Morning brief 13/07/2022

GLOBAL MARKET

30,981.33

1D -0.62%

YTD -14.88%

3,818.80

1D -0.92%

YTD -20.09%

11,264.73

1D -0.95%

YTD -28.44%

27.29

1D 4.28%

7,209.86

1D 0.18%

YTD -2.61%

12,905.48

1D 0.57%

YTD -18.76%

6,044.20

1D 0.80%

YTD -15.74%

95.34

1D -7.23%

YTD 24.63%

1,725.30

1D -0.34%

YTD -5.24%

US stocks continued to decline on Tuesday (July 12), as concerns about global economic growth reduced the attractiveness of risky assets to investors and Wall Street prepared to take the plunge June inflation data. At the close, the Dow Jones Industrial Average fell 192.51 points, or 0.62%, to 30,981.33, the S&P 500 lost 0.92% to 3,818.80 and the Nasdaq Composite dropped 0.95% to 11,264.73 the point.

VIETNAM ECONOMY

0.72%

1D (bps) 4

YTD (bps) -9

5.60%

2.69%

1D (bps) 1

YTD (bps) 168

3.30%

1D (bps) -2

YTD (bps) 130

23,535

1D (%) 0.19%

YTD (%) 2.59%

24,201

1D (%) 0.38%

YTD (%) -8.57%

3,549

1D (%) 0.08%

YTD (%) -2.98%

According to Deputy Governor Dao Minh Tu, the SBV will hold a conference to review the banking industry's activities at the end of this week. At the conference, the SBV will thoroughly understand the problem of credit growth of commercial banks. Information about the "room" of credit is being interested and expected by the market when many banks have hit the growth ceiling right from the end of the first quarter and the beginning of the second quarter.

VIETNAM STOCK MARKET

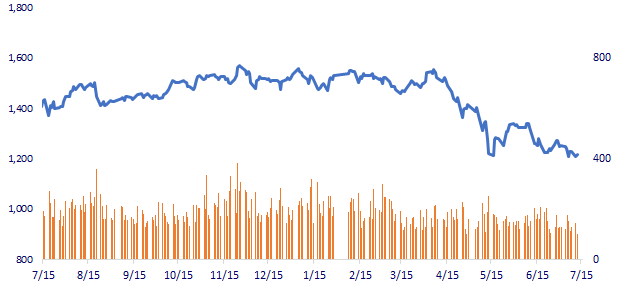

1,174.82

1D 1.69%

YTD -21.59%

1,219.44

1D 0.86%

YTD -20.59%

281.99

1D 1.83%

YTD -40.51%

86.78

1D 0.61%

YTD -22.99%

-316.08

12,581.92

1D -3.92%

YTD -59.51%

Foreign investors net sold 316 billion dong in the session 12/7. Foreign investors on HoSE were the strongest net sellers of VHM with 87 billion dong. VCB, CTG and VND were all net sold over 40 billion dong. Meanwhile, STB was the strongest net buyer with a value of more than 25 billion dong. VNM and KBC were net bought at 22.2 billion dong and 21.8 billion dong, respectively.

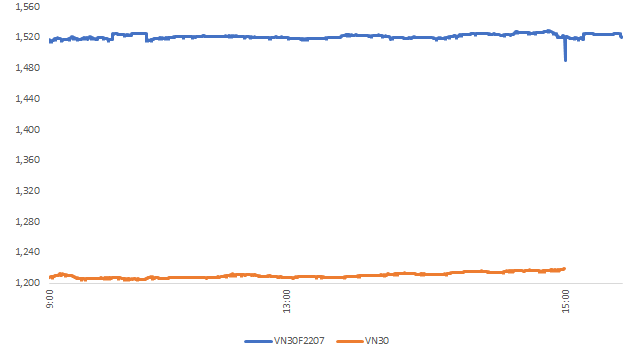

INTRADAY

VN30 (12M)

SELECTED NEWS

- The Government issues a separate resolution on capital market development

- The issue of "room" of credit will be thoroughly understood by the SBV this week

- Vietnam ranks 2nd in Asia in terms of not having a bank account

- EU continues to disburse $1 billion in aid to Ukraine

- Asia is unstable because of the energy crisis

- White House: June inflation may be high, but 'not up to date'

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.