Market brief 21/07/2022

VIETNAM STOCK MARKET

1,198.47

1D 0.36%

YTD -20.01%

1,235.25

1D 0.79%

YTD -19.56%

288.09

1D -0.27%

YTD -39.22%

89.12

1D 0.27%

YTD -20.91%

389.47

1D 0.00%

YTD 0.00%

14,147.33

1D -19.76%

YTD -54.47%

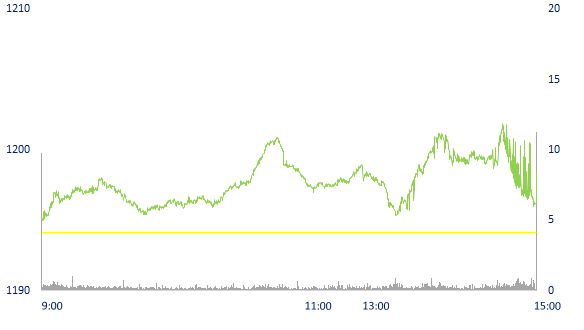

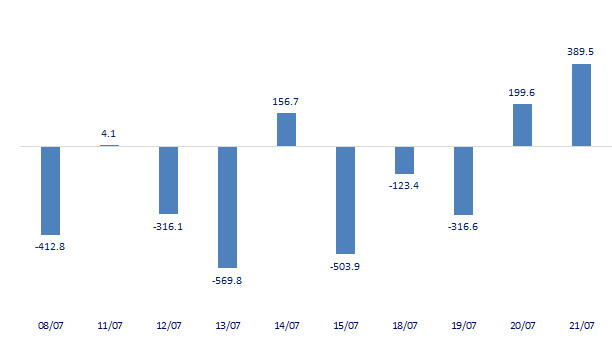

Buyers and sellers struggled strongly in the derivative maturity session, VN-Index gained slightly. Market liquidity decreased compared to yesterday. The total matched value reached 12,975 billion dong, down 15.7%, of which, the matched value on HoSE alone decreased by 14.2% and was at 11,107 billion dong. Foreign investors boosted their net buying of about 389 billion dong.

ETF & DERIVATIVES

20,790

1D 0.43%

YTD -19.51%

14,520

1D 0.48%

YTD -19.73%

15,300

1D -14.09%

YTD -19.47%

17,300

1D 0.52%

YTD -24.45%

16,680

1D 0.79%

YTD -25.80%

26,240

1D 1.31%

YTD -6.45%

15,930

1D -0.13%

YTD -25.84%

1,224

1D 0.11%

YTD 0.00%

1,224

1D -0.22%

YTD 0.00%

1,226

1D 0.24%

YTD 0.00%

1,234

1D 0.65%

YTD 0.00%

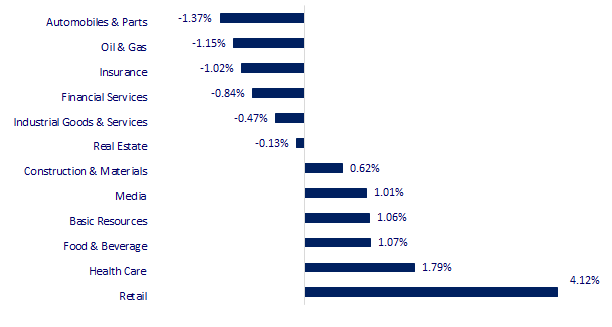

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

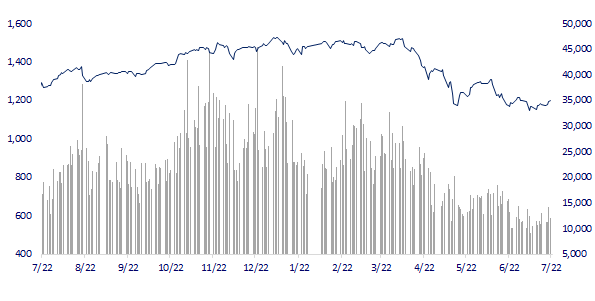

VNINDEX (12M)

GLOBAL MARKET

27,803.00

1D 0.71%

YTD -3.43%

3,272.00

1D -0.99%

YTD -10.10%

2,409.16

1D 0.93%

YTD -19.09%

20,574.63

1D -0.71%

YTD -12.07%

3,152.30

1D -0.57%

YTD 0.92%

1,546.31

1D 0.45%

YTD -6.72%

94.98

1D -4.23%

YTD 24.16%

1,680.90

1D -0.51%

YTD -7.68%

Asian stocks were mixed while investors in the region awaited the decision on new interest rate policy from Japan. In South Korea, the Kospi index rose 0.93%. In Hong Kong, the Hang Seng index fell 0.71%. Chinese stocks fell. The Shanghai Composite Index fell 0.99%. The Nikkei 225 in Japan rose 0.71%.

