Market Brief 15/03/2023

VIETNAM STOCK MARKET

1,062.19

1D 2.12%

YTD 5.47%

1,064.38

1D 2.61%

YTD 5.89%

207.01

1D 2.20%

YTD 0.83%

76.59

1D 1.08%

YTD 6.89%

249.14

1D 0.00%

YTD 0.00%

12,233.06

1D 1.64%

YTD 41.98%

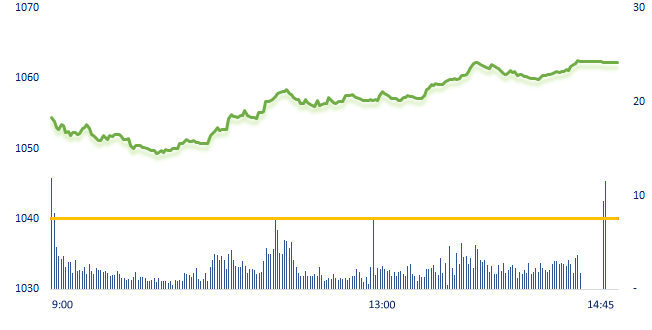

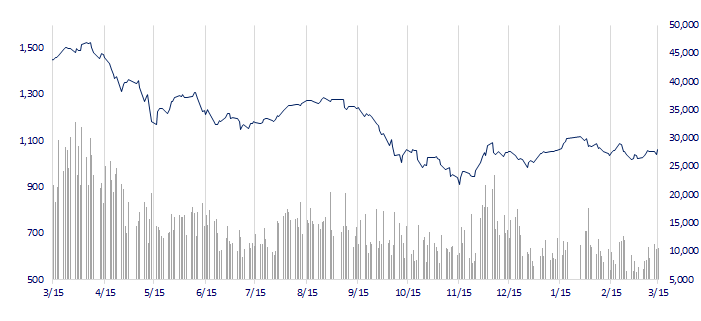

The SBV's decision to reduce interest rates had a positive impact on the securities industry. Many stocks hit ceiling price since the morning such as SSI, VND, FTS, VCI. VNIndex had a prosperous session when both the index and trading volume improved compared to the average of the previous 5 sessions. However, on the weekly time frame, VNIndex still has a resistance around 1,100 points.

ETF & DERIVATIVES

18,120

1D 2.72%

YTD 4.56%

12,550

1D 2.62%

YTD 5.29%

13,010

1D 2.52%

YTD 4.25%

15,950

1D -0.87%

YTD 13.52%

15,370

1D 2.60%

YTD 7.11%

22,320

1D 1.50%

YTD -0.36%

13,360

1D 1.21%

YTD 3.17%

1,057

1D 2.82%

YTD 0.00%

1,055

1D 2.53%

YTD 0.00%

1,063

1D 2.79%

YTD 0.00%

1,063

1D 2.42%

YTD 0.00%

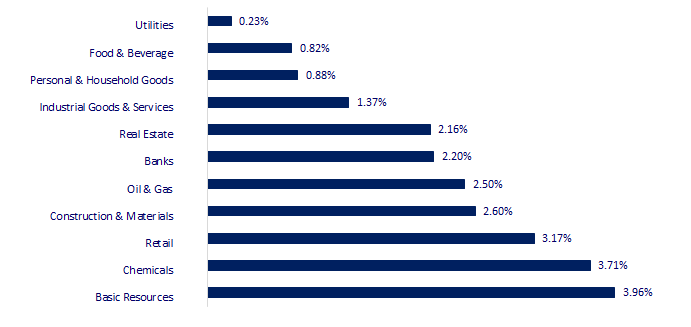

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,229.48

1D 0.03%

YTD 4.35%

3,263.31

1D 0.55%

YTD 5.63%

2,379.72

1D 1.31%

YTD 6.41%

19,539.87

1D 1.52%

YTD -1.22%

3,172.92

1D 1.38%

YTD -2.41%

1,565.00

1D 2.70%

YTD -6.31%

77.55

1D -0.89%

YTD -9.73%

1,911.15

1D 0.23%

YTD 4.65%

China's economic activity picked up in the first two months of 2023 as consumption and infrastructure investment drove recovery from pandemic disruption, despite challenges of weak global demand and a persistent downturn in the property sector. This sent Chinese stocks up sharply today.

