Market Brief 16/02/2023

VIETNAM STOCK MARKET

1,058.29

1D 0.96%

YTD 5.08%

1,055.26

1D 1.14%

YTD 4.98%

210.84

1D 1.38%

YTD 2.69%

79.66

1D 0.24%

YTD 11.18%

-92.98

1D 0.00%

YTD 0.00%

10,164.76

1D -9.47%

YTD 17.98%

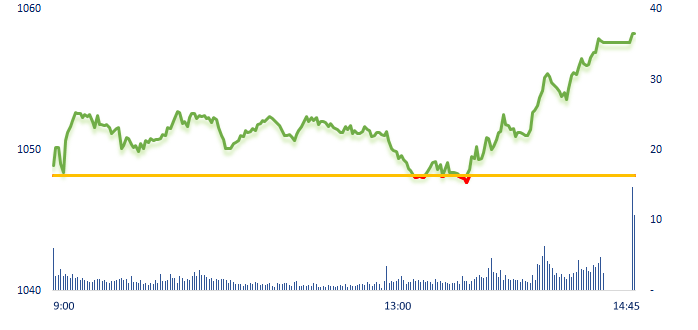

Almost the whole derivatives maturity session, the market was cautious then the main index suddenly rebounded strongly before closing. After reporting the highest profit in 15 quarters, PVS impressed with a gain of 6.88%, some tickers in the oil and gas group followed like PVD (+4.49%), BSR (+5.73%), PVT ( +3.55%). Foreign investors continued to be a slight net selling, they focused on selling STB (VND83.45 billion).

ETF & DERIVATIVES

17,920

1D 1.01%

YTD 3.40%

12,450

1D 1.55%

YTD 4.45%

12,860

1D 0.39%

YTD 3.04%

15,650

1D 1.10%

YTD 11.39%

14,860

1D 0.34%

YTD 3.55%

22,930

1D 1.24%

YTD 2.37%

13,370

1D 1.29%

YTD 3.24%

1,045

1D 1.63%

YTD 0.00%

1,049

1D 1.51%

YTD 0.00%

1,055

1D 1.74%

YTD 0.00%

1,052

1D 1.48%

YTD 0.00%

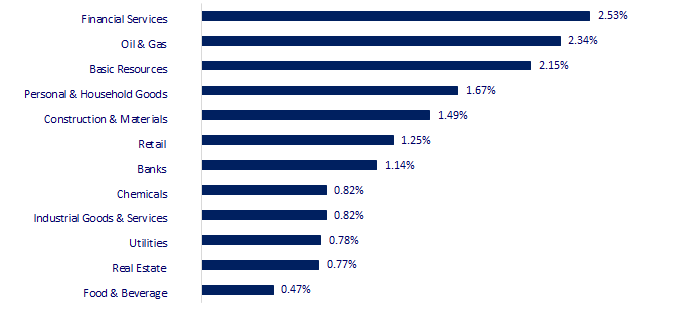

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

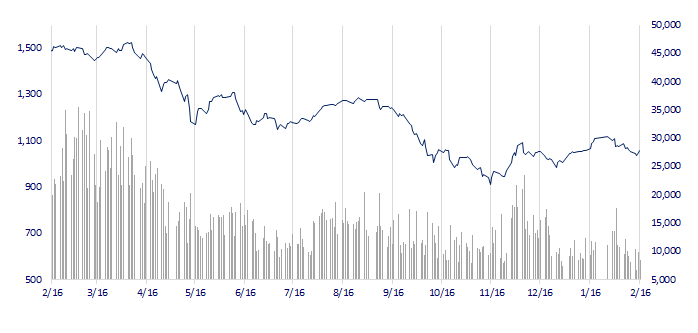

VNINDEX (12M)

GLOBAL MARKET

27,696.44

1D 0.71%

YTD 6.14%

3,249.03

1D -0.96%

YTD 5.17%

2,475.48

1D 1.96%

YTD 10.69%

20,987.67

1D 0.84%

YTD 6.10%

3,311.23

1D 0.93%

YTD 1.84%

1,658.29

1D 0.66%

YTD -0.72%

85.14

1D -0.40%

YTD -0.90%

1,847.15

1D 0.01%

YTD 1.15%

Asian stocks rose after the latest retail sales report showed US consumer confidence remained stable, despite high inflation and the US Federal Reserve could continue to raise interest rates. In the session of February 16, Korean stocks led the gain thanks to the push of large-cap auto and technology stocks in the country.