VIETNAM ECONOMY

1.40%

1D (bps) 25

YTD (bps) 59

5.60%

2.77%

1D (bps) -2

YTD (bps) 176

3.27%

1D (bps) -6

YTD (bps) 127

23,630

1D (%) 0.30%

YTD (%) 3.01%

24,308

1D (%) -1.19%

YTD (%) -8.16%

3,530

1D (%) -0.14%

YTD (%) -3.50%

The preliminary report of the first 6 months of 2022 of the Vietnam Cotton and Yarn Association shows that Vietnam's exports of textiles, fibers, fabrics... in the first 5 months of 2022 reached 18.73 billion USD, up 20.81% over the same period in 2021. In which, textile and garment exports reached 14.99 billion USD (up 22.2%), fiber yarn 2.37 billion USD (up 10%), geotextile 376 0.8 million USD (up 27%) and raw materials 979.8 million USD (up 19.2%).

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam's fiber and yarn export ranks 6th in the world, surpassing South Korea

- It is difficult for businesses to access the 2% interest rate support package

- ADB maintains Vietnam's GDP growth forecast at 6.5% this year

- Russia says it won't export oil if the price ceiling is low

- EU agrees 7th package of sanctions against Russia

- Bank of Japan maintains super low interest rate policy, raising inflation forecast

VN30

BANK

72,500

1D 0.00%

5D 0.14%

Buy Vol. 1,631,700

Sell Vol. 2,631,100

36,500

1D 0.27%

5D 0.97%

Buy Vol. 3,352,700

Sell Vol. 3,975,500

27,500

1D 1.66%

5D 1.85%

Buy Vol. 9,108,900

Sell Vol. 9,194,900

36,850

1D 1.52%

5D 2.50%

Buy Vol. 10,558,800

Sell Vol. 8,749,500

28,200

1D 0.18%

5D 0.53%

Buy Vol. 14,231,800

Sell Vol. 15,351,600

25,600

1D 0.20%

5D 0.39%

Buy Vol. 13,284,400

Sell Vol. 12,093,900

24,050

1D 0.84%

5D 1.48%

Buy Vol. 3,278,400

Sell Vol. 4,351,300

28,300

1D -0.53%

5D 5.20%

Buy Vol. 4,303,800

Sell Vol. 4,428,200

23,100

1D 0.22%

5D -0.86%

Buy Vol. 39,862,900

Sell Vol. 34,485,700

24,650

1D 1.44%

5D 2.49%

Buy Vol. 8,283,900

Sell Vol. 8,210,200

TPB: According to TPBank's Q2 financial statements, net interest income increased by 20% QoQ at 3,034.8b dong. Profit from service activities is 680.6b dong, up 65%. Investment securities trading also recorded a profit of 460.1b dong, up nearly 65%. In addition, foreign exchange business made a profit of 179.1b dong, up 12.4%. Profit from other activities was recorded at 218b dong, 3.8 times higher than the same period. In the second quarter, the bank set aside 645.3b dong for credit risk provision, up 5.4%. Operating expenses increased 42.4% to 1,762.8b dong. Bank profit before tax is 2,164b dong, up 37%.

REAL ESTATE

74,200

1D 0.41%

5D 0.68%

Buy Vol. 2,558,000

Sell Vol. 3,114,300

36,950

1D 0.68%

5D 0.41%

Buy Vol. 1,437,800

Sell Vol. 1,432,500

52,900

1D -0.38%

5D 0.19%

Buy Vol. 1,897,500

Sell Vol. 1,996,900

PDR: recognized revenue from the transfer of a part of Nhon Hoi eco-tourism urban area project, PDR saw a net profit of nearly VND 413b in Q2/2022, up 64% QoQ.

OIL & GAS

104,100

1D 1.07%

5D 5.36%

Buy Vol. 1,489,400

Sell Vol. 1,760,200

13,350

1D -1.11%

5D 1.91%

Buy Vol. 21,486,900

Sell Vol. 26,927,000

42,350

1D -1.17%

5D 5.61%

Buy Vol. 804,100

Sell Vol. 854,300

From 3pm on July 21, the domestic price of E5 RON 92 gasoline decreased by VND 2,710/liter, and RON 95 gasoline price decreased by VND 3,600/liter. This is the 3rd decrease.

