Market Brief 12/01/2023

VIETNAM STOCK MARKET

1,056.39

1D 0.06%

YTD 4.90%

1,066.24

1D 0.10%

YTD 6.07%

211.94

1D 0.13%

YTD 3.23%

72.19

1D -0.25%

YTD 0.75%

323.84

1D 0.00%

YTD 0.00%

9,994.33

1D -1.30%

YTD 16.00%

Signs of the trading sessions nearing the Lunar New Year, the market was dull in terms of scores and trading volume. The spotlight on session 12/01 was a breakout in oil and gas stocks, boosted by the prospect of oil prices rising thanks to the market's optimism. Because the world's top oil importer - China reopened.

ETF & DERIVATIVES

18,130

1D 0.28%

YTD 4.62%

12,580

1D 0.08%

YTD 5.54%

13,110

1D 2.26%

YTD 5.05%

14,700

1D 0.00%

YTD 4.63%

15,200

1D -0.52%

YTD 5.92%

23,160

1D 0.70%

YTD 3.39%

13,510

1D -1.53%

YTD 4.32%

1,039

1D 0.03%

YTD 0.00%

1,052

1D -0.24%

YTD 0.00%

1,060

1D -0.01%

YTD 0.00%

1,065

1D 0.24%

YTD 0.00%

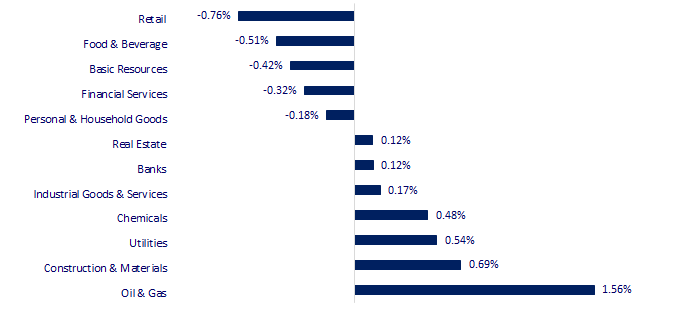

CHANGE IN PRICE BY SECTOR

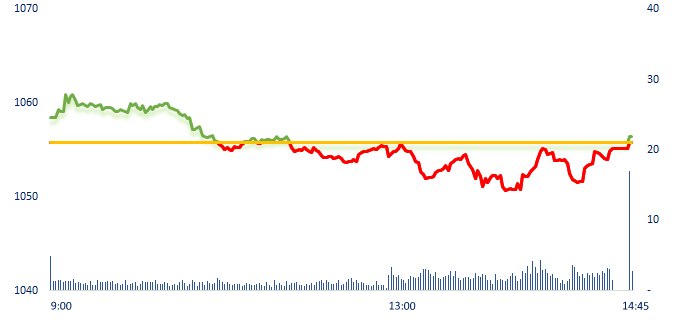

INTRADAY VNINDEX

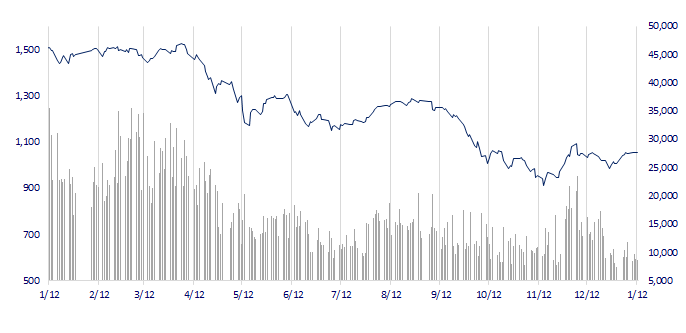

VNINDEX (12M)

GLOBAL MARKET

26,449.82

1D 0.01%

YTD 1.36%

3,163.45

1D 0.05%

YTD 2.40%

2,365.10

1D 0.24%

YTD 5.75%

21,514.10

1D 0.36%

YTD 8.76%

3,267.78

1D -0.11%

YTD 0.51%

1,687.45

1D 0.18%

YTD 1.02%

83.55

1D 0.41%

YTD -2.75%

1,886.40

1D 0.26%

YTD 3.30%

China's annual consumer inflation rate accelerated in December, driven by rising food prices even as domestic demand wavered amid restrained economic activity during the month. The consumer price index (CPI) in December was 1.8% higher than a year earlier, data from the National Bureau of Statistics (NBS) showed on Thursday.

