Market Brief 31/03/2023

VIETNAM STOCK MARKET

1,064.64

1D 0.49%

YTD 5.71%

1,073.68

1D 0.60%

YTD 6.81%

207.50

1D 0.75%

YTD 1.07%

76.76

1D 0.35%

YTD 7.13%

167.83

1D 0.00%

YTD 0.00%

13,314.70

1D 7.38%

YTD 54.54%

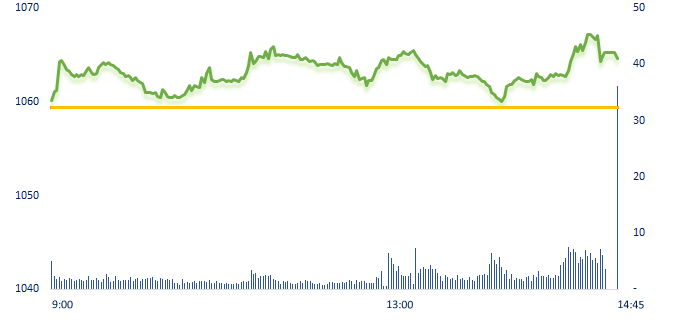

VHM and VIC contributed the most to VNIndex's gain, this is also the 2nd session in a row that VHM led the VNIndex. The banking group was divided when TCB, HDB, ACB, VPB were in the top 10 stocks with the biggest influence on VNIndex's gain, VCB was the leading stock in the decline, putting pressure on the overall market, BID MBB started increased sharply and then returned to reference at the end of the session.

ETF & DERIVATIVES

18,400

1D 0.99%

YTD 6.17%

12,690

1D 0.55%

YTD 6.46%

13,150

1D 1.00%

YTD 5.37%

15,550

1D 3.53%

YTD 10.68%

16,110

1D 0.94%

YTD 12.26%

22,470

1D 0.81%

YTD 0.31%

13,510

1D 0.45%

YTD 4.32%

1,060

1D -0.01%

YTD 0.00%

1,062

1D 0.32%

YTD 0.00%

1,063

1D 0.05%

YTD 0.00%

1,066

1D 0.14%

YTD 0.00%

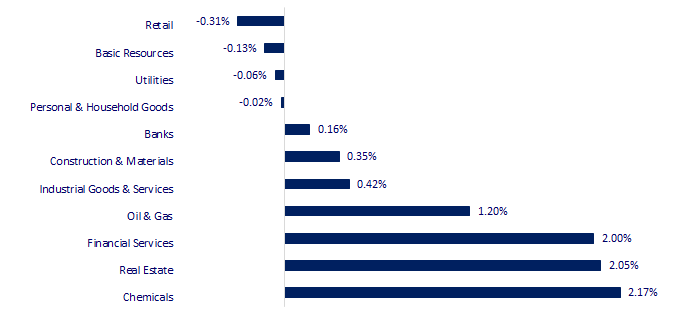

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

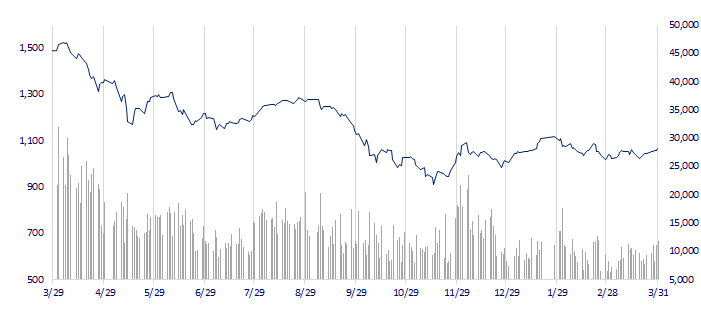

VNINDEX (12M)

GLOBAL MARKET

28,041.48

1D 0.93%

YTD 7.46%

3,272.86

1D 0.36%

YTD 5.94%

2,476.86

1D 0.97%

YTD 10.75%

20,400.11

1D 0.45%

YTD 3.13%

3,258.90

1D 0.05%

YTD 0.23%

1,609.17

1D 0.23%

YTD -3.66%

78.72

1D 0.01%

YTD -8.37%

1,995.65

1D -0.22%

YTD 9.28%

Chinese stocks rallied, as the positive impact of China's the services sector was stronger, with activity expanding at the fastest pace in nearly 12 years after the end of China's zero-COVID policy in December boosted transportation, accommodation and construction.

