Market brief 15/09/2022

VIETNAM STOCK MARKET

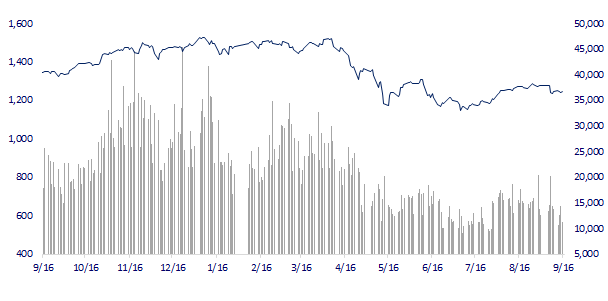

1,245.66

1D 0.39%

YTD -16.86%

1,262.82

1D 0.15%

YTD -17.77%

279.69

1D 0.10%

YTD -40.99%

90.27

1D 0.12%

YTD -19.89%

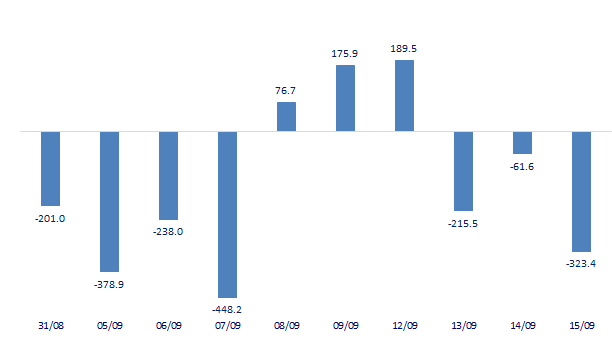

-323.41

1D 0.00%

YTD 0.00%

12,995.96

1D -22.37%

YTD -58.17%

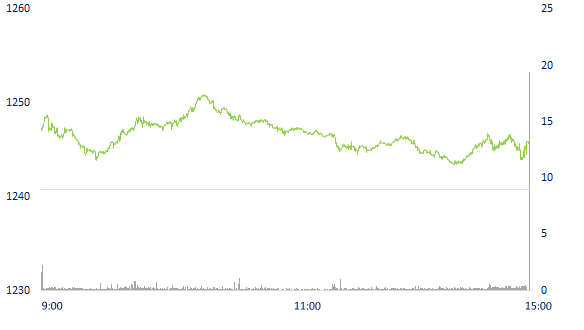

Derivative maturity session was 'quiet', VN-Index gained slightly. The total matched value reached 11,312 billion dong, down 28% compared to the previous session, of which, the matched value on HoSE alone decreased by 27% and reached 9,778 billion dong. Foreign investors net sold more than 323 billion dong.

ETF & DERIVATIVES

21,410

1D 0.09%

YTD -17.11%

14,900

1D 0.00%

YTD -17.63%

15,690

1D -11.90%

YTD -17.42%

21,900

1D 0.00%

YTD -4.37%

17,160

1D -0.46%

YTD -23.67%

26,890

1D 0.34%

YTD -4.14%

16,350

1D 0.93%

YTD -23.88%

1,247

1D 0.32%

YTD 0.00%

1,255

1D 0.33%

YTD 0.00%

1,259

1D 0.47%

YTD 0.00%

1,262

1D 0.25%

YTD 0.00%

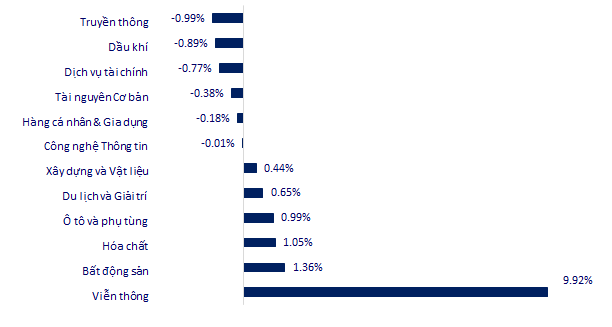

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,875.91

1D 0.21%

YTD -3.18%

3,199.92

1D -1.16%

YTD -12.08%

2,401.83

1D -0.40%

YTD -19.34%

18,930.38

1D 0.44%

YTD -19.09%

3,267.98

1D 0.31%

YTD 4.62%

1,642.33

1D -0.86%

YTD -0.92%

87.84

1D 0.39%

YTD 14.82%

1,698.25

1D -1.00%

YTD -6.73%

Asian stocks mixed, Japan rallied despite record high trade deficit. In Japan, the Nikkei 225 index rose 0.21%. South Korea's Kospi index fell 0.4 percent to 2,401.83 points. Chinese stocks fell. The Shanghai Composite Index fell 1.16%. The Hang Seng Index (Hong Kong) rose 0.44%.

