Market Brief 18/11/2022

VIETNAM STOCK MARKET

969.33

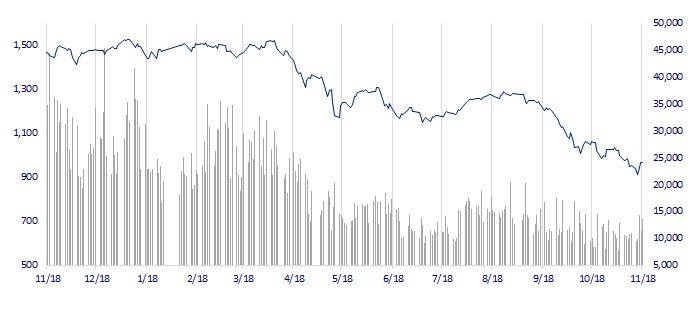

1D 0.01%

YTD -35.30%

971.20

1D 0.02%

YTD -36.76%

190.87

1D 1.60%

YTD -59.73%

67.15

1D 0.92%

YTD -40.41%

11.78

1D 0.00%

YTD 0.00%

15,283.92

1D 21.28%

YTD -50.81%

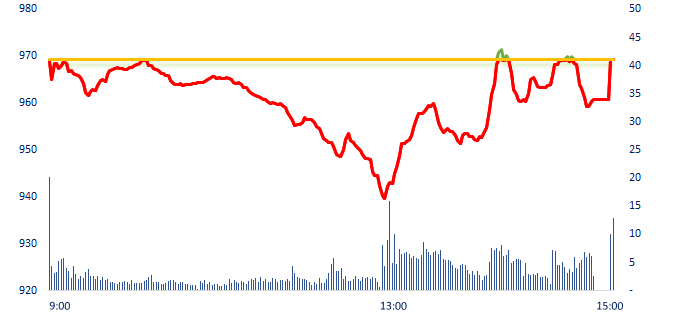

The last session of the week closed without much volatility, the VN-Index at the deepest drop of nearly 3% but quickly rebalanced and closed with a slight gain. In the VN30 basket, the number of stocks increasing and the number of stocks falling is equal, notably that NVL and PDR remained at the floor since the beginning of the session.

ETF & DERIVATIVES

16,650

1D 0.85%

YTD -35.54%

11,420

1D -0.44%

YTD -36.87%

11,730

1D -0.59%

YTD -38.26%

11,510

1D -4.56%

YTD -49.74%

12,220

1D -2.32%

YTD -45.64%

21,050

1D -1.50%

YTD -24.96%

11,990

1D -1.72%

YTD -44.18%

954

1D 0.37%

YTD 0.00%

955

1D 0.63%

YTD 0.00%

960

1D -1.73%

YTD 0.00%

963

1D -0.01%

YTD 0.00%

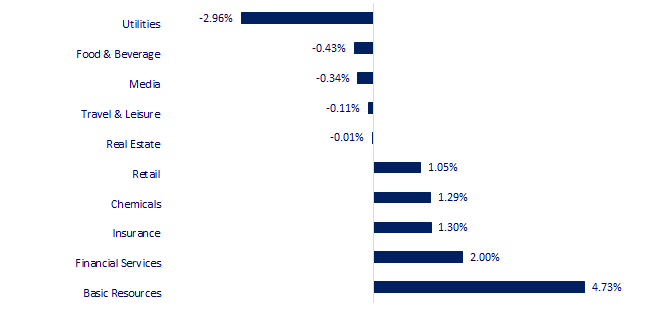

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,899.77

1D -0.11%

YTD -3.10%

3,097.24

1D -0.58%

YTD -14.91%

2,444.48

1D 0.06%

YTD -17.91%

17,992.54

1D -0.29%

YTD -23.10%

3,272.23

1D -0.42%

YTD 4.76%

1,617.38

1D 0.15%

YTD -2.43%

89.96

1D -0.07%

YTD 17.59%

1,766.65

1D 0.22%

YTD -2.97%

Asian stocks were in a cautious mood on Friday after U.S. Federal Reserve officials fired more warning shots on interest rates, while rising coronavirus cases in China and liquidity strains in its bond market added to uncertainty.

