Market brief 20/03/2023

VIETNAM STOCK MARKET

1,023.10

1D -2.11%

YTD 1.59%

1,024.50

1D -2.22%

YTD 1.92%

201.62

1D -1.39%

YTD -1.80%

76.02

1D -0.54%

YTD 6.10%

-331.99

1D 0.00%

YTD 0.00%

10,994.47

1D -3.03%

YTD 27.61%

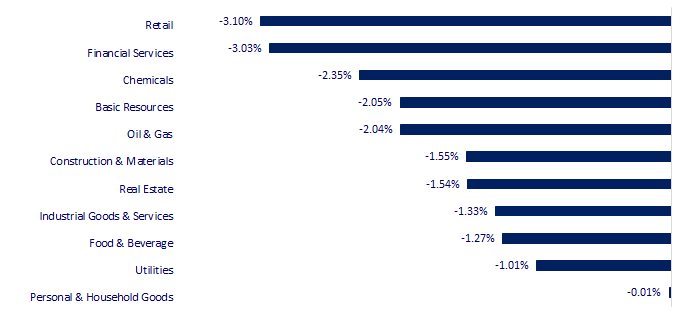

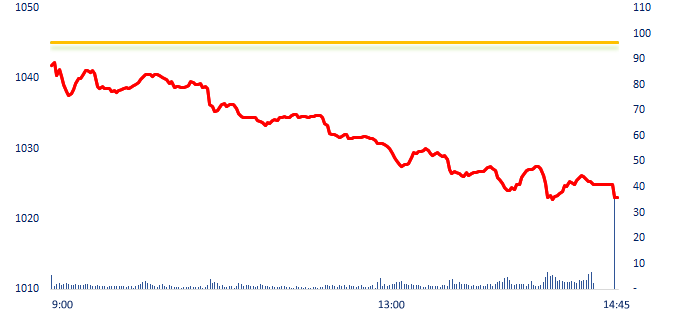

VN-Index was in red at the beginning and decreased gradually until the end of the session. All sectors dropped today, especially retails, financial services, and banks with typical stocks such as FRT, MWG, SSI, TPB, VCB, etc. However, there were still a few rare stocks that went upstream compared to the market, including PNJ when the world gold price surpassed the peak.

ETF & DERIVATIVES

17,400

1D -2.25%

YTD 0.40%

12,070

1D -2.27%

YTD 1.26%

12,510

1D -4.50%

YTD 0.24%

15,340

1D -1.03%

YTD 9.18%

14,920

1D -1.58%

YTD 3.97%

21,800

1D -0.91%

YTD -2.68%

12,990

1D -2.33%

YTD 0.31%

1,021

1D -1.74%

YTD 0.00%

1,019

1D -2.10%

YTD 0.00%

1,016

1D -2.40%

YTD 0.00%

1,022

1D -2.17%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

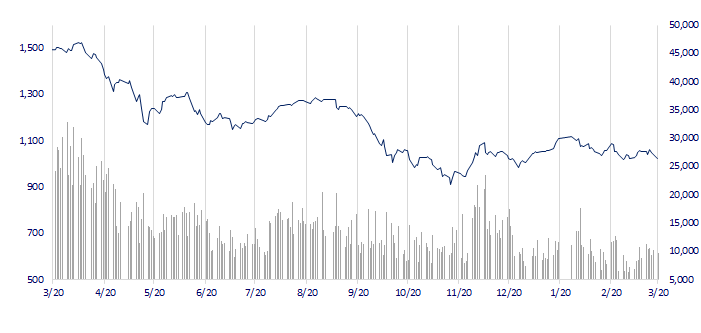

VNINDEX (12M)

GLOBAL MARKET

26,945.67

1D -1.42%

YTD 3.26%

3,234.91

1D -0.48%

YTD 4.71%

2,379.20

1D -0.69%

YTD 6.39%

19,000.71

1D -2.65%

YTD -3.95%

3,139.76

1D -1.37%

YTD -3.43%

1,555.45

1D -0.53%

YTD -6.88%

70.81

1D -6.57%

YTD -17.58%

1,990.40

1D 2.85%

YTD 8.99%

Asian markets had a gloomy first session of this week due to negative news from US banks as well as Credit Suisse in recent days, despite the news that UBS has acquired this bank with the support from the central bank at the weekend.