VIETNAM ECONOMY

4.17%

1D (bps) -3

YTD (bps) 336

5.60%

3.24%

1D (bps) -2

YTD (bps) 223

3.55%

1D (bps) -5

YTD (bps) 155

23,767

1D (%) 0.11%

YTD (%) 3.61%

24,344

1D (%) 0.28%

YTD (%) -8.02%

3,455

1D (%) -0.14%

YTD (%) -5.55%

To remove difficulties for businesses, the Ministry of Finance proposed the Government allow enterprises to temporarily pay corporate income tax for four quarters, which must not be lower than 80% of the income tax payable for the whole year.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Finance proposes to reduce 10% tax on gasoline products

- Proposing the Government to allow businesses to temporarily pay 80% of income tax for 4 quarters

- Hanoi directs site clearance for Ring Road 4 project

- EU extends sanctions against Russia for another 6 months

- Japan has record trade deficit due to weak yen

- IEA: EU embargo will affect Russia's oil production

VN30

BANK

79,200

1D 1.15%

5D 1.54%

Buy Vol. 1,111,300

Sell Vol. 1,081,800

35,750

1D -2.05%

5D -2.59%

Buy Vol. 3,117,100

Sell Vol. 3,301,000

26,900

1D -0.37%

5D 0.19%

Buy Vol. 2,147,100

Sell Vol. 2,865,400

36,600

1D -0.54%

5D -2.14%

Buy Vol. 2,645,300

Sell Vol. 2,906,500

30,300

1D 0.00%

5D 1.34%

Buy Vol. 12,952,300

Sell Vol. 16,747,400

22,150

1D -1.12%

5D -2.85%

Buy Vol. 9,353,800

Sell Vol. 7,614,000

25,150

1D -0.20%

5D -1.37%

Buy Vol. 1,921,100

Sell Vol. 2,559,600

26,550

1D 0.00%

5D -1.30%

Buy Vol. 1,738,400

Sell Vol. 1,895,300

23,050

1D 0.00%

5D -3.56%

Buy Vol. 22,216,500

Sell Vol. 16,341,300

23,000

1D -0.65%

5D -2.54%

Buy Vol. 1,438,900

Sell Vol. 1,634,200

23,550

1D 0.21%

5D -1.88%

Buy Vol. 2,978,900

Sell Vol. 3,281,000

Summarizing the financial statements of the second quarter of 27 listed banks, the data shows that by the end of June 30, the total service income of 27 banks reached VND 49,640 billion, up 16% over the same period last year, equivalent to an increase of more than VND 6,800 billion. In which, 22/27 banks recorded a double-digit increase, ranging from 10 to nearly 70%. 5 banks that recorded a decrease in service fee collection over the same period were Vietcombank, BIDV, MSB, Eximbank and BacABank.

REAL ESTATE

85,300

1D 2.16%

5D 0.35%

Buy Vol. 3,780,900

Sell Vol. 3,927,600

35,500

1D -0.56%

5D 0.00%

Buy Vol. 1,103,800

Sell Vol. 1,301,400

51,300

1D 0.79%

5D -5.00%

Buy Vol. 2,277,800

Sell Vol. 2,194,900

KDH: During the restructuring period of Q3 2022, FTSE Vietnam Index may exclude KDH and SBT, without adding any shares.

OIL & GAS

111,800

1D -0.62%

5D 0.00%

Buy Vol. 945,400

Sell Vol. 1,127,000

14,450

1D 2.12%

5D 5.47%

Buy Vol. 72,686,600

Sell Vol. 61,864,700

39,300

1D -0.25%

5D -1.26%

Buy Vol. 1,693,000

Sell Vol. 1,233,400

The gas price in the EU on September 14 was at 208 euros/mwh (207 USD/mwh), up 4.7% compared to the previous day, equivalent to the price at the end of July.

