Market brief 27/04/2022

VIETNAM STOCK MARKET

1,353.77

1D 0.93%

YTD -9.65%

1,402.03

1D 0.37%

YTD -8.70%

357.09

1D 3.45%

YTD -24.66%

101.37

1D 0.22%

YTD -10.04%

-249.68

1D 0.00%

YTD 0.00%

17,346.32

1D -28.80%

YTD -44.17%

The minus point in today's session is that the liquidity is very low, the trading value of all 3 exchanges is nearly 17,000 billion dong. Foreign investors, after the recent series of net buying sessions, turned to be net sellers of 249 billion dong in the whole market, the selling force focused on VND, DXG, DIG, VIC, KBC...

ETF & DERIVATIVES

24,000

1D 1.91%

YTD -7.08%

16,540

1D 0.92%

YTD -8.57%

17,850

1D 0.22%

YTD -6.05%

20,500

1D -0.53%

YTD -10.48%

20,000

1D 0.00%

YTD -11.03%

28,400

1D 0.07%

YTD 1.25%

18,610

1D -2.82%

YTD -13.36%

1,400

1D 0.79%

YTD 0.00%

1,401

1D 0.86%

YTD 0.00%

1,401

1D 0.57%

YTD 0.00%

1,401

1D 0.72%

YTD 0.00%

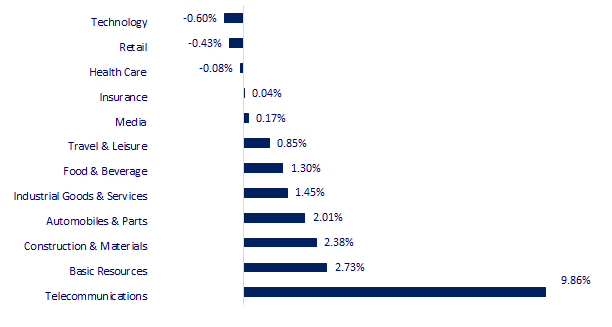

CHANGE IN PRICE BY SECTOR

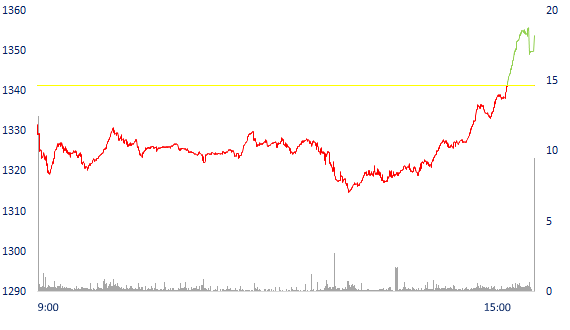

INTRADAY VNINDEX

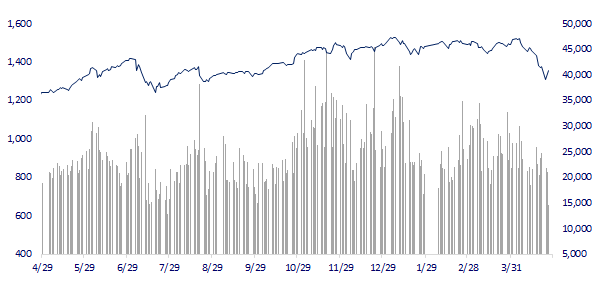

VNINDEX (12M)

GLOBAL MARKET

26,386.63

1D 0.59%

YTD -8.35%

2,958.28

1D 2.49%

YTD -18.72%

2,639.06

1D -1.10%

YTD -11.37%

19,946.36

1D 0.49%

YTD -14.75%

3,320.67

1D -0.04%

YTD 6.31%

1,661.89

1D -0.42%

YTD 0.26%

102.03

1D -0.60%

YTD 33.37%

1,897.60

1D -0.33%

YTD 4.22%

Asian markets reacted differently after the "red fire" session in the US. Japan's Nikkei 225 index gained 0.59% while South Korea's Kospi index fell 1.1%. China's Hang Seng and Shanghai rose 0.49% and 2.49%, respectively.

