Market Brief 01/02/2023

VIETNAM STOCK MARKET

1,075.97

1D -3.17%

YTD 6.84%

1,088.09

1D -3.29%

YTD 8.25%

216.01

1D -2.89%

YTD 5.21%

74.93

1D -1.20%

YTD 4.58%

131.65

1D 0.00%

YTD 0.00%

20,207.90

1D 31.18%

YTD 134.54%

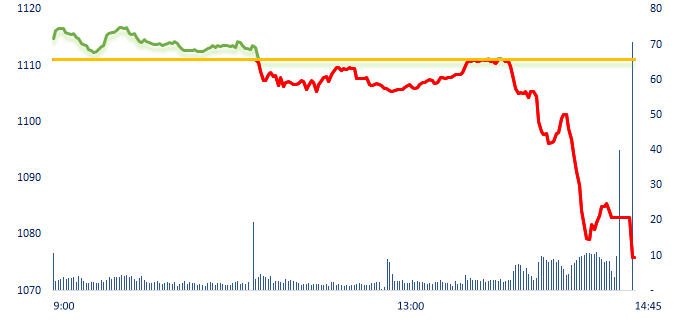

The market dropped sharply in the first session of February, the green color spread at the beginning of the morning session was not maintained when the selling pressure increased since 10 am. VN-Index fell deeply with the matching volume increased by 50% compared to yesterday and reached the highest level in the past 2 months.

ETF & DERIVATIVES

18,520

1D -3.54%

YTD 6.87%

12,850

1D -2.87%

YTD 7.80%

13,200

1D -3.72%

YTD 5.77%

15,940

1D 0.19%

YTD 13.45%

15,750

1D -2.30%

YTD 9.76%

23,710

1D -2.02%

YTD 5.85%

14,170

1D -2.41%

YTD 9.42%

1,066

1D -3.41%

YTD 0.00%

1,074

1D -3.19%

YTD 0.00%

1,085

1D -3.44%

YTD 0.00%

1,089

1D -3.24%

YTD 0.00%

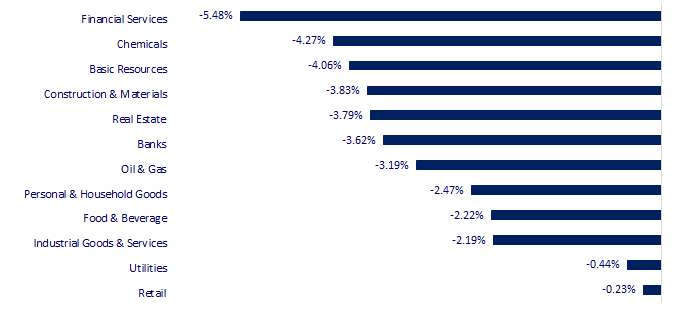

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

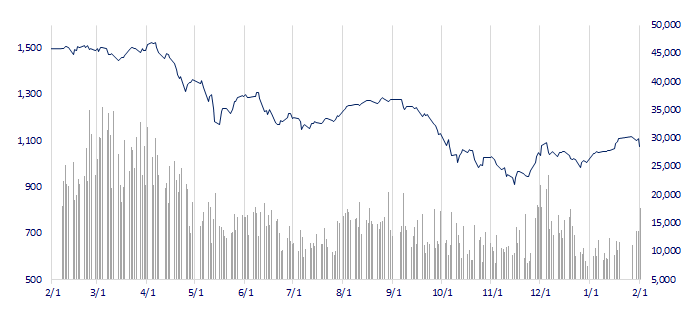

VNINDEX (12M)

GLOBAL MARKET

27,346.88

1D 0.07%

YTD 4.80%

3,284.92

1D 0.90%

YTD 6.33%

2,449.80

1D 1.02%

YTD 9.54%

22,072.18

1D 1.05%

YTD 11.58%

3,377.65

1D 0.36%

YTD 3.89%

1,685.75

1D 0.85%

YTD 0.92%

85.53

1D -0.11%

YTD -0.44%

1,941.45

1D -0.05%

YTD 6.31%

Hong Kong stocks rose despite weak economic data. Hong Kong's economy shrank for the fourth straight quarter, contracting an annual 4.2%, worse than economists' estimates as weakening global demand and higher interest rates hit exports and spending. It was the second deepest contraction since the second quarter of 2020 when gross domestic product shrank 9.4% as COVID-19 took a toll around the world.

