Market brief 06/06/2022

VIETNAM STOCK MARKET

1,290.01

1D 0.16%

YTD -13.90%

1,327.04

1D -0.03%

YTD -13.59%

306.81

1D -1.18%

YTD -35.27%

93.90

1D -0.29%

YTD -16.67%

13.28

1D 0.00%

YTD 0.00%

20,666.27

1D 27.74%

YTD -33.49%

Foreign investors were net buyers again in the session 6/6, focusing on collecting fertilizer stocks. DPM was the strongest net bought by foreign investors on HoSE with 202 billion dong. DCM was also net bought 112 billion dong. After that, CCQ ETF FUEVFVND was also net bought 92 billion dong. On the other side, HPG was sold the most with 101 billion dong. STB and GMD were net sold 84 billion dong and 81 billion dong.

ETF & DERIVATIVES

22,350

1D 1.13%

YTD -13.47%

15,600

1D -0.32%

YTD -13.76%

16,360

1D -8.14%

YTD -13.89%

19,000

1D -2.16%

YTD -17.03%

17,090

1D -1.78%

YTD -23.98%

28,800

1D -0.35%

YTD 2.67%

16,800

1D -1.47%

YTD -21.79%

1,313

1D 0.02%

YTD 0.00%

1,314

1D -0.14%

YTD 0.00%

1,315

1D -0.14%

YTD 0.00%

1,315

1D -0.27%

YTD 0.00%

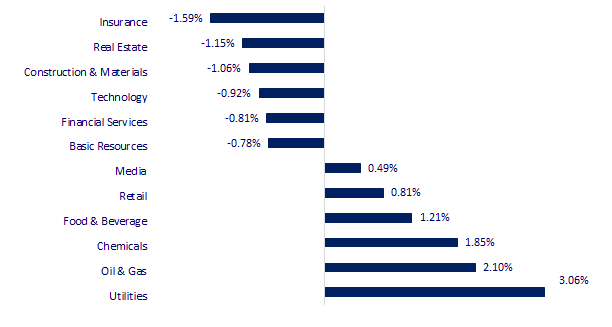

CHANGE IN PRICE BY SECTOR

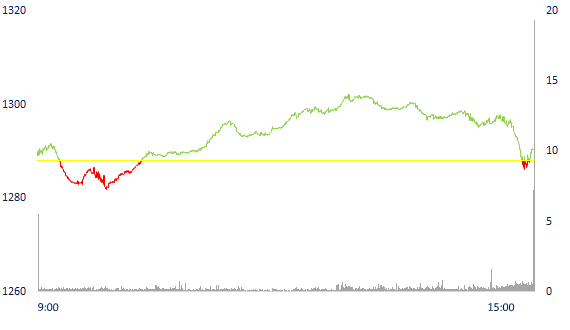

INTRADAY VNINDEX

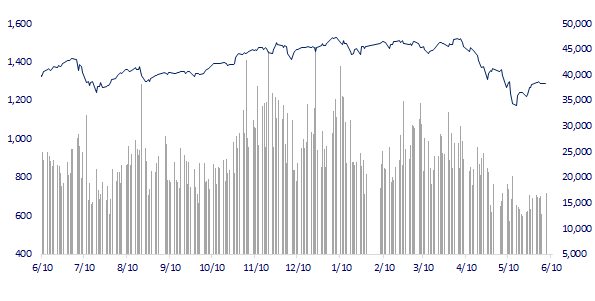

VNINDEX (12M)

GLOBAL MARKET

27,915.89

1D 0.39%

YTD -3.04%

3,236.37

1D 1.28%

YTD -11.08%

2,670.65

1D 0.00%

YTD -10.31%

21,653.90

1D 2.26%

YTD -7.45%

3,226.63

1D -0.17%

YTD 3.30%

1,646.08

1D -0.10%

YTD -0.70%

118.86

1D -0.68%

YTD 55.37%

1,856.65

1D 0.04%

YTD 1.97%

Asian stocks mostly rose in the session 6/6. The results of a private survey showed that service sector activity in China continued to decline in May. In China, the Shanghai Composite index increased 1.28%. Hong Kong's Hang Seng Index rose 2.26%. In Japan, the Nikkei 225 index rose 0.39%. Korean stocks closed for a holiday.

