Market Brief 10/05/2021

VIETNAM STOCK MARKET

1,259.58

1D 1.43%

YTD 14.56%

1,370.66

1D 2.23%

YTD 29.50%

280.27

1D 0.15%

YTD 42.20%

80.84

1D -0.01%

YTD 9.49%

90.27

1D 0.00%

YTD 0.00%

26,046.09

1D 1.58%

YTD 51.84%

- Foreign investors' trade was somewhat positive when they bought 48.7 million shares, worth 2.050 billion VND, while sold out 46.9 million shares, worth 1.934 billion VND. The total net buying volume was 1.9 million shares, equivalent to a net buying value of 90 billion dong. VHM, MSN, HPG, VRE ... are stocks with strong net buying by foreign investors.

ETF & DERIVATIVES

22,990

1D 2.63%

YTD 22.29%

16,100

1D 2.22%

YTD 28.49%

17,000

1D 1.92%

YTD 27.53%

19,500

1D 0.52%

YTD 23.42%

19,020

1D 2.81%

YTD 39.34%

22,750

1D -1.09%

YTD 32.27%

17,190

1D 0.29%

YTD 23.23%

1,350

1D 3.30%

YTD 0.00%

1,351

1D 3.11%

YTD 0.00%

1,368

1D 3.68%

YTD 0.00%

1,375

1D 3.87%

YTD 0.00%

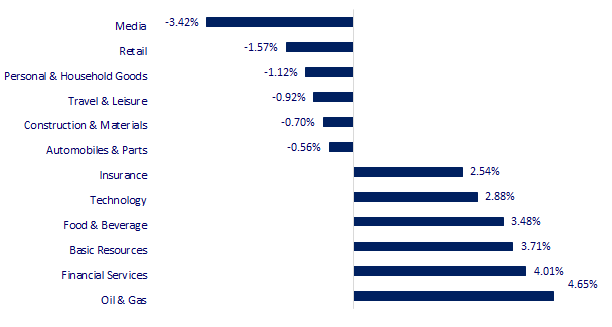

CHANGE IN PRICE BY SECTOR

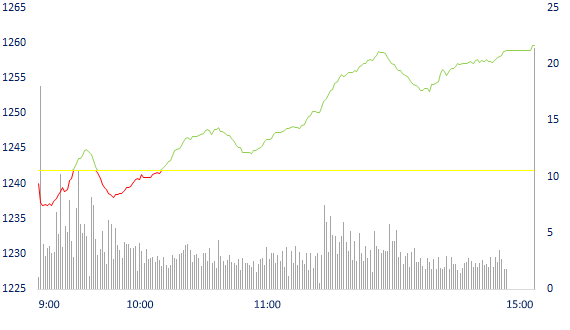

INTRADAY VNINDEX

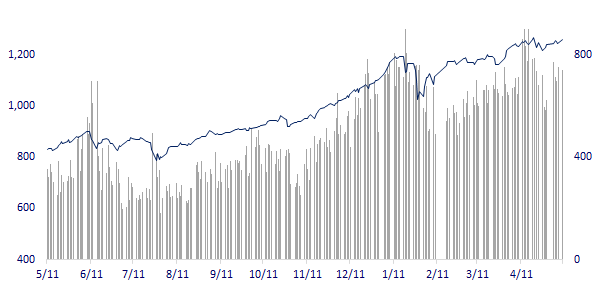

VNINDEX (12M)

GLOBAL MARKET

29,518.34

1D -0.43%

YTD 7.56%

3,427.99

1D 0.27%

YTD 0.40%

3,249.30

1D 1.63%

YTD 13.08%

28,594.50

1D -0.71%

YTD 5.33%

3,182.41

1D -0.56%

YTD 10.92%

1,588.15

1D 0.28%

YTD 9.58%

65.24

1D -0.72%

YTD 35.07%

1,838.95

1D 0.33%

YTD -3.40%

- Asian stocks are mixed after reporting 'shocking' jobs in the US. In Japan, the Nikkei 225 decreased by 0.43%. China market went up with Shanghai Composite up 0.27%, Shenzhen Component up 0.19%. Hong Kong's Hang Seng Index was in the opposite direction, down 0.71%. Korea's Kospi Index rose 1.63%, the strongest in the region.

