Market Brief 02/02/2023

VIETNAM STOCK MARKET

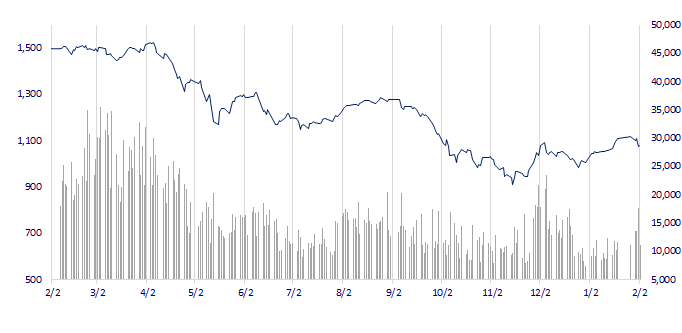

1,077.59

1D 0.15%

YTD 7.00%

1,093.48

1D 0.50%

YTD 8.78%

215.31

1D -0.32%

YTD 4.87%

74.88

1D -0.07%

YTD 4.51%

474.37

1D 0.00%

YTD 0.00%

12,794.56

1D -36.69%

YTD 48.50%

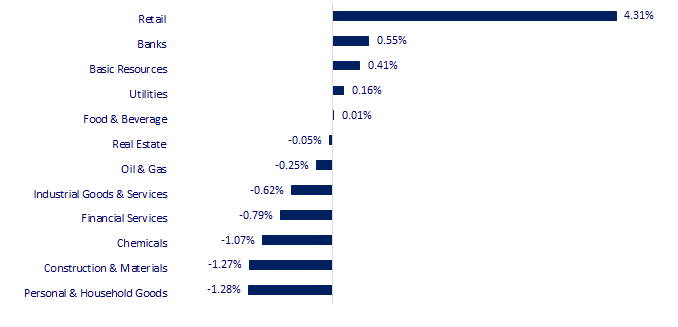

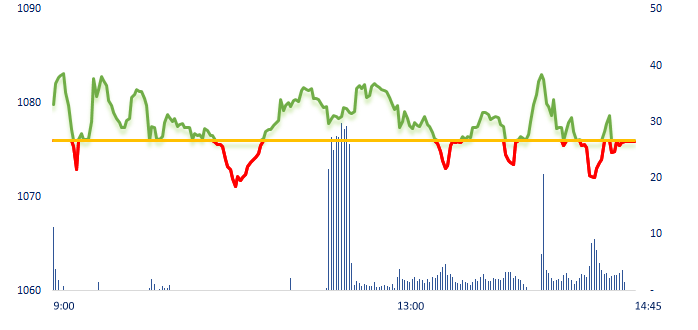

The market today experienced a mixed session, from the ATO session to the ATC session. The retail group recorded positive growth with the largest representative being the breakout of MWG. Banking stocks diverged, although many tickers were exhausted at the end of the session, in general, the banking stocks still played a leading role in the VN-Index's gains during the session.

ETF & DERIVATIVES

18,550

1D 0.16%

YTD 7.04%

12,850

1D 0.00%

YTD 7.80%

13,300

1D 0.76%

YTD 6.57%

15,900

1D -0.25%

YTD 13.17%

15,630

1D -0.76%

YTD 8.92%

23,600

1D -0.46%

YTD 5.36%

14,040

1D -0.92%

YTD 8.42%

1,067

1D 0.18%

YTD 0.00%

1,072

1D -0.20%

YTD 0.00%

1,078

1D -0.61%

YTD 0.00%

1,088

1D -0.05%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,402.05

1D 0.20%

YTD 5.01%

3,285.67

1D 0.02%

YTD 6.36%

2,468.88

1D 0.78%

YTD 10.40%

21,958.36

1D -0.52%

YTD 11.01%

3,363.68

1D -0.41%

YTD 3.46%

1,682.58

1D -0.19%

YTD 0.73%

82.78

1D -0.84%

YTD -3.64%

1,971.15

1D 0.02%

YTD 7.94%

South Korean's Kospi-Index rose despite consumer inflation ticked up in January to a three-month high, but driven mostly by temporary effects, left investors are still confident that the central bank had ended its cycle of interest rate rises. The consumer price index was 5.2% higher in January than in the same month a year before, rising faster than the 5.0% rate seen in December.