VIETNAM ECONOMY

1.50%

1D (bps) 50

YTD (bps) -347

7.40%

3.40%

1D (bps) -7

YTD (bps) -139

3.50%

1D (bps) -7

YTD (bps) -140

23,628

1D (%) -0.11%

YTD (%) -0.56%

26,262

1D (%) -0.39%

YTD (%) 2.35%

3,482

1D (%) -0.17%

YTD (%) -0.09%

The SBV pledged on Friday to keep monetary policy flexible for the rest of the year to support economic stability amid external challenges, with space for more interest rate cuts while it prioritises keeping inflation in check. The SBV said it was confident the country can keep inflation below 4.5% this year, after the consumer price index in February edged down from the previous month.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The central bank likely will further cut interest rates in a near future, according to deputy governor of the SBV Dao Minh Tu;

- Traffic projects in the first quarter were disbursed nearly VND17,000 billion;

- Rice exports in the first quarter were the highest in 12 years;

- French prosecutors raid five banks in massive tax fraud case;

- Despite sanctions, EU keeps on doing business with Russia;

- Sterling set for biggest monthly gain since November.

VN30

BANK

91,400

1D -1.40%

5D 2.70%

Buy Vol. 1,443,607

Sell Vol. 1,658,605

46,200

1D 0.00%

5D 1.43%

Buy Vol. 1,716,926

Sell Vol. 1,297,574

29,200

1D 0.69%

5D 2.46%

Buy Vol. 3,684,176

Sell Vol. 4,928,585

28,350

1D 2.35%

5D 7.18%

Buy Vol. 11,392,881

Sell Vol. 13,912,015

21,050

1D 0.72%

5D -0.47%

Buy Vol. 35,793,813

Sell Vol. 40,584,932

18,250

1D 0.00%

5D 2.82%

Buy Vol. 18,748,075

Sell Vol. 22,172,514

19,250

1D 2.94%

5D 6.65%

Buy Vol. 8,452,230

Sell Vol. 10,632,075

22,200

1D 0.23%

5D 0.91%

Buy Vol. 4,964,800

Sell Vol. 5,641,602

26,200

1D 0.77%

5D 4.59%

Buy Vol. 42,299,065

Sell Vol. 46,389,991

21,400

1D 0.23%

5D 2.15%

Buy Vol. 9,804,955

Sell Vol. 11,467,558

25,000

1D 1.63%

5D 1.83%

Buy Vol. 9,680,573

Sell Vol. 10,918,459

HDB: HDB has just announced its 2022 audited financial statement with pre-tax profit exceeding VND10,268 billion for the first time, completing 105% of the year plan. In addition, the number of activated credit cards in 2022 increased more than 4 times, card transactions increased nearly 3 times over the same period, the number of transactions via digital banking was nearly twice higher than the same period last year.

REAL ESTATE

12,700

1D -0.78%

5D 6.72%

Buy Vol. 17,968,790

Sell Vol. 31,545,568

82,900

1D 0.73%

5D 1.10%

Buy Vol. 246,052

Sell Vol. 185,059

12,500

1D 0.81%

5D 1.21%

Buy Vol. 9,541,381

Sell Vol. 12,212,947

According to Savills, in the first 3 months of the year, real estate ranked second among the industries with the largest amount of FDI with a total investment capital of USD766 million.

OIL & GAS

102,000

1D -0.39%

5D -0.39%

Buy Vol. 417,137

Sell Vol. 626,825

13,200

1D 0.00%

5D -0.38%

Buy Vol. 21,544,664

Sell Vol. 15,616,107

37,450

1D 1.49%

5D 3.03%

Buy Vol. 3,622,359

Sell Vol. 4,755,371

GAS: PV GAS forecasts that its profit in 2023 will decrease by 57%.

VINGROUP

55,000

1D 2.42%

5D 3.19%

Buy Vol. 3,626,900

Sell Vol. 4,624,518

51,500

1D 3.94%

5D 5.10%

Buy Vol. 3,573,550

Sell Vol. 5,092,582

29,550

1D -1.17%

5D 1.03%

Buy Vol. 7,315,950

Sell Vol. 8,155,285

VRE: Thailand's largest retailer - Central Retail confirmed that the group was not related to the news of buying shares of Vincom Retail.

FOOD & BEVERAGE

74,400

1D -0.80%

5D -0.80%

Buy Vol. 1,546,999

Sell Vol. 2,678,733

77,800

1D -1.77%

5D -0.26%

Buy Vol. 1,901,025

Sell Vol. 2,374,335

184,700

1D -0.16%

5D -1.65%

Buy Vol. 125,944

Sell Vol. 180,680

MSN: Mr. Ju Han Yoo - Director and Board Member of SK Investment Vina I Pte. Ltd (Massan's major shareholder) has just submitted his resignation as a member of the BOD of MSN.