VIETNAM ECONOMY

0.40%

1D (bps) -5

YTD (bps) -41

5.60%

2.52%

1D (bps) 2

YTD (bps) 151

3.08%

1D (bps) 1

YTD (bps) 108

23,405

1D (%) 0.32%

YTD (%) 2.03%

25,308

1D (%) -1.02%

YTD (%) -4.38%

3,561

1D (%) 0.14%

YTD (%) -2.65%

Governor of the State Bank Nguyen Thi Hong said that real estate investment and business is a risky field for banking activities. One of the solutions is to strengthen inspection, focusing on credit records in the real estate sector of credit institutions.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Governor: Real estate bad debt VND 37,000 billion, checking credit records

- Submitting to the National Assembly 2 super projects of ring road worth 161,191 billion VND

- International visitors through airports increased by more than 900%

- The US considers partially removing tariffs on Chinese goods

- China strives to regain growth

- Russia says the West has exhausted its sanctions

VN30

BANK

79,700

1D 2.84%

5D 2.18%

Buy Vol. 1,483,600

Sell Vol. 1,700,300

34,200

1D -0.44%

5D -4.34%

Buy Vol. 1,772,200

Sell Vol. 1,665,500

27,200

1D -0.73%

5D -0.37%

Buy Vol. 7,494,700

Sell Vol. 7,130,800

36,050

1D -1.10%

5D -4.50%

Buy Vol. 5,697,600

Sell Vol. 6,866,700

30,600

1D -0.49%

5D -3.16%

Buy Vol. 15,056,500

Sell Vol. 14,052,100

27,250

1D -0.55%

5D -3.02%

Buy Vol. 12,028,900

Sell Vol. 12,530,200

25,300

1D -0.39%

5D -2.13%

Buy Vol. 2,695,300

Sell Vol. 2,933,400

30,700

1D -3.61%

5D -6.97%

Buy Vol. 3,798,000

Sell Vol. 4,916,200

20,500

1D -3.07%

5D -10.09%

Buy Vol. 26,394,300

Sell Vol. 25,440,900

25,300

1D 0.00%

5D -1.02%

Buy Vol. 2,379,800

Sell Vol. 4,115,600

According to statistics Q1/2022 financial statements of the inspected banks, 5/8 banks have an increase in the value of bonds held by economic organizations in Q1. The top 3 banks subject to inspection are currently holding the largest amount of corporate bonds at the end of Q1 were Techcombank, TPBank and SHB. As of March 31, Techcombank is holding VND 76,782 billion of debt securities of economic organizations, up 22.2% compared to the end of 2021 and leading among the inspected banks. Following, TPBank owns VND 27,633 billion, up 48.4%. 3rd place is SHB with 16,408 billion dong, up 169%.

REAL ESTATE

76,300

1D -1.55%

5D -3.05%

Buy Vol. 4,126,400

Sell Vol. 3,957,100

40,650

1D -0.37%

5D -4.13%

Buy Vol. 864,400

Sell Vol. 1,114,900

53,700

1D 0.00%

5D -2.89%

Buy Vol. 2,528,900

Sell Vol. 2,774,800

KDH: KDH plans to launch Classia project (176 low-rise units) in 2021 but the outbreak of the disease has limited construction activities and caused delays in the launch of this project.

OIL & GAS

129,900

1D 4.59%

5D 18.09%

Buy Vol. 4,696,200

Sell Vol. 3,741,500

13,800

1D 2.22%

5D 2.60%

Buy Vol. 55,939,500

Sell Vol. 56,907,300

44,900

1D 3.22%

5D 3.46%

Buy Vol. 2,497,900

Sell Vol. 2,844,400

VN-Index's gaining momentum was still maintained in the past week thanks to GAS when this stock helped pull it up by nearly 7.3 points, the liquidity reached more than 1.7m shares/session

VINGROUP

78,500

1D -0.38%

5D 0.00%

Buy Vol. 2,113,800

Sell Vol. 3,155,500

69,300

1D -0.14%

5D 1.17%

Buy Vol. 4,591,200

Sell Vol. 6,461,100

29,950

1D 0.00%

5D 0.00%

Buy Vol. 1,872,300

Sell Vol. 3,443,200

VIC: The Board of Directors approved the issuance of the second round of international bonds in 2022 in June 2022 and signed the bond documents of the second round of bonds.

FOOD & BEVERAGE

70,800

1D 0.71%

5D -2.34%

Buy Vol. 2,787,400

Sell Vol. 2,662,700

117,000

1D 3.72%

5D 6.36%

Buy Vol. 2,660,600

Sell Vol. 2,497,600

158,500

1D 2.13%

5D 3.32%

Buy Vol. 475,200

Sell Vol. 392,700

VNM: CEO Mai Kieu Lien said that by 2025, the total domestic revenue of Vietnam's dairy industry is estimated at VND136,000b, of which Vinamilk strives to reach VND86,000b(~ 63%).