VIETNAM ECONOMY

4.76%

1D (bps) 66

YTD (bps) -21

7.40%

3.96%

1D (bps) 5

YTD (bps) -83

4.08%

1D (bps) -1

YTD (bps) -82

23,940

1D (%) 0.61%

YTD (%) 0.76%

25,855

1D (%) -0.51%

YTD (%) 0.76%

3,531

1D (%) 0.40%

YTD (%) 1.32%

Most commercial banks have started to increase the exchange rate strongly in the afternoon session today. Although the exchange rate movement has continued to increase recently, on the other hand, analysts believe that Vietnam currently has favorable conditions to stabilize the exchange rate in 2023, and this is allowing SBV to buy USD to replenish foreign exchange reserves. It is estimated that SBV has bought about USD3.6 billion since the beginning of 2023.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Vietnamese coffee dropped in market share in China;

- Hanoi will set up a scheme to exploit and use the F1 racetrack;

- Vietnam - China trade exceeds USD11 billion;

- China's oil buying spree a boost for global demand outlook;

- US retail sales recover strongest since 2021;

- The ECB will continue to raise interest rates by 0.5 percentage points in March 2023.

VN30

BANK

92,400

1D -0.65%

5D -0.65%

Buy Vol. 1,445,570

Sell Vol. 1,495,996

45,000

1D 2.27%

5D 2.27%

Buy Vol. 2,073,267

Sell Vol. 2,261,329

29,700

1D 2.77%

5D 1.02%

Buy Vol. 4,517,028

Sell Vol. 5,672,929

27,900

1D 1.82%

5D 2.20%

Buy Vol. 3,960,255

Sell Vol. 4,068,787

17,500

1D 1.74%

5D -2.78%

Buy Vol. 23,724,502

Sell Vol. 23,259,702

18,250

1D 1.39%

5D -1.08%

Buy Vol. 10,933,159

Sell Vol. 10,069,365

18,500

1D 3.93%

5D 1.65%

Buy Vol. 4,698,327

Sell Vol. 4,607,947

24,000

1D 0.84%

5D -1.03%

Buy Vol. 7,107,711

Sell Vol. 7,572,525

23,900

1D 2.36%

5D -2.25%

Buy Vol. 39,029,148

Sell Vol. 24,716,819

20,900

1D 0.97%

5D -5.00%

Buy Vol. 4,594,353

Sell Vol. 4,176,337

24,800

1D 1.02%

5D 1.22%

Buy Vol. 3,311,285

Sell Vol. 3,272,026

STB: STB has reported to the State Securities Commission of Vietnam, Vietnam Securities Depository and HOSE, saying that STB has never asked to increase foreign room to 30% and asked VSD to reduce it to more than 23.63% according to the announcement on September 19, 2016. STB said that on November 12, 2015, SBV has approved the merger of Sacombank with the Southern Commercial Joint Stock Bank with 400 million shares issued due to the M&A. After that, VSD announced: As of September 19, 2016, the foreign ownership ratio limit for STB is 23.63468% of the total listed shares after the merger is more than 1,885 million shares.

REAL ESTATE

11,500

1D 3.14%

5D -18.73%

Buy Vol. 35,114,319

Sell Vol. 25,969,662

85,000

1D 0.12%

5D 0.35%

Buy Vol. 169,320

Sell Vol. 184,139

11,000

1D 0.92%

5D -8.71%

Buy Vol. 9,188,006

Sell Vol. 8,954,817

PDR: Phat Dat proposes urban planning on an area of 546 hectares in Di Linh, Lam Dong.

OIL & GAS

107,900

1D 0.75%

5D -0.19%

Buy Vol. 888,669

Sell Vol. 773,064

12,350

1D 2.92%

5D 2.92%

Buy Vol. 27,807,083

Sell Vol. 24,214,331

39,000

1D 0.65%

5D 2.90%

Buy Vol. 1,282,103

Sell Vol. 1,511,885

POW: Revenue in January only reached 85% of the plan. During the Lunar New Year, demand for electrical load drops sharply, power plants (especially thermal power plants) operate with low output.

VINGROUP

53,400

1D 0.95%

5D -1.48%

Buy Vol. 5,627,673

Sell Vol. 4,679,286

42,500

1D 0.00%

5D -6.18%

Buy Vol. 4,250,152

Sell Vol. 3,255,211

28,400

1D 0.18%

5D 0.71%

Buy Vol. 1,990,370

Sell Vol. 2,039,298

VIC: According to Bloomberg, VinFast has cut about 80 employees in North America, including the American CFO.