VIETNAM ECONOMY

2.84%

1D (bps) -66

YTD (bps) -213

7.40%

3.85%

1D (bps) -1

YTD (bps) -94

3.94%

1D (bps) 1

YTD (bps) -96

23,756

1D (%) -0.02%

YTD (%) -0.02%

25,906

1D (%) 0.23%

YTD (%) 0.96%

3,495

1D (%) 0.00%

YTD (%) 0.29%

By March 17, there were no banks that needed liquidity support from the SBV. This is the first time since mid-February (February 20), the banking system has not borrowed from the SBV on the open market.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Long An: Potential development of Duc Hoa III Industrial Park project;

- Quang Ninh wants to build 130ha Co To airport;

- Large port projects are constantly behind schedule;

- Fed and central banks together support liquidity;

- FDIC announces sale of Signature Bank assets to New York Community Bancorp;

- Iraq is committed to maintaining oil production of 220,000 barrels per day.

VN30

BANK

85,100

1D -4.38%

5D -6.99%

Buy Vol. 1,625,421

Sell Vol. 1,679,931

45,350

1D -2.05%

5D -1.95%

Buy Vol. 1,326,841

Sell Vol. 1,269,710

28,000

1D -3.45%

5D -4.44%

Buy Vol. 2,551,989

Sell Vol. 3,285,337

26,250

1D -1.50%

5D -1.87%

Buy Vol. 3,919,798

Sell Vol. 4,011,276

19,700

1D 0.00%

5D 1.55%

Buy Vol. 27,829,917

Sell Vol. 29,905,150

17,300

1D -0.86%

5D -1.14%

Buy Vol. 14,437,965

Sell Vol. 15,184,560

17,800

1D -3.78%

5D -3.52%

Buy Vol. 4,511,942

Sell Vol. 9,960,213

21,600

1D -5.26%

5D -1.37%

Buy Vol. 5,648,313

Sell Vol. 7,278,547

24,200

1D -3.39%

5D -3.20%

Buy Vol. 28,541,864

Sell Vol. 32,467,292

20,550

1D -1.91%

5D -0.72%

Buy Vol. 9,103,541

Sell Vol. 8,632,145

24,000

1D -1.44%

5D -2.04%

Buy Vol. 4,874,997

Sell Vol. 4,421,597

TPB: Today (March 20) is the ex-rights date to receive 25% cash dividend of TPB (TPBank) shares. Previously, TPBank postponed the last registration date to exercise the right for existing shareholders to pay dividends from February 21, 2023 to March 21, 2023. Payment date changed to 3/4 instead of 3/3. The reason for the adjustment is to review and complete the internal procedures of the bank.

REAL ESTATE

11,100

1D -3.48%

5D 0.91%

Buy Vol. 17,949,207

Sell Vol. 22,914,266

81,600

1D -0.97%

5D -2.51%

Buy Vol. 140,984

Sell Vol. 192,346

11,800

1D -3.28%

5D 0.00%

Buy Vol. 8,316,496

Sell Vol. 14,793,032

NVL: Novaland (NVL) proposes a bond payment of VND1,500 billion with real estates.

OIL & GAS

103,000

1D -0.68%

5D -4.72%

Buy Vol. 354,837

Sell Vol. 282,938

12,850

1D -4.10%

5D -2.28%

Buy Vol. 19,236,748

Sell Vol. 20,469,561

35,400

1D 0.00%

5D -6.96%

Buy Vol. 2,462,480

Sell Vol. 4,948,908

GAS: PV Gas was fined with a total of VND270 million due to some violations of information disclosure.

VINGROUP

52,800

1D -0.75%

5D -0.94%

Buy Vol. 4,755,395

Sell Vol. 4,177,604

42,550

1D -1.85%

5D -4.92%

Buy Vol. 3,162,617

Sell Vol. 3,064,300

29,000

1D -1.69%

5D -0.34%

Buy Vol. 3,634,309

Sell Vol. 5,890,015

VHM: CapitaLand negotiates to buy USD1.5 billion of Vinhomes real estates.

FOOD & BEVERAGE

74,300

1D -0.27%

5D -3.38%

Buy Vol. 3,029,791

Sell Vol. 2,378,037

81,500

1D -2.40%

5D -3.55%

Buy Vol. 1,918,448

Sell Vol. 1,935,766

189,000

1D -1.56%

5D 1.07%

Buy Vol. 113,535

Sell Vol. 144,288

VNM: The Ministry of Information and Communications has coordinated with the People's Committee of Binh Dinh province and Vinamilk to organize the 2023 Press Economic Forum.