OTHERS

127,600

1D 0.47%

5D -3.70%

Buy Vol. 952,200

Sell Vol. 831,100

127,600

1D 0.47%

5D -3.70%

Buy Vol. 952,200

Sell Vol. 831,100

113,000

1D -0.88%

5D 1.53%

Buy Vol. 3,636,200

Sell Vol. 6,428,700

154,700

1D 1.64%

5D 7.24%

Buy Vol. 2,767,800

Sell Vol. 3,430,200

125,000

1D 1.46%

5D 3.73%

Buy Vol. 2,528,000

Sell Vol. 3,066,000

25,150

1D 0.60%

5D -1.18%

Buy Vol. 3,045,100

Sell Vol. 3,089,400

29,000

1D -0.85%

5D -3.01%

Buy Vol. 20,366,400

Sell Vol. 29,238,300

33,300

1D -0.30%

5D -6.06%

Buy Vol. 26,730,500

Sell Vol. 31,808,000

HPG: HPG has approved the business plan for 2022 with an expected consolidated revenue of VND160,000b, an increase of nearly 7% in 2021. However, the target profit after tax is only about VND25,000-30,000b, down 13-28% compared to 2021. Management said that this year, revenue is expected to increase slightly compared to the previous year, thanks to the output of Hoa Phat Dung Quat Iron and Steel Complex, container products and revenue from the segment. household electrical appliances

Market by numbers

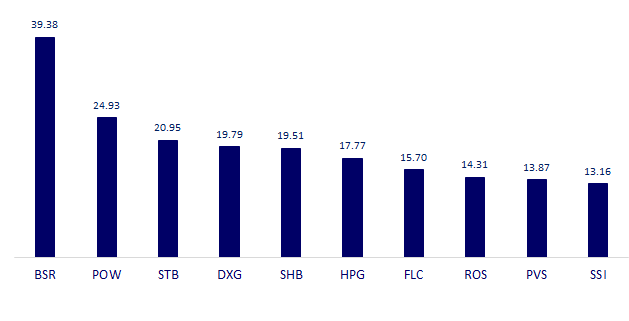

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

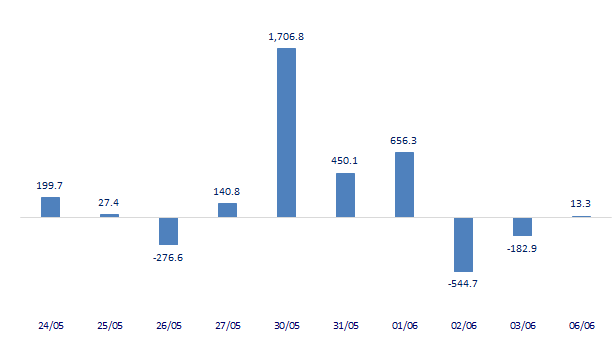

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

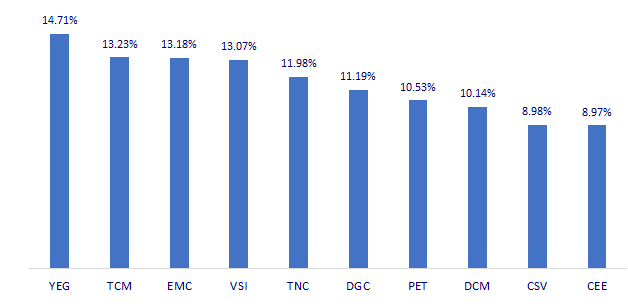

TOP INCREASES 3 CONSECUTIVE SESSIONS

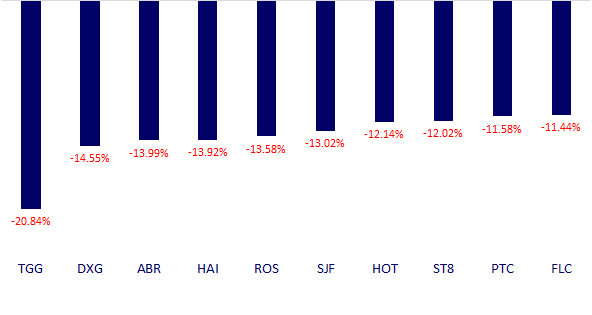

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.