Market brief 11/08/2022

VIETNAM STOCK MARKET

1,252.07

1D -0.35%

YTD -16.43%

1,272.33

1D -0.38%

YTD -17.15%

300.18

1D -1.11%

YTD -36.67%

92.72

1D -0.42%

YTD -17.71%

130.77

1D 0.00%

YTD 0.00%

22,536.65

1D 31.18%

YTD -27.47%

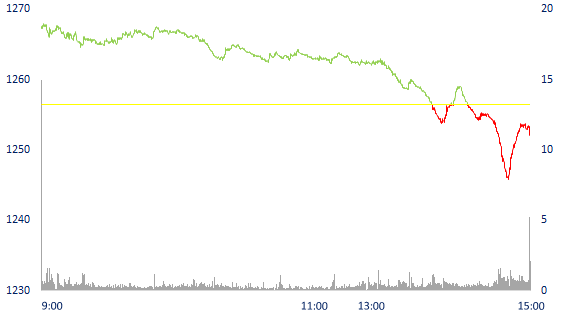

At the end of the session, VN-Index dropped 4.43 points (-0.35%) to 1,252.07 points. Market liquidity increased sharply compared to the previous session. Total matched value reached VND20,884 billion, up 37% compared to the previous session, of which, matched value on HoSE increased by 36% to VND 17,258 billion. Foreign investors net bought about VND130.7 billion on HoSE.

ETF & DERIVATIVES

21,670

1D 0.46%

YTD -16.11%

15,060

1D -0.40%

YTD -16.75%

16,080

1D -9.71%

YTD -15.37%

18,200

1D -0.05%

YTD -20.52%

17,900

1D -0.50%

YTD -20.37%

26,650

1D -0.82%

YTD -4.99%

16,490

1D -0.06%

YTD -23.23%

1,253

1D -0.05%

YTD 0.00%

1,260

1D 0.14%

YTD 0.00%

1,266

1D -0.17%

YTD 0.00%

1,268

1D -0.20%

YTD 0.00%

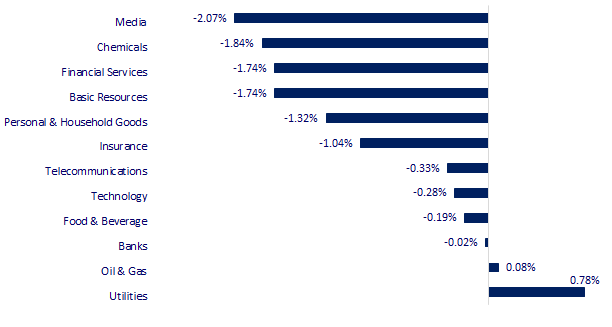

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

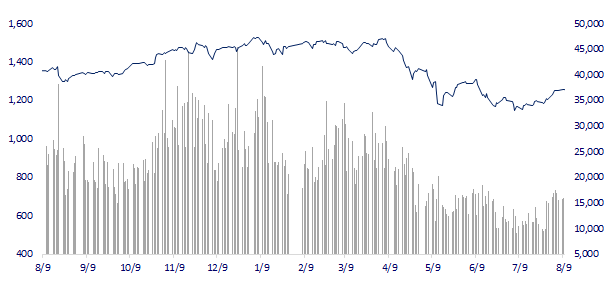

VNINDEX (12M)

GLOBAL MARKET

27,819.33

1D 0.00%

YTD -3.38%

3,281.67

1D 1.60%

YTD -9.84%

2,523.78

1D 1.73%

YTD -15.24%

20,082.43

1D 2.40%

YTD -14.17%

3,298.92

1D 0.48%

YTD 5.61%

1,617.97

1D 0.16%

YTD -2.39%

92.72

1D 1.20%

YTD 21.20%

1,805.10

1D -0.07%

YTD -0.86%

Asia - Pacific stocks all gained at the beginning of the session on August 11 after the July inflation report in the US. Korea's Kospi index rose 1.73%, the Hang Seng (Hong Kong) index increased 2.4%. Chinese stocks shared gains. The Shanghai Composite Index rose 1.6%. Japanese stocks closed for a holiday.

