Market Brief 16/03/2023

VIETNAM STOCK MARKET

1,047.40

1D -1.39%

YTD 4.00%

1,046.99

1D -1.63%

YTD 4.16%

204.19

1D -1.36%

YTD -0.55%

76.02

1D -0.74%

YTD 6.10%

87.82

1D 0.00%

YTD 0.00%

10,550.67

1D -13.75%

YTD 22.46%

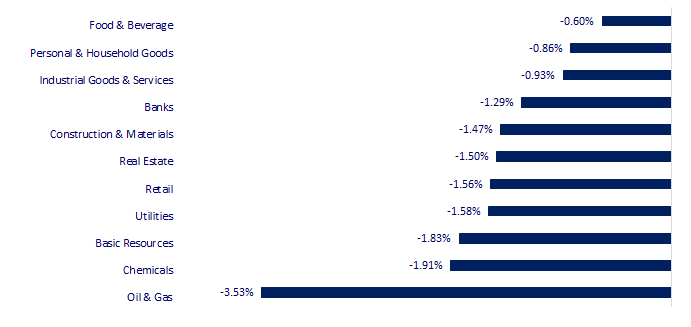

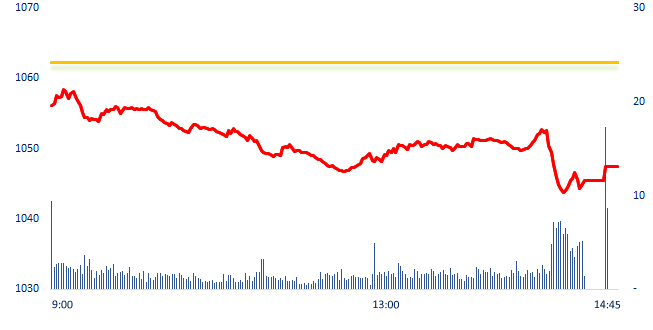

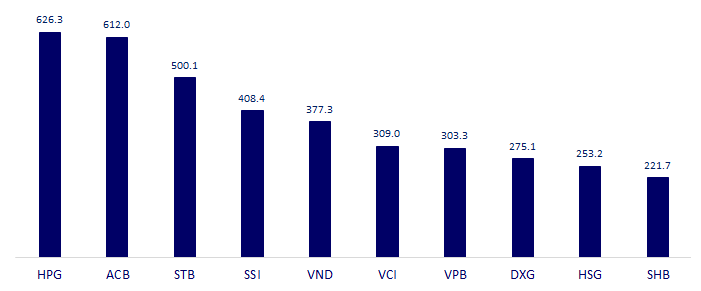

Stocks fell deeply when investors' sentiment was concerned that the Vietnamese market would be affected if Credit Suisse collapsed. Oil and gas was the biggest loser today with a decrease of 3.53%, in the context that the price of Brent oil dropped to the lowest level since the beginning of 2022. Foreign investors net bought VND87.3 billion on HOSE, focused on steel stocks: HPG and HSG.

