Market Brief 06/10/2021

VIETNAM STOCK MARKET

1,362.82

1D 0.60%

YTD 23.95%

1,461.72

1D 0.38%

YTD 38.11%

368.47

1D 0.54%

YTD 86.95%

97.38

1D 0.50%

YTD 31.90%

-531.89

1D 0.00%

YTD 0.00%

23,355.72

1D -3.97%

YTD 36.16%

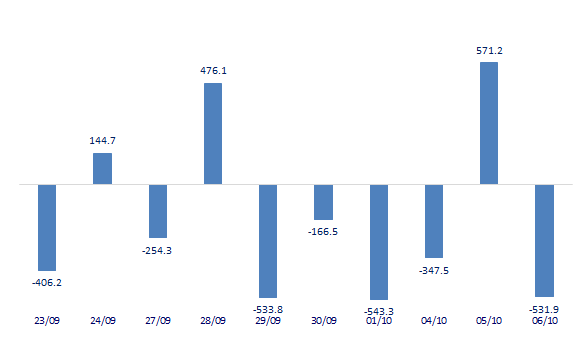

- Foreign investors net sold again 531 billion dong on October 6, HPG and NVL were the focus. TPB was still strongly net bought but the value decreased significantly compared to yesterday's sudden session to 115 billion dong.

ETF & DERIVATIVES

24,530

1D 0.12%

YTD 30.48%

17,200

1D 0.23%

YTD 37.27%

18,000

1D 1.07%

YTD 35.34%

21,600

1D 0.47%

YTD 36.71%

19,660

1D -0.20%

YTD 44.03%

25,900

1D -0.38%

YTD 50.58%

18,280

1D 0.22%

YTD 31.04%

1,452

1D 0.21%

YTD 0.00%

1,449

1D 0.11%

YTD 0.00%

1,448

1D 0.23%

YTD 0.00%

1,448

1D 0.28%

YTD 0.00%

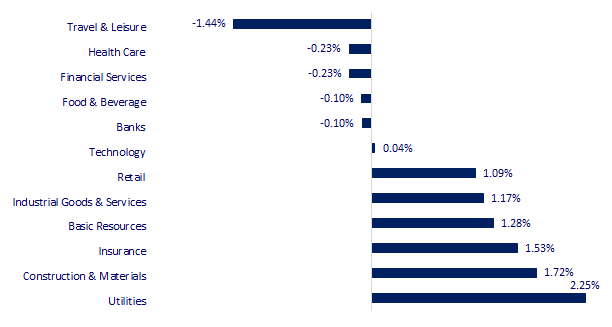

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

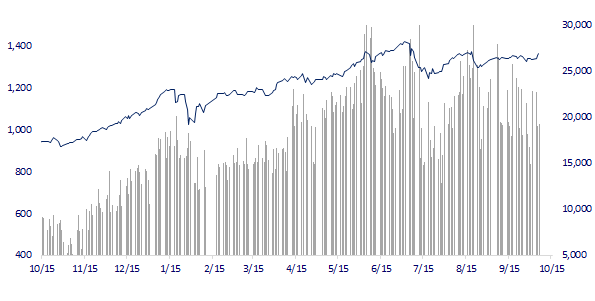

VNINDEX (12M)

GLOBAL MARKET

27,528.87

1D -1.07%

YTD 0.31%

3,568.17

1D 0.00%

YTD 4.50%

2,908.31

1D -1.82%

YTD 1.21%

23,966.49

1D -0.57%

YTD -11.72%

3,083.88

1D 0.51%

YTD 7.48%

1,619.48

1D -0.29%

YTD 11.74%

78.55

1D -0.61%

YTD 62.63%

1,754.95

1D -0.09%

YTD -7.81%

- New Zealand raises interest rates amid pandemic, Asian stocks fall. In Japan, the Nikkei 225 fell 1.07%. The Chinese market is off for Golden Week. Hong Kong's Hang Seng fell 0.57%. South Korea's Kospi index fell 1.82%.

