Market brief 02/08/2022

VIETNAM STOCK MARKET

1,241.62

1D 0.83%

YTD -17.13%

1,265.97

1D 0.77%

YTD -17.56%

295.84

1D 0.41%

YTD -37.59%

90.13

1D 0.24%

YTD -20.01%

385.28

1D 0.00%

YTD 0.00%

20,087.12

1D 6.84%

YTD -35.35%

At the end of the session on August 2, Foreign investors were still quite active when buying 54.7 million shares, worth VND1,446 billion, while selling 40 million shares, worth VND1,073 billion. Total net buying volume was at 14.89 million shares, equivalent to a net buying value of VND374 billion . Similar to the previous session, foreign investors on HoSE were still the strongest net buyers of SSI with VND182 billion.

ETF & DERIVATIVES

21,300

1D 0.95%

YTD -17.54%

14,910

1D 0.81%

YTD -17.58%

15,420

1D -13.42%

YTD -18.84%

18,120

1D 0.72%

YTD -20.87%

17,400

1D 0.29%

YTD -22.60%

26,420

1D 0.27%

YTD -5.81%

16,300

1D 2.52%

YTD -24.12%

1,239

1D 0.03%

YTD 0.00%

1,242

1D 0.24%

YTD 0.00%

1,243

1D 0.23%

YTD 0.00%

1,246

1D 0.12%

YTD 0.00%

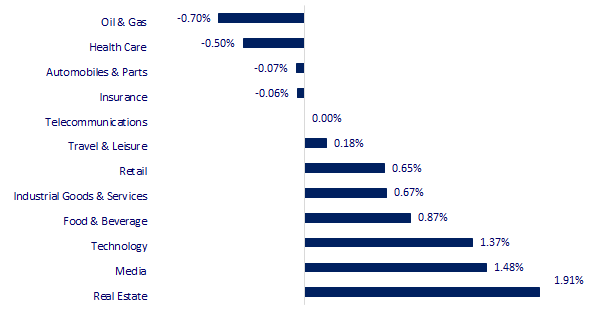

CHANGE IN PRICE BY SECTOR

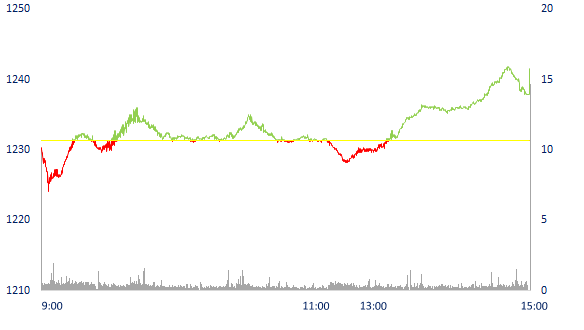

INTRADAY VNINDEX

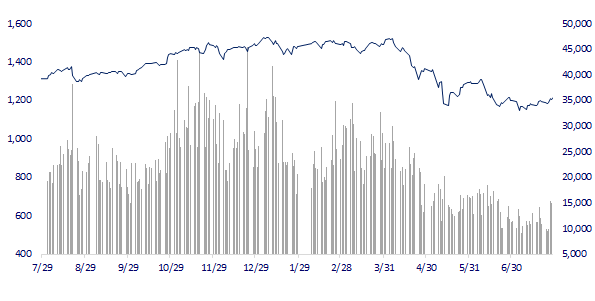

VNINDEX (12M)

GLOBAL MARKET

27,594.73

1D -0.25%

YTD -4.16%

3,186.27

1D -2.26%

YTD -12.46%

2,439.62

1D -0.52%

YTD -18.07%

19,689.21

1D -2.36%

YTD -15.85%

3,239.15

1D 0.01%

YTD 3.70%

1,589.16

1D -0.26%

YTD -4.13%

93.34

1D -0.37%

YTD 22.01%

1,790.45

1D -0.28%

YTD -1.67%

Asian stocks all fell after falling on Wall Street. Hong Kong's Hang Seng Index fell 2.36%. In China, the Shanghai Composite Index fell 2.26%. In Japan, the Nikkei 225 index fell 0.25%, the Kospi index (South Korea) dropped 0.52%. Korea's consumer price index (CPI) increased by 6.3% in July compared with the same period in 2021, the strongest increase since November 1998. Also in July, the Bank of Korea raised interest rates by 0.5%.