VIETNAM ECONOMY

5.95%

1D (bps) 45

YTD (bps) 98

7.40%

4.58%

1D (bps) -5

YTD (bps) -21

4.64%

1D (bps) -6

YTD (bps) -26

23,643

1D (%) 0.16%

YTD (%) -0.49%

25,657

1D (%) -1.19%

YTD (%) -0.01%

3,543

1D (%) 0.11%

YTD (%) 1.66%

On January 12, the State Bank net withdrew VND16.117 billion through both channels. On the OMO channel, SBV provided VND5,383 billion with an interest rate of 6%/year, with a term of 7 days. On the treasury bill issuance channel, SBV attracted VND21,500 billion with an interest rate of 6%/year, with a term of 7 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Government has devised plans to restructure the domestic money, corporate bonds, securities, and real estate markets;

- FDI inflows into Vietnam have a positive impact on the serviced apartment market;

- In 2023, Binh Duong was allocated VND21,817 billion of public investment capital, the highest ever;

- A USD314 billion debt bill haunts Asia borrowers as rates rise;

- Russia's oil revenues are starting to suffer from the effects of sanctions;

- IEA says clean energy manufacturing set for substantial growth as world enters 'new industrial age'.

VN30

BANK

84,800

1D -0.35%

5D 0.95%

Buy Vol. 2,634,689

Sell Vol. 2,448,242

41,450

1D 0.48%

5D 1.72%

Buy Vol. 1,472,787

Sell Vol. 2,386,560

28,900

1D -0.69%

5D 1.40%

Buy Vol. 4,002,536

Sell Vol. 5,388,256

27,850

1D 0.72%

5D 0.72%

Buy Vol. 4,355,743

Sell Vol. 4,268,505

18,700

1D 1.36%

5D -1.32%

Buy Vol. 31,094,261

Sell Vol. 26,237,512

18,250

1D 0.00%

5D 0.27%

Buy Vol. 12,055,843

Sell Vol. 14,036,277

16,600

1D -0.60%

5D 1.22%

Buy Vol. 1,644,474

Sell Vol. 2,295,591

22,400

1D -0.22%

5D -0.67%

Buy Vol. 3,185,953

Sell Vol. 4,613,096

24,950

1D 1.01%

5D 3.10%

Buy Vol. 17,132,901

Sell Vol. 17,665,650

21,800

1D 2.83%

5D 8.46%

Buy Vol. 9,588,805

Sell Vol. 13,391,215

24,500

1D 1.24%

5D 7.22%

Buy Vol. 4,520,878

Sell Vol. 6,090,255

VPB: In 2022, pre-tax profit is estimated at about VND25,000 billion, up 73.5% over the same period. In Q4/2022, the growth rate will remain high at the parent bank (60-70% compared to the same period last year) as credit growth may increase sharply at the end of the year and close to the credit room by the State Bank.

REAL ESTATE

14,950

1D 0.34%

5D 9.12%

Buy Vol. 28,983,572

Sell Vol. 37,929,463

26,800

1D -4.63%

5D -3.25%

Buy Vol. 2,190,637

Sell Vol. 3,089,325

14,650

1D -1.01%

5D -3.30%

Buy Vol. 9,841,464

Sell Vol. 15,318,224

In 2023, the supply of condotels is forecast to decrease compared to 2022, expected to be about 3,700 units, mainly concentrated in Ba Ria - Vung Tau, Binh Dinh and Quang Binh.

OIL & GAS

105,000

1D 0.77%

5D -1.50%

Buy Vol. 369,864

Sell Vol. 438,782

11,750

1D 0.86%

5D 0.00%

Buy Vol. 19,057,265

Sell Vol. 18,995,287

37,100

1D -0.40%

5D 3.63%

Buy Vol. 1,115,420

Sell Vol. 1,272,955

After a few days of technical problems, Nghi Son Refinery will return to operation at the latest on January 15, and only about 3-4 days later, it will reach 100% of capacity.

VINGROUP

55,000

1D -0.18%

5D -2.14%

Buy Vol. 1,787,218

Sell Vol. 2,350,233

51,500

1D 1.38%

5D 3.62%

Buy Vol. 1,985,092

Sell Vol. 2,432,585

28,700

1D 0.70%

5D -1.71%

Buy Vol. 1,653,949

Sell Vol. 1,832,149

The occupancy rate in the shopping mall segment in HCMC reached 88% in Q4/2022, lower than the same period last year. The rental price recorded a positive growth with more than USD49 m2/month.

FOOD & BEVERAGE

80,000

1D 0.76%

5D -1.48%

Buy Vol. 1,927,737

Sell Vol. 1,635,226

93,300

1D -2.81%

5D -6.23%

Buy Vol. 883,411

Sell Vol. 1,067,387

179,800

1D -0.66%

5D 3.21%

Buy Vol. 86,098

Sell Vol. 90,612

MSN: Masan plans to issue VND1,500 billion to the public in January and February.

