Market brief 07/01/2022

VIETNAM STOCK MARKET

1,528.48

1D -0.01%

YTD 2.02%

1,532.24

1D -0.82%

YTD -0.23%

493.84

1D 1.85%

YTD 4.19%

115.60

1D 1.06%

YTD 2.59%

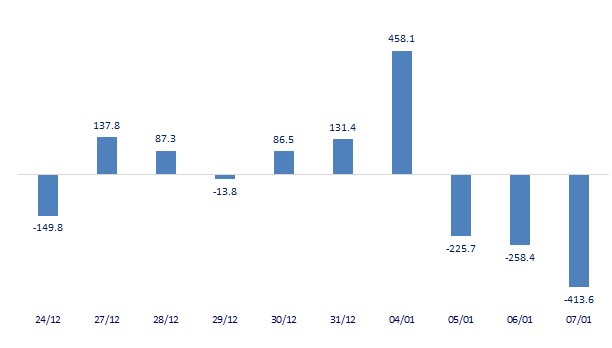

-413.61

1D 0.00%

YTD 0.00%

38,839.32

1D -7.80%

YTD 25.00%

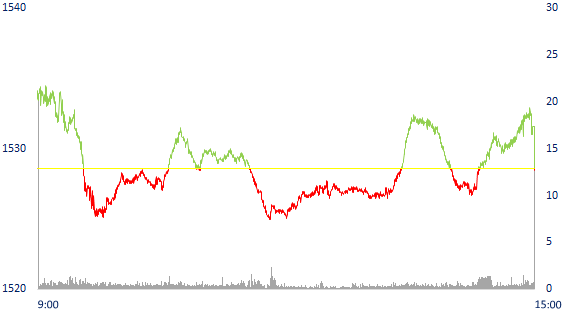

The stock market today had 167 stocks hitting the ceiling price, but the strong selling of blue-chips made VnIndex decline at the end of the day. The stock market is choosing penny stocks, midcaps and cash flows also focusing on this group.

ETF & DERIVATIVES

25,850

1D 0.12%

YTD 0.08%

18,120

1D -0.44%

YTD 0.17%

18,600

1D 4.44%

YTD -2.11%

23,100

1D -2.49%

YTD 0.87%

21,700

1D -0.82%

YTD -3.47%

28,330

1D 1.72%

YTD 1.00%

20,450

1D 0.15%

YTD -4.80%

1,537

1D -0.34%

YTD 0.00%

1,538

1D -0.36%

YTD 0.00%

1,526

1D -1.10%

YTD 0.00%

1,540

1D -0.36%

YTD 0.00%

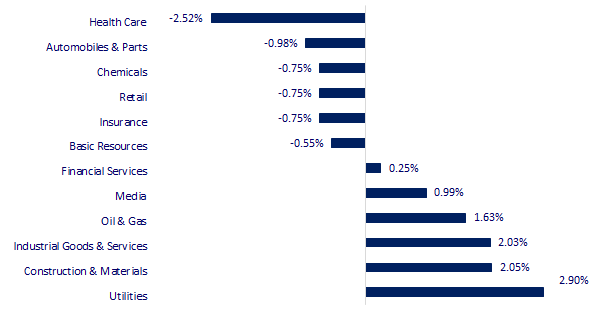

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

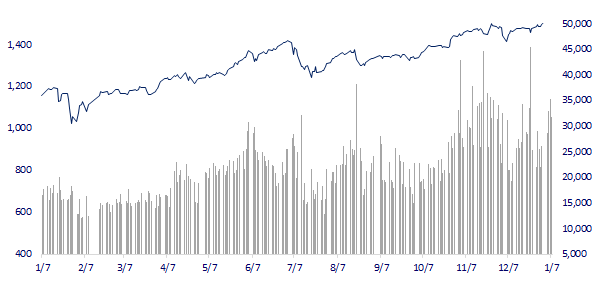

VNINDEX (12M)

GLOBAL MARKET

28,478.56

1D -0.35%

YTD -1.09%

3,579.54

1D -0.18%

YTD -1.66%

2,954.89

1D 1.18%

YTD -0.76%

23,493.38

1D 1.28%

YTD 0.41%

3,205.26

1D 0.66%

YTD 2.61%

1,657.62

1D 0.28%

YTD 0.00%

80.34

1D 0.49%

YTD 5.02%

1,791.95

1D 0.04%

YTD -1.58%

Asian stocks mixed after being sold strongly. In Japan, the Nikkei 225 fell 0.35% after falling nearly 3% in the session on January 6. The Chinese market fell with the Shanghai Composite down 0.18% and the Shenzhen Component down 0.595%. Hong Kong's Hang Seng rose 1.28%. South Korea's Kospi index rose 1.18%.

