Market Brief 20/09/2022

VIETNAM STOCK MARKET

1,218.93

1D 1.12%

YTD -18.64%

1,241.07

1D 0.91%

YTD -19.19%

266.91

1D 1.01%

YTD -43.69%

88.51

1D 0.19%

YTD -21.45%

423.51

1D 0.00%

YTD 0.00%

12,813.55

1D -33.89%

YTD -58.76%

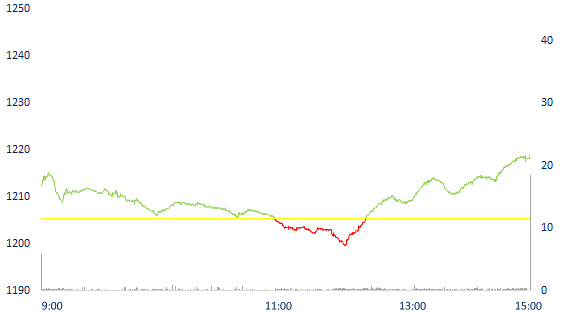

The support area of 1,200 points helped VN-Index recover strongly. After a gloomy morning session, when the VN-Index was pushed down to break through 1,200 points, the buying force at the bottom appeared and pulled the market to recover. Many blue-chips reversed to gain and the supply at the same time was significantly reduced were the main motivations that helped VN-Index recovered, closing at the highest level of the day.

ETF & DERIVATIVES

20,930

1D -0.10%

YTD -18.97%

14,620

1D 0.55%

YTD -19.18%

15,240

1D -14.43%

YTD -19.79%

20,150

1D -1.99%

YTD -12.01%

16,410

1D 1.36%

YTD -27.00%

26,330

1D 0.50%

YTD -6.13%

15,900

1D 0.25%

YTD -25.98%

1,228

1D 0.57%

YTD 0.00%

1,230

1D 0.47%

YTD 0.00%

1,231

1D 0.73%

YTD 0.00%

1,233

1D 0.75%

YTD 0.00%

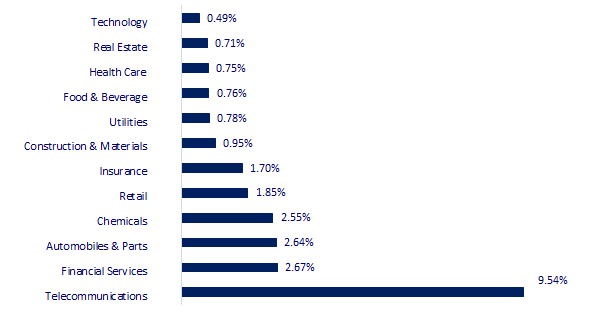

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

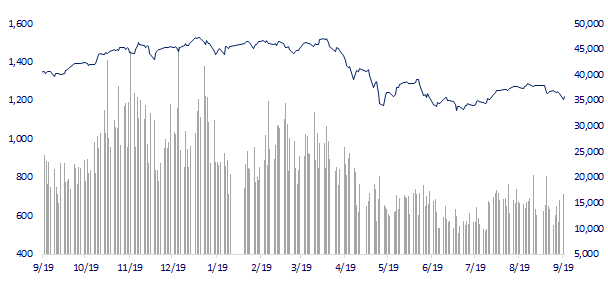

VNINDEX (12M)

GLOBAL MARKET

27,688.42

1D 0.05%

YTD -3.83%

3,122.41

1D 0.22%

YTD -14.21%

2,367.85

1D 0.52%

YTD -20.48%

18,781.42

1D 1.16%

YTD -19.73%

3,266.94

1D 0.33%

YTD 4.59%

1,638.59

1D 0.43%

YTD -1.15%

85.15

1D 0.14%

YTD 11.31%

1,675.45

1D -0.51%

YTD -7.98%

Asian stocks simultaneously gained in the session on September 20 before the important meeting of the US Federal Reserve (Fed). In Japan, the Nikkei 225 index rose 0.05% to 27,688.42 points in the first trading day after the holiday. The Hang Seng Index (Hong Kong) increased 1.16% to 18,781.42 points. The Hang Seng Tech Index rose 2.1% to 3,858.06 points.