ETF & DERIVATIVES

17,770

1D -1.93%

YTD 2.54%

12,330

1D -1.75%

YTD 3.44%

12,820

1D -1.46%

YTD 2.72%

15,540

1D -2.57%

YTD 10.60%

15,110

1D -1.69%

YTD 5.30%

21,950

1D -1.66%

YTD -2.01%

13,180

1D -1.35%

YTD 1.78%

1,041

1D -1.51%

YTD 0.00%

1,042

1D -1.24%

YTD 0.00%

1,048

1D -1.46%

YTD 0.00%

1,043

1D -1.88%

YTD 0.00%

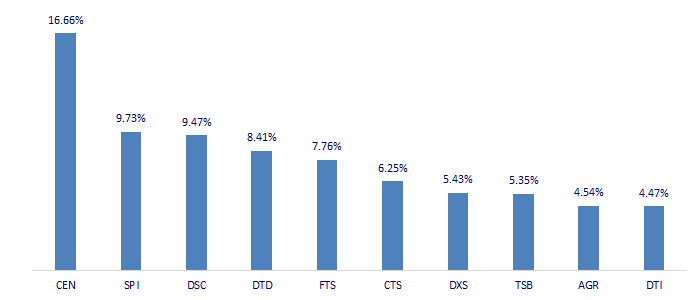

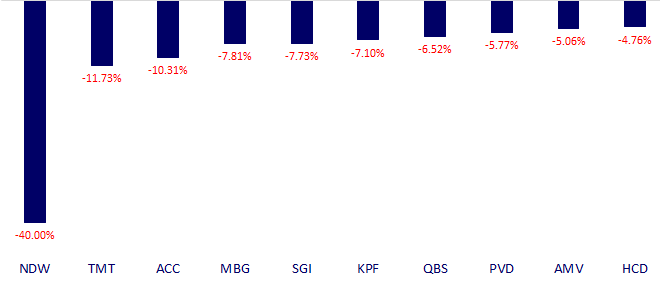

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

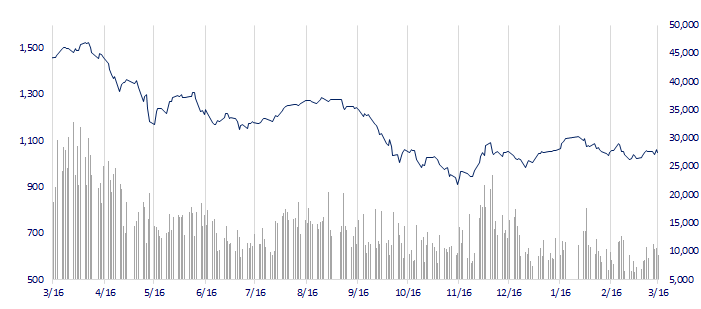

VNINDEX (12M)

GLOBAL MARKET

27,010.61

1D -0.80%

YTD 3.51%

3,226.89

1D -1.12%

YTD 4.46%

2,377.91

1D -0.08%

YTD 6.33%

19,203.91

1D -1.72%

YTD -2.92%

3,155.54

1D -0.55%

YTD -2.95%

1,554.65

1D -0.66%

YTD -6.93%

73.56

1D -1.06%

YTD -14.38%

1,928.15

1D 0.71%

YTD 5.58%

Gold prices edged up on Thursday, helped by a weaker dollar, but prices held below last session's 6-week peak as risk sentiment improved after Credit Suisse, the latest focal point of a potential banking crisis, secured funds.

VIETNAM ECONOMY

4.17%

1D (bps) -96

YTD (bps) -80

7.40%

3.89%

1D (bps) -9

YTD (bps) -90

4.00%

1D (bps) -10

YTD (bps) -90

23,780

1D (%) 0.19%

YTD (%) 0.08%

25,462

1D (%) -0.89%

YTD (%) -0.77%

3,487

1D (%) 0.14%

YTD (%) 0.06%

Interbank interest rate continued to cool down in the context of excess liquidity in the banking system. Besides, lending interest rate is also decreasing gradually according to operating interest rate. This will help reduce the pressure on financial expenses of businesses, and at the same time, credit growth is expected to be better in the coming time.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The Ministry of Transport proposes to the Government to allow genuine maintenance facilities to register automobiles;

- Can Tho will invest VND180,000 billion in industrial development;

- In the first two months of the year, Ho Chi Minh City disbursed only 1% of government spending;

- Credit Suisse wants to borrow nearly USD54 billion from Swiss National Bank;

- The world gold price increased steeply;

- China's crude steel output has recovered.

VN30

BANK

91,000

1D -0.44%

5D -2.15%

Buy Vol. 1,282,381

Sell Vol. 1,701,413

46,250

1D -1.18%

5D -2.94%

Buy Vol. 1,448,768

Sell Vol. 1,633,594

28,950

1D -1.86%

5D -1.53%

Buy Vol. 3,524,243

Sell Vol. 4,603,634

26,750

1D -1.65%

5D -3.78%

Buy Vol. 4,313,438

Sell Vol. 4,616,680

19,450

1D -1.77%

5D 6.87%

Buy Vol. 23,856,939

Sell Vol. 32,763,775

17,450

1D -1.97%

5D -1.97%

Buy Vol. 13,406,326

Sell Vol. 13,562,209

17,850

1D -3.51%

5D -3.51%

Buy Vol. 3,293,774

Sell Vol. 5,516,706

24,650

1D 0.00%

5D 0.61%

Buy Vol. 7,503,779

Sell Vol. 6,320,548

24,600

1D -2.96%

5D -7.17%

Buy Vol. 37,125,972

Sell Vol. 41,864,223

20,900

1D -2.34%

5D -1.42%

Buy Vol. 6,301,556

Sell Vol. 6,100,870

24,400

1D -1.61%

5D -3.75%

Buy Vol. 4,870,502

Sell Vol. 5,389,415

Under the draft revised Law on Credit Institutions, the State Bank asked for opinions on tightening the limit on lending and the percentage of share ownership of one or a group of shareholders at the bank. Specifically, the credit limit for a customer is expected to decrease from 15% as to 10%, based on the tier 1 capital and must not exceed 15% of the commercial bank's tier 1 capital, a decrease of 25% compared to current regulations.