VIETNAM ECONOMY

5.13%

1D (bps) -59

YTD (bps) 16

7.40%

3.98%

YTD (bps) -81

4.10%

1D (bps) -3

YTD (bps) -80

23,775

1D (%) 0.17%

YTD (%) 0.06%

25,573

1D (%) -1.72%

YTD (%) -0.34%

3,484

1D (%) -0.43%

YTD (%) -0.03%

Interbank interest rates has been on a downward trend, showing that the money market is basically stable and the liquidity of the banking system is more abundant. Besides, the pressure on the exchange rate and inflation also showed signs of decreasing which are some of the reasons for the State Bank to make the decision to reduce interest rates on March 14.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Interest rate on March 15: Big4 reduced 12-month term interest rate to 7.2%;

- As of March 9, credit growth reached 1.12%;

- Renewable energy companies are urging Vietnam’s government to change power price polices that threaten bankruptcy for generators;

- After the collapse of SVB, tens of billions of dollars of deposits flowed to the largest banks in the US;

- Moody's cuts outlook on U.S. banking system to negative;

- The UK unemployment rate remains at a record low.

VN30

BANK

91,400

1D 0.44%

5D -0.87%

Buy Vol. 1,326,665

Sell Vol. 1,384,786

46,800

1D 3.88%

5D -2.50%

Buy Vol. 1,650,764

Sell Vol. 1,455,878

29,500

1D 1.72%

5D 0.34%

Buy Vol. 4,503,053

Sell Vol. 6,042,857

27,200

1D 3.42%

5D -0.37%

Buy Vol. 4,644,432

Sell Vol. 4,935,722

19,800

1D 2.06%

5D 9.09%

Buy Vol. 36,878,807

Sell Vol. 44,055,165

17,800

1D 3.49%

5D 1.14%

Buy Vol. 15,533,199

Sell Vol. 12,864,708

18,500

1D 2.49%

5D -0.54%

Buy Vol. 3,597,358

Sell Vol. 4,003,730

24,650

1D 1.86%

5D 2.92%

Buy Vol. 15,569,261

Sell Vol. 16,795,361

25,350

1D 3.89%

5D 0.00%

Buy Vol. 44,784,884

Sell Vol. 35,182,248

21,400

1D 5.68%

5D 3.38%

Buy Vol. 15,228,829

Sell Vol. 10,251,563

24,800

1D 3.12%

5D -0.80%

Buy Vol. 3,239,744

Sell Vol. 4,354,075

VIB: At the General Meeting of Shareholders on March 14, VIB announced that it will pay dividends and bonus shares to shareholders at the rate of 15% in cash and 20% in shares. Accordingly, VIB will increase the charter capital from nearly VND21,077 billion to more than VND25,368 billion. In addition, VIB will also issue 7.6 million shares under the ESOP with a year restriction on transfer.

REAL ESTATE

11,350

1D 6.07%

5D 2.71%

Buy Vol. 37,761,933

Sell Vol. 30,851,729

83,200

1D 0.12%

5D -1.54%

Buy Vol. 211,134

Sell Vol. 185,384

12,250

1D 3.81%

5D 3.38%

Buy Vol. 21,501,508

Sell Vol. 17,816,961

In the first 2 months of the year, the demand of the real estate market decreased, only by 2% over the same period.

OIL & GAS

107,000

1D -0.65%

5D 1.04%

Buy Vol. 334,009

Sell Vol. 642,295

13,500

1D 5.06%

5D 5.88%

Buy Vol. 33,750,489

Sell Vol. 28,660,767

37,650

1D 1.48%

5D -3.21%

Buy Vol. 1,375,343

Sell Vol. 1,038,968

In the morning of March 15, Brent crude oil price jumped more than 1% after falling to the lowest level in 2023 yesterday.

VINGROUP

54,000

1D 1.89%

5D 1.89%

Buy Vol. 1,814,051

Sell Vol. 1,884,014

46,000

1D 2.79%

5D 8.62%

Buy Vol. 3,571,036

Sell Vol. 3,765,251

28,500

1D -1.04%

5D 4.59%

Buy Vol. 8,351,284

Sell Vol. 5,977,955

VIC: VinFast has received a permit from the North Carolina Department of Environmental Quality, allowing the first stage of construction to proceed.