VIETNAM ECONOMY

1.43%

1D (bps) 14

YTD (bps) 62

5.60%

2.36%

1D (bps) -6

YTD (bps) 135

2.94%

1D (bps) -4

YTD (bps) 94

23,180

1D (%) -0.06%

YTD (%) 1.05%

24,824

1D (%) -0.61%

YTD (%) -6.21%

3,575

1D (%) -0.11%

YTD (%) -2.27%

According to VASEP, the average price of seafood exports to other markets increased, which can be seen as the main factor helping this industry's export turnover in the first three months of the year to be the highest among the first quarters of the years. In which, the price of pangasius to markets increased by 40-70%, other products also increased compared to the same period in 2021.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Pangasius export price to the US in the first quarter increased by nearly 70%

- VND tends to appreciate in 2021

- Proposing to increase export tax to reduce domestic fertilizer prices

- The global supply chain crisis flared up again

- China is trying to prevent a stock market downturn

- The global economy is short of breath

VN30

BANK

81,500

1D 1.24%

5D 3.95%

Buy Vol. 2,638,100

Sell Vol. 1,950,400

37,200

1D 0.81%

5D -1.98%

Buy Vol. 1,521,000

Sell Vol. 1,421,700

28,300

1D 2.35%

5D -1.39%

Buy Vol. 6,802,700

Sell Vol. 5,606,600

41,600

1D 0.24%

5D -3.37%

Buy Vol. 10,723,800

Sell Vol. 8,378,800

35,950

1D -1.24%

5D 2.13%

Buy Vol. 21,606,800

Sell Vol. 26,337,800

29,700

1D 1.19%

5D 0.68%

Buy Vol. 17,831,300

Sell Vol. 11,838,300

25,000

1D 2.04%

5D -2.91%

Buy Vol. 4,821,500

Sell Vol. 4,273,500

34,800

1D -0.43%

5D -1.97%

Buy Vol. 3,731,500

Sell Vol. 3,488,600

28,200

1D 2.92%

5D 2.36%

Buy Vol. 16,984,000

Sell Vol. 13,949,100

30,900

1D 0.00%

5D -3.13%

Buy Vol. 5,045,300

Sell Vol. 3,908,700

HDB: In 2022, HDBank sets a plan that profits before and after tax will both increase 21% compared to 2021, reaching VND 9,770 billion and VND 7,816 billion, respectively. The target is that by December 31, 2022, the Bank's total assets will increase by 18% compared to the beginning of the year, reaching VND 440.439 billion; charter capital increased 27% to 25,503 billion dong. Total capital mobilization is also expected to increase by 17%, of which, customer mobilization and issuance of valuable papers increase by 23%.

REAL ESTATE

81,300

1D 0.37%

5D -0.12%

Buy Vol. 3,701,600

Sell Vol. 3,637,600

47,000

1D 0.11%

5D -5.81%

Buy Vol. 1,605,300

Sell Vol. 1,408,500

62,000

1D -1.12%

5D -2.36%

Buy Vol. 2,774,900

Sell Vol. 3,165,300

KDH: Hung Thinh VinaWealth Stock Investment Fund bought 150,000 shares of KDH, helping to increase its ownership to 421,018 shares (0.066%).

OIL & GAS

111,000

1D 1.83%

5D 4.13%

Buy Vol. 1,413,000

Sell Vol. 1,628,400

12,950

1D -0.38%

5D -0.77%

Buy Vol. 16,256,100

Sell Vol. 17,086,500

48,300

1D 1.05%

5D -5.85%

Buy Vol. 1,275,000

Sell Vol. 1,512,800

Japan will auction 4.8 million barrels of oil from its national reserves on May 10, part of an effort coordinated by the International Energy Agency (IEA) to cool oil prices.

VINGROUP

78,000

1D 0.00%

5D -1.64%

Buy Vol. 4,849,500

Sell Vol. 5,025,700

65,000

1D 0.00%

5D -2.69%

Buy Vol. 7,906,900

Sell Vol. 7,625,800

30,500

1D -1.77%

5D -0.49%

Buy Vol. 6,653,500

Sell Vol. 6,395,700

VIC: Vinfast has just announced that it will join Israel in its journey to conquer the international market. In Israel, Vinfast will not do business directly but cooperate with B-EV Motors.

FOOD & BEVERAGE

75,000

1D -1.19%

5D -0.79%

Buy Vol. 3,081,700

Sell Vol. 3,781,600

119,000

1D 2.59%

5D -4.26%

Buy Vol. 2,071,400

Sell Vol. 2,478,800

169,000

1D 0.00%

5D -1.74%

Buy Vol. 360,900

Sell Vol. 709,000

SAB: Q1/2022, net revenue reached more than VND7,306b, up 25% QoQ. In which, beer sales reached nearly VND6,414b, up 24% and raw material sales reached nearly VND854b, up 37%.

