Morning brief 21/02/2022

GLOBAL MARKET

34,079.18

1D -0.68%

YTD -6.37%

4,348.87

1D -0.72%

YTD -9.00%

13,548.07

1D -1.23%

YTD -13.93%

27.75

1D -1.28%

7,513.62

1D -0.32%

YTD 1.49%

15,042.51

1D -1.47%

YTD -5.30%

6,929.63

1D -0.25%

YTD -3.40%

89.75

1D -1.67%

YTD 17.32%

1,897.90

1D 0.14%

YTD 4.23%

US stocks continued to decline on Friday (February 18) and recorded 2 consecutive weeks of decline, when the Russia-Ukraine conflict made investors worried. Ending Friday's session, the Dow Jones Industrial Average fell 232.85 points (or 0.68%) to 34,079.18 points. The S&P 500 fell 0.72% to 4,348.87. The Nasdaq Composite Index lost 1.23% to 13,548.07 points.

VIETNAM ECONOMY

2.90%

YTD (bps) 209

5.60%

1.27%

1D (bps) -7

YTD (bps) 26

2.18%

1D (bps) 6

YTD (bps) 18

22,965

1D (%) 0.17%

YTD (%) 0.11%

26,632

1D (%) 0.03%

YTD (%) 0.62%

3,679

1D (%) 0.33%

YTD (%) 0.57%

The short-term source balance of the banking system has stabilized again, when the delay in money going to the market and returning to the system after Tet is gradually shortened. By the last trading session of this week, February 18, VND interest rates on the interbank market had dropped sharply compared to before and after Tet holiday. The overnight interest rate until the morning of February 18 was only trading at 2.56%/year, sharply lower than the previous level of over 3%/year.

VIETNAM STOCK MARKET

1,504.84

1D -0.21%

YTD 0.44%

1,531.47

1D -0.59%

YTD -0.28%

435.61

1D 1.25%

YTD -8.10%

112.72

1D 0.27%

YTD 0.04%

53.16

25,951.97

1D 14.00%

YTD -16.48%

In the past week, individual investors suddenly became the only net sellers on HOSE with a scale of more than 2,100b dong. Individual cash flow strongly withdrew from large-cap groups such as banks and real estate such as STB, VHM, TCB. In contrast to individuals, these stocks was bought by foreign investors, proprietary traders and domestic organizations.

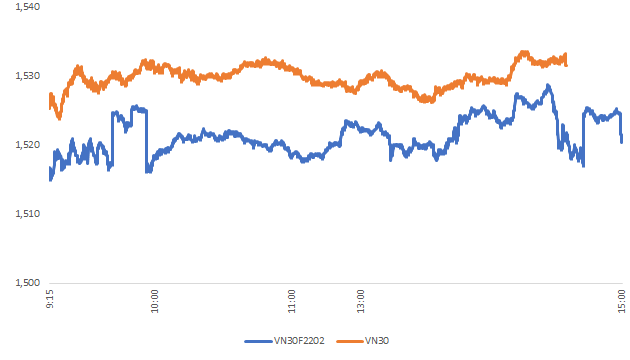

INTRADAY

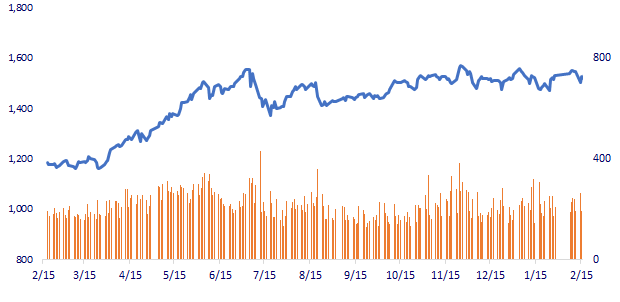

VN30 (12M)

SELECTED NEWS

- The Prime Minister asked to minimize new bad debts

- Vietnam attaches importance to energy cooperation with EU enterprises

- Interbank interest rates have cooled down

- The Fed does not need to implement a plan to raise interest rates too drastically early

- JP Morgan forecasts the Fed will have 9 consecutive rate hikes

- Singapore to increase 1% tax on goods and services from 2023

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.