Market Brief 31/03/2023

VIETNAM STOCK MARKET

1,111.18

1D 0.78%

YTD 10.34%

1,125.07

1D 1.00%

YTD 11.93%

222.43

1D 0.75%

YTD 8.34%

75.84

1D 0.58%

YTD 5.85%

-113.62

1D 0.00%

YTD 0.00%

15,405.11

1D -2.18%

YTD 78.80%

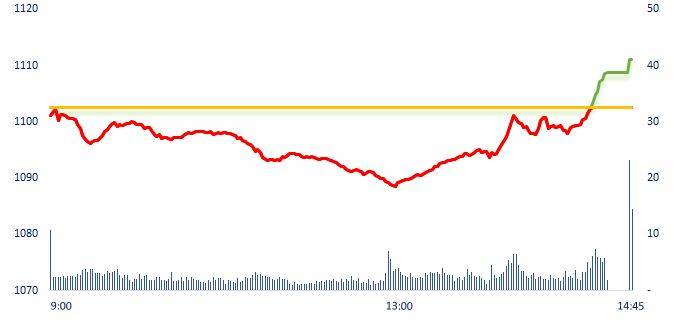

In the last session of January, the market suddenly turned bullish in the last 20 minutes of the session. After the final financial statements of the banking industry were published, banking stocks led the gain of the market today, followed by the securities industry.

ETF & DERIVATIVES

19,200

1D 1.05%

YTD 10.79%

13,230

1D 0.61%

YTD 10.99%

13,710

1D 1.33%

YTD 9.86%

15,910

1D 0.06%

YTD 13.24%

16,120

1D 0.94%

YTD 12.33%

24,200

1D 0.46%

YTD 8.04%

14,520

1D -0.48%

YTD 12.12%

1,103

1D 1.20%

YTD 0.00%

1,110

1D 1.14%

YTD 0.00%

1,124

1D 1.37%

YTD 0.00%

1,125

1D 1.37%

YTD 0.00%

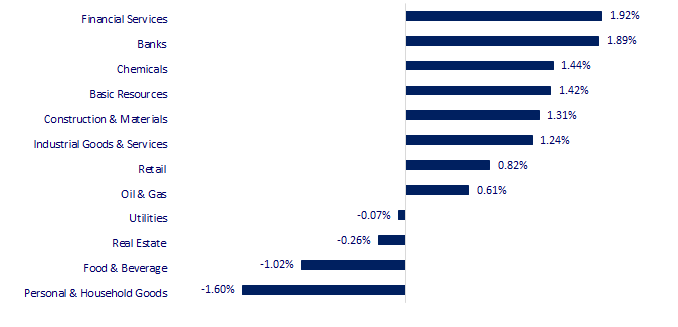

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

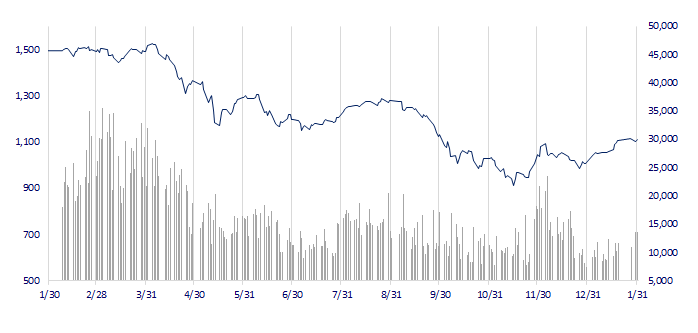

VNINDEX (12M)

GLOBAL MARKET

27,327.11

1D -0.39%

YTD 4.72%

3,255.67

1D -0.42%

YTD 5.39%

2,425.08

1D -1.04%

YTD 8.44%

21,842.33

1D -1.03%

YTD 10.42%

3,365.67

1D -0.37%

YTD 3.52%

1,671.46

1D -0.58%

YTD 0.07%

83.38

1D -1.26%

YTD -2.94%

1,904.10

1D -0.97%

YTD 4.27%

Asia-Pacific stocks stumbled tumbled on Tuesday as hotter than anticipated European inflation numbers jangled investor nerves ahead of a slew of earnings reports, central bank meetings, and key U.S. economic data.