VIETNAM ECONOMY

6.23%

1D (bps) 3

YTD (bps) 126

7.40%

4.37%

1D (bps) -3

YTD (bps) -42

4.35%

1D (bps) -11

YTD (bps) -55

23,660

1D (%) 0.18%

YTD (%) -0.42%

25,970

1D (%) -0.87%

YTD (%) 1.21%

3,549

1D (%) 0.11%

YTD (%) 1.84%

In the three days after the Tet holiday, SBV net provided about VND31,733 billion to commercial banks, mainly thanks to a large amount of bills issued before Tet due. Notably, SBV did not conduct any T-bills transactions to attract money, showing the SBV's position in supporting liquidity.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Minister of Transport accelerates the selection of contractors to build the passenger terminal at Long Thanh Airport;

- Construction steel prices increased for the third time in a row in January;

- The world's major airlines 'landed' in Vietnam;

- China's manufacturing activity grows after 4 months of decline;

- The cost of global trade increased sharply;

- Korea has a record trade deficit, the economy is close to recession.

VN30

BANK

89,100

1D -3.05%

5D -4.19%

Buy Vol. 1,711,786

Sell Vol. 1,742,961

42,800

1D -5.10%

5D -6.86%

Buy Vol. 3,352,618

Sell Vol. 4,021,045

29,000

1D -4.92%

5D -6.75%

Buy Vol. 6,654,123

Sell Vol. 8,305,533

28,200

1D -4.08%

5D -3.09%

Buy Vol. 8,600,978

Sell Vol. 10,946,149

18,300

1D -5.91%

5D -6.15%

Buy Vol. 42,605,905

Sell Vol. 69,189,361

18,900

1D -3.32%

5D -3.57%

Buy Vol. 22,705,205

Sell Vol. 31,215,648

19,000

1D 1.88%

5D 8.57%

Buy Vol. 9,319,283

Sell Vol. 9,693,746

23,700

1D -5.20%

5D -1.25%

Buy Vol. 28,352,065

Sell Vol. 23,564,847

25,650

1D -5.35%

5D -4.29%

Buy Vol. 23,653,523

Sell Vol. 30,385,606

23,600

1D 0.21%

5D 3.06%

Buy Vol. 12,490,224

Sell Vol. 12,035,175

25,200

1D -3.26%

5D -3.08%

Buy Vol. 5,281,904

Sell Vol. 6,621,391

MBB: By the end of 2022, outstanding loans to customers reached more than VND460 trillion, up 26.7% yoy, of which the separate bank's outstanding loans to customers increased by 27.5% to VND435 trillion. Total outstanding loans (including corporate bonds) increased by 25% to over VND507 trillion. Customer deposits grew by 15.3% to over VND443.6 trillion. In which, demand deposits (CASA) reached more than VND180 trillion, accounting for about 40% of total deposits.

REAL ESTATE

14,550

1D 2.46%

5D 3.56%

Buy Vol. 58,845,826

Sell Vol. 58,070,860

26,500

1D -5.36%

5D -3.99%

Buy Vol. 3,961,477

Sell Vol. 4,940,212

13,900

1D 0.36%

5D -1.77%

Buy Vol. 33,537,570

Sell Vol. 28,996,804

NVL: At the end of 2022, NVL's inventories recorded nearly VND134,485 billion, mainly coming from the investment in projects Aqua City, NovaWorld Phan Thiet, NovaWorld Ho Tram.

OIL & GAS

106,600

1D 0.28%

5D 2.01%

Buy Vol. 1,093,063

Sell Vol. 1,462,250

11,950

1D -3.63%

5D -2.05%

Buy Vol. 33,471,237

Sell Vol. 32,324,151

36,250

1D -1.49%

5D -4.61%

Buy Vol. 2,063,063

Sell Vol. 2,135,963

PLX: In Q4/2022, Petrolimex recorded net revenue of nearly VND78,400 billion, up 59% yoy, this is also the second highest in the company's history.

VINGROUP

55,200

1D -3.33%

5D -3.83%

Buy Vol. 2,400,325

Sell Vol. 3,676,690

48,000

1D -5.70%

5D -8.05%

Buy Vol. 5,029,922

Sell Vol. 4,856,090

28,000

1D -5.72%

5D -5.56%

Buy Vol. 2,460,820

Sell Vol. 3,539,395

VHM: As of December 31, total assets reached VND361,203 billion, an increase of 56% compared to the beginning of the year.