VIETNAM ECONOMY

1.21%

1D (bps) -8

YTD (bps) 108

5.60%

YTD (bps) -20

1.39%

1D (bps) 2

YTD (bps) 17

2.24%

YTD (bps) 21

23,157

1D (%) -0.03%

YTD (%) -0.09%

28,762

1D (%) -0.01%

YTD (%) -1.17%

3,666

1D (%) 0.27%

YTD (%) 2.60%

- Generally, the total investment capital of Vietnam abroad (newly and additionally capital) reached 545.9 million USD in 4 months, nearly 8 times higher than the same period in 2020. Last year, the total investment capital of the enterprise Vietnam went abroad both newly and adjusted to reach over 590 million USD, an increase of more than 16% compared to 2019.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Many coal-fired power projects will find to access cheap finance difficultly

- Investing VND 6,996 billion to build Ha Giang - Tuyen Quang expressway

- In the first 4 months of the year, Vietnamese enterprises' overseas investment increased 8 times over the same period last year

- The global 'thirst for' chips has started to have big consequences

- Iron ore market surged, prices jumped 10% in just a few minutes

- The European Union and India agreed to resume the FTA negotiations

VN30

BANK

98,100

1D 1.13%

5D -1.90%

Buy Vol. 3,474,000

Sell Vol. 2,889,200

41,400

1D 1.85%

5D 0.98%

Buy Vol. 6,241,700

Sell Vol. 5,192,800

44,800

1D 2.28%

5D 9.80%

Buy Vol. 42,671,700

Sell Vol. 42,477,800

48,100

1D 2.23%

5D 17.32%

Buy Vol. 37,685,100

Sell Vol. 30,559,300

62,300

1D 1.30%

5D 6.50%

Buy Vol. 54,398,200

Sell Vol. 47,463,100

33,200

1D 5.06%

5D 9.39%

Buy Vol. 67,375,100

Sell Vol. 57,122,100

30,800

1D 2.67%

5D 13.03%

Buy Vol. 15,825,800

Sell Vol. 17,039,600

31,100

1D 6.87%

5D 13.50%

Buy Vol. 26,773,700

Sell Vol. 21,373,800

24,300

1D 1.25%

5D 1.67%

Buy Vol. 83,445,100

Sell Vol. 70,719,100

- Statistics from 27 banks that have published quarterly financial statements of the first quarter of 2021 show that the total pre-tax profit of banks in the period reached VND 52,152 billion, an increase of 78.2% over the same period last year. Top 10 banks with the highest profit before tax include Vietcombank, VietinBank, Techcombank, MB, VPBank, BIDV, ACB, HDBank, VIB and SHB. The total profit of these 10 banks reached 42,867 billion dong, accounting for more than 82% of the total profit of 27 banks as reported.

REAL ESTATE

128,500

1D -5.38%

5D -2.21%

Buy Vol. 2,600,100

Sell Vol. 2,777,000

21,850

1D -0.23%

5D 0.69%

Buy Vol. 9,107,500

Sell Vol. 8,527,700

36,450

1D 0.41%

5D 3.70%

Buy Vol. 7,037,000

Sell Vol. 6,963,100

69,900

1D -1.41%

5D -0.43%

Buy Vol. 3,473,700

Sell Vol. 3,427,600

- NVL: On 14/025/2021 officially traded 77,079,598 additional shares issued to existing shareholders

OIL & GAS

86,000

1D 2.38%

5D 2.99%

Buy Vol. 1,371,500

Sell Vol. 1,316,700

12,200

1D 0.83%

5D -0.81%

Buy Vol. 22,626,900

Sell Vol. 21,041,900

53,300

1D 5.13%

5D 5.96%

Buy Vol. 7,121,200

Sell Vol. 4,099,200

- PLX: PLX will continue to sell 25m treasury shares. Previously, PLX just sold 25m treasury shares in March, earning more than 1,400b dong.

VINGROUP

132,500

1D 0.38%

5D 1.15%

Buy Vol. 1,991,500

Sell Vol. 1,767,800

99,100

1D 2.06%

5D -0.20%

Buy Vol. 7,302,700

Sell Vol. 6,930,300

31,750

1D 2.42%

5D -0.78%

Buy Vol. 17,548,000

Sell Vol. 13,924,900

- Vingroup closes the phone and television segment and lets VinSmart focus its resources on developing electronic products and Infotainment features for VinFast.

