Market Brief 07/10/2021

VIETNAM STOCK MARKET

1,365.99

1D 0.23%

YTD 24.24%

1,462.74

1D 0.07%

YTD 38.20%

370.40

1D 0.52%

YTD 87.92%

97.96

1D 0.60%

YTD 32.68%

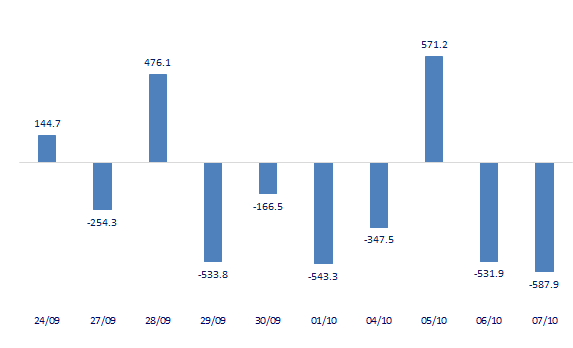

-587.86

1D 0.00%

YTD 0.00%

24,172.41

1D 3.50%

YTD 40.92%

- Session 7/10: Foreign investors boosted their net selling of 587 billion dong. Selling pressure focused on stocks such as HPG, SBT, PAN while foreign capital flow buy VRE, DHC, KBC, POW.

ETF & DERIVATIVES

24,600

1D 0.29%

YTD 30.85%

17,200

1D 0.00%

YTD 37.27%

18,240

1D 2.41%

YTD 37.14%

21,500

1D -0.46%

YTD 36.08%

19,790

1D 0.66%

YTD 44.98%

26,000

1D 0.39%

YTD 51.16%

18,340

1D 0.33%

YTD 31.47%

1,455

1D 0.19%

YTD 0.00%

1,452

1D 0.20%

YTD 0.00%

1,450

1D 0.11%

YTD 0.00%

1,450

1D 0.15%

YTD 0.00%

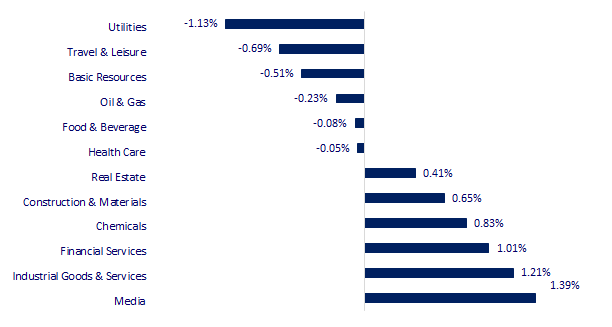

CHANGE IN PRICE BY SECTOR

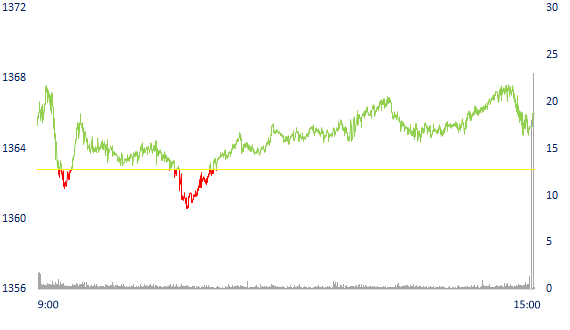

INTRADAY VNINDEX

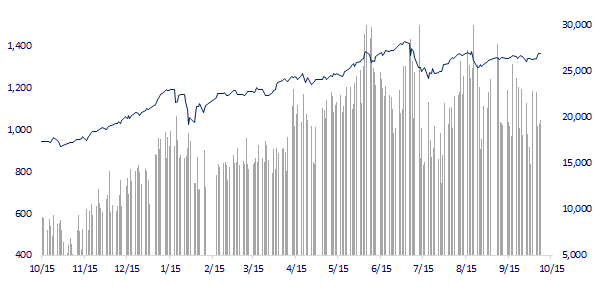

VNINDEX (12M)

GLOBAL MARKET

27,678.21

1D -1.07%

YTD 0.85%

3,568.17

1D 0.00%

YTD 4.50%

2,959.46

1D 1.76%

YTD 2.99%

24,701.73

1D 0.95%

YTD -9.01%

3,101.15

1D 0.56%

YTD 8.08%

1,632.43

1D 0.80%

YTD 12.63%

75.91

1D -1.38%

YTD 57.16%

1,760.65

1D -0.10%

YTD -7.51%

- Asian stocks mostly rose. In Japan, Nikkei fell 1.07%. The Chinese market is off for Golden Week. Hong Kong's Hang Seng was up 0.95%, with shares of major Chinese tech companies Tencent and Alibaba up 4.7% and 6.77%, respectively. South Korea's Kospi index rose 1.76%.

