Market Brief 15/09/2021

VIETNAM STOCK MARKET

1,345.83

1D 0.46%

YTD 22.40%

1,444.85

1D 0.47%

YTD 36.51%

350.75

1D 0.83%

YTD 77.96%

95.81

1D 0.84%

YTD 29.77%

-11.96

1D 0.00%

YTD 0.00%

24,714.28

1D 0.43%

YTD 44.08%

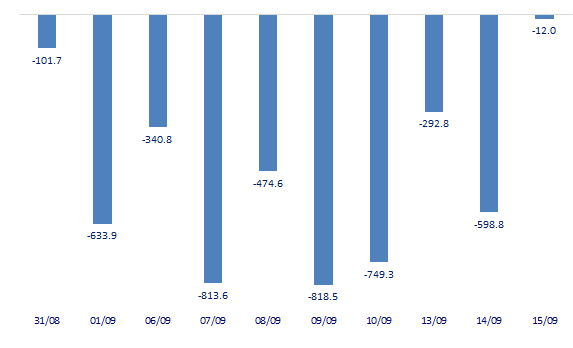

- On September 15, foreign investors only had a slight net selling on both exchanges with a value of nearly 12 billion dong. MSN, HSG stocks today saw positive foreign trade as they were net bought while net selling was reduced with no stocks being sold more than 100 billion dong.

ETF & DERIVATIVES

24,400

1D 0.83%

YTD 29.79%

17,090

1D 0.65%

YTD 36.39%

17,880

1D 0.39%

YTD 34.44%

21,300

1D 0.47%

YTD 34.81%

20,170

1D -0.84%

YTD 47.77%

25,750

1D 0.39%

YTD 49.71%

18,280

1D -0.11%

YTD 31.04%

1,440

1D 0.47%

YTD 0.00%

1,439

1D 0.24%

YTD 0.00%

1,441

1D 0.38%

YTD 0.00%

1,448

1D 0.77%

YTD 0.00%

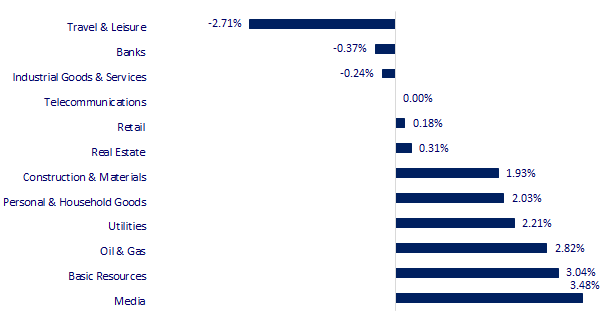

CHANGE IN PRICE BY SECTOR

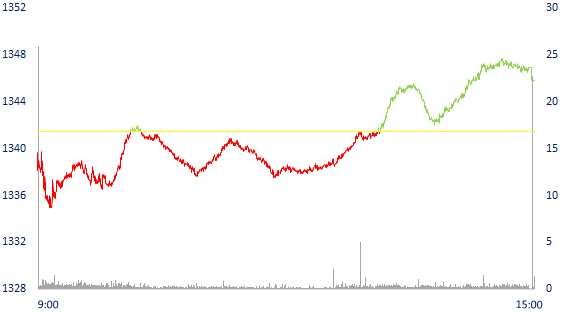

INTRADAY VNINDEX

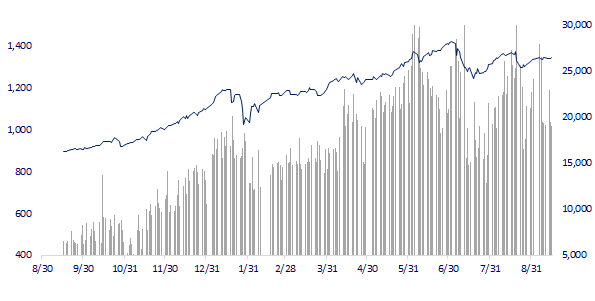

VNINDEX (12M)