OTHERS

48,450

1D 0.00%

5D -0.10%

Buy Vol. 339,523

Sell Vol. 523,069

105,100

1D -1.13%

5D -1.04%

Buy Vol. 312,492

Sell Vol. 450,387

79,100

1D 0.00%

5D 0.64%

Buy Vol. 1,614,365

Sell Vol. 1,485,144

38,550

1D -0.13%

5D 1.58%

Buy Vol. 3,090,363

Sell Vol. 4,231,713

15,500

1D 5.44%

5D 4.73%

Buy Vol. 12,758,227

Sell Vol. 9,713,862

21,500

1D 2.63%

5D 5.13%

Buy Vol. 51,949,660

Sell Vol. 60,317,284

20,800

1D 0.00%

5D 1.96%

Buy Vol. 40,300,060

Sell Vol. 50,639,198

HPG: As of March 30, the total fixed asset investment of Dung Quat phase 2 project has reached VND75,000 billion. Once completed, the project will probably contribute about VND80,000 to VND100,000 billion in annual revenue.

Market by numbers

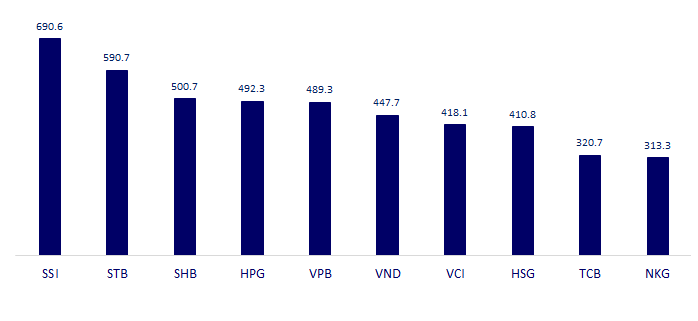

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

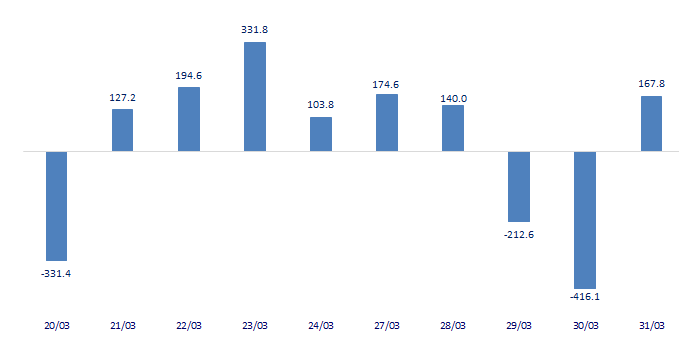

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

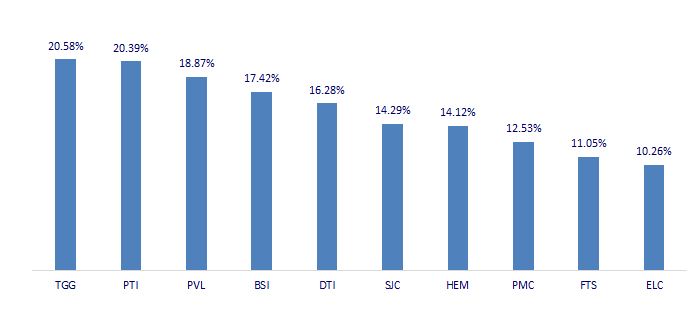

TOP INCREASES 3 CONSECUTIVE SESSIONS

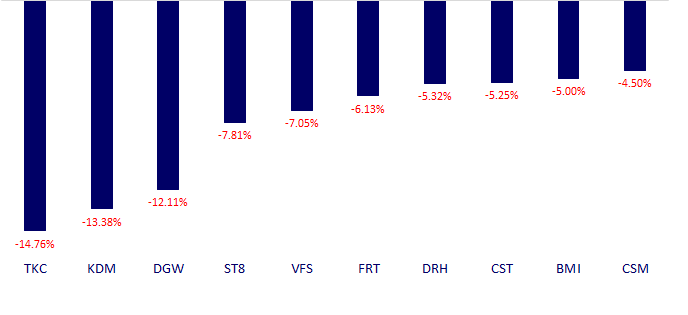

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.