Market brief 31/08/2023

VIETNAM STOCK MARKET

1,224.05

1D 0.90%

YTD 21.54%

1,234.53

1D 0.73%

YTD 22.82%

249.75

1D 0.72%

YTD 21.65%

93.32

1D 0.69%

YTD 30.24%

499.25

1D 0.00%

YTD 0.00%

24,075.94

1D 2.53%

YTD 179.43%

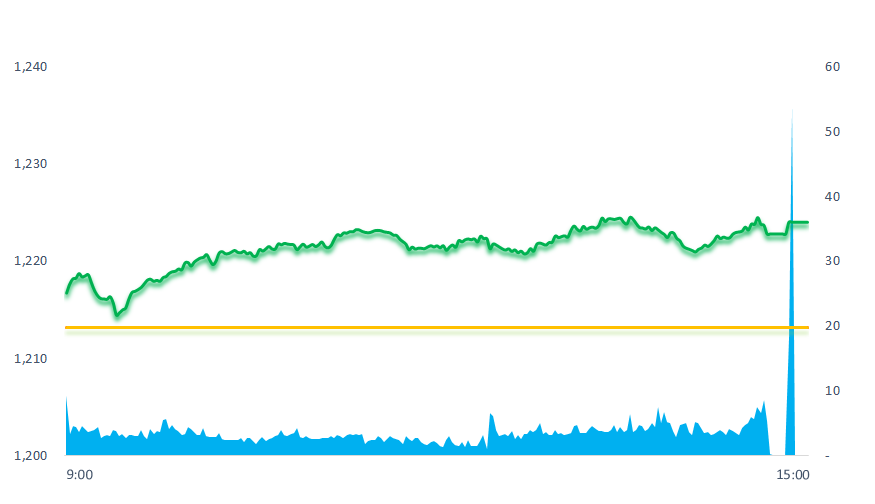

Continuing the excitement in the previous session, the stock market opened this morning in green. The market's upward momentum is increasingly strengthened with consensus from all sectors and market liquidity continues to be high.

