Market brief 18/10/2021

VIETNAM STOCK MARKET

1,395.53

1D 0.20%

YTD 26.93%

1,510.49

1D 0.38%

YTD 42.72%

384.88

1D 0.01%

YTD 95.27%

99.37

1D -0.07%

YTD 34.59%

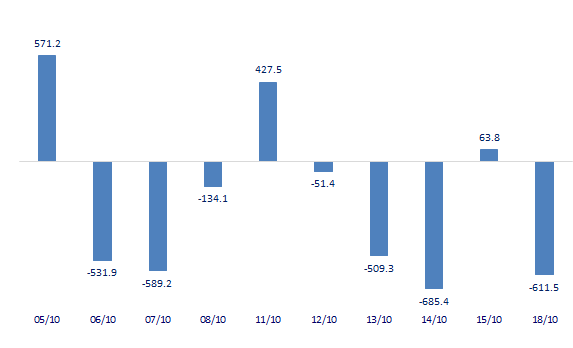

-611.53

1D 0.00%

YTD 0.00%

28,678.85

1D 4.55%

YTD 67.19%

- Foreign investors net sold again 611 billion dong on October 18. HPG was still strongly sold by foreign investors with a value of 184 billion dong. SSI and GMD were net sold 93 billion dong and 81 billion dong respectively. Meanwhile, STB was the strongest net buyer with the value of 81 billion dong. HAH was behind and was net bought 50 billion dong.

ETF & DERIVATIVES

25,850

1D 2.01%

YTD 37.50%

17,770

1D 0.23%

YTD 41.82%

19,980

1D 12.18%

YTD 50.23%

22,000

1D 0.00%

YTD 39.24%

20,510

1D 0.79%

YTD 50.26%

27,300

1D 0.37%

YTD 58.72%

19,000

1D 0.00%

YTD 36.20%

1,511

1D 0.40%

YTD 0.00%

1,510

1D 0.59%

YTD 0.00%

1,508

1D 0.46%

YTD 0.00%

1,505

1D 0.68%

YTD 0.00%

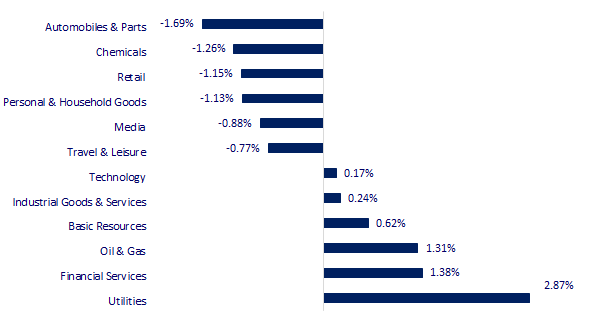

CHANGE IN PRICE BY SECTOR

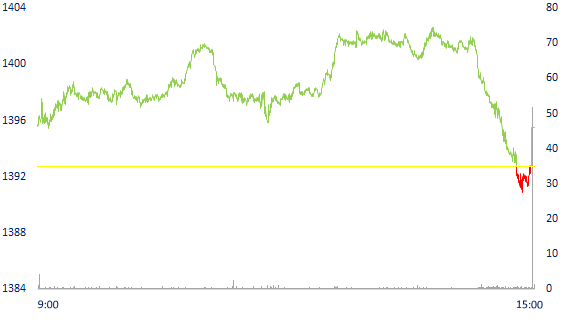

INTRADAY VNINDEX

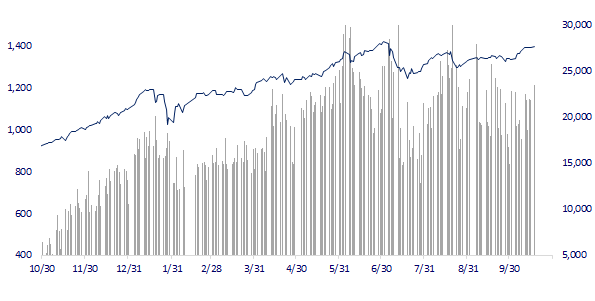

VNINDEX (12M)

GLOBAL MARKET

29,025.46

1D 0.23%

YTD 5.76%

3,568.14

1D -0.12%

YTD 4.50%

3,006.68

1D -0.28%

YTD 4.64%

25,409.75

1D 0.90%

YTD -6.40%

3,173.82

1D 0.00%

YTD 10.62%

1,643.92

1D 0.34%

YTD 13.42%

83.00

1D 0.30%

YTD 71.84%

1,762.15

1D -0.52%

YTD -7.43%

- China announced third-quarter GDP, Asian stocks were mostly mixed. In Japan, the Nikkei 225 gained 0.23%. The Chinese market fell with the Shanghai Composite down 0.12% and the Shenzhen Component down 0.458%. Hong Kong's Hang Seng rose 0.9%. South Korea's Kospi index fell 0.28%.