VIETNAM ECONOMY

6.20%

1D (bps) -3

YTD (bps) 123

7.40%

4.32%

1D (bps) -5

YTD (bps) -47

4.37%

1D (bps) 2

YTD (bps) -53

23,617

1D (%) -0.01%

YTD (%) -0.60%

26,517

1D (%) -0.16%

YTD (%) 3.34%

3,557

1D (%) 0.25%

YTD (%) 2.07%

Interbank interest rates have continuously increased after the Lunar New Year, reflecting the system's increased demand for liquidity. It is worth noting that the demand for liquidity of banks has tended to increase recently. Therefore, the State Bank has also suspended the issuance of bills to attract money in the past 4 sessions, but instead continuously bought valuable papers to support liquidity.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Ho Chi Minh City proposed to do 6 BOT projects of nearly VND100,000 billion;

- VASEP: Seafood exports in January decreased by 31%, not expected to recover immediately;

- With a discount of VND0, thousands of petrol and oil retailers called for help;

- Google, Baidu join the race with ChatGPT;

- The UK is expected to be the only G7 country to control interest rate hikes;

- Bank of Japan buys record amount of bonds to defend governor’s new target.

VN30

BANK

90,600

1D 1.68%

5D -2.58%

Buy Vol. 1,996,390

Sell Vol. 2,204,852

43,150

1D 0.82%

5D -6.09%

Buy Vol. 4,712,059

Sell Vol. 3,914,247

29,200

1D 0.69%

5D -6.11%

Buy Vol. 6,834,170

Sell Vol. 6,388,445

28,000

1D -0.71%

5D -3.78%

Buy Vol. 7,033,527

Sell Vol. 7,354,264

18,400

1D 0.55%

5D -5.64%

Buy Vol. 42,805,198

Sell Vol. 44,808,496

18,950

1D 0.26%

5D -3.32%

Buy Vol. 24,292,877

Sell Vol. 21,325,440

18,350

1D -3.42%

5D 4.86%

Buy Vol. 3,470,358

Sell Vol. 6,553,586

23,900

1D 0.84%

5D -0.42%

Buy Vol. 14,288,982

Sell Vol. 13,843,028

26,150

1D 1.95%

5D -2.43%

Buy Vol. 35,887,053

Sell Vol. 32,274,781

23,600

1D 0.00%

5D 3.06%

Buy Vol. 7,169,353

Sell Vol. 7,511,117

25,000

1D -0.79%

5D -3.85%

Buy Vol. 5,185,990

Sell Vol. 5,588,631

TCB: By the end of the fourth quarter of 2022, TCB has 10.8 million customers, attracting 373,000 new customers in the quarter and 1.2 million new customers in 2022. Digital banking transaction volume of individual customers in Q4/2022 reached 238.7 million transactions (up 21.7% over the same period last year).

REAL ESTATE

14,200

1D -2.41%

5D 1.07%

Buy Vol. 21,460,119

Sell Vol. 32,847,584

26,600

1D 0.38%

5D -3.62%

Buy Vol. 2,127,236

Sell Vol. 2,096,502

13,750

1D -1.08%

5D -2.83%

Buy Vol. 6,651,910

Sell Vol. 9,545,456

The supply of real estate in Ho Chi Minh City decreased due to many projects being investigated and reviewed legal procedures.

OIL & GAS

107,000

1D 0.38%

5D 2.39%

Buy Vol. 705,241

Sell Vol. 723,733

12,000

1D 0.42%

5D -1.64%

Buy Vol. 20,786,467

Sell Vol. 15,086,766

36,200

1D -0.14%

5D -4.74%

Buy Vol. 1,036,355

Sell Vol. 1,360,981

The total inventories of PLX and PV Oil has increased again to over VND20,000 billion by the end of 2022, an increase of about VND2,000 billion compared to the end of the third quarter.

VINGROUP

55,800

1D 1.09%

5D -2.79%

Buy Vol. 1,903,535

Sell Vol. 1,892,166

47,900

1D -0.21%

5D -8.24%

Buy Vol. 3,594,623

Sell Vol. 2,872,355

28,850

1D 3.04%

5D -2.70%

Buy Vol. 2,923,677

Sell Vol. 2,793,276

VinBrain (under Vingroup) has officially signed a cooperation agreement with Microsoft to develop AI-powered healthcare services.

FOOD & BEVERAGE

76,700

1D -0.65%

5D -5.66%

Buy Vol. 2,137,186

Sell Vol. 2,624,254

96,700

1D 1.58%

5D -5.20%

Buy Vol. 1,129,614

Sell Vol. 1,015,640

187,500

1D 0.27%

5D 0.97%

Buy Vol. 157,051

Sell Vol. 208,053

VNM: After 6 years, Vinamilk's profit after tax for the first time fell below the milestone of VND9,000 billion.

