Market brief 07/09/2023

VIETNAM STOCK MARKET

1,243.14

1D -0.19%

YTD 23.44%

1,255.22

1D -0.38%

YTD 24.87%

256.14

1D 0.31%

YTD 24.76%

94.70

1D 0.15%

YTD 32.17%

-893.95

1D 0.00%

YTD 0.00%

28,046.78

1D -2.83%

YTD 225.52%

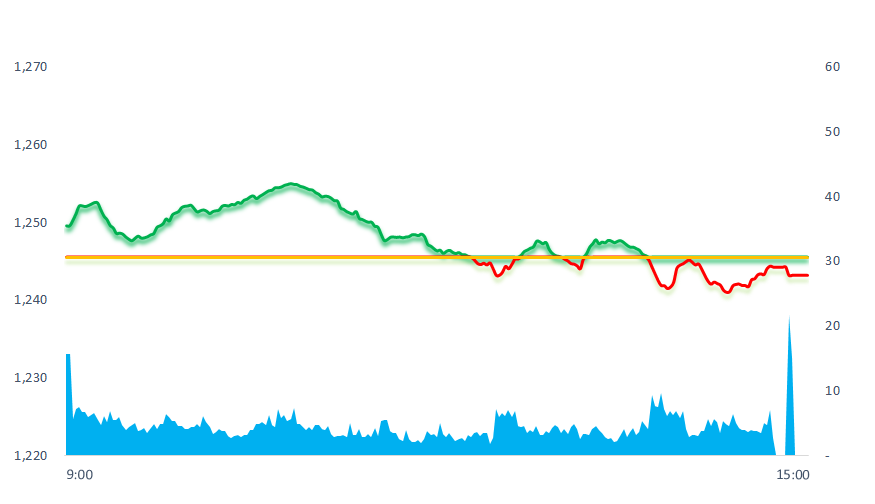

Today the stock market opened to its highest level since the beginning of this year, but the market's upward momentum did not last long. After 10:30 a.m., the index reversed and closed the morning session below the reference level. Although in the afternoon, there was a time VNIndex was pulled into the green, after that, selling pressure weighed heavily, pulling the index down.