VIETNAM ECONOMY

4.26%

1D (bps) 1

YTD (bps) 345

5.60%

3.41%

1D (bps) 4

YTD (bps) 240

3.74%

1D (bps) 3

YTD (bps) 174

23,816

1D (%) 0.01%

YTD (%) 3.82%

24,425

1D (%) -0.27%

YTD (%) -7.72%

3,445

1D (%) -0.12%

YTD (%) -5.82%

According to preliminary statistics of the General Department of Customs, in August, the export turnover to the US was nearly 10 billion USD, bringing the accumulated from the beginning of the year to 77 billion USD, up 24% over the same period last year. Three groups reached 10 billion USD or more. Leading the group is machinery, equipment, tools and spare parts; then came textiles; finally computers, electronic products, components

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnam has a trade surplus with the US of more than 67 billion USD in 8 months

- Starting credit limit calculation and credit growth management in 2023

- Canada imposes anti-dumping tax on Vietnam's leading steel pipe

- China keeps lending rates unchanged

- OPEC+ fails to reach target output, oil prices go up

- Exceeding 3.5%, US bond yields hit 10-year highs

VN30

BANK

79,200

1D 0.51%

5D 0.76%

Buy Vol. 771,000

Sell Vol. 995,400

35,150

1D 2.78%

5D -4.48%

Buy Vol. 2,451,700

Sell Vol. 1,791,200

26,000

1D 1.96%

5D -5.45%

Buy Vol. 3,151,700

Sell Vol. 3,064,400

35,050

1D 0.00%

5D -6.03%

Buy Vol. 3,473,300

Sell Vol. 3,454,300

30,000

1D 0.33%

5D -1.64%

Buy Vol. 19,840,000

Sell Vol. 19,817,000

21,350

1D 1.67%

5D -5.32%

Buy Vol. 10,814,100

Sell Vol. 8,329,600

24,800

1D 1.22%

5D -4.25%

Buy Vol. 2,342,900

Sell Vol. 1,842,200

25,400

1D 1.60%

5D -5.40%

Buy Vol. 1,789,000

Sell Vol. 1,689,800

22,150

1D 2.55%

5D -3.90%

Buy Vol. 15,033,500

Sell Vol. 10,390,200

22,300

1D 1.13%

5D -4.50%

Buy Vol. 3,150,600

Sell Vol. 2,571,300

22,900

1D 0.22%

5D -3.78%

Buy Vol. 3,504,800

Sell Vol. 3,293,800

MBB: Military Commercial Joint Stock Bank announced the Resolution of the Board of Directors approving the plan to exercise the right to buy shares in the 2022 capital increase of Military Securities (HNX: MBS). The purchase amount of 47.2 million MBS shares, respectively with ownership rate of more than 79% capital. At the same time, the bank also said that in case this securities company does not distribute all the shares, the bank will buy more and ensure in the investment budget to contribute capital to the subsidiary in 2022 approved by the Board of Directors.

REAL ESTATE

84,600

1D -0.47%

5D 1.32%

Buy Vol. 4,577,100

Sell Vol. 4,199,200

33,400

1D -0.74%

5D -6.70%

Buy Vol. 1,491,900

Sell Vol. 1,707,600

51,700

1D 1.37%

5D -0.19%

Buy Vol. 2,273,000

Sell Vol. 2,200,500

Decree 65 amending and supplementing Decree 153 on private placement of bonds: real estate businesses are relieved from worries about the ban on issuing bonds to "reverse debt"

OIL & GAS

109,100

1D 1.02%

5D -4.47%

Buy Vol. 759,200

Sell Vol. 1,056,400

13,700

1D 1.48%

5D -3.18%

Buy Vol. 35,947,400

Sell Vol. 26,580,200

38,000

1D 0.00%

5D -5.24%

Buy Vol. 2,030,600

Sell Vol. 2,327,500

The revised Petroleum Law allows the project to be put into operation soon, with the expectation of increasing reserves of 70-80million barrels of oil, bringing in revenue of about USD1-1.5bil

VINGROUP

63,900

1D 1.59%

5D -0.31%

Buy Vol. 1,410,200

Sell Vol. 1,662,900

58,900

1D 0.86%

5D -2.97%

Buy Vol. 2,060,100

Sell Vol. 2,901,000

29,050

1D -0.17%

5D 2.47%

Buy Vol. 2,049,700

Sell Vol. 2,654,700

VIC, VHM had a positive gaining session so VN-Index broke out on September 20. VIC had the second gain of the week with 1.6%, VHM recovered by 0.9%, contributing nearly 1.5 points to the VN-Index.