VIETNAM ECONOMY

4.18%

1D (bps) -1

YTD (bps) 337

5.60%

3.11%

1D (bps) -2

YTD (bps) 210

3.60%

1D (bps) -3

YTD (bps) 160

23,498

1D (%) -0.01%

YTD (%) 2.43%

24,639

1D (%) -0.34%

YTD (%) -6.91%

3,526

1D (%) 0.14%

YTD (%) -3.61%

Binh Dinh Investment Promotion Center said that the province has attracted 44 domestic investment projects with a total investment capital of 10,768.42 bil VND and implemented an increase in investment capital in 09 projects, with an increase in total capital by 5,196.44 bil VND. In which, classified by fields: 31 projects in the field of Industry; 09 projects in the field of trade, service, tourism; 03 projects in the field of real estate and 01 project for information technology.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Infrastructure leads capital flows to Ninh Thuan

- Binh Dinh attracts 44 new projects with a total capital of nearly VND 16,000 billion

- The Saigon River BOT project went bankrupt because it could not collect fees

- Australia's central bank raises interest rates for 4 months in a row

- China's real estate crisis threatens to drag down the steel industry

- Grain exports in Ukraine resumed: Undoing food supply bottlenecks

VN30

BANK

78,900

1D 2.47%

5D 6.77%

Buy Vol. 3,031,700

Sell Vol. 2,734,400

38,500

1D -1.28%

5D 8.30%

Buy Vol. 3,470,300

Sell Vol. 4,207,700

28,600

1D -0.35%

5D 7.72%

Buy Vol. 7,937,200

Sell Vol. 9,975,400

38,300

1D -0.78%

5D 4.64%

Buy Vol. 7,958,800

Sell Vol. 8,611,700

29,050

1D -0.17%

5D 4.87%

Buy Vol. 19,216,000

Sell Vol. 25,116,200

26,700

1D 0.75%

5D 6.16%

Buy Vol. 17,836,200

Sell Vol. 19,141,100

24,850

1D 0.61%

5D 5.30%

Buy Vol. 5,866,800

Sell Vol. 4,077,300

27,650

1D 1.47%

5D 2.41%

Buy Vol. 3,854,900

Sell Vol. 4,305,700

24,950

1D -0.99%

5D 8.71%

Buy Vol. 32,199,400

Sell Vol. 33,795,900

26,600

1D -0.19%

5D 3.70%

Buy Vol. 3,230,700

Sell Vol. 4,010,600

BID: BIDV has just announced its financial statements for the second quarter of 2022 with pre-tax income of VND 11,084 billion, up 37.5% over the same period last year, reaching 53.8% of the year plan. Total assets at the end of the second quarter of 2022 reached over VND 1.98 million billion, up 12.4% compared to the beginning of the year. In credit activities, customer loans reached over VND 1.48 million billion, up 9.5% compared to the beginning of the year, the growth rate was higher than that of the same period in previous years; in which, outstanding loans grew well in the segments of FDI customers (32.7%), retail customers (15.8%) and SME corporate customers (8.3%).