ETF & DERIVATIVES

21,570

1D -0.32%

YTD 24.47%

14,810

1D -0.54%

YTD 24.24%

15,410

1D 0.33%

YTD 23.48%

18,810

1D -0.95%

YTD 33.88%

19,960

1D 1.27%

YTD 39.09%

27,600

1D 0.18%

YTD 23.21%

16,540

1D -0.06%

YTD 27.72%

1,255

1D -0.62%

YTD 0.00%

1,253

1D -0.58%

YTD 0.00%

1,249

1D -0.89%

YTD 0.00%

1,237

1D -0.93%

YTD 0.00%

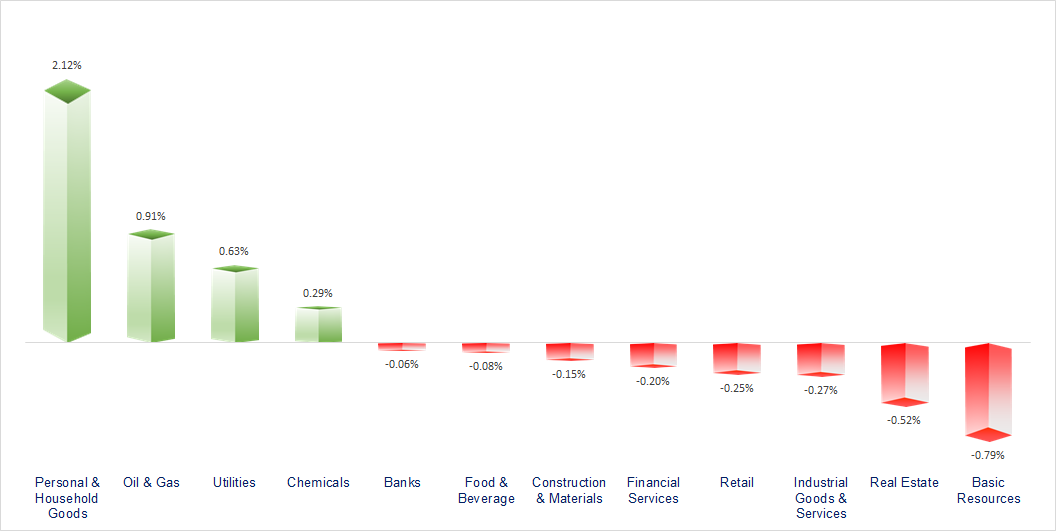

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

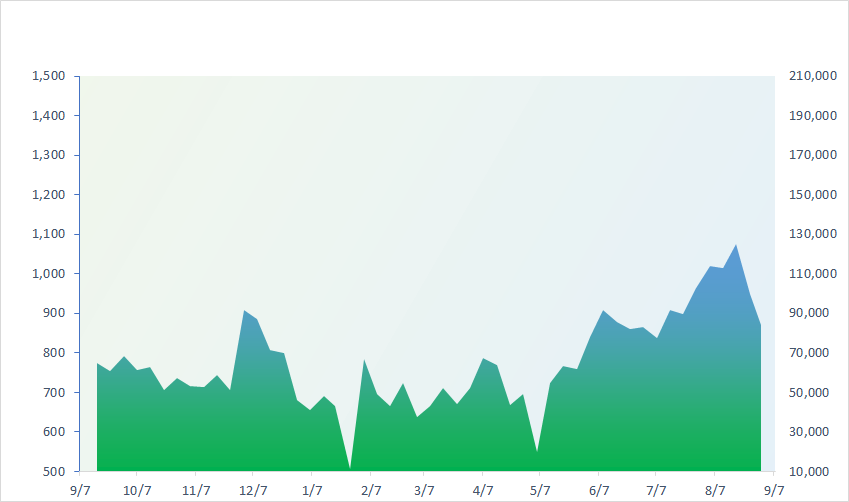

VNINDEX (12M)

GLOBAL MARKET

0

1D 32991.08

YTD -0.007519023

0

1D 3122.35

YTD -0.011313836

0

1D 10321.44

YTD -0.018427592

0

1D 18202.07

YTD -0.013436871

0

1D 2548.26

YTD -0.00588295

0

1D 66265.56

YTD 0.00584452

0

1D 3226.59

YTD 0.001151144

0

1D 1550.36

YTD 0.001020158

0

1D 90.17

YTD -0.006828946

0

1D 1920.74

YTD 0.001329378

Asian stock markets were mostly in red on September 7. Chinese stocks fell the most in the region when Shanghai, Shenzhen and Hang Sang all recorded declines of over 1%. Earlier, the Shanghai Composite and Hang Seng indexes recovered thanks to real estate and financial stocks.

VIETNAM ECONOMY

0.18%

1D (bps) -1

YTD (bps) -479

5.80%

YTD (bps) -160

2.15%

1D (bps) -4

YTD (bps) -264

2.48%

1D (bps) -8

YTD (bps) -242

24,277

1D (%) 0.26%

YTD (%) 2.18%

26,209

1D (%) -1.18%

YTD (%) 2.14%

3,354

1D (%) -0.06%

YTD (%) -3.76%

According to a report by the State Bank of Vietnam, by August 29, 2023, credit to the economy reached about VND12.56 million billion, an increase of 5.33% compared to the end of 2022 ( 9.87% in the same period in 2022)

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Domestic rice prices hit a new peak, making exporting even more difficult;

- VASEP: The seafood export market has not yet recovered as expected;

- IFC commits to invest nearly USD1.9 billion in Vietnam;

- Fed: The US economy continues to grow even at a humility level;

- The European Union still needs gas from Russia;

- Bloomberg: China requires companies to temporarily stop urea exports.

VN30

BANK

89,500

1D -0.78%

5D 0.45%

Buy Vol. 2,449,095

Sell Vol. 3,015,514

47,350

1D 0.11%

5D 0.85%

Buy Vol. 2,489,972

Sell Vol. 3,092,279

32,650

1D 0.00%

5D 0.62%

Buy Vol. 13,370,054

Sell Vol. 15,492,997

35,750

1D 1.56%

5D 3.62%

Buy Vol. 16,602,974

Sell Vol. 14,635,186

21,750

1D -0.23%

5D 3.82%

Buy Vol. 32,604,205

Sell Vol. 42,004,512

19,300

1D 0.26%

5D 4.32%

Buy Vol. 48,721,980

Sell Vol. 39,232,522

17,300

1D 0.58%

5D 2.67%

Buy Vol. 8,237,989

Sell Vol. 8,950,234

19,650

1D -0.51%

5D 0.26%

Buy Vol. 30,965,628

Sell Vol. 29,775,850

33,000

1D -0.15%

5D 1.07%

Buy Vol. 45,270,729

Sell Vol. 45,280,476

20,700

1D 0.24%

5D 1.72%

Buy Vol. 10,667,539

Sell Vol. 11,744,674

22,900

1D -0.22%

5D 1.33%

Buy Vol. 14,869,518

Sell Vol. 21,571,868

12,750

1D 0.79%

5D 2.41%

Buy Vol. 68,064,330

Sell Vol. 80,506,333

27,450

1D -1.26%

5D -2.31%

Buy Vol. 2,540,685

Sell Vol. 2,972,975

Vietcombank is the first bank to implement a policy for individual customers to borrow capital to repay loans early at other banks with interest rates from 6.9%/year for the first 6 months or 7.5%/year for the first 12 months or 8.0%/year for the first 24 months. After that, Vietcombank will adjust the lending interest rate according to the actual situation.