ETF & DERIVATIVES

21,200

1D 0.57%

YTD 22.33%

14,640

1D 1.04%

YTD 22.82%

15,130

1D 1.14%

YTD 21.23%

18,910

1D 0.05%

YTD 34.59%

19,500

1D 1.35%

YTD 35.89%

27,080

1D 1.42%

YTD 20.89%

16,280

1D 0.43%

YTD 25.71%

1,233

1D 0.72%

YTD 0.00%

1,232

1D 0.76%

YTD 0.00%

1,228

1D 0.64%

YTD 0.00%

1,219

1D 0.66%

YTD 0.00%

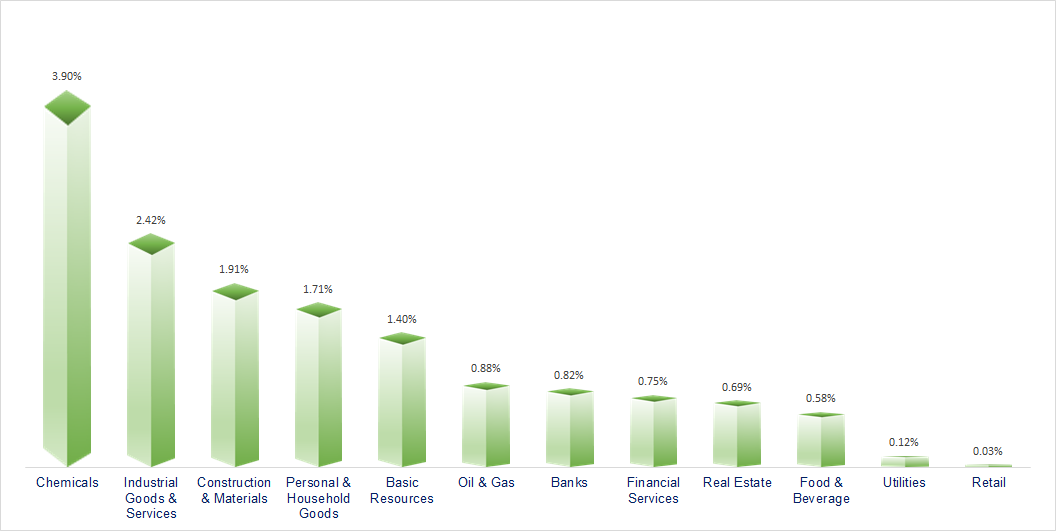

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

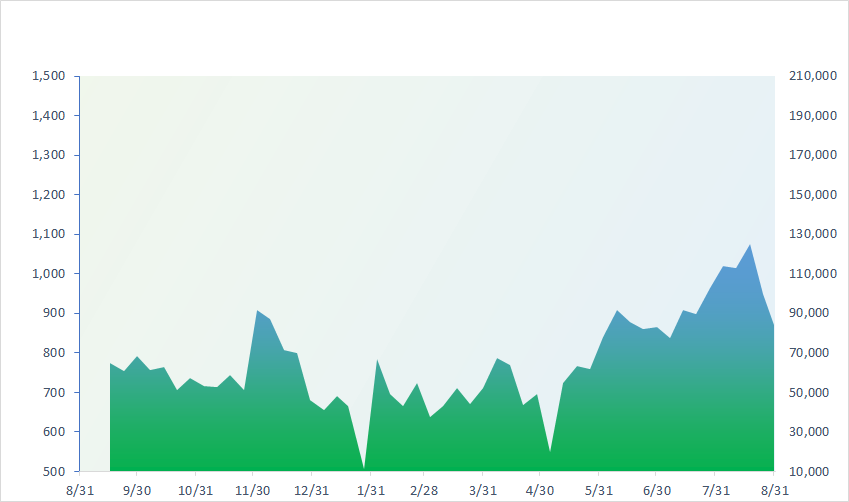

VNINDEX (12M)

GLOBAL MARKET

0

1D 32619.34

YTD 0.008841615

0

1D 3119.88

YTD -0.005501827

0

1D 10418.21

YTD -0.006133079

0

1D 18382.06

YTD -0.005453701

0

1D 2556.27

YTD -0.001932673

0

1D 64831.41

YTD -0.003930724

0

1D 3233.3

YTD 0.004061834

0

1D 1565.94

YTD -0.006805482

0

1D 85.55

YTD 0.003048423

0

1D 1944.54

YTD -0.001012068

Asian stock markets mostly fell today. Kospi index fell 0.19%, due to larger-than-expected declines in retail sales and industrial production. Although Japan's Nikkei 225 Index rose 0.88% today thanks to stronger-than-expected retail sales data for July, the index also recorded a decline of nearly 2% for the month as a whole.

VIETNAM ECONOMY

0.29%

1D (bps) 9

YTD (bps) -468

5.80%

YTD (bps) -160

1.82%

1D (bps) 1

YTD (bps) -297

2.58%

YTD (bps) -232

24,290

1D (%) -0.08%

YTD (%) 2.23%

26,614

1D (%) -1.89%

YTD (%) 3.72%

3,374

1D (%) -0.30%

YTD (%) -3.19%

By August 20, total FDI capital reached nearly USD18.15 billion, up 8.2% over the same period last year. Of which, new investment capital reached USD8.87 billion , an increase of 39.7% over the same period; Investment capital through capital contribution and share purchases reached USD4.47 billion, an increase of 62.8%. However, the additional capital only reached USD4.53 billion, down 39.7%.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- The number of newly established real estate businesses decreased by more than 53%;

- FDI attraction is improving after a long period of decline;

- Binh Thuan will have an industrial park of nearly 500 hectares;

- The US proposes new regulations in the banking industry to minimize risks;

- The British economy still cannot overcome post-Brexit difficulties;

- Bloomberg: China signals to 'rescue' indebted financial company with USD137 billion in assets.