VIETNAM ECONOMY

0.65%

YTD (bps) 52

5.60%

YTD (bps) -20

1.21%

YTD (bps) -1

1.94%

YTD (bps) -9

22,855

1D (%) 0.00%

YTD (%) -1.39%

26,813

1D (%) 0.01%

YTD (%) -7.87%

3,609

1D (%) 0.08%

YTD (%) 1.01%

- Vietnam's sea freight rates are the lowest in the region on the same route. The shipping line surcharge in Vietnam does not increase and no new surcharge arises even though the shortage of containers or lack of ships continuously occurs. The Maritime Administration said thanks to the stability of the seaport.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Monetary policy towards reducing income inequality in Vietnam

- Wind power investors are at risk of losing

- Vietnam's sea freight rates are the lowest in the region on the same route

- Bank of England Deputy Governor: Cryptocurrencies Could Cause a Global Financial Crisis

- China's GDP disappoints, Q3 growth slows to 4.9%

- Faced with an energy crisis, China has "little choice" but to increase coal consumption

VN30

BANK

96,000

1D -0.52%

5D -1.54%

Buy Vol. 3,164,800

Sell Vol. 2,287,100

39,300

1D -0.51%

5D -1.75%

Buy Vol. 3,636,800

Sell Vol. 3,412,100

30,200

1D -1.47%

5D -2.58%

Buy Vol. 17,136,800

Sell Vol. 18,069,800

52,900

1D 0.57%

5D -0.19%

Buy Vol. 24,229,400

Sell Vol. 30,198,200

38,400

1D 2.40%

5D 4.35%

Buy Vol. 21,050,600

Sell Vol. 22,621,900

28,400

1D 0.00%

5D -1.39%

Buy Vol. 13,784,300

Sell Vol. 22,086,300

25,700

1D 0.19%

5D 0.19%

Buy Vol. 5,491,400

Sell Vol. 6,124,000

44,000

1D 1.03%

5D 2.09%

Buy Vol. 9,132,800

Sell Vol. 9,285,800

26,900

1D 0.19%

5D 1.51%

Buy Vol. 33,151,700

Sell Vol. 26,634,600

32,000

1D -0.62%

5D -1.84%

Buy Vol. 7,584,300

Sell Vol. 9,153,200

- TPB: TPBank's capital adequacy ratio after raising capital from private placement is about 13.6%. The bank will balance the plan to increase capital, which can pay dividends in shares, private placement or issue to existing shareholders, meeting Basel III standards.

REAL ESTATE

101,700

1D -0.29%

5D -2.21%

Buy Vol. 3,291,700

Sell Vol. 3,703,700

44,300

1D 1.03%

5D 1.49%

Buy Vol. 6,251,200

Sell Vol. 5,854,900

94,000

1D 2.96%

5D 5.86%

Buy Vol. 6,512,000

Sell Vol. 5,491,200

- PDR: Q3.2021, PDR's profit was mainly recorded from the transfer and handover of land plots in Division 2 project, and some land plots in Subdivision 9 project.

OIL & GAS

116,500

1D 4.02%

5D 3.56%

Buy Vol. 15,325,000

Sell Vol. 4,952,500

12,350

1D 0.41%

5D -0.40%

Buy Vol. 36,844,100

Sell Vol. 33,604,300

54,400

1D 1.49%

5D -0.91%

Buy Vol. 4,288,500

Sell Vol. 3,917,500

- The price of US WTI crude oil increased 0.87% to $82.44/barrel at 6:40 am (GMT) on October 18. While the price of Brent crude oil for December delivery rose 0.6 percent to $85.35 per barrel.