VIETNAM ECONOMY

0.67%

1D (bps) 2

YTD (bps) 54

5.60%

YTD (bps) -20

1.21%

1D (bps) -1

YTD (bps) -1

1.94%

1D (bps) -1

YTD (bps) -9

22,858

1D (%) 0.01%

YTD (%) -1.38%

26,698

1D (%) -0.44%

YTD (%) -8.26%

3,600

1D (%) 0.00%

YTD (%) 0.76%

- The Prime Minister praised 4 central agencies and 11 localities by the end of September 2021, disbursing over 60% of the assigned plan; severely criticized and requested 36 ministries, central agencies and 8 localities to disburse less than 40% of the plan, assigning them to review, learn from experience, clarify the collective and individual responsibilities involved, and on that basis set forth suitable solution to accelerate disbursement in the near future

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Accelerating disbursement of public investment capital must ensure the quality of the works and fighting against negativity

- Phu Yen: Adjusting investment in infrastructure project of High-tech Agricultural Park

- Vietnam becomes a "strategic base"

- New Zealand is the next country to raise interest rates

- US trade deficit sets a new record

- 'The US will fall into a recession if it doesn't raise the debt ceiling within two weeks'

VN30

BANK

95,600

1D 0.00%

5D -2.94%

Buy Vol. 1,696,400

Sell Vol. 1,126,900

39,400

1D 0.25%

5D -1.25%

Buy Vol. 1,787,500

Sell Vol. 2,564,600

29,300

1D -0.68%

5D -3.62%

Buy Vol. 14,494,900

Sell Vol. 13,198,600

50,300

1D 2.44%

5D 1.82%

Buy Vol. 15,460,600

Sell Vol. 14,058,600

61,600

1D -1.60%

5D -6.67%

Buy Vol. 22,239,800

Sell Vol. 26,546,200

27,500

1D 0.36%

5D -1.08%

Buy Vol. 18,035,600

Sell Vol. 17,680,900

24,250

1D -1.02%

5D -4.53%

Buy Vol. 2,409,300

Sell Vol. 2,245,500

42,300

1D -0.47%

5D 2.17%

Buy Vol. 12,228,200

Sell Vol. 15,391,100

25,500

1D -0.97%

5D -1.16%

Buy Vol. 22,439,100

Sell Vol. 22,074,000

31,350

1D -0.48%

5D 0.00%

Buy Vol. 7,422,200

Sell Vol. 7,121,700

- TPBank: by the end of September 30, 2021, the bank's total assets reached VND 260,328 billion, up 35% over the same period last year and exceeding 4% of the whole year plan. The bank's total operating income reached VND 9,868 billion, up 39% over the same period. Credit growth over the past three quarters has been 15%. This is a positive growth compared to the context that many major economic centers across the country have been subject to prolonged social distancing.

REAL ESTATE

105,000

1D 0.57%

5D 2.94%

Buy Vol. 4,335,600

Sell Vol. 5,416,800

42,000

1D 1.08%

5D 0.96%

Buy Vol. 3,136,800

Sell Vol. 3,421,200

84,300

1D 0.36%

5D 3.82%

Buy Vol. 4,530,400

Sell Vol. 4,622,700

- NVL: contributed more than 4,592 billion VND to Nova Hospitality JSC to expand the land fund in Mui Ne

OIL & GAS

113,500

1D 4.13%

5D 17.25%

Buy Vol. 4,222,800

Sell Vol. 5,063,800

12,850

1D 0.78%

5D 7.08%

Buy Vol. 31,375,500

Sell Vol. 48,000,100

53,900

1D 0.00%

5D 3.65%

Buy Vol. 4,040,700

Sell Vol. 3,771,100

- POW: held a signing ceremony to designate a consortium to assist in arranging and coordinating capital mobilization for Nhon Trach 3 and 4 Power Plant projects.

VINGROUP

88,600

1D 0.00%

5D 2.19%

Buy Vol. 3,466,100

Sell Vol. 3,604,100

80,500

1D 1.39%

5D 2.94%

Buy Vol. 10,454,000

Sell Vol. 8,122,800

29,400

1D 3.34%

5D 3.89%

Buy Vol. 9,591,000

Sell Vol. 9,592,400

- VHM: More than 1 billion shares of VHM paying dividends have been traded since October 12. The number of listed and outstanding shares of VHM increased to 4.35 billion units.