VN30

BANK

89,100

1D 0.00%

5D 2.41%

Buy Vol. 2,259,920

Sell Vol. 2,840,454

46,950

1D 1.62%

5D 2.51%

Buy Vol. 3,174,769

Sell Vol. 3,007,576

32,450

1D 1.09%

5D 2.20%

Buy Vol. 8,759,764

Sell Vol. 11,270,403

34,500

1D 1.47%

5D 2.07%

Buy Vol. 8,483,279

Sell Vol. 8,161,220

20,950

1D 0.72%

5D 2.20%

Buy Vol. 25,137,279

Sell Vol. 28,033,744

18,500

1D 0.54%

5D 1.37%

Buy Vol. 15,543,435

Sell Vol. 15,824,256

16,850

1D 3.06%

5D 4.01%

Buy Vol. 7,439,694

Sell Vol. 6,578,107

19,600

1D 0.26%

5D 4.26%

Buy Vol. 12,673,783

Sell Vol. 12,042,401

32,650

1D 0.46%

5D 3.49%

Buy Vol. 33,714,352

Sell Vol. 39,404,851

20,350

1D 1.75%

5D 3.04%

Buy Vol. 7,943,604

Sell Vol. 7,145,112

22,600

1D 0.67%

5D 2.49%

Buy Vol. 13,283,231

Sell Vol. 15,577,912

12,450

1D 1.63%

5D 2.89%

Buy Vol. 40,933,960

Sell Vol. 45,227,022

28,100

1D 0.00%

5D -1.23%

Buy Vol. 2,572,296

Sell Vol. 2,684,481

VPB: 2023 continues to be a bad business year for FE Credit, especially in the first 6 months of the year when FE Credit reported losses far exceeding the total loss after tax for the whole year 2022 of VND2,376 billion. The period 2019 - 2020 is the peak business period when the Company profited VND3,590 billion and VND2,670 billion respectively.

OIL & GAS

98,600

1D -0.70%

5D -0.23%

Buy Vol. 1,006,973

Sell Vol. 1,004,793

12,800

1D 0.79%

5D 1.59%

Buy Vol. 13,470,063

Sell Vol. 16,378,846

38,550

1D 0.39%

5D 1.98%

Buy Vol. 1,356,344

Sell Vol. 2,002,071

PLX: PLX is estimated to record VND1,490 billion in revenue from financial activities for the parent company, expected to be recorded in the third quarter of 2023 business results.

VINGROUP

62,100

1D 0.16%

5D -3.27%

Buy Vol. 28,093,154

Sell Vol. 25,435,643

54,700

1D 0.18%

5D -1.26%

Buy Vol. 10,765,225

Sell Vol. 9,861,646

30,300

1D 2.02%

5D 4.30%

Buy Vol. 11,579,934

Sell Vol. 13,336,918

VHM: DHK Technology Development JSC is the only enterprise competing with Vinhomes registered as a social housing construction project of nearly VND6000 billion in Hai Phong

FOOD & BEVERAGE

77,800

1D 0.00%

5D 4.15%

Buy Vol. 7,018,954

Sell Vol. 7,882,225

81,500

1D 2.39%

5D 1.88%

Buy Vol. 4,323,151

Sell Vol. 3,880,384

158,000

1D -1.13%

5D 2.93%

Buy Vol. 582,589

Sell Vol. 832,447

MSN: In the first 6 months of 2023, Wincommerce lost VND381.5 billion after tax, down 30% compared to the same period last year (loss of VND541 billion).