VIETNAM ECONOMY

4.29%

1D (bps) -13

YTD (bps) 348

5.60%

3.12%

1D (bps) -15

YTD (bps) 211

3.45%

1D (bps) -17

YTD (bps) 145

23,533

1D (%) 0.01%

YTD (%) 2.59%

24,920

1D (%) 0.44%

YTD (%) -5.85%

3,542

1D (%) -0.20%

YTD (%) -3.17%

According to the State Budget Department's report, the total state budget revenue in the first seven months of 2022 is estimated at 1,093.5 trillion VND, equaling 77.5% of the estimate, up 18.1% over the same period in 2021. In which, domestic revenue reached 74% of the estimate, up 15%; revenue from crude oil reached 152.5% of the estimate, up 91.6%; Balanced income from import-export activities reached 90.3% of the estimate, up 23.6%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Hai Phong: Creating conditions for Korean businesses to invest

- Budget revenue of more than 1 million billion dong after the first 7 months of the year

- In 2045, the capacity of coal-fired power plants will be only 13.2%.

- The largest iPhone assembler achieves profits that exceed expectations

- Morgan Stanley: India could become Asia's fastest growing economy in 2022-2023

- 9.2 million British families face poverty

VN30

BANK

81,500

1D 1.24%

5D -1.21%

Buy Vol. 1,511,800

Sell Vol. 2,713,100

38,300

1D -0.26%

5D -2.54%

Buy Vol. 2,557,300

Sell Vol. 3,868,900

28,500

1D 0.18%

5D -1.21%

Buy Vol. 6,410,200

Sell Vol. 9,257,000

38,500

1D -0.77%

5D 0.26%

Buy Vol. 7,318,400

Sell Vol. 10,314,800

29,600

1D -1.66%

5D 0.68%

Buy Vol. 21,426,700

Sell Vol. 27,900,700

26,800

1D -1.47%

5D -0.56%

Buy Vol. 15,393,300

Sell Vol. 19,847,300

25,300

1D 1.00%

5D 1.61%

Buy Vol. 6,247,700

Sell Vol. 8,117,900

28,500

1D 0.71%

5D -1.04%

Buy Vol. 4,137,500

Sell Vol. 5,984,100

25,200

1D 1.20%

5D 0.00%

Buy Vol. 25,137,400

Sell Vol. 29,188,800

25,650

1D -1.35%

5D -1.72%

Buy Vol. 3,266,600

Sell Vol. 5,383,500

24,750

1D -0.40%

5D -1.00%

Buy Vol. 5,479,800

Sell Vol. 7,917,400

HDB: HDBank has just been approved by the State Bank (SBV) to increase its charter capital by a maximum of VND 5,030 billion by issuing more than 503 million shares to pay dividends in 2021, with a distribution rate of 25%, expected completed in the third quarter. When completing the issuance plan, HDBank's charter capital will increase from VND 20,273 billion to VND 25,303 billion. The additional charter capital is expected to be spent about VND 3,000 billion to supplement medium and long-term loans, the rest will supplement working capital for other activities.

REAL ESTATE

81,300

1D -2.28%

5D 3.57%

Buy Vol. 5,115,300

Sell Vol. 6,940,600

39,000

1D 0.65%

5D 0.00%

Buy Vol. 1,247,800

Sell Vol. 1,407,400

53,600

1D -0.19%

5D -0.74%

Buy Vol. 3,065,200

Sell Vol. 3,352,300

Novaland Group is present in the 'Top 50 Sustainable Development Enterprises 2022' at the Corporate Sustainability Awards 2022 program.

OIL & GAS

113,000

1D 1.89%

5D 3.67%

Buy Vol. 1,354,000

Sell Vol. 1,797,900

13,800

1D -1.08%

5D 1.47%

Buy Vol. 25,378,000

Sell Vol. 37,402,400

41,850

1D -0.24%

5D -0.59%

Buy Vol. 2,182,200

Sell Vol. 2,843,000

GAS: PV Gas publicly auctioned more than 183.3 million shares held at PV Pipe with a starting price of nearly 8,200 VND/share.

VINGROUP

65,800

1D 1.54%

5D -0.90%

Buy Vol. 2,437,400

Sell Vol. 4,003,500

61,400

1D 0.16%

5D -2.54%

Buy Vol. 2,961,500

Sell Vol. 4,303,300

28,900

1D 1.76%

5D -0.34%

Buy Vol. 3,424,800

Sell Vol. 4,510,900

VHM: HCMC appears dense with images and information about Vinhomes Ocean Park 2 - The Empire, opening the journey to conquer the southern market of this great coastal city.