FOOD & BEVERAGE

75,800

1D 0.80%

5D 0.13%

Buy Vol. 1,894,800

Sell Vol. 2,624,000

113,300

1D 0.71%

5D -0.61%

Buy Vol. 517,800

Sell Vol. 603,500

187,500

1D 1.19%

5D -1.83%

Buy Vol. 170,100

Sell Vol. 203,000

MSN: Masan Group announced a resolution to change the private issuance plan of 2 lots of corporate bonds with a total value of VND 1,500 billion for professional securities investors.

OTHERS

116,100

1D 0.96%

5D -1.11%

Buy Vol. 508,000

Sell Vol. 461,600

116,100

1D 0.96%

5D -1.11%

Buy Vol. 508,000

Sell Vol. 461,600

83,400

1D 0.36%

5D -1.42%

Buy Vol. 1,957,200

Sell Vol. 1,513,000

71,700

1D 1.70%

5D -3.24%

Buy Vol. 6,959,200

Sell Vol. 5,822,600

23,500

1D 2.62%

5D -6.19%

Buy Vol. 3,130,300

Sell Vol. 2,383,600

20,700

1D 4.02%

5D -4.39%

Buy Vol. 32,063,300

Sell Vol. 26,246,900

23,000

1D 1.55%

5D -2.95%

Buy Vol. 23,508,100

Sell Vol. 20,938,500

GVR: GVR estimates 9M/2022 business results. Consolidated revenue reached VND 18,397 billion in 9 months, equaling 102% compared to the same period last year; profit was recorded at VND 4,408 billion, equaling 104% compared to the same period in 2021. In which, the revenue and profit realized in the first 9M/2022 of the parent company are estimated at VND1,927 billion and VND876 billion, respectively 101% and 102% over the same period last year.

Market by numbers

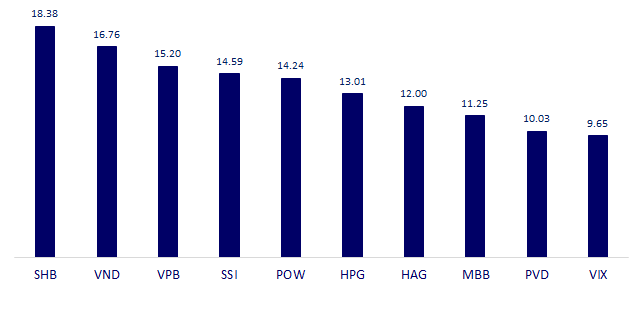

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

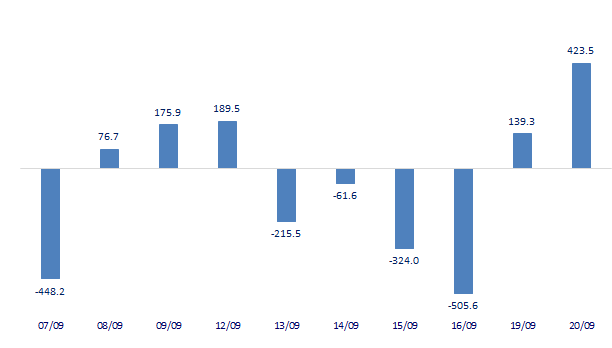

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

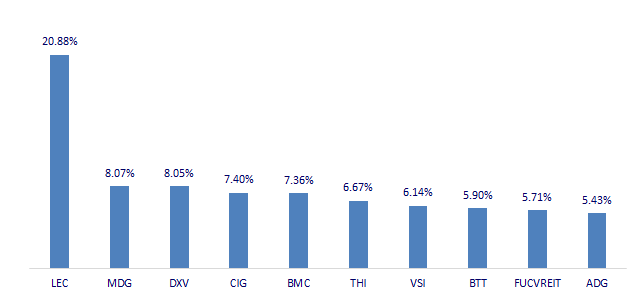

TOP INCREASES 3 CONSECUTIVE SESSIONS

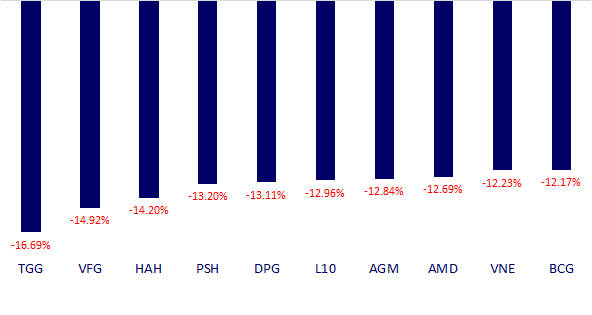

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.