VIETNAM ECONOMY

6.20%

1D (bps) 10

YTD (bps) 123

7.40%

4.40%

1D (bps) -10

YTD (bps) -39

4.46%

1D (bps) -11

YTD (bps) -44

23,617

1D (%) 0.00%

YTD (%) -0.60%

26,126

1D (%) -0.20%

YTD (%) 1.82%

3,541

1D (%) -0.08%

YTD (%) 1.61%

In the session on January 31, on the OMO channel, SBV provided liquidity into the market for 10 commercial banks with a value of about VND24,034 billion, with an interest rate of 6%/year with a term of 7 days.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The volume of goods exported to the US market through Vietnam's seaports ranks second in Asia;

- Proposing to make an Outlet Mall of more than 800 hectares along Nhat Tan - Noi Bai road;

- Gold price turned down on the God of Wealth Day;

- OPEC raised its forecast for world oil demand;

- IMF raised its forecast for global economic growth in 2023 to 2.9%;

- Talent, capital and wealth are moving from China to Southeast Asia.

VN30

BANK

91,900

1D 2.22%

5D -1.18%

Buy Vol. 2,269,853

Sell Vol. 2,284,494

45,100

1D 1.35%

5D -1.85%

Buy Vol. 2,905,051

Sell Vol. 2,474,257

30,500

1D 2.52%

5D -1.93%

Buy Vol. 6,234,894

Sell Vol. 5,138,267

29,400

1D 2.44%

5D 1.03%

Buy Vol. 10,736,766

Sell Vol. 8,795,697

19,450

1D 1.04%

5D -0.26%

Buy Vol. 48,468,101

Sell Vol. 39,937,446

19,550

1D 1.56%

5D -0.26%

Buy Vol. 26,522,249

Sell Vol. 26,289,810

18,650

1D 2.19%

5D 6.57%

Buy Vol. 5,810,968

Sell Vol. 5,953,905

25,000

1D 4.60%

5D 4.17%

Buy Vol. 29,949,381

Sell Vol. 19,739,835

27,100

1D 4.84%

5D 1.12%

Buy Vol. 43,828,002

Sell Vol. 37,686,914

23,550

1D 2.17%

5D 2.84%

Buy Vol. 11,682,366

Sell Vol. 9,288,356

26,050

1D 2.56%

5D 0.19%

Buy Vol. 6,219,197

Sell Vol. 5,453,818

VPB: VPB's profit before tax in Q4/2022 reached VND1,383 billion, down 47% yoy. The main reason was the sharp increase in operating expenses and provision expenses credit losses. Although business results in Q4 was not positive, VPBank still recorded a profit in 2022 up 47.7%, reaching VND21,219 billion, belonging to the list of the top 5 most profitable banks. VPB's profit mainly focused in the first months of the year, especially in Q1, VPB had a sudden profit thanks to the exclusive bancassurance agreement.

REAL ESTATE

14,200

1D 1.79%

5D 1.07%

Buy Vol. 20,119,464

Sell Vol. 26,318,621

28,000

1D 0.90%

5D 1.45%

Buy Vol. 3,656,102

Sell Vol. 3,394,519

13,850

1D 1.09%

5D -2.12%

Buy Vol. 6,503,608

Sell Vol. 7,418,881

NVL: In the whole year of 2022, NVL recorded nearly VND11,152 billion of total consolidated revenue, down 25% compared to 2021.

OIL & GAS

106,300

1D -0.28%

5D 1.72%

Buy Vol. 583,527

Sell Vol. 554,772

12,400

1D 0.40%

5D 1.64%

Buy Vol. 17,413,611

Sell Vol. 16,814,918

36,800

1D -0.67%

5D -3.16%

Buy Vol. 1,716,958

Sell Vol. 1,471,562

POW: PV Power has announced business results in Q4/2022 with net revenue of VND7,669 billion, up 113% yoy. Gross profit margin reached 14%.

VINGROUP

57,100

1D -1.04%

5D -0.52%

Buy Vol. 2,141,043

Sell Vol. 3,114,756

50,900

1D -1.17%

5D -2.49%

Buy Vol. 2,032,739

Sell Vol. 2,154,889

29,700

1D -0.34%

5D 0.17%

Buy Vol. 1,830,538

Sell Vol. 2,837,961

VIC: For the whole year of 2022, VIC recorded a net revenue of VND101,523 billion, down 19% and a net profit of VND8,352 billion, in contrast to a loss of VND2,514 billion in 2021.

FOOD & BEVERAGE

77,100

1D -2.90%

5D -5.17%

Buy Vol. 7,018,852

Sell Vol. 7,467,466

101,100

1D -0.88%

5D -0.88%

Buy Vol. 550,022

Sell Vol. 636,624

189,000

1D -0.53%

5D 1.78%

Buy Vol. 159,059

Sell Vol. 99,300

SAB: For the whole year of 2022, Sabeco's revenue reached VND34,979 billion, up 33% compared to 2021 and profit after tax reached VND5,500 billion, up 40% compared to 2021.