FOOD & BEVERAGE

71,100

1D -1.93%

5D -3.00%

Buy Vol. 5,128,200

Sell Vol. 7,125,900

106,800

1D 0.95%

5D -1.02%

Buy Vol. 1,093,100

Sell Vol. 1,615,100

182,000

1D 0.00%

5D -1.62%

Buy Vol. 378,200

Sell Vol. 304,800

MSN: Masan Group has more than 15,000 billion unsecured bond loans.

OTHERS

125,200

1D -0.16%

5D -3.10%

Buy Vol. 865,600

Sell Vol. 953,100

125,200

1D -0.16%

5D -3.10%

Buy Vol. 865,600

Sell Vol. 953,100

86,000

1D 0.00%

5D -0.12%

Buy Vol. 3,187,300

Sell Vol. 3,642,100

63,000

1D -0.94%

5D 0.48%

Buy Vol. 3,759,300

Sell Vol. 5,971,500

24,700

1D -1.40%

5D 0.41%

Buy Vol. 3,602,200

Sell Vol. 5,228,800

24,400

1D -0.61%

5D 3.61%

Buy Vol. 45,642,600

Sell Vol. 55,268,500

23,400

1D -1.68%

5D -1.06%

Buy Vol. 52,257,700

Sell Vol. 69,274,000

FPT: In the first 7 months of the year, the group's revenue reached VND 23,219 billion, profit before tax was VND4,242 billion, up 22.2% and 23.7% respectively over the same period last year. Profit after tax for shareholders of parent company is VND2,906 billion, up 30.1% and EPS is VND2,659. In July alone, FPT recorded VND3,390 billion in revenue, VND605 billion in pre-tax income; up 22% and nearly 23% respectively compared to July last year.

Market by numbers

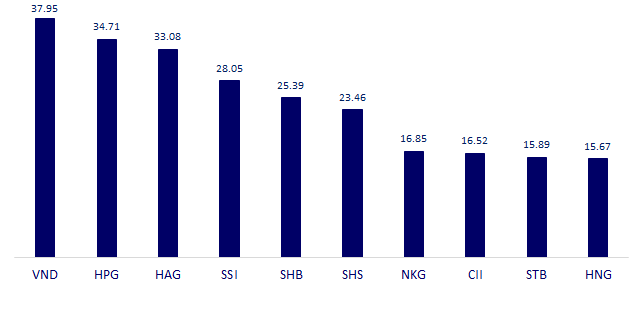

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

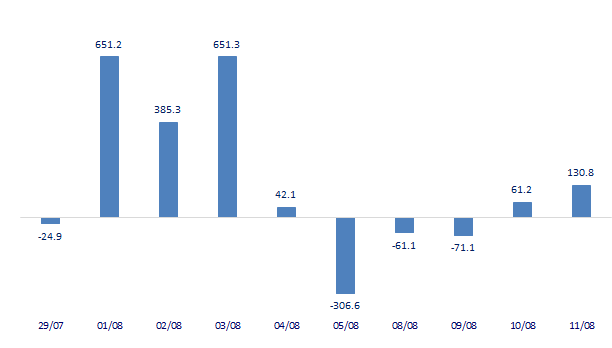

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

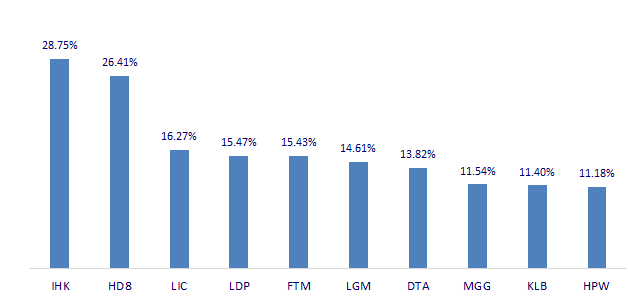

TOP INCREASES 3 CONSECUTIVE SESSIONS

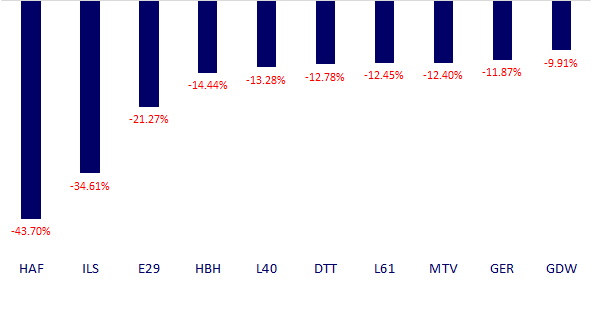

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.