OIL & GAS

102,900

1D 1.38%

5D 4.36%

Buy Vol. 1,429,084

Sell Vol. 1,342,827

12,900

1D -0.77%

5D 0.78%

Buy Vol. 17,158,484

Sell Vol. 19,989,104

39,350

1D 0.13%

5D 2.08%

Buy Vol. 1,611,406

Sell Vol. 2,637,798

According to Goldman Sachs, if both Russia and Saudi Arabia continue to squeeze supply, the price of oil can rise to USD107 - equivalent to the beginning of the war in Ukraine.

VINGROUP

60,800

1D -1.30%

5D -2.09%

Buy Vol. 24,714,512

Sell Vol. 28,518,169

55,100

1D -1.43%

5D 0.73%

Buy Vol. 12,585,238

Sell Vol. 13,954,733

30,300

1D 0.00%

5D 0.00%

Buy Vol. 8,466,551

Sell Vol. 9,752,963

VIC: In the US market, VinFast sold a total of 394 electric cars in August. The number of cars sold from the beginning of the year until now recorded 1,624 units.

FOOD & BEVERAGE

79,500

1D -0.63%

5D 2.19%

Buy Vol. 5,372,768

Sell Vol. 6,289,249

82,000

1D -0.85%

5D 0.61%

Buy Vol. 4,337,112

Sell Vol. 3,925,727

160,500

1D 0.94%

5D 1.58%

Buy Vol. 518,237

Sell Vol. 523,527

SAB: Sabeco gained 0.9% today as its premium beer segment contributed to a significant improvement in gross profit margin.

OTHERS

45,750

1D 0.22%

5D 1.22%

Buy Vol. 1,887,789

Sell Vol. 2,118,977

45,750

1D 0.22%

5D 1.22%

Buy Vol. 1,887,789

Sell Vol. 2,118,977

101,000

1D -0.69%

5D 3.06%

Buy Vol. 1,355,313

Sell Vol. 1,424,574

97,900

1D -1.11%

5D 1.24%

Buy Vol. 5,576,763

Sell Vol. 5,951,470

55,000

1D 0.00%

5D 2.23%

Buy Vol. 8,759,755

Sell Vol. 13,138,994

22,400

1D 1.82%

5D 2.52%

Buy Vol. 10,199,321

Sell Vol. 9,442,692

33,650

1D -1.03%

5D 0.75%

Buy Vol. 40,187,341

Sell Vol. 40,123,600

28,650

1D -1.21%

5D 3.80%

Buy Vol. 59,421,901

Sell Vol. 71,067,150

MWG: The Mobile World representative emphasized that Bach Hoa Xanh will make efforts to protect sales during the rainy period, lasting from August to October, and continue to push growth to an average of VND1.7 billion/store for the whole system in the last months of this year. It is expected that this chain will contribute profits to Mobile World from 2024.

