Market brief 22/03/2023

VIETNAM STOCK MARKET

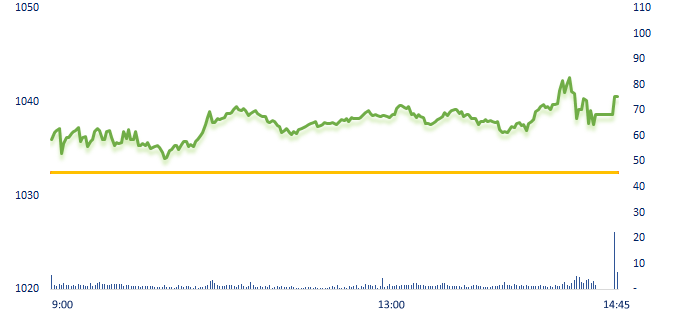

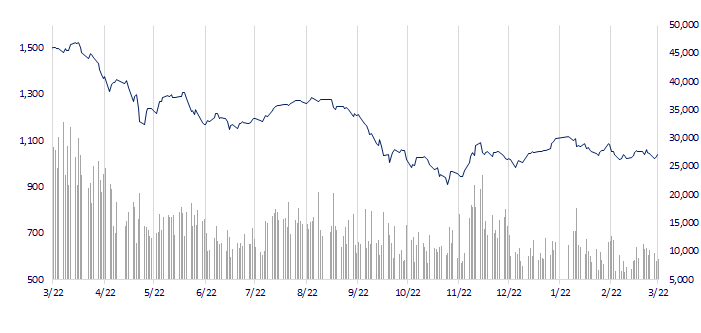

1,040.54

1D 0.79%

YTD 3.32%

1,043.14

1D 0.78%

YTD 3.78%

203.96

1D 0.42%

YTD -0.66%

75.90

1D 0.30%

YTD 5.93%

194.22

1D 0.00%

YTD 0.00%

9,795.20

1D 3.89%

YTD 13.69%

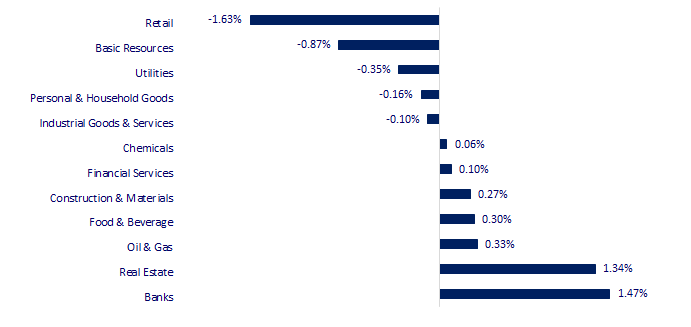

Vietnam stock market opened the session in green color and remained positive until the end of the session. Banking and real estates sectors led the market today with typical VHM (+5%) and VPB (+3.2%) with many positive news in recent days.

ETF & DERIVATIVES

17,840

1D 1.36%

YTD 2.94%

12,320

1D 0.74%

YTD 3.36%

12,670

1D 0.32%

YTD 1.52%

15,350

1D 0.26%

YTD 9.25%

15,490

1D 2.79%

YTD 7.94%

21,830

1D -0.09%

YTD -2.54%

13,130

1D 0.92%

YTD 1.39%

1,026

1D 0.10%

YTD 0.00%

1,031

1D 0.37%

YTD 0.00%

1,030

1D 0.29%

YTD 0.00%

1,035

1D 0.39%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

27,466.61

1D 1.93%

YTD 5.26%

3,265.75

1D 0.31%

YTD 5.71%

2,416.96

1D 1.20%

YTD 8.07%

19,591.43

1D 1.73%

YTD -0.96%

3,220.98

1D 1.48%

YTD -0.93%

1,585.08

1D 0.50%

YTD -5.11%

74.79

1D -0.20%

YTD -12.94%

1,946.80

1D -0.04%

YTD 6.60%

At the end of the session, Asian markets mostly rallied as concerns about the eased contagion of risks in the banking system and the market is looking forward to the upcoming Fed policy meeting.