FOOD & BEVERAGE

76,500

1D 0.66%

5D 2.00%

Buy Vol. 1,471,790

Sell Vol. 1,695,732

92,900

1D -0.11%

5D 1.20%

Buy Vol. 645,815

Sell Vol. 763,124

189,700

1D 0.37%

5D -2.12%

Buy Vol. 81,711

Sell Vol. 59,160

VNM: The farm project in Lao - Jargo (currently has 1,000 dairy cows and is expected to import 4,000 additionally) is expected to launch products in 2023.

OTHERS

50,100

1D 1.42%

5D 1.52%

Buy Vol. 1,042,047

Sell Vol. 820,002

102,800

1D 0.10%

5D 0.88%

Buy Vol. 262,654

Sell Vol. 208,266

81,600

1D 0.00%

5D 1.12%

Buy Vol. 1,202,284

Sell Vol. 2,131,164

43,300

1D 1.29%

5D -1.59%

Buy Vol. 2,108,831

Sell Vol. 1,943,103

14,750

1D 1.72%

5D -1.34%

Buy Vol. 2,864,281

Sell Vol. 2,388,601

19,500

1D 2.09%

5D 0.78%

Buy Vol. 19,421,295

Sell Vol. 20,682,364

21,300

1D 2.40%

5D 3.40%

Buy Vol. 45,479,772

Sell Vol. 46,880,595

MWG: A member of Arisaig Partners Fund (Singapore) bought more than 4 million shares of MWG, a fund specializing in investment in the field of consumer goods, with a scale of more than billion dollars. The fund group mainly focuses on leading enterprises in the industry, with competitive advantages and high returns. Arisaig Partners currently has 4 members, of which Arisaig Asia Fund is the largest fund, holding nearly 104 million MWG shares.

Market by numbers

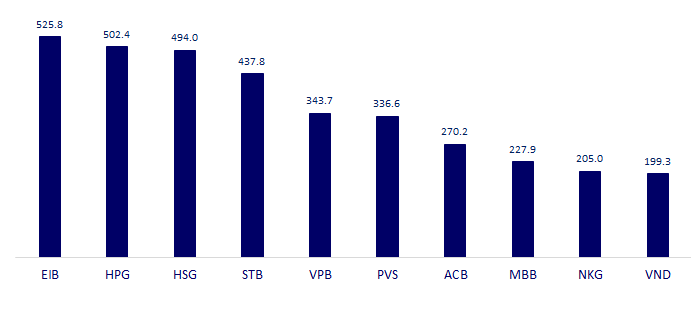

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

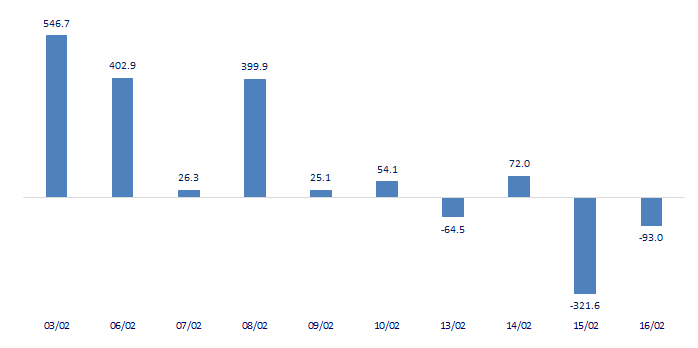

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

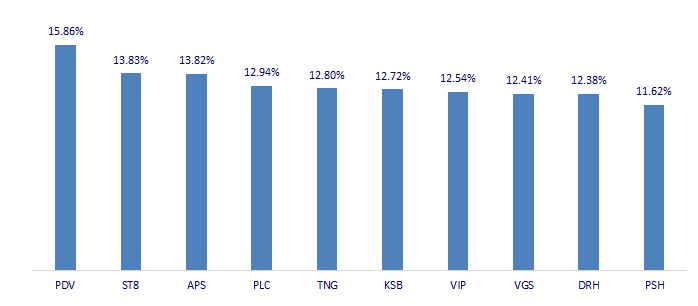

TOP INCREASES 3 CONSECUTIVE SESSIONS

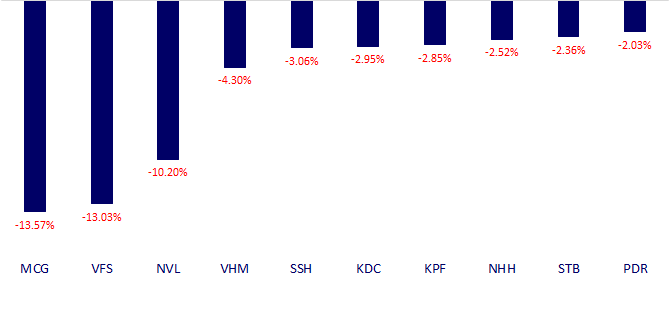

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.