VIETNAM ECONOMY

1.26%

1D (bps) -21

YTD (bps) 45

5.60%

1.19%

1D (bps) -1

YTD (bps) 18

1.91%

1D (bps) 1

YTD (bps) -9

22,837

1D (%) -0.21%

YTD (%) -0.45%

26,322

1D (%) -0.05%

YTD (%) -0.55%

3,630

1D (%) -0.08%

YTD (%) -0.77%

In 2021, Binh Duong ranked 4th in the country in terms of attracting FDI. As of November, this locality has had 64 new FDI projects, 24 capital adjustment projects and 161 investment projects in the form of capital contribution or share purchase with a total registered investment capital of more than 2 billion USD. Up to now, this province has 4,011 FDI projects from 65 countries and territories with a total registered capital of 37 billion USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Attracting FDI in the Southern key economic region: Strong increase

- The World Bank grants a credit of USD 126.9 million to Vinh Long city to improve adaptation to climate change

- Fed officials discuss reducing bond holdings

- The Fed is expected to start raising interest rates in March of this year

- Japan's December inflation is forecast to be near a record high

- Global food prices hit 10-year high in 2021

VN30

BANK

79,800

1D 0.88%

5D 1.27%

Buy Vol. 1,690,200

Sell Vol. 1,982,800

39,200

1D 3.16%

5D 5.66%

Buy Vol. 7,313,600

Sell Vol. 6,890,300

33,200

1D -2.35%

5D -2.06%

Buy Vol. 19,685,100

Sell Vol. 19,526,800

49,450

1D -0.90%

5D -1.10%

Buy Vol. 11,593,600

Sell Vol. 12,617,000

34,600

1D -1.56%

5D -3.35%

Buy Vol. 17,893,100

Sell Vol. 16,935,800

28,600

1D 0.88%

5D -1.04%

Buy Vol. 16,884,600

Sell Vol. 16,690,900

30,300

1D -0.66%

5D -1.78%

Buy Vol. 6,435,200

Sell Vol. 7,167,800

41,000

1D -2.38%

5D -0.12%

Buy Vol. 6,114,700

Sell Vol. 8,385,300

31,950

1D -2.29%

5D 1.43%

Buy Vol. 45,958,900

Sell Vol. 43,161,300

33,300

1D -1.33%

5D -3.48%

Buy Vol. 4,953,200

Sell Vol. 8,245,100

CTG: Entering 2022, VietinBank sets a number of key business goals to submit to the authorities for approval. Specifically, individual and consolidated profit before tax continued to improve strongly, increasing by 10% - 20%. Total assets are expected to grow by 5% - 10%; mobilized capital increased by 10% - 12%; Credit increased about 10% - 14% with bad debt ratio below 2%.

REAL ESTATE

86,400

1D -2.04%

5D -5.05%

Buy Vol. 4,615,700

Sell Vol. 5,265,800

56,600

1D -0.35%

5D 10.98%

Buy Vol. 3,048,400

Sell Vol. 3,396,700

93,000

1D -0.85%

5D -2.31%

Buy Vol. 4,428,700

Sell Vol. 4,808,500

Bac Giang province has just approved planning a residential area in Ninh Son, in addition, the province also agreed to adjust the size of the residential area in An Chau town from 25ha to 50ha

OIL & GAS

107,500

1D 3.66%

5D 11.75%

Buy Vol. 2,615,400

Sell Vol. 2,775,700

20,150

1D 4.68%

5D 15.14%

Buy Vol. 55,726,300

Sell Vol. 70,964,700

56,300

1D 1.44%

5D 4.45%

Buy Vol. 2,636,400

Sell Vol. 2,945,000

POW: Before Dakrinh officially signed a loan of 95 million USD, PV Power took nearly 1 year to do business rating and was rated BB+ by Fitch.