VIETNAM ECONOMY

1.60%

1D (bps) -62

YTD (bps) -337

7.40%

3.82%

YTD (bps) -97

3.90%

1D (bps) -3

YTD (bps) -101

23,698

1D (%) -0.20%

YTD (%) -0.26%

26,110

1D (%) -0.03%

YTD (%) 1.76%

3,487

1D (%) -0.20%

YTD (%) 0.06%

Interbank interest rate continued to go down after the SBV decided to reduce the operating interest rate from March 15. Currently, the interbank overnight interest rate has dropped below 2%/year, the lowest in the last 6 months.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Granting a credit package of more than VND450,000 billion to support businesses in Ho Chi Minh City;

- More than VND5,000 billion to invest in the road connecting Binh Duong and Ho Chi Minh City;

- More than USD6 billion of FDI "flows" into Quang Nam;

- Chinese bank stocks become "storm shelters";

- World gold dropped more than 1% waiting for Fed interest rate decision;

- Oil rose 1% as eased worries about the banking crisis.

VN30

BANK

89,000

1D 2.89%

5D -2.63%

Buy Vol. 1,889,142

Sell Vol. 1,987,880

46,100

1D 1.65%

5D -1.50%

Buy Vol. 1,039,604

Sell Vol. 1,087,239

28,500

1D 0.71%

5D -3.39%

Buy Vol. 3,268,528

Sell Vol. 3,232,691

26,200

1D -0.57%

5D -3.68%

Buy Vol. 4,362,873

Sell Vol. 4,886,899

21,000

1D 3.19%

5D 6.06%

Buy Vol. 73,762,360

Sell Vol. 72,594,746

17,400

1D 0.29%

5D -2.25%

Buy Vol. 10,897,747

Sell Vol. 13,957,442

17,650

1D 1.44%

5D -4.59%

Buy Vol. 7,368,828

Sell Vol. 5,434,001

21,800

1D 0.93%

5D -1.87%

Buy Vol. 4,668,466

Sell Vol. 5,837,095

24,800

1D 0.81%

5D -2.17%

Buy Vol. 33,779,729

Sell Vol. 34,196,312

20,700

1D -0.24%

5D -3.27%

Buy Vol. 4,643,249

Sell Vol. 4,040,665

24,150

1D -0.21%

5D -2.62%

Buy Vol. 3,998,417

Sell Vol. 4,199,805

TPB: On March 20, 2023, TPBank received the approval from SBV for network expansion. Specifically, the SBV approved the establishment of 5 branches of TPBank in Dong Anh, Vinh Phuc, Ha Nam, Quang Binh and Tay Ninh and 3 transaction offices in Trung Kinh (Hanoi), Que Vo (Bac Ninh) and Vinh Hai (Khanh Hoa).

REAL ESTATE

11,100

1D 0.45%

5D -2.20%

Buy Vol. 11,650,534

Sell Vol. 16,728,846

81,500

1D -0.61%

5D -2.04%

Buy Vol. 267,641

Sell Vol. 229,637

11,900

1D 2.59%

5D -2.86%

Buy Vol. 12,350,207

Sell Vol. 9,035,250

NVL: Due to not being able to arrange the money source, Novaland announced to postpone the payment of principal and interest of the due bond lot with total value of more than VND900 billion.

OIL & GAS

102,900

1D -0.29%

5D -3.83%

Buy Vol. 269,415

Sell Vol. 287,971

13,150

1D -0.38%

5D -2.59%

Buy Vol. 10,221,383

Sell Vol. 12,338,823

34,700

1D 0.00%

5D -7.84%

Buy Vol. 2,680,520

Sell Vol. 4,365,998

PLX: Petrolimex will hold a public auction to sell all shares of PG Bank on April 7.

VINGROUP

52,800

1D 0.00%

5D -2.22%

Buy Vol. 3,049,873

Sell Vol. 3,076,039

47,650

1D 4.96%

5D 3.59%

Buy Vol. 6,484,892

Sell Vol. 6,866,078

29,700

1D 0.85%

5D 4.21%

Buy Vol. 6,657,213

Sell Vol. 6,792,642

VHM: Vinhomes announced to sell its entire capital contribution in 2 subsidiaries in Hung Yen with a total capital contribution of VND11,400 billion.

FOOD & BEVERAGE

74,400

1D 0.00%

5D -3.50%

Buy Vol. 1,429,502

Sell Vol. 1,831,899

80,500

1D 0.50%

5D -4.96%

Buy Vol. 3,116,972

Sell Vol. 2,883,989

187,500

1D 0.81%

5D -1.06%

Buy Vol. 274,282

Sell Vol. 325,940

VNM: At the end of 2022, VNM recorded a profit of VND8,578 billion, down 20% compared to its profit in 2021. This is the lowest net profit of the business since 2016.