VINGROUP

63,900

1D 0.79%

5D 1.59%

Buy Vol. 1,441,300

Sell Vol. 2,099,300

60,500

1D 0.83%

5D 1.51%

Buy Vol. 3,159,200

Sell Vol. 2,674,100

28,850

1D 1.23%

5D 5.29%

Buy Vol. 1,680,800

Sell Vol. 2,528,500

VHM: passed a resolution to establish 3 subsidiaries with a total charter capital of up to VND11,100b, of which VHM will contribute capital by assets with the rate of capital contribution of 99.9%.

FOOD & BEVERAGE

74,500

1D 0.68%

5D -1.59%

Buy Vol. 2,230,600

Sell Vol. 1,979,200

112,000

1D 0.00%

5D -2.61%

Buy Vol. 916,400

Sell Vol. 1,415,400

185,300

1D 0.71%

5D -3.34%

Buy Vol. 327,900

Sell Vol. 318,500

MSN: Masan Group put into operation 27 WIN convenience stores in Hanoi and Ho Chi Minh City. In 2022, Masan Group plans to open 80-100 WIN stores across the country.

OTHERS

116,000

1D -0.17%

5D 0.87%

Buy Vol. 906,400

Sell Vol. 1,037,100

116,000

1D -0.17%

5D 0.87%

Buy Vol. 906,400

Sell Vol. 1,037,100

83,700

1D -0.36%

5D -0.71%

Buy Vol. 1,593,400

Sell Vol. 1,759,400

73,900

1D 0.27%

5D 3.36%

Buy Vol. 5,771,500

Sell Vol. 7,762,100

25,500

1D 2.00%

5D 2.00%

Buy Vol. 5,357,300

Sell Vol. 6,806,900

21,650

1D -1.37%

5D -1.81%

Buy Vol. 22,618,200

Sell Vol. 24,198,800

23,600

1D -0.42%

5D 2.16%

Buy Vol. 23,674,800

Sell Vol. 31,849,800

HPG: In April, HPG proposed to survey investment projects including: Alumin project, capacity of 2m tons of Alumin/year; ore refinery with a capacity of 5m tons/year. HPG also proposed the Aluminum Electrolysis project with a capacity of 0.5m tons/year and the Hoa Phat Wind Power Plant project with a capacity of 1,500MW to be built in Dak Song and Tuy Duc districts. The complex of projects is about 4.3 billion USD.

Market by numbers

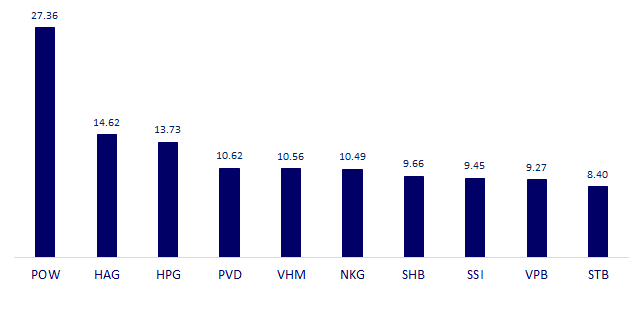

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

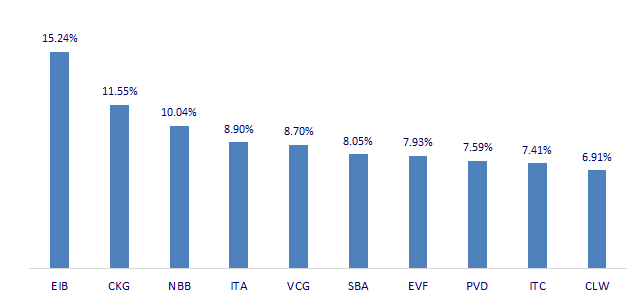

TOP INCREASES 3 CONSECUTIVE SESSIONS

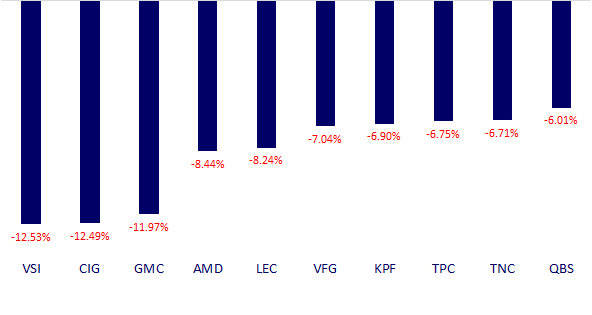

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.