Market by numbers

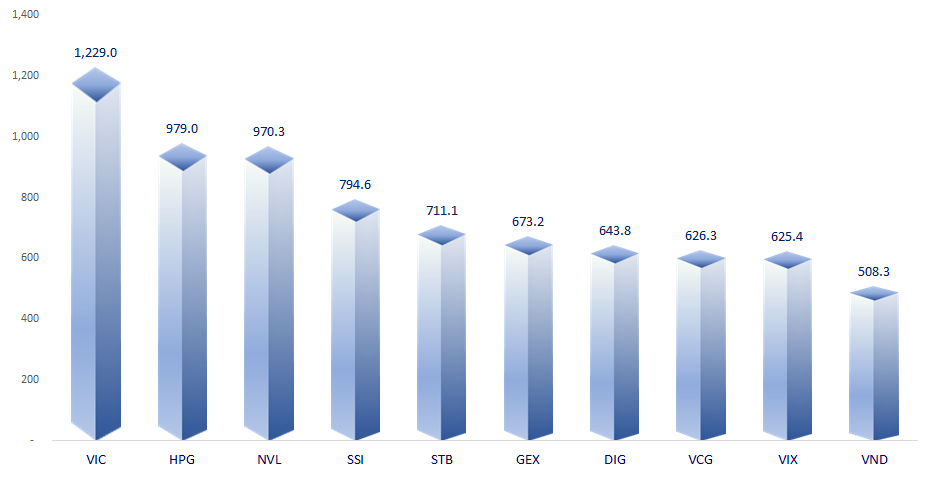

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

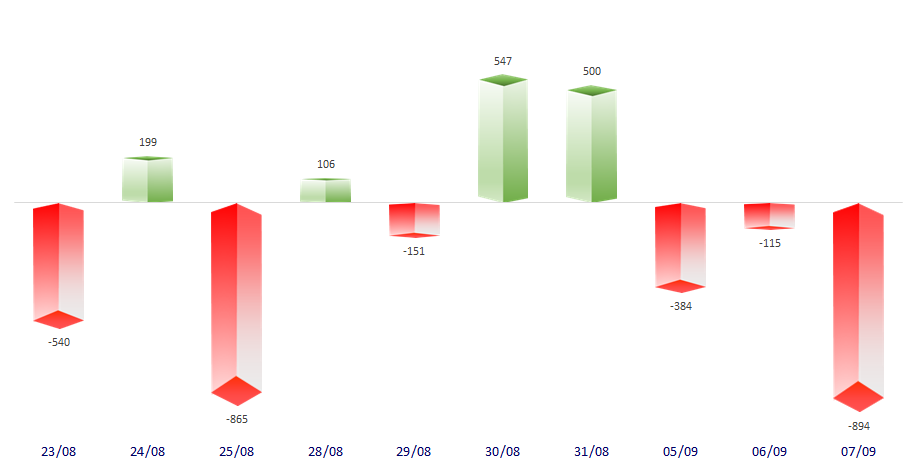

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

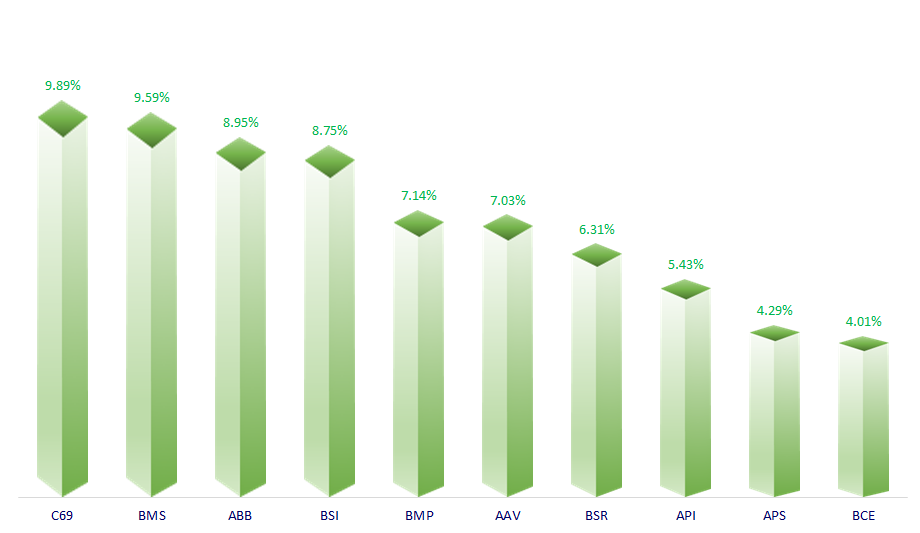

TOP INCREASES 3 CONSECUTIVE SESSIONS

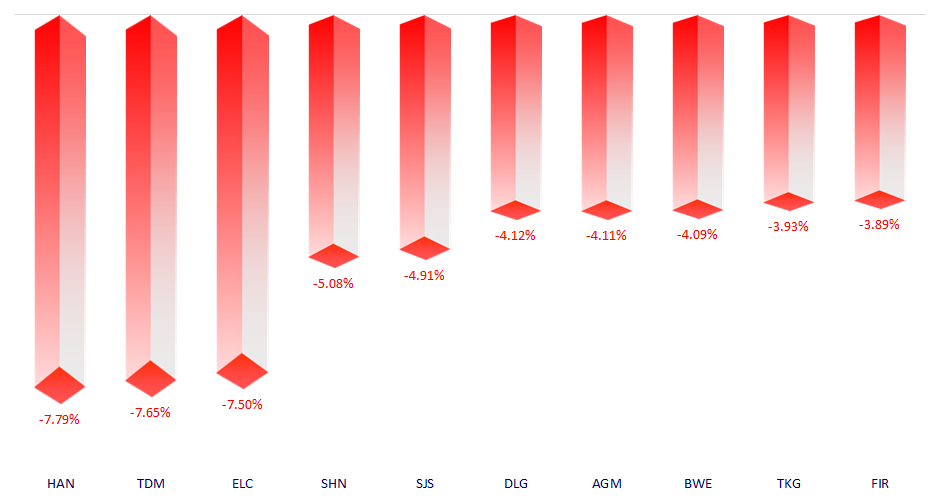

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.