FOOD & BEVERAGE

93,000

1D 6.90%

5D -0.53%

Buy Vol. 15,143,100

Sell Vol. 11,646,500

101,600

1D 6.95%

5D 3.67%

Buy Vol. 7,044,000

Sell Vol. 5,566,300

19,050

1D -1.55%

5D -4.75%

Buy Vol. 4,859,000

Sell Vol. 5,854,800

- VNM: F&N DAIRY INVESTMENTS PTE. LTD registered to buy nearly 21 million shares of VNM. Trading time is from May 12, 2021 to June 10, 2021

OTHERS

119,200

1D -0.25%

5D -4.56%

Buy Vol. 637,400

Sell Vol. 579,200

119,200

1D -0.25%

5D -4.56%

Buy Vol. 637,400

Sell Vol. 579,200

85,800

1D 3.37%

5D 6.06%

Buy Vol. 8,133,400

Sell Vol. 7,359,800

138,100

1D -1.50%

5D -1.99%

Buy Vol. 2,617,200

Sell Vol. 2,500,200

93,600

1D -1.99%

5D -4.49%

Buy Vol. 667,900

Sell Vol. 1,037,300

56,700

1D 1.07%

5D 5.78%

Buy Vol. 1,560,200

Sell Vol. 1,521,200

34,700

1D 6.12%

5D 6.44%

Buy Vol. 40,226,800

Sell Vol. 35,598,500

63,000

1D 3.62%

5D 8.43%

Buy Vol. 49,410,100

Sell Vol. 44,437,800

- HPG: Can Tho accepts Hoa Phat's proposal to research 2 projects in Cai Rang and Ninh Kieu districts. Accordingly, Hoa Phat will survey the 88.2 ha project in Cai Rang and the 6.24 ha project in Ninh Kieu.

Market by numbers

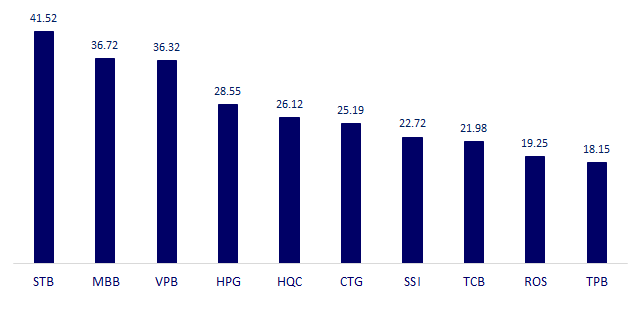

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

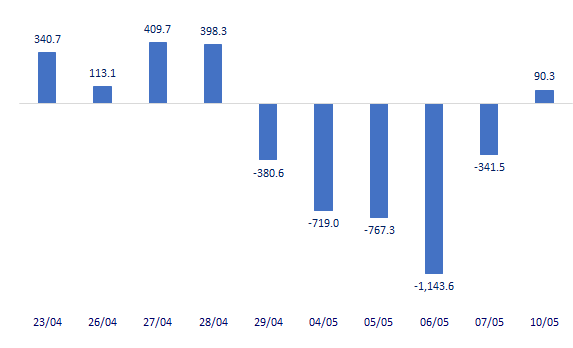

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

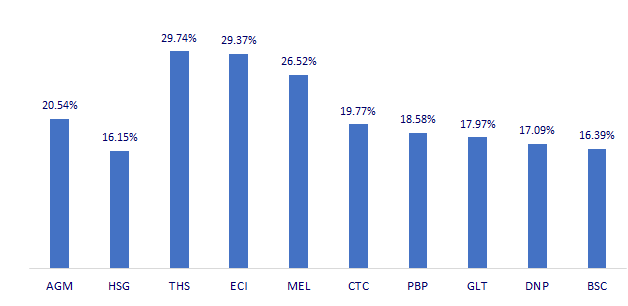

TOP INCREASES 3 CONSECUTIVE SESSIONS

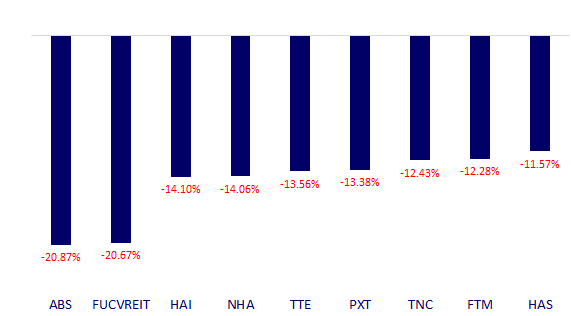

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.