REAL ESTATE

24,900

1D -0.40%

5D 3.53%

Buy Vol. 6,080,000

Sell Vol. 5,657,500

75,700

1D 1.34%

5D 2.44%

Buy Vol. 3,865,400

Sell Vol. 3,547,800

38,900

1D 1.04%

5D 4.99%

Buy Vol. 1,930,500

Sell Vol. 2,022,600

OIL & GAS

53,800

1D 0.37%

5D 2.87%

Buy Vol. 2,307,400

Sell Vol. 1,933,900

108,200

1D 0.28%

5D 3.34%

Buy Vol. 1,083,100

Sell Vol. 1,018,800

13,750

1D 1.85%

5D 5.77%

Buy Vol. 40,486,900

Sell Vol. 39,248,200

VINGROUP

41,000

1D -1.91%

5D 0.37%

Buy Vol. 2,141,900

Sell Vol. 2,296,300

66,600

1D 2.94%

5D 0.76%

Buy Vol. 2,577,600

Sell Vol. 2,307,800

62,500

1D 4.17%

5D 6.47%

Buy Vol. 7,424,600

Sell Vol. 7,109,100

FOOD & BEVERAGE

29,000

1D 0.00%

5D 11.32%

Buy Vol. 3,462,100

Sell Vol. 3,659,200

73,400

1D -0.14%

5D 1.94%

Buy Vol. 4,617,600

Sell Vol. 5,117,100

110,000

1D 0.55%

5D 0.00%

Buy Vol. 1,768,000

Sell Vol. 1,864,400

OTHERS

187,800

1D 2.62%

5D 11.99%

Buy Vol. 535,000

Sell Vol. 369,400

127,500

1D 0.31%

5D 1.92%

Buy Vol. 544,600

Sell Vol. 444,000

127,500

1D 0.31%

5D 1.92%

Buy Vol. 544,600

Sell Vol. 444,000

85,000

1D 1.19%

5D 0.24%

Buy Vol. 3,847,700

Sell Vol. 2,825,800

62,000

1D 1.14%

5D -1.59%

Buy Vol. 4,400,600

Sell Vol. 4,462,400

24,800

1D 0.40%

5D 9.01%

Buy Vol. 4,533,300

Sell Vol. 4,395,500

23,200

1D 1.75%

5D 14.57%

Buy Vol. 60,616,800

Sell Vol. 59,606,100

22,900

1D 0.44%

5D 5.77%

Buy Vol. 43,919,300

Sell Vol. 54,968,600

Market by numbers

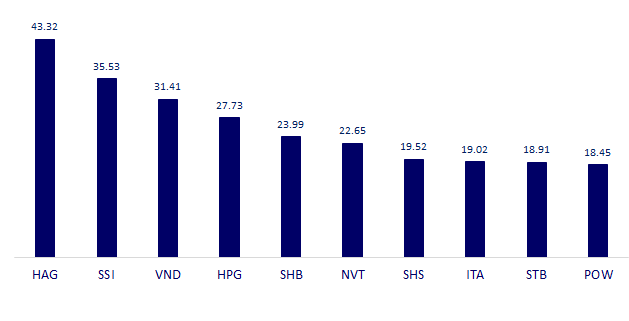

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

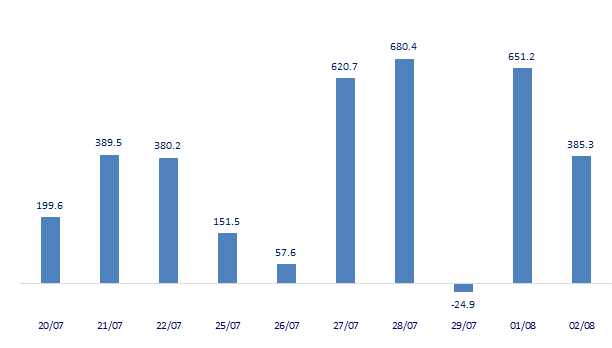

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

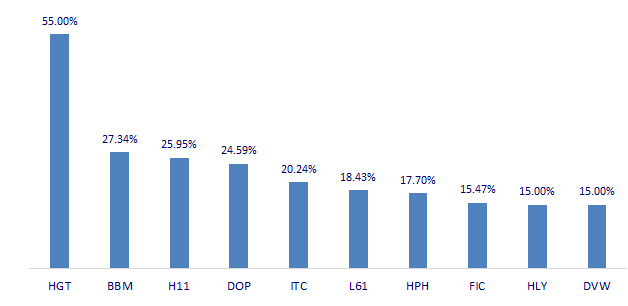

TOP INCREASES 3 CONSECUTIVE SESSIONS

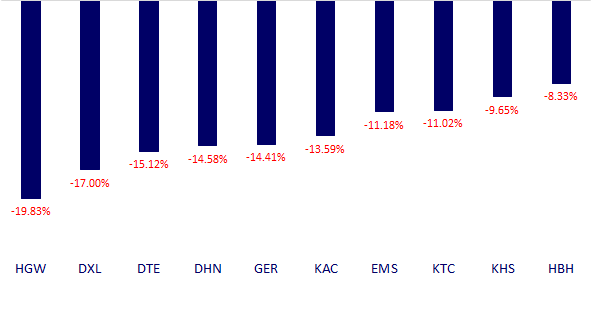

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.