VINGROUP

68,500

1D 0.44%

5D -1.44%

Buy Vol. 1,394,900

Sell Vol. 2,564,800

58,900

1D -1.34%

5D -2.00%

Buy Vol. 3,502,500

Sell Vol. 4,759,900

26,300

1D 0.96%

5D 0.96%

Buy Vol. 3,060,800

Sell Vol. 3,618,500

VIC: In 2022, Vingroup plans to raise 1.5 billion USD from international bond issuance, so far it has completed mobilizing 625 million USD through 2 issuances.

FOOD & BEVERAGE

73,200

1D 0.27%

5D 1.10%

Buy Vol. 2,530,400

Sell Vol. 4,029,200

105,500

1D 2.43%

5D 2.93%

Buy Vol. 1,525,500

Sell Vol. 1,580,400

165,000

1D 3.25%

5D 6.52%

Buy Vol. 443,000

Sell Vol. 514,700

VNM: Vinamilk has continued to support the HCMC Sponsoring Association for Poor Patients. Ho Chi Minh City budgeted 500m VND for free heart surgery for poor children.

OTHERS

126,000

1D 0.40%

5D -0.55%

Buy Vol. 562,300

Sell Vol. 639,700

126,000

1D 0.40%

5D -0.55%

Buy Vol. 562,300

Sell Vol. 639,700

85,000

1D 0.12%

5D 2.66%

Buy Vol. 3,566,100

Sell Vol. 4,030,400

64,100

1D 4.74%

5D 2.40%

Buy Vol. 14,716,600

Sell Vol. 7,401,400

114,000

1D 0.35%

5D -1.30%

Buy Vol. 1,410,000

Sell Vol. 1,180,900

23,700

1D -0.42%

5D 2.16%

Buy Vol. 3,140,900

Sell Vol. 3,990,700

21,300

1D 0.00%

5D -0.93%

Buy Vol. 27,060,200

Sell Vol. 35,101,500

22,700

1D 1.57%

5D 2.25%

Buy Vol. 48,570,700

Sell Vol. 49,550,700

SSI: announced business results for Q2/2022 and 6M2022. Revenue and profit before tax in the second quarter reached VND 1,578.8 billion and VND 518.1 billion, respectively. Accumulated in the first 6 months of 2022, the company recorded a revenue of VND 3,585.2 billion, profit before tax reached VND 1,375.6 billion, up 10.5% and 11.7% respectively over the same period last year 2021. As of June 30, the company has total assets of 42,752.3 billion dong, of which equity is 13,910.6 billion dong.

Market by numbers

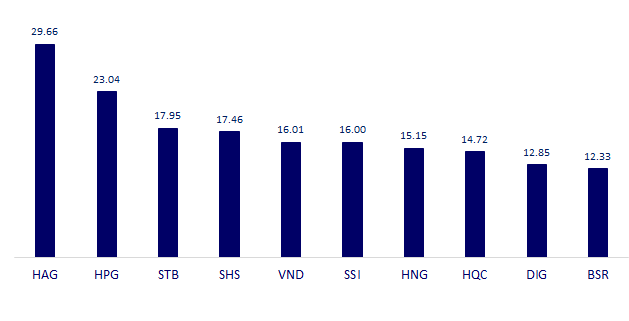

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

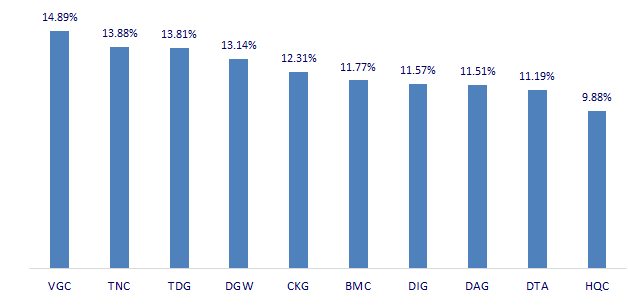

TOP INCREASES 3 CONSECUTIVE SESSIONS

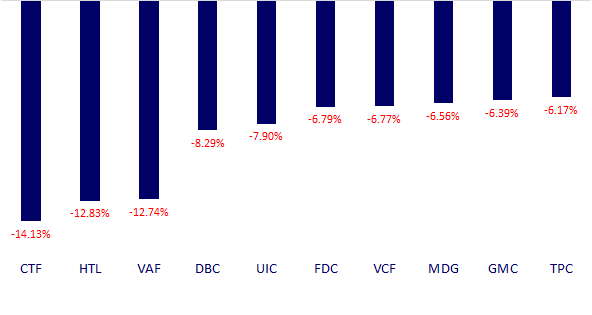

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.