VIETNAM ECONOMY

5.23%

1D (bps) 60

YTD (bps) 442

7.40%

YTD (bps) 180

4.90%

1D (bps) 3

YTD (bps) 389

4.91%

1D (bps) 1

YTD (bps) 291

24,859

1D (%) 0.00%

YTD (%) 8.37%

26,483

1D (%) 0.01%

YTD (%) 0.06%

3,556

1D (%) 0.51%

YTD (%) -2.79%

The session of November 17 continued to witness the trend of net collection of liquidity of the State Bank of Vietnam in the interbank market. Specifically, SBV has successfully offered VND5,000 billion T-bills for two commercial banks, the winning interest rate dropped to 5.49%/year. With no old bills to mature, SBV net sold VND5,000 billion T-bills on November 17.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Garment, textile, footwear industries face declining in orders;

- Proposing to support commercial banks through refinancing;

- Hai Phong starts construction of Nam Dinh Vu sea dike project worth nearly VND2,300 billion;

- UK retail sales weaker than expected in living cost crisis;

- German industry faces 8.5% pay increase from union deal;

- ECB president says risk of euro-area recession has increased.

VN30

BANK

76,500

1D 0.00%

5D 1.32%

Buy Vol. 2,267,042

Sell Vol. 2,541,745

35,950

1D 0.84%

5D -0.14%

Buy Vol. 3,333,712

Sell Vol. 3,066,582

24,700

1D -1.20%

5D 4.66%

Buy Vol. 19,882,974

Sell Vol. 22,652,421

22,700

1D -1.09%

5D -0.44%

Buy Vol. 13,145,766

Sell Vol. 12,035,717

15,500

1D 0.00%

5D -4.91%

Buy Vol. 28,604,456

Sell Vol. 28,066,547

15,700

1D 0.00%

5D -1.88%

Buy Vol. 23,728,373

Sell Vol. 25,266,152

15,000

1D -1.96%

5D 1.35%

Buy Vol. 4,553,297

Sell Vol. 6,158,429

20,600

1D -1.20%

5D 3.52%

Buy Vol. 3,890,712

Sell Vol. 4,252,896

17,100

1D -0.58%

5D 9.62%

Buy Vol. 65,100,588

Sell Vol. 50,652,535

18,400

1D -0.27%

5D 5.14%

Buy Vol. 5,846,905

Sell Vol. 4,782,468

21,150

1D 0.48%

5D 1.68%

Buy Vol. 6,198,442

Sell Vol. 7,174,709

HDB: After signing an agreement with the Vietnam General Confederation of Labour to provide a VND10 trillion loan package to workers at industrial parks around the country, HDBank subsidiary HD SAISON Finance Company Limited has quickly deployed the funds to provide support to workers. So far workers in eight provinces and cities, including Dong Nai, Nghe An, Binh Duong, Long An, Da Nang, and HCM City have accessed the preferential loan package at half the market interest rate.

REAL ESTATE

29,250

1D -6.85%

5D -30.11%

Buy Vol. 1,272,841

Sell Vol. 87,946,068

22,100

1D 2.55%

5D 9.41%

Buy Vol. 6,866,595

Sell Vol. 5,795,174

18,350

1D -6.85%

5D -29.96%

Buy Vol. 198,429

Sell Vol. 175,309,585

PDR: On November 17, Phat Dat announced to continue adding collateral for the third time for the second bond issuance in 2021, while PDR fell to the floor for 11 consecutive sessions.

OIL & GAS

114,300

1D -4.51%

5D 0.35%

Buy Vol. 770,943

Sell Vol. 805,049

10,100

1D 0.00%

5D -4.72%

Buy Vol. 15,265,628

Sell Vol. 18,959,160

25,100

1D -2.14%

5D -7.72%

Buy Vol. 2,012,765

Sell Vol. 2,437,004

PLX: SCIC in September 2022 issued a direction on maintaining the state ownership rate in PLX, specifically 75.87% of charter capital in the period 2021-2025.

VINGROUP

65,600

1D 1.55%

5D 20.81%

Buy Vol. 2,428,359

Sell Vol. 4,874,975

48,000

1D 0.10%

5D 8.72%

Buy Vol. 5,193,570

Sell Vol. 5,868,913

27,600

1D -2.82%

5D 9.09%

Buy Vol. 2,948,169

Sell Vol. 3,326,830

VIC: On November 17, VinFast received an order to supply more than 2,500 units for Autonomy - America's largest car rental service provider.

FOOD & BEVERAGE

77,000

1D 1.32%

5D -1.79%

Buy Vol. 3,410,015

Sell Vol. 3,889,717

95,200

1D -1.86%

5D 10.06%

Buy Vol. 1,459,586

Sell Vol. 1,756,441

179,200

1D -2.08%

5D -4.58%

Buy Vol. 419,873

Sell Vol. 422,435

MSN: Masan announced to adjust its 2022 after-tax profit plan to VND4,800-5,500 billion, 30%-35% lower than the profit target of VND6,900-8,500 billion set at the beginning of this year.