GLOBAL MARKET

30,511.71

1D 0.25%

YTD 11.18%

3,656.22

1D -0.17%

YTD 7.08%

3,153.40

1D 0.15%

YTD 9.74%

25,033.21

1D -1.05%

YTD -7.79%

3,058.61

1D -0.71%

YTD 6.60%

1,628.04

1D 0.26%

YTD 12.33%

71.45

1D 0.76%

YTD 47.93%

1,803.05

1D -0.12%

YTD -5.28%

- Chinese economic data missed expectations, Asian stocks fell. In Japan, Nikkei rose 0.25%. The Chinese market fell with Shanghai Composite down 0.17%, Shenzhen Component down 0.614%. Hong Kong's Hang Seng fell 1.05%, the third consecutive session down more than 1%. South Korea's Kospi index rose 0.15%.

VIETNAM ECONOMY

0.64%

YTD (bps) 51

5.60%

YTD (bps) -20

1.10%

1D (bps) 15

YTD (bps) -12

1.81%

1D (bps) -10

YTD (bps) -22

22,855

1D (%) -0.02%

YTD (%) -1.39%

27,528

1D (%) 0.11%

YTD (%) -5.41%

3,607

1D (%) 0.06%

YTD (%) 0.95%

- A representative of the Textile and Apparel Association said that the lack of human resources is a big challenge for the business community when the economy reopens. Labor shortage is expected at 35-37%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The textile and garment industry will have a shortage of 35-37% of workers when the economy reopens

- Ho Chi Minh City and 5 Eastern provinces may experience negative growth in 2021

- Deputy Prime Minister Le Van Thanh: 'Do not accept the delay of the North - South expressway'

- Global trade has unpredictable variables

- Bad debt alarm in emerging economies

- The Chinese economy is further weakened because of the Delta mutation

VN30

BANK

97,100

1D -1.22%

5D -2.61%

Buy Vol. 1,219,800

Sell Vol. 1,450,800

38,800

1D 0.26%

5D -2.02%

Buy Vol. 2,578,700

Sell Vol. 1,895,800

31,150

1D -0.16%

5D -3.11%

Buy Vol. 12,789,500

Sell Vol. 11,407,600

48,400

1D -0.21%

5D -0.82%

Buy Vol. 9,506,000

Sell Vol. 9,456,900

63,900

1D 0.00%

5D 3.06%

Buy Vol. 8,534,700

Sell Vol. 7,801,400

27,450

1D -0.54%

5D -3.00%

Buy Vol. 22,161,500

Sell Vol. 20,089,900

24,750

1D -0.20%

5D -7.48%

Buy Vol. 3,166,400

Sell Vol. 3,514,200

38,250

1D 1.73%

5D 5.96%

Buy Vol. 11,582,600

Sell Vol. 11,177,100

26,600

1D -0.19%

5D -2.56%

Buy Vol. 16,437,100

Sell Vol. 16,621,600

31,200

1D -0.95%

5D -2.95%

Buy Vol. 8,840,700

Sell Vol. 8,510,200

- CTG: just announced that it has successfully issued the 12th private placement of bonds this year. This bond lot is worth 700 billion VND with a par value of 1 billion VND each, with a term of 8 years. Bond interest rate is 6.43%/year, paid periodically once a year. This is a non-convertible bond that is not secured by assets and satisfies the conditions to be included in VietinBank's Tier 2 capital.

REAL ESTATE

103,100

1D 0.10%

5D -0.87%

Buy Vol. 3,485,200

Sell Vol. 2,675,600

41,200

1D -0.12%

5D 3.00%

Buy Vol. 3,414,300

Sell Vol. 2,665,600

81,700

1D 1.49%

5D -2.97%

Buy Vol. 4,389,300

Sell Vol. 3,531,400

- NVL: Support Delta-Valley Binh Thuan Company to pay due debts to continue implementing the H4 Hotel project on schedule.