OTHERS

50,400

1D -0.20%

5D 1.00%

Buy Vol. 1,134,559

Sell Vol. 1,137,778

116,300

1D 2.92%

5D 1.57%

Buy Vol. 346,586

Sell Vol. 418,344

83,500

1D -0.24%

5D -0.48%

Buy Vol. 2,399,331

Sell Vol. 2,536,499

46,500

1D 0.65%

5D 1.97%

Buy Vol. 4,711,267

Sell Vol. 4,055,383

16,700

1D 1.21%

5D 2.45%

Buy Vol. 7,788,551

Sell Vol. 5,301,478

21,600

1D 2.86%

5D 1.89%

Buy Vol. 32,979,160

Sell Vol. 32,251,531

22,100

1D 1.61%

5D 4.49%

Buy Vol. 45,382,275

Sell Vol. 53,017,139

GVR: The consolidated financial statements of GVR in Q4/2022 show that net revenue reached VND9,013 billion, down nearly 7% yoy due to a decrease in selling prices. In the revenue structure, the rubber latex production and business segment contributed VND6,710 billion, accounting for 74% of total revenue and the highest in the past year.

Market by numbers

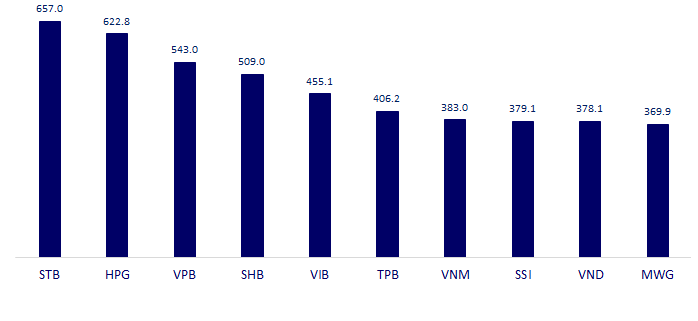

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

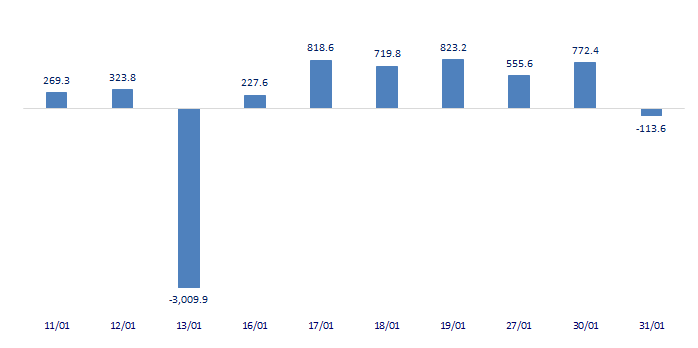

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

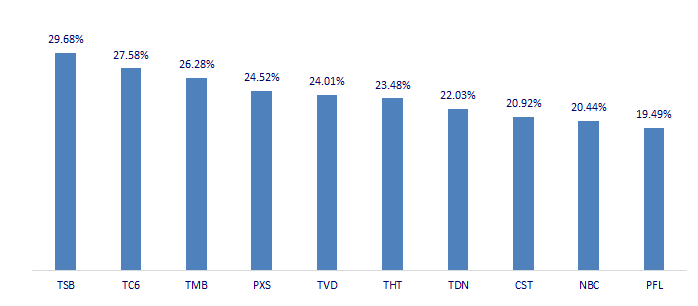

TOP INCREASES 3 CONSECUTIVE SESSIONS

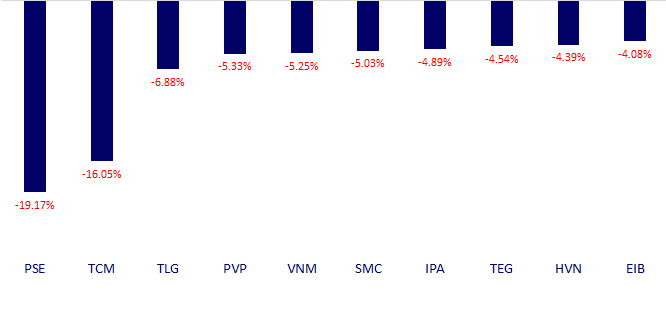

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.