OTHERS

49,000

1D -2.00%

5D -1.01%

Buy Vol. 503,682

Sell Vol. 1,072,899

105,600

1D -3.03%

5D 4.87%

Buy Vol. 890,521

Sell Vol. 524,662

77,600

1D -1.77%

5D -1.65%

Buy Vol. 1,540,857

Sell Vol. 1,282,292

38,100

1D -3.30%

5D -3.30%

Buy Vol. 4,000,598

Sell Vol. 3,503,756

14,350

1D -3.69%

5D -4.01%

Buy Vol. 3,571,862

Sell Vol. 3,737,826

19,500

1D -3.94%

5D -0.76%

Buy Vol. 32,976,956

Sell Vol. 33,722,024

20,000

1D -1.96%

5D -5.21%

Buy Vol. 41,168,879

Sell Vol. 42,742,186

FPT: In 2023, FPT sets planned revenue of VND52,289 billion and pre-tax income of VND9,055 billion, up 19% and 18.2% respectively compared to the results in 2022.

Market by numbers

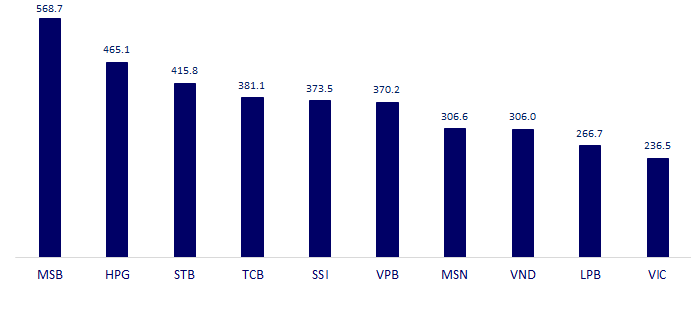

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

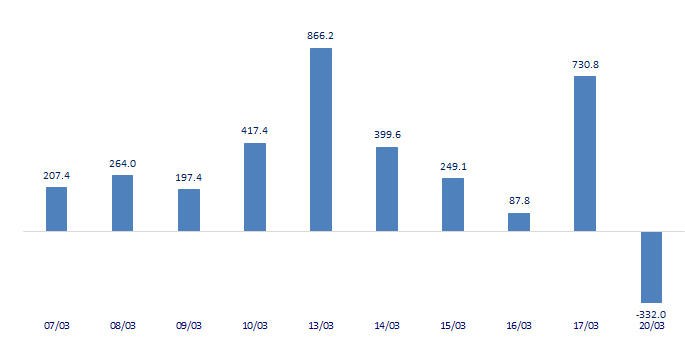

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

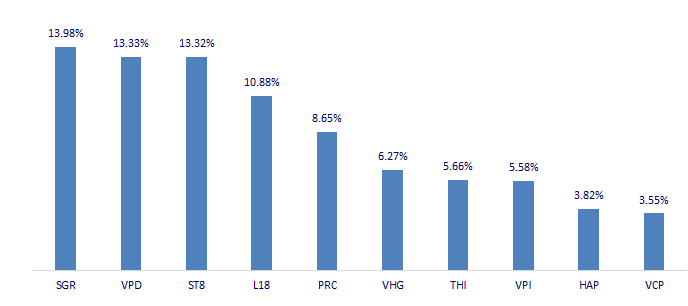

TOP INCREASES 3 CONSECUTIVE SESSIONS

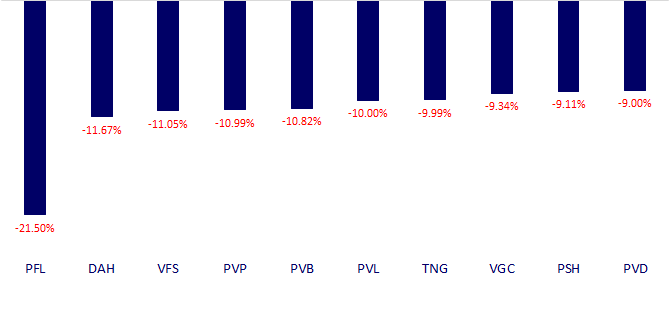

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.