OTHERS

49,100

1D 1.03%

5D 2.19%

Buy Vol. 803,515

Sell Vol. 1,251,447

109,800

1D -0.27%

5D -0.18%

Buy Vol. 330,883

Sell Vol. 412,153

80,700

1D -0.25%

5D 0.12%

Buy Vol. 1,001,878

Sell Vol. 1,196,524

42,100

1D -1.06%

5D -3.44%

Buy Vol. 2,086,394

Sell Vol. 2,951,473

14,800

1D 2.07%

5D -0.67%

Buy Vol. 4,712,120

Sell Vol. 5,051,865

19,300

1D 0.00%

5D 0.00%

Buy Vol. 12,145,136

Sell Vol. 18,913,737

20,050

1D -0.74%

5D 1.26%

Buy Vol. 36,232,974

Sell Vol. 43,870,440

FPT: FPT Retail - an associate company of FPT has announced an additional contribution of VND225 billion to FPT Long Chau Pharmaceutical JSC, increasing the capital that this company contributes to the Long Chau chain to VND450 billion, equivalent to 89.83% ownership. In the next 5 years, FPT Retail plans to increase the total number of Long Chau stores to 3,000.

Market by numbers

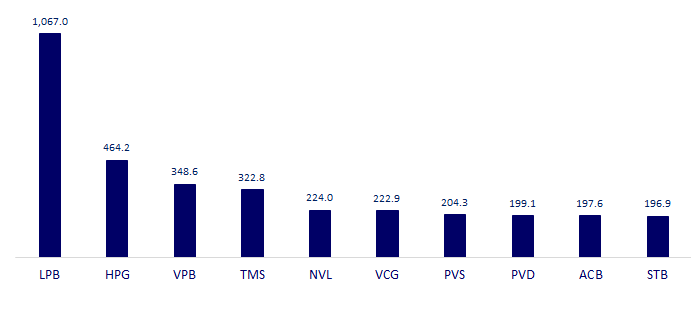

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

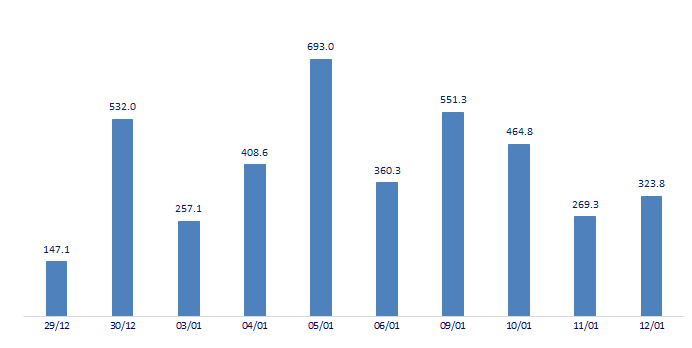

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

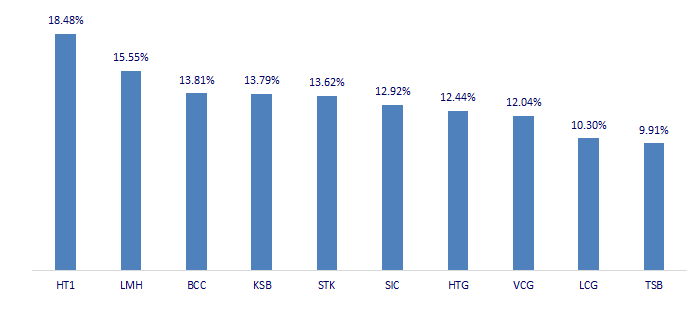

TOP INCREASES 3 CONSECUTIVE SESSIONS

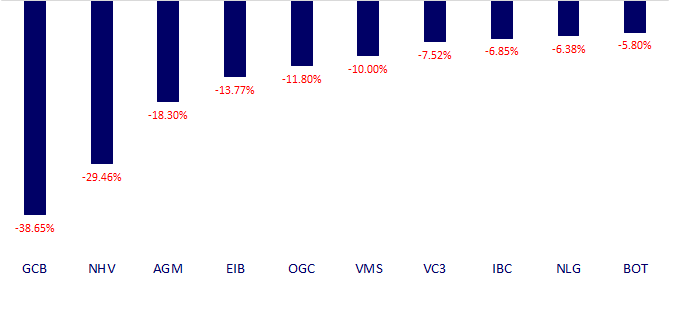

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.