FOOD & BEVERAGE

77,200

1D 0.13%

5D -5.04%

Buy Vol. 3,055,630

Sell Vol. 2,941,499

95,200

1D -5.84%

5D -6.67%

Buy Vol. 1,414,788

Sell Vol. 1,604,182

187,000

1D -1.06%

5D 0.70%

Buy Vol. 284,921

Sell Vol. 263,692

MSN: In 2023, WCM is expected to achieve net sales in the range of VND36,000-40,500 billion, up 23% to 38% yoy.

OTHERS

50,000

1D -0.79%

5D 0.20%

Buy Vol. 2,442,639

Sell Vol. 2,290,924

113,900

1D -2.06%

5D -0.52%

Buy Vol. 474,792

Sell Vol. 513,355

82,000

1D -1.80%

5D -2.26%

Buy Vol. 1,610,808

Sell Vol. 1,979,508

47,100

1D 1.29%

5D 3.29%

Buy Vol. 10,640,279

Sell Vol. 11,459,289

15,550

1D -6.89%

5D -4.60%

Buy Vol. 4,072,706

Sell Vol. 5,518,504

20,150

1D -6.71%

5D -4.95%

Buy Vol. 38,886,009

Sell Vol. 50,469,109

21,100

1D -4.52%

5D -0.24%

Buy Vol. 73,789,644

Sell Vol. 87,396,142

BVH: Total consolidated revenue in 2022 reached VND54,459 billion, up 8.1% compared to 2021. Consolidated profit before tax and profit after tax reached VND1,988 and VND1,604 billion, respectively, completing the year plan. Total consolidated assets as of December 31 reached VND201,610 billion, up 18.9% yoy.

Market by numbers

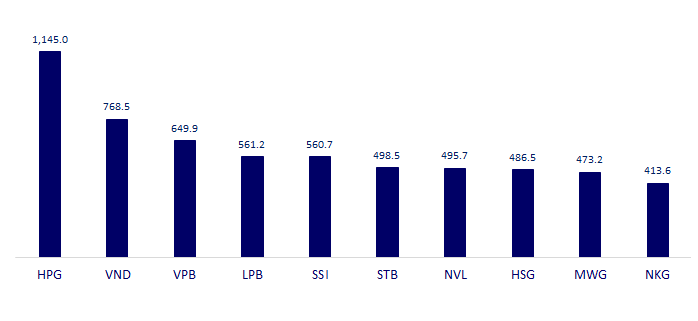

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

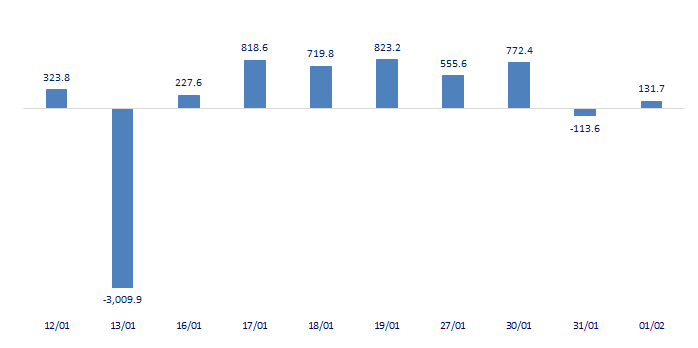

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

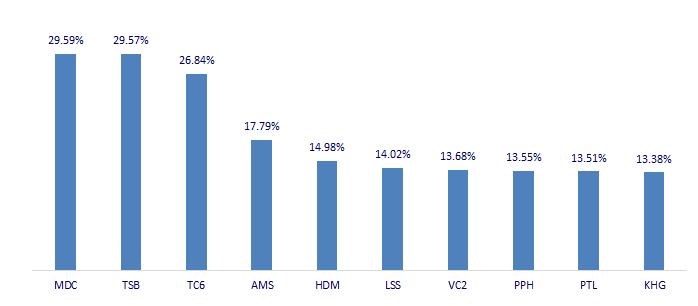

TOP INCREASES 3 CONSECUTIVE SESSIONS

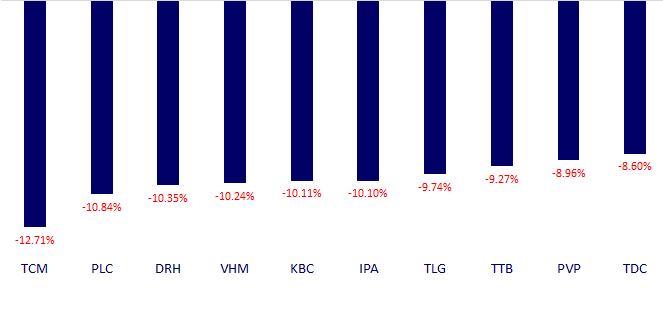

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.