OTHERS

129,000

1D 0.00%

5D -9.15%

Buy Vol. 664,700

Sell Vol. 611,400

129,000

1D 0.00%

5D -9.15%

Buy Vol. 664,700

Sell Vol. 611,400

103,000

1D -1.25%

5D -8.04%

Buy Vol. 4,728,300

Sell Vol. 4,026,500

147,200

1D -1.08%

5D -5.64%

Buy Vol. 3,392,200

Sell Vol. 2,431,100

107,000

1D -0.37%

5D -10.01%

Buy Vol. 1,493,800

Sell Vol. 1,723,200

29,100

1D 2.11%

5D -10.60%

Buy Vol. 3,155,700

Sell Vol. 2,593,800

34,400

1D -0.29%

5D -2.27%

Buy Vol. 8,998,900

Sell Vol. 9,863,800

42,500

1D 3.16%

5D -1.62%

Buy Vol. 35,395,500

Sell Vol. 27,407,400

HPG: In the first quarter of 2022, amid complicated developments of the COVID-19 epidemic, the price of input materials for steel production such as coke coal, iron ore increased, HPG's factories produced 2.16 million tons. crude steel, up 8% over the same period. Sales volume of finished construction steel, billet and hot rolled coil reached 2.17 million tons, up 12% compared to the first quarter of 2021.

Market by numbers

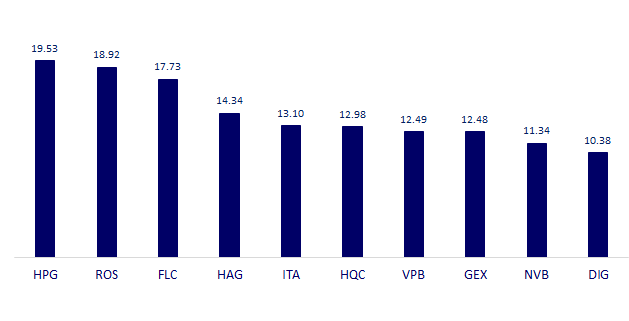

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

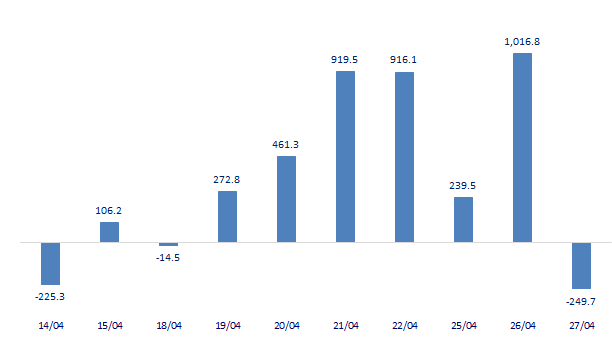

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

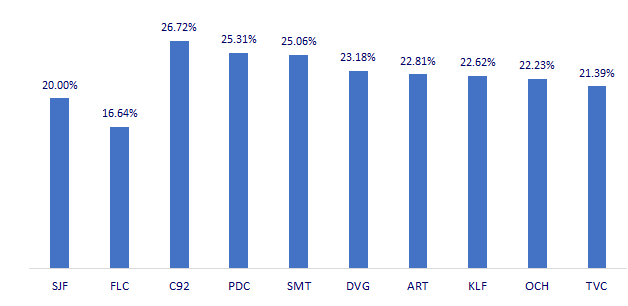

TOP INCREASES 3 CONSECUTIVE SESSIONS

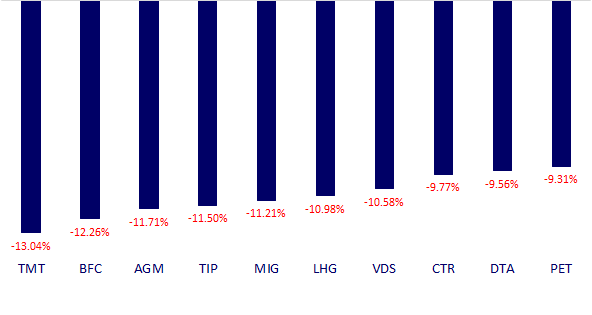

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.