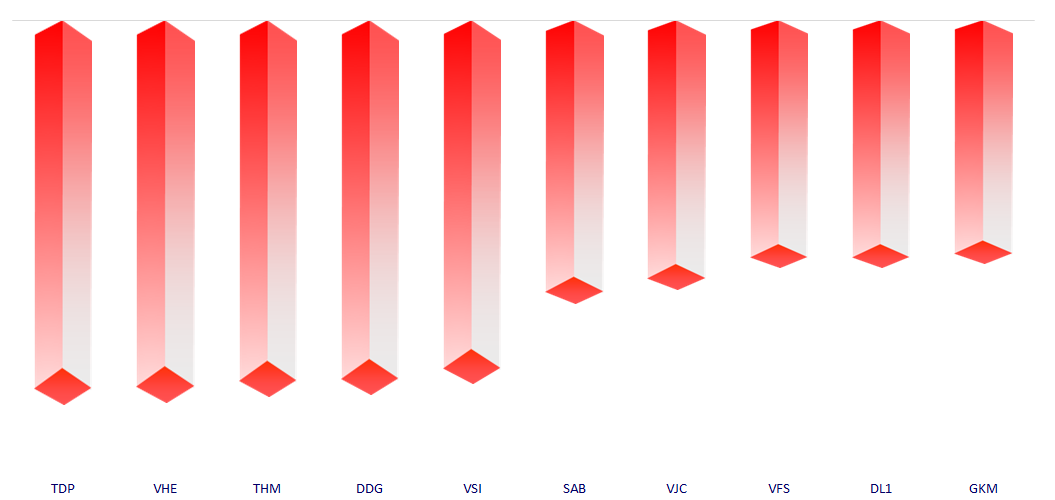

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.