FOOD & BEVERAGE

77,100

1D 0.65%

5D 0.78%

Buy Vol. 2,692,956

Sell Vol. 2,910,028

84,700

1D 1.32%

5D 5.35%

Buy Vol. 1,533,322

Sell Vol. 1,543,834

189,500

1D -0.26%

5D 1.61%

Buy Vol. 458,818

Sell Vol. 376,734

MSN: For the whole year of 2022, the revenue of Phuc Long's kiosk system and mini-store only reached about 27% of the system's revenue.

OTHERS

49,300

1D 1.23%

5D 0.61%

Buy Vol. 628,664

Sell Vol. 638,166

104,900

1D 3.15%

5D 6.71%

Buy Vol. 373,721

Sell Vol. 381,308

80,500

1D 2.29%

5D 1.26%

Buy Vol. 1,416,864

Sell Vol. 1,406,715

40,000

1D 3.63%

5D 1.52%

Buy Vol. 3,070,014

Sell Vol. 3,391,661

15,200

1D 6.29%

5D 4.83%

Buy Vol. 4,824,689

Sell Vol. 3,927,441

20,350

1D 6.82%

5D 2.78%

Buy Vol. 51,575,210

Sell Vol. 35,466,361

21,300

1D 4.93%

5D 0.47%

Buy Vol. 49,879,781

Sell Vol. 41,110,891

SSI: In the evening of March 14, the SBV issued two decisions to reduce regulatory interest rates by 0.5% to 1%, causing a positive effect for the securities industry. Specifically, in the session of March 15, most securities stocks increased sharply. Notably, SSI rose to the ceiling price since the morning session.

Market by numbers

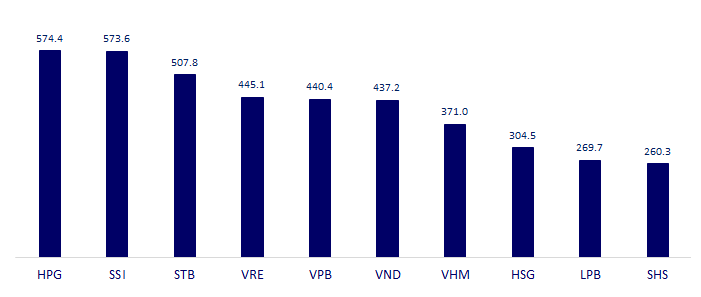

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

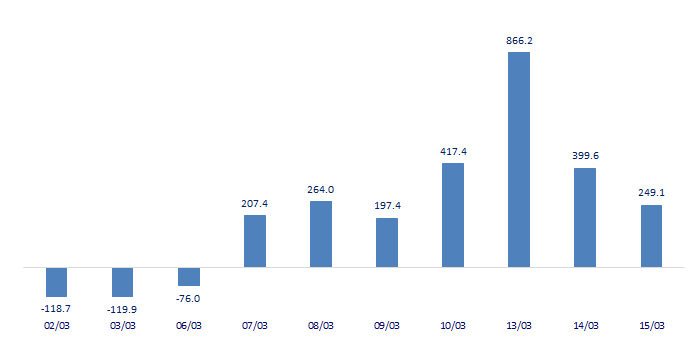

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

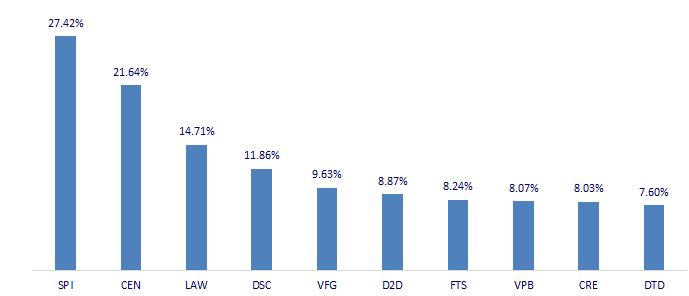

TOP INCREASES 3 CONSECUTIVE SESSIONS

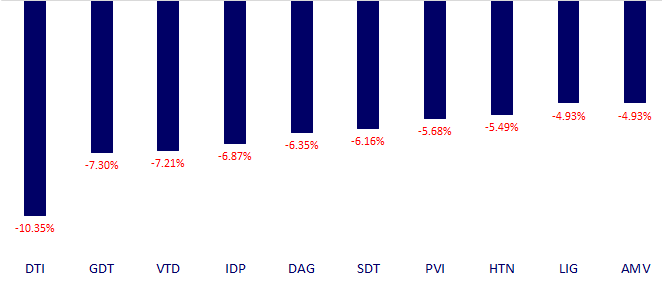

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.