VINGROUP

92,600

1D 0.00%

5D 0.76%

Buy Vol. 2,575,500

Sell Vol. 4,179,700

78,900

1D 0.25%

5D -2.59%

Buy Vol. 8,179,700

Sell Vol. 7,702,300

30,800

1D 0.98%

5D 1.15%

Buy Vol. 8,342,200

Sell Vol. 10,656,400

- VIC: VinFast announced that it will officially launch a global electric vehicle brand at the Los Angeles Auto Show 2021 - one of the largest global auto shows.

FOOD & BEVERAGE

89,800

1D -0.22%

5D -0.22%

Buy Vol. 6,909,800

Sell Vol. 4,814,500

143,000

1D 1.42%

5D -2.72%

Buy Vol. 1,189,500

Sell Vol. 1,426,200

160,000

1D -1.72%

5D -1.84%

Buy Vol. 336,300

Sell Vol. 383,400

- MSN: WinMart+ begins to appear to replace VinMart+: integrates more Phano pharmacies, including Techcombank services and Phuc Long milk tea

OTHERS

131,200

1D -0.38%

5D -0.98%

Buy Vol. 962,900

Sell Vol. 1,042,400

131,200

1D -0.38%

5D -0.98%

Buy Vol. 962,900

Sell Vol. 1,042,400

99,000

1D 0.10%

5D -0.20%

Buy Vol. 3,841,500

Sell Vol. 4,180,600

130,700

1D -1.28%

5D 0.93%

Buy Vol. 2,298,500

Sell Vol. 2,723,000

99,000

1D -1.49%

5D -2.94%

Buy Vol. 1,286,900

Sell Vol. 1,445,100

37,850

1D -0.92%

5D 1.75%

Buy Vol. 6,087,600

Sell Vol. 10,127,400

40,850

1D 0.25%

5D -2.51%

Buy Vol. 19,202,700

Sell Vol. 20,060,000

57,900

1D 1.05%

5D 1.22%

Buy Vol. 35,729,000

Sell Vol. 38,099,800

- SSI: Revenue and profit before tax in the third quarter of 2021 reached VND 1,846 billion and VND 831 billion, respectively. Profit after tax of the parent company was 667 billion dong, more than doubled over the same period last year. SSI Securities currently leads the market in terms of margin lending, with outstanding balance at the end of the quarter reaching a record of VND18,100 billion. Revenue from loans and receivables reached VND 431.6 billion, up 268% compared to the third quarter of 2020

Market by numbers

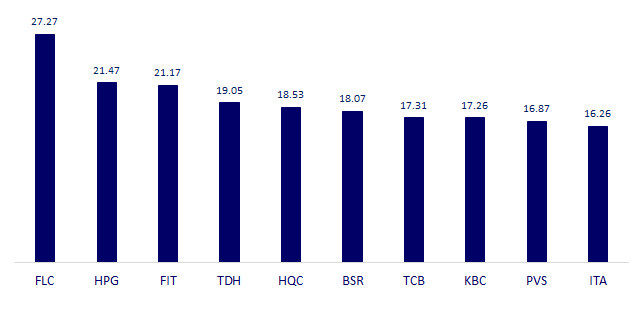

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

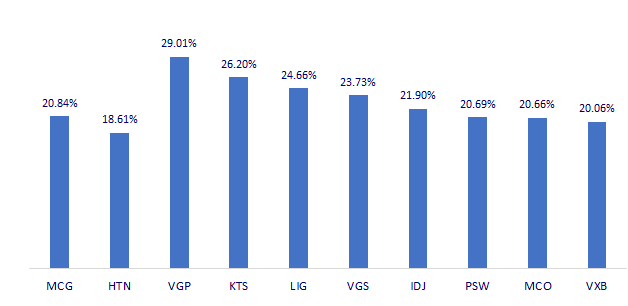

TOP INCREASES 3 CONSECUTIVE SESSIONS

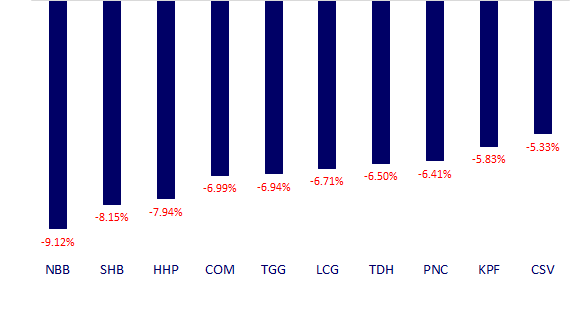

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.