VIETNAM ECONOMY

0.66%

1D (bps) -1

YTD (bps) 53

5.60%

YTD (bps) -20

1.01%

1D (bps) -20

YTD (bps) -21

1.94%

YTD (bps) -9

22,858

1D (%) 0.00%

YTD (%) -1.38%

26,747

1D (%) 0.04%

YTD (%) -8.10%

3,600

1D (%) 0.00%

YTD (%) 0.76%

- According to statistics from the US Department of Finance recorded by Statista, Vietnam is holding more than $39 billion of US government bonds. In fact, the fact that the US "debts" Vietnam more than 39 billion USD is a figure that reflects the number of US government bonds that Vietnam holds, currently deposited at banks located in the US. This is considered the foreign exchange of Vietnam.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam is the 32nd "creditor" of the US

- Strict control of value-added tax refund

- Many Japanese companies are considering a plan to move part of their production chains to Vietnam

- China pushes Australian coal from storage to wait for other coal imports when the whole country is struggling due to lack of electricity

- Senior officials of the US and China hold talks in Switzerland

- EU officials aim for 15% global minimum tax deal to be completed in October

VN30

BANK

96,800

1D 1.26%

5D -0.41%

Buy Vol. 1,523,100

Sell Vol. 1,160,400

39,150

1D -0.63%

5D -0.76%

Buy Vol. 1,976,500

Sell Vol. 2,414,800

29,350

1D 0.17%

5D -3.45%

Buy Vol. 17,916,300

Sell Vol. 14,419,700

50,000

1D -0.60%

5D 0.81%

Buy Vol. 8,961,100

Sell Vol. 13,901,200

35,650

1D 4.16%

5D -2.63%

Buy Vol. 19,708,100

Sell Vol. 18,274,800

27,650

1D 0.55%

5D -0.72%

Buy Vol. 11,570,800

Sell Vol. 14,670,900

24,100

1D -0.62%

5D -5.12%

Buy Vol. 3,088,800

Sell Vol. 2,602,600

42,000

1D -0.71%

5D 0.96%

Buy Vol. 7,729,100

Sell Vol. 11,322,800

25,500

1D 0.00%

5D -0.78%

Buy Vol. 20,966,700

Sell Vol. 19,345,300

31,200

1D -0.48%

5D -1.11%

Buy Vol. 4,811,800

Sell Vol. 5,248,500

- TPB: In the third quarter, TPBank increased its charter capital by 1,000 billion dong, bringing the total charter capital of the bank to more than 11.716 billion dong, through a private placement of shares. Besides, the bank's total deposits as of the end of September reached VND 230,644 billion, up 24.73% over the same period and exceeding approximately 4% of the whole year plan. By the end of the third quarter, TPBank's capital adequacy ratio (CAR) was recorded at 13.43%, much higher than the minimum level of 8% prescribed by the State Bank.

REAL ESTATE

104,100

1D -0.86%

5D 2.06%

Buy Vol. 3,134,500

Sell Vol. 4,526,200

42,350

1D 0.83%

5D 1.80%

Buy Vol. 4,739,700

Sell Vol. 5,321,000

85,400

1D 1.30%

5D 4.40%

Buy Vol. 5,913,500

Sell Vol. 5,540,900

- KDH: Nguyen Thu Real Estate Development Joint Stock Company officially became a subsidiary of Nam Phu Real Estate Development Company Limited (KDH owns 99%).

OIL & GAS

111,000

1D -2.20%

5D 14.43%

Buy Vol. 3,760,700

Sell Vol. 4,251,800

12,650

1D -1.56%

5D 5.86%

Buy Vol. 31,919,600

Sell Vol. 41,696,300

54,000

1D 0.19%

5D 4.65%

Buy Vol. 8,363,500

Sell Vol. 4,834,700

- POW: Techcombank and MB arrange capital for Nhon Trach 3 and 4 power plants

VINGROUP

88,800

1D 0.23%

5D 0.91%

Buy Vol. 8,138,100

Sell Vol. 4,328,600

80,000

1D -0.62%

5D 2.17%

Buy Vol. 4,692,800

Sell Vol. 5,480,800

29,300

1D -0.34%

5D 0.69%

Buy Vol. 6,719,500

Sell Vol. 8,280,200

- VHM: successfully offered 21.6 million individual bonds with a total par value of VND 2,160 billion, 3-year term.