OTHERS

49,000

1D 0.00%

5D -0.61%

Buy Vol. 346,772

Sell Vol. 579,515

104,800

1D 0.96%

5D -0.10%

Buy Vol. 717,010

Sell Vol. 617,530

78,500

1D 0.51%

5D -2.48%

Buy Vol. 1,492,653

Sell Vol. 1,066,181

37,950

1D -1.43%

5D -5.13%

Buy Vol. 2,801,813

Sell Vol. 2,712,611

14,500

1D 0.35%

5D -4.61%

Buy Vol. 3,189,324

Sell Vol. 2,878,773

19,850

1D -0.75%

5D -2.46%

Buy Vol. 20,953,420

Sell Vol. 31,038,167

20,300

1D -0.73%

5D -4.69%

Buy Vol. 26,915,738

Sell Vol. 33,262,966

HPG: In announced annual report, Hoa Phat Group revealed its intention to develop megacities with scale from 300 to 500 ha and also 10 industrial parks.

Market by numbers

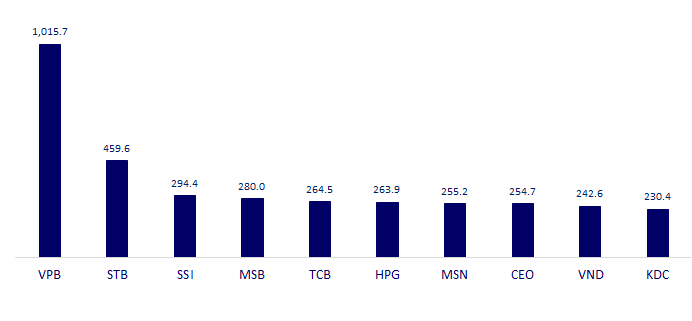

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

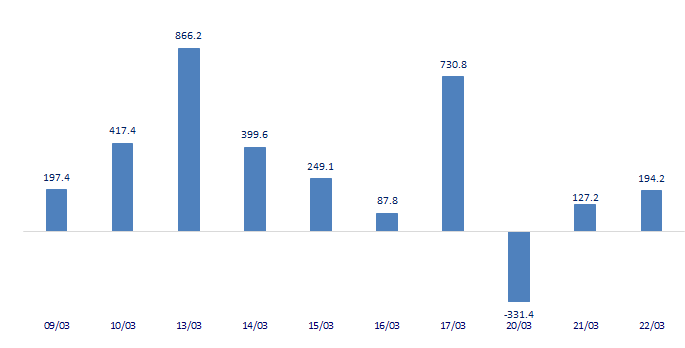

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

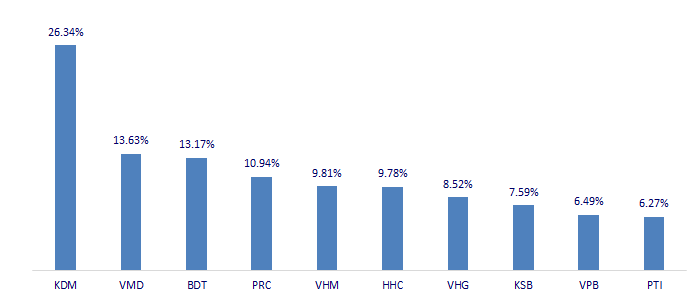

TOP INCREASES 3 CONSECUTIVE SESSIONS

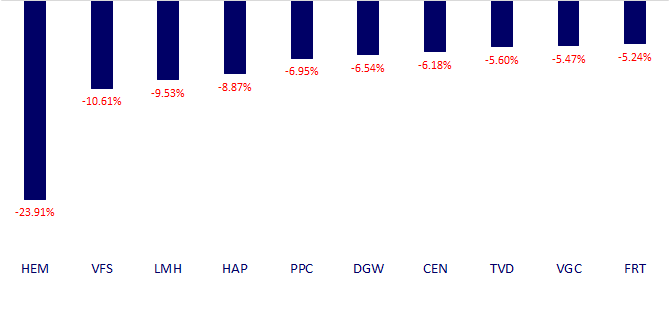

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.