OIL & GAS

91,500

1D 2.81%

5D 4.21%

Buy Vol. 2,102,800

Sell Vol. 2,240,600

11,800

1D 2.61%

5D -0.84%

Buy Vol. 16,289,000

Sell Vol. 13,533,600

50,900

1D 1.60%

5D 3.25%

Buy Vol. 1,560,500

Sell Vol. 1,478,100

- POW: on October 1, the last registration paying dividend in 2020 at the rate of 2%. The total amount of money to spend is 468bVND, the implementation date is November 4.

VINGROUP

91,400

1D -0.65%

5D -0.65%

Buy Vol. 4,248,700

Sell Vol. 2,311,800

81,900

1D 0.93%

5D 0.08%

Buy Vol. 13,096,400

Sell Vol. 19,181,000

28,550

1D 0.88%

5D 5.35%

Buy Vol. 7,845,700

Sell Vol. 8,535,500

- VIC: just announced information about contributing 99% (466b VND) to establish VinBigData Joint Stock Company with the main business being scientific R&D

FOOD & BEVERAGE

86,100

1D -1.03%

5D 0.82%

Buy Vol. 4,222,900

Sell Vol. 3,997,500

144,900

1D 6.94%

5D 13.20%

Buy Vol. 4,558,400

Sell Vol. 3,608,200

166,000

1D 0.00%

5D 10.74%

Buy Vol. 515,200

Sell Vol. 501,300

- MSN: De Heus will focus on providing nutrition, breeding and livestock solutions, while Masan MEATLife develops branded cool meat.

OTHERS

126,000

1D 0.16%

5D 1.12%

Buy Vol. 780,600

Sell Vol. 854,200

126,000

1D 0.16%

5D 1.12%

Buy Vol. 780,600

Sell Vol. 854,200

94,100

1D 0.32%

5D 1.07%

Buy Vol. 3,120,900

Sell Vol. 3,841,900

124,600

1D 0.08%

5D 11.85%

Buy Vol. 1,261,300

Sell Vol. 1,612,300

91,900

1D 3.26%

5D 6.61%

Buy Vol. 1,035,700

Sell Vol. 790,800

38,500

1D 1.32%

5D -1.28%

Buy Vol. 5,561,600

Sell Vol. 4,494,800

42,900

1D 0.94%

5D -3.05%

Buy Vol. 14,659,100

Sell Vol. 13,578,500

51,600

1D 2.58%

5D 0.58%

Buy Vol. 46,933,200

Sell Vol. 46,885,200

- SSI: More than 218 million shares have been distributed to pay dividends at the ratio of 6:2, accordingly, the total number of shares after the issuance is nearly 875.6 million shares.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

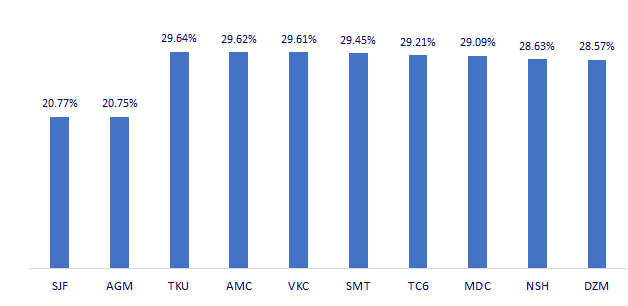

TOP INCREASES 3 CONSECUTIVE SESSIONS

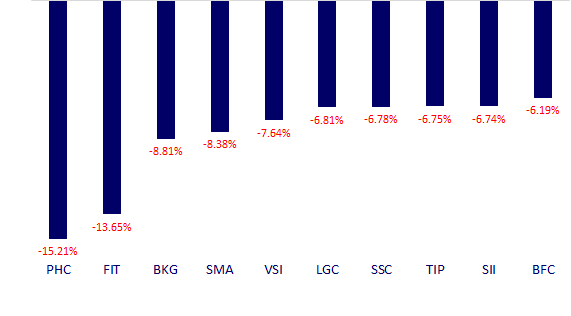

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.