OTHERS

49,950

1D -0.10%

5D 0.10%

Buy Vol. 1,223,029

Sell Vol. 1,037,276

112,000

1D -1.67%

5D -2.18%

Buy Vol. 405,702

Sell Vol. 461,131

81,900

1D -0.12%

5D -2.38%

Buy Vol. 3,328,265

Sell Vol. 2,033,492

49,900

1D 5.94%

5D 9.43%

Buy Vol. 5,946,201

Sell Vol. 6,008,510

15,250

1D -1.93%

5D -6.44%

Buy Vol. 4,115,865

Sell Vol. 3,984,538

20,150

1D 0.00%

5D -4.95%

Buy Vol. 25,718,646

Sell Vol. 25,742,593

21,300

1D 0.95%

5D 0.71%

Buy Vol. 49,587,087

Sell Vol. 49,475,373

FPT: Long Chau pharmacy under FRT (an associate company of FPT) said that the number of drug stores with revenue by the end of 2022 is 937. Long Chau's revenue reached VND9,596 billion, an increase of 2.4 times compared to 2021. As a result, Long Chau is becoming a new growth engine of FPT Retail, when the revenue of the FPT Shop increased by only 11% compared to last year.

Market by numbers

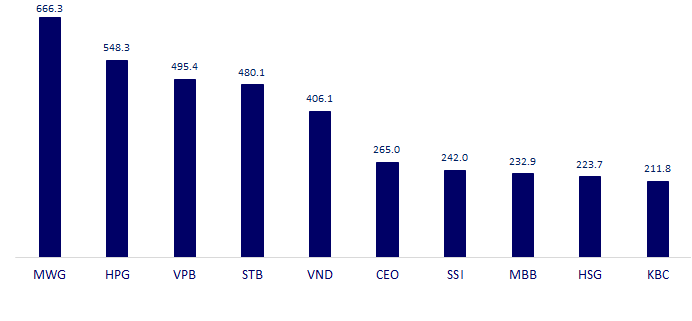

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

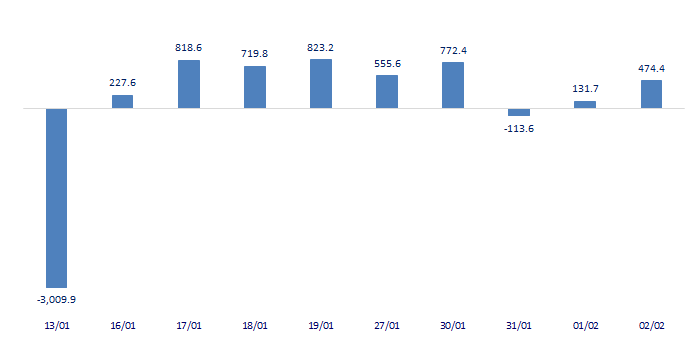

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

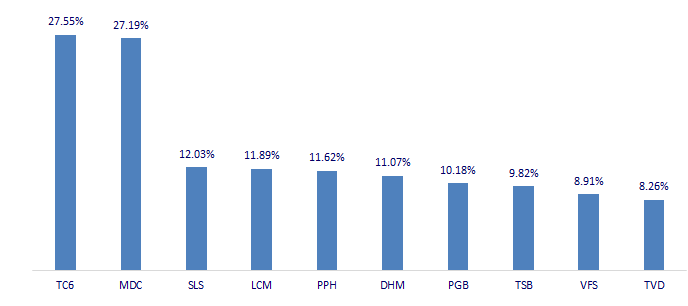

TOP INCREASES 3 CONSECUTIVE SESSIONS

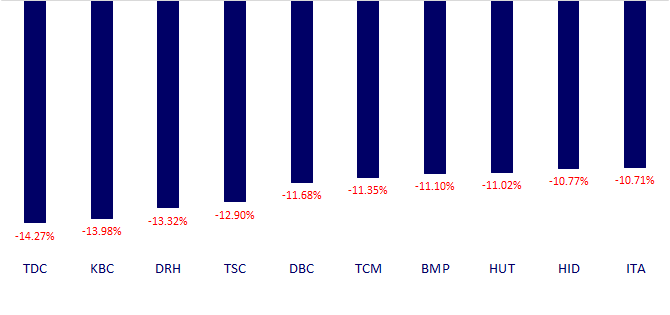

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.