FOOD & BEVERAGE

88,800

1D -0.56%

5D -0.89%

Buy Vol. 6,633,900

Sell Vol. 4,583,700

141,700

1D -0.35%

5D -0.63%

Buy Vol. 1,049,700

Sell Vol. 874,500

158,600

1D 0.13%

5D 1.41%

Buy Vol. 151,700

Sell Vol. 118,500

- MSN: In September, domestic institutional investors (excluding proprietary trading) net bought MSN over 1,000 billion dong.

OTHERS

128,800

1D -0.46%

5D 0.70%

Buy Vol. 843,600

Sell Vol. 1,146,700

128,800

1D -0.46%

5D 0.70%

Buy Vol. 843,600

Sell Vol. 1,146,700

94,300

1D -0.11%

5D 1.40%

Buy Vol. 2,880,600

Sell Vol. 3,654,600

128,000

1D -0.23%

5D 0.16%

Buy Vol. 1,511,800

Sell Vol. 2,108,500

97,000

1D -1.12%

5D -1.72%

Buy Vol. 637,800

Sell Vol. 957,000

38,200

1D 0.92%

5D 6.41%

Buy Vol. 7,392,600

Sell Vol. 8,583,200

40,700

1D 1.88%

5D 0.12%

Buy Vol. 13,945,300

Sell Vol. 15,703,300

55,600

1D -0.89%

5D 5.10%

Buy Vol. 47,178,200

Sell Vol. 49,861,300

- SSI: In 9M2021, SSI is estimated to reach nearly VND2,100b in pre-tax profit, increased by 94% compared to the same period last year . SSI's profit is estimated at VND836b in the Q3.2021. - HPG: On October 6, British financial data firm Refinitiv Eikon announced the Top 30 largest capitalized steel companies in the world. HPG ranks 15th in this list with a market capitalization of 11 billion USD, larger than the capitalization of Japan's leading Steel Corporation, JFE Holdings.

Market by numbers

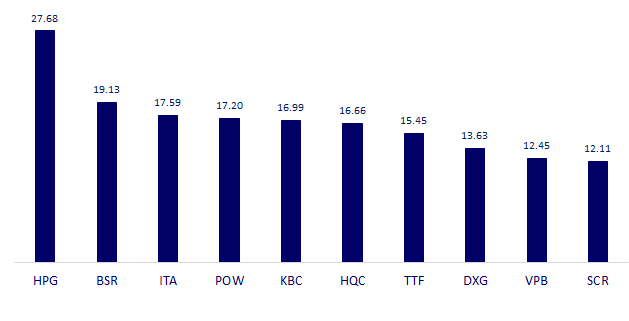

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

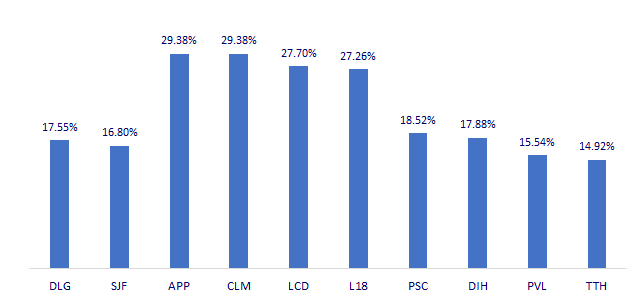

TOP INCREASES 3 CONSECUTIVE SESSIONS

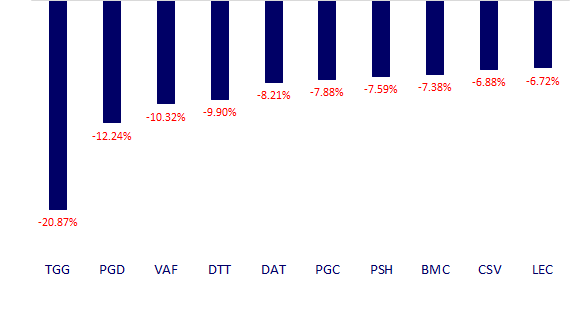

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.