VINGROUP

102,200

1D -2.20%

5D 7.47%

Buy Vol. 5,606,900

Sell Vol. 6,174,300

85,400

1D 0.12%

5D 4.15%

Buy Vol. 12,326,700

Sell Vol. 16,866,000

34,750

1D -2.39%

5D 15.45%

Buy Vol. 24,184,000

Sell Vol. 32,404,100

VIC: will issue about 8.72 million shares to KEB Hana Bank as a trustee of Hanwha Vietnam Opportunity Private Fund 1 to convert preferred shares.

FOOD & BEVERAGE

85,200

1D -0.23%

5D -1.39%

Buy Vol. 4,476,100

Sell Vol. 4,235,100

154,000

1D 0.13%

5D -9.94%

Buy Vol. 2,008,000

Sell Vol. 1,969,600

153,200

1D -0.90%

5D 2.77%

Buy Vol. 245,200

Sell Vol. 230,100

MSN: Through the adjustment of the maximum foreign ownership ratio in the Company, changing from 100% to 49% of the Company's charter capital.

OTHERS

123,800

1D 0.00%

5D -3.51%

Buy Vol. 745,600

Sell Vol. 1,037,900

123,800

1D 0.00%

5D -3.51%

Buy Vol. 745,600

Sell Vol. 1,037,900

93,400

1D -0.11%

5D 0.43%

Buy Vol. 1,863,800

Sell Vol. 1,911,600

135,500

1D -1.45%

5D -0.29%

Buy Vol. 1,307,400

Sell Vol. 1,731,800

93,900

1D -0.74%

5D -2.39%

Buy Vol. 726,900

Sell Vol. 547,600

38,500

1D -0.26%

5D 4.19%

Buy Vol. 4,630,000

Sell Vol. 7,911,900

51,600

1D -0.58%

5D -0.39%

Buy Vol. 22,861,900

Sell Vol. 24,696,600

45,800

1D -0.65%

5D -1.29%

Buy Vol. 26,786,100

Sell Vol. 24,953,900

HPG: Last year, Hoa Phat Group bought 3 large ships, of which two with a tonnage of 90,000 tons and one with a tonnage of 80,000 tons. According to calculations, the fleet can transport cargo volume of over 2 million tons per year. According to the plan, 3 ships to be purchased in 2021, Hoa Phat mainly serve to transport coal and iron ore from Australia, to meet the group's steel production complexes. From time to time, Hoa Phat will adjust the exploitation plan flexibly.

Market by numbers

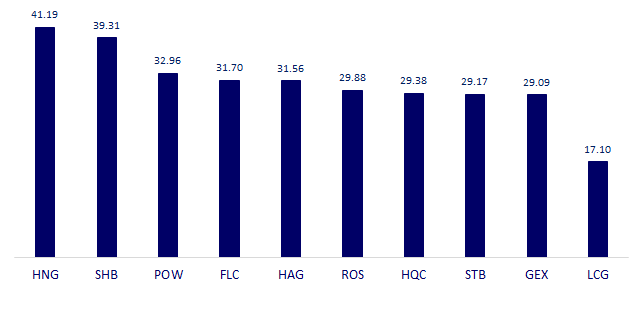

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

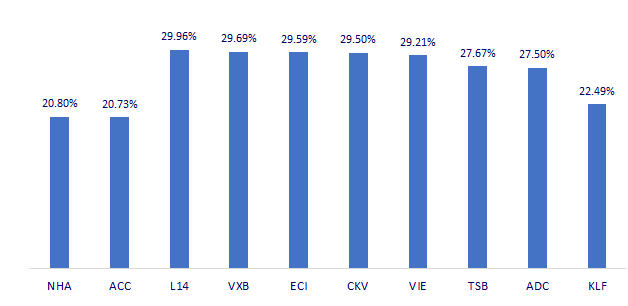

TOP INCREASES 3 CONSECUTIVE SESSIONS

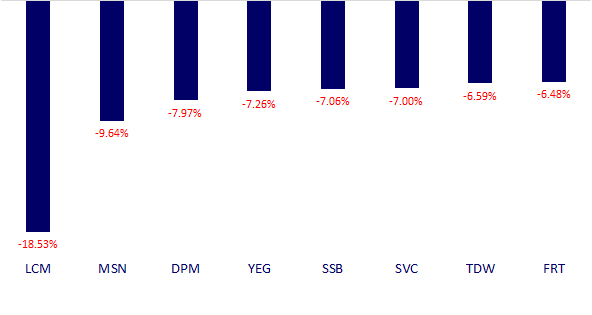

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.