OTHERS

45,200

1D 0.33%

5D -0.44%

Buy Vol. 2,599,127

Sell Vol. 1,845,294

45,200

1D 0.33%

5D -0.44%

Buy Vol. 2,599,127

Sell Vol. 1,845,294

98,000

1D 1.14%

5D 0.51%

Buy Vol. 1,148,519

Sell Vol. 1,197,532

96,700

1D 0.10%

5D 7.44%

Buy Vol. 2,667,673

Sell Vol. 3,283,077

53,800

1D 0.00%

5D 6.96%

Buy Vol. 9,167,878

Sell Vol. 10,859,479

21,850

1D 5.56%

5D 10.35%

Buy Vol. 14,283,189

Sell Vol. 10,149,258

33,400

1D -0.30%

5D 4.38%

Buy Vol. 32,468,136

Sell Vol. 32,890,429

27,600

1D 1.47%

5D 4.94%

Buy Vol. 45,677,642

Sell Vol. 57,673,085

VJC: VJC was cut off from margin lending by HOSE because the after-tax profit of parent company on the 2022 audited consolidated financial statements is negative.

Market by numbers

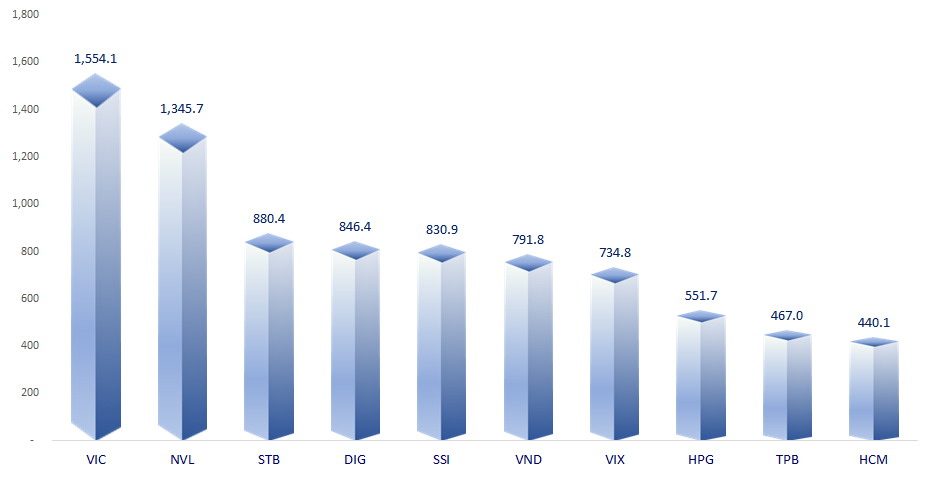

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

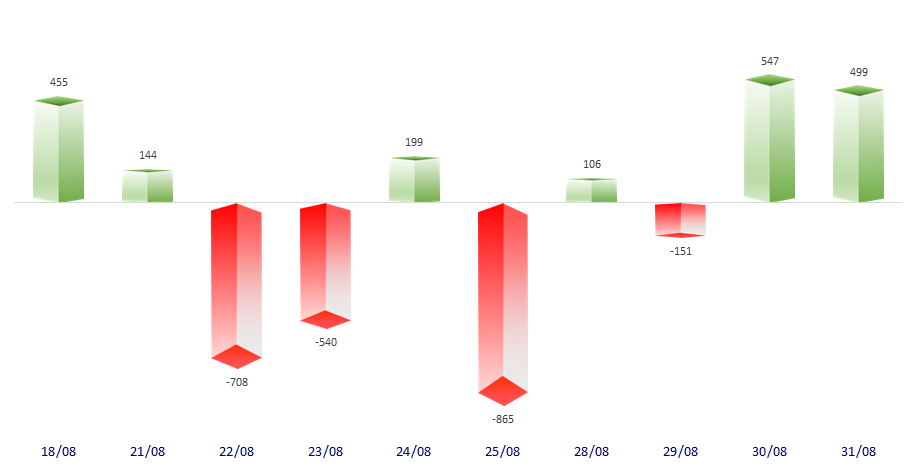

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.