FOOD & BEVERAGE

89,300

1D -0.33%

5D -0.33%

Buy Vol. 6,523,700

Sell Vol. 5,055,000

142,200

1D 0.71%

5D 0.85%

Buy Vol. 1,180,000

Sell Vol. 952,800

158,400

1D -1.31%

5D 1.02%

Buy Vol. 158,300

Sell Vol. 99,800

- MSN: The Board of Directors has approved the purchase of bonds issued by Masan MeatLife JSC

OTHERS

129,400

1D -1.07%

5D 0.70%

Buy Vol. 834,400

Sell Vol. 945,200

129,400

1D -1.07%

5D 0.70%

Buy Vol. 834,400

Sell Vol. 945,200

94,400

1D 0.00%

5D 1.29%

Buy Vol. 3,224,900

Sell Vol. 3,074,600

128,300

1D 1.18%

5D 0.39%

Buy Vol. 2,709,600

Sell Vol. 3,608,400

98,100

1D 1.13%

5D 5.14%

Buy Vol. 873,300

Sell Vol. 783,800

37,850

1D 0.93%

5D 5.14%

Buy Vol. 5,772,500

Sell Vol. 7,076,000

39,950

1D -1.11%

5D -0.37%

Buy Vol. 11,467,900

Sell Vol. 14,010,200

56,100

1D 1.45%

5D 5.25%

Buy Vol. 43,928,100

Sell Vol. 45,282,400

- HPG: Amersham Industries Limited has sold 500,000 shares, CTBC Vietnam Equity Fund has sold 600,000 shares, Hanoi Investments Holdings Limited has sold 110,000 shares, Norges Bank has sold 2 million shares and Samsung Vietnam Securities Master Investment Trust [Equity] has sold sold 100,000 shares, reducing the group's ownership of 13 related funds from 271,222,201 shares (ratio 6.063 percent) to 267,912,201 shares (ratio 5,9896%). The transaction was made on October 4, 2021.

Market by numbers

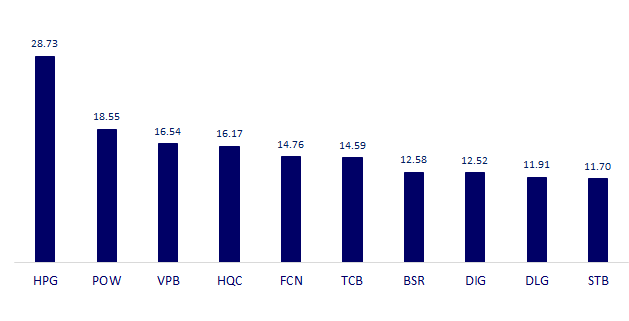

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

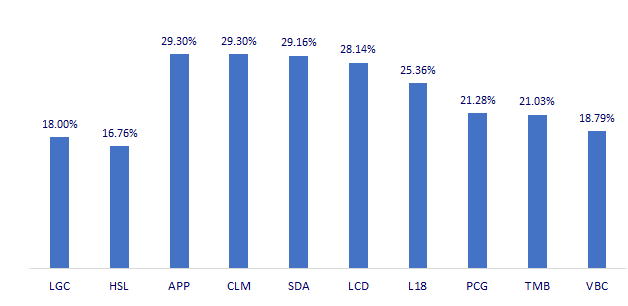

TOP INCREASES 3 CONSECUTIVE SESSIONS

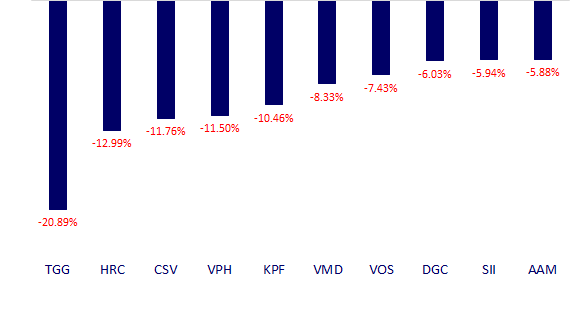

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.