OTHERS

48,300

1D 1.90%

5D -1.43%

Buy Vol. 1,345,512

Sell Vol. 1,515,377

102,200

1D 0.10%

5D 0.89%

Buy Vol. 383,174

Sell Vol. 428,721

71,500

1D 0.70%

5D -1.79%

Buy Vol. 2,331,362

Sell Vol. 2,900,066

42,150

1D 0.84%

5D -1.98%

Buy Vol. 8,113,556

Sell Vol. 6,678,271

12,150

1D 6.58%

5D 5.19%

Buy Vol. 7,143,145

Sell Vol. 4,789,263

16,250

1D 2.85%

5D 15.25%

Buy Vol. 64,983,705

Sell Vol. 58,648,046

15,100

1D 5.96%

5D 22.76%

Buy Vol. 163,145,723

Sell Vol. 142,385,071

FPT: In the first 10 months of the year, technology continued to account for a large proportion, contributing 57% of FPT's revenue and 46% of pre-tax profit, equivalent to VND20,047 billion and VND2,970 billion. In which, the software export segment continued to grow with a revenue of VND15,249 billion, equivalent to an increase of 30%, contributed by the growth of the US market (up 46%) and the Asia Pacific (up 46.6%).

Market by numbers

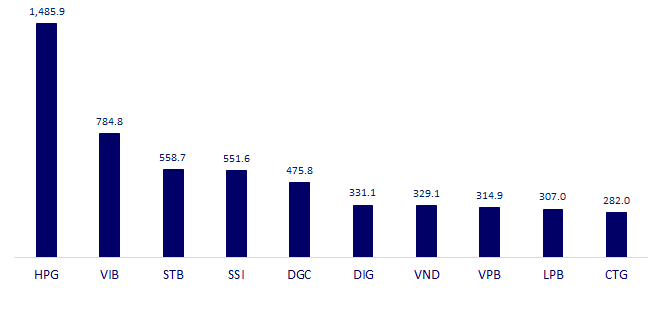

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

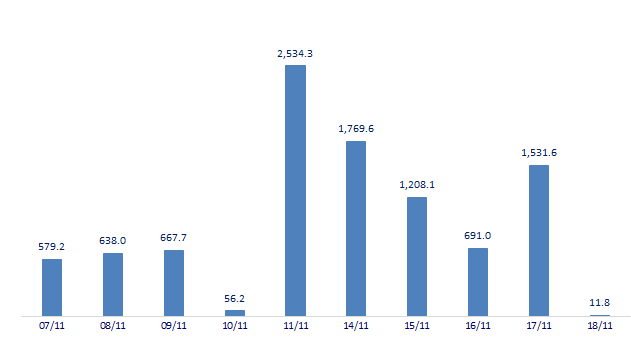

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

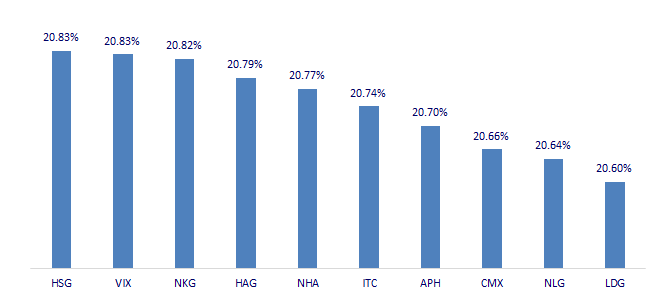

TOP INCREASES 3 CONSECUTIVE SESSIONS

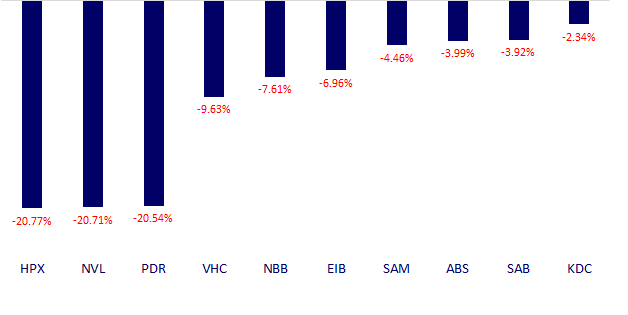

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.