REAL ESTATE

11,150

1D -1.76%

5D 1.83%

Buy Vol. 22,801,725

Sell Vol. 25,024,267

82,200

1D -1.20%

5D -2.14%

Buy Vol. 198,879

Sell Vol. 224,670

12,200

1D -0.41%

5D 1.67%

Buy Vol. 8,969,085

Sell Vol. 11,170,995

BCM: Becamex IDC transferred more than 22,000 m2 of land at the project in Binh Duong province.

OIL & GAS

104,600

1D -2.24%

5D -2.06%

Buy Vol. 594,930

Sell Vol. 516,293

13,250

1D -1.85%

5D 1.92%

Buy Vol. 33,069,220

Sell Vol. 23,410,906

36,350

1D -3.45%

5D -6.79%

Buy Vol. 2,390,093

Sell Vol. 1,968,914

POW: PV Power's profit (POW) increased by nearly VND230 billion after the audit.

VINGROUP

53,300

1D -1.30%

5D 0.57%

Buy Vol. 4,554,536

Sell Vol. 5,767,796

44,500

1D -3.26%

5D 4.95%

Buy Vol. 2,911,453

Sell Vol. 3,918,916

28,950

1D 1.58%

5D 7.22%

Buy Vol. 4,173,249

Sell Vol. 4,975,985

VIC: Chairman Pham Nhat Vuong has just announced that he plans to transfer 50.8 million VIC shares to contribute capital to Smart and Green Moving JSC (GSM).

FOOD & BEVERAGE

76,400

1D -0.91%

5D -0.13%

Buy Vol. 2,267,510

Sell Vol. 3,319,046

83,800

1D -1.06%

5D 3.71%

Buy Vol. 1,214,534

Sell Vol. 1,706,117

191,000

1D 0.79%

5D 2.41%

Buy Vol. 515,304

Sell Vol. 427,205

MSN: The Fubon FTSE Vietnam ETF is expected to increase MSN's weight in the portfolio to 9.32% from 8.55%.

OTHERS

48,600

1D -1.42%

5D -1.72%

Buy Vol. 333,736

Sell Vol. 379,178

102,000

1D -2.76%

5D 0.20%

Buy Vol. 429,734

Sell Vol. 638,120

79,200

1D -1.61%

5D -1.74%

Buy Vol. 1,671,054

Sell Vol. 1,579,412

39,400

1D -1.50%

5D -1.50%

Buy Vol. 2,552,812

Sell Vol. 3,208,053

14,850

1D -2.30%

5D -1.98%

Buy Vol. 2,984,218

Sell Vol. 4,339,723

20,150

1D -0.98%

5D 1.77%

Buy Vol. 40,047,839

Sell Vol. 42,904,679

20,850

1D -2.11%

5D -1.65%

Buy Vol. 51,203,651

Sell Vol. 57,201,488

FPT Long Chau and Novartis Vietnam implemented a pharmacist training program.

Market by numbers

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

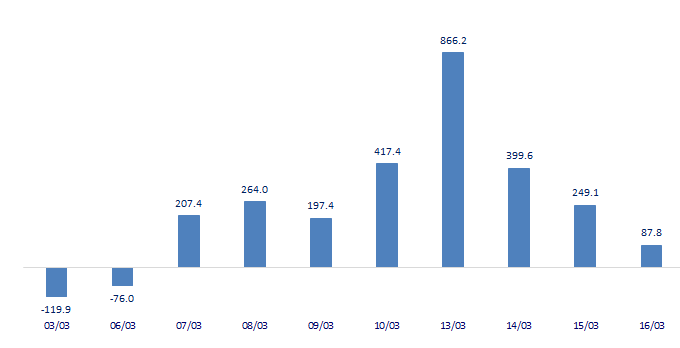

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.