Market brief 08/09/2023

VIETNAM STOCK MARKET

1,241.48

1D -0.13%

YTD 23.27%

1,249.14

1D -0.48%

YTD 24.27%

256.20

1D 0.02%

YTD 24.79%

94.72

1D 0.02%

YTD 32.20%

142.89

1D 0.00%

YTD 0.00%

29,478.25

1D 5.10%

YTD 242.14%

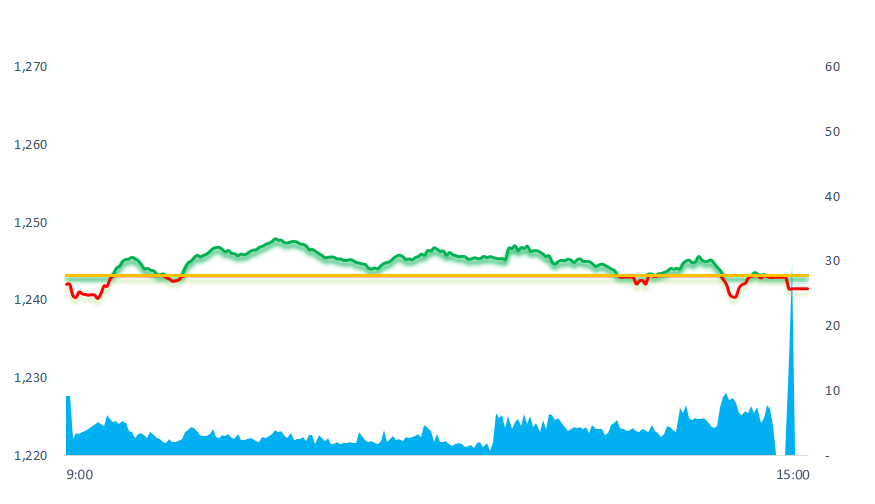

Following yesterday's drop, this morning, the stock market opened in the red, but soon after that VNIndex recovered and rallied again. The market traded above the reference level for most of the trading session. The end of afternoon session, active selling increased and pulled the index down.

ETF & DERIVATIVES

21,540

1D -0.14%

YTD 24.29%

14,790

1D -0.14%

YTD 24.08%

15,450

1D 0.26%

YTD 23.80%

19,050

1D 1.28%

YTD 35.59%

19,830

1D -0.65%

YTD 38.19%

27,610

1D 0.04%

YTD 23.26%

16,610

1D 0.42%

YTD 28.26%

1,250

1D -0.42%

YTD 0.00%

1,250

1D -0.28%

YTD 0.00%

1,247

1D -0.10%

YTD 0.00%

1,240

1D 0.21%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

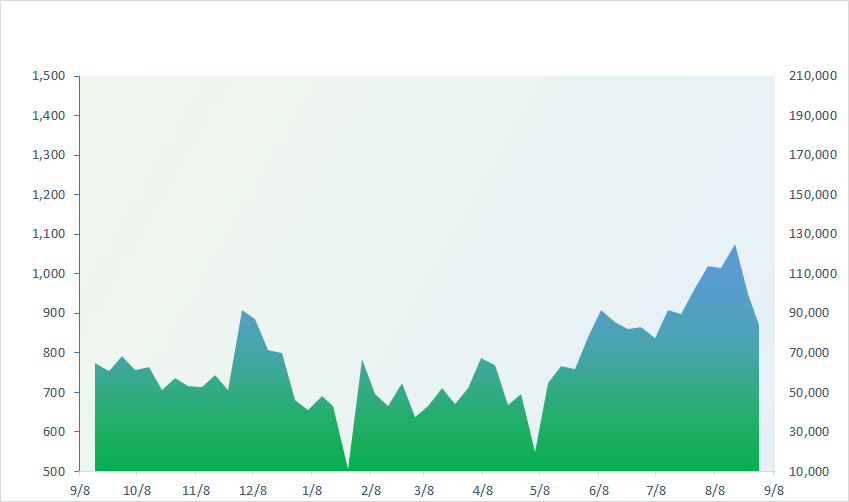

VNINDEX (12M)

GLOBAL MARKET

0

1D 32606.84

YTD -0.011646785

0

1D 3116.72

YTD -0.001803129

0

1D 10281.88

YTD -0.003832799

0

1D 18202.07

0

1D 2547.68

YTD -0.000227606

0

1D 66598.91

YTD 0.005030517

0

1D 3207.75

YTD -0.005838982

0

1D 1547.17

YTD -0.002057587

0

1D 90.47

YTD 0.009709821

0

1D 1925.4

YTD -6.75139E-05

Most Asian markets fell on Friday as weak economic data from Japan raised concerns about slowing growth and worsening US-China relations dented tech stocks. Japan's Nikkei 225 was the worst performer in Asia, falling 1.16% as stimulus measures from the BOJ may not support growth as much as initially expected.

VIETNAM ECONOMY

0.17%

1D (bps) -1

YTD (bps) -480

5.80%

YTD (bps) -160

2.16%

1D (bps) 1

YTD (bps) -263

2.50%

1D (bps) 2

YTD (bps) -240

24,273

1D (%) 0.14%

YTD (%) 2.16%

26,529

1D (%) 0.05%

YTD (%) 3.39%

3,355

1D (%) 0.03%

YTD (%) -3.73%

In the morning of September 8, the State Bank listed the central exchange rate at 23,979VND/USD, down 12VND/USD compared to yesterday. At commercial banks, the USD exchange rate is around 23,910 - 24,210VND/USD, an increase of 15VND/USD.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- There are more than VND100 trillion of bonds maturing in the last 4 months of the year;

- As of August 29, credit increased by 5.33% compared to the beginning of the year;

- The Ministry of Transport proposes to exempt or reduce registration fees and license plate fees for electric cars;

- The US seeks to increase financial resources for the IMF;

- The Eurozone economy grow by 0.1% in Q2/2023;

- The US announced a new aid package of more than USD1 billion for Ukraine.

VN30

BANK

89,500

1D 0.00%

5D 0.45%

Buy Vol. 2,041,402

Sell Vol. 2,122,562

47,000

1D -0.74%

5D 0.11%

Buy Vol. 2,420,087

Sell Vol. 3,311,626

32,300

1D -1.07%

5D -0.46%

Buy Vol. 6,902,175

Sell Vol. 7,611,219

35,350

1D -1.12%

5D 2.46%

Buy Vol. 7,974,318

Sell Vol. 7,857,749

21,800

1D 0.23%

5D 4.06%

Buy Vol. 26,060,857

Sell Vol. 31,362,327

19,100

1D -1.04%

5D 3.24%

Buy Vol. 23,657,888

Sell Vol. 21,852,167

17,350

1D 0.29%

5D 2.97%

Buy Vol. 8,830,962

Sell Vol. 9,286,943

19,400

1D -1.27%

5D -1.02%

Buy Vol. 10,257,248

Sell Vol. 12,321,979

32,500

1D -1.52%

5D -0.46%

Buy Vol. 39,556,412

Sell Vol. 39,670,585

20,600

1D -0.48%

5D 1.23%

Buy Vol. 6,203,500

Sell Vol. 10,202,430

22,750

1D -0.66%

5D 0.66%

Buy Vol. 9,372,406

Sell Vol. 12,113,670

12,700

1D -0.39%

5D 2.01%

Buy Vol. 42,206,055

Sell Vol. 51,431,296

27,500

1D 0.18%

5D -2.14%

Buy Vol. 2,241,472

Sell Vol. 2,230,191

The bank group continued to lead in the amount of private corporate bond issuance in August with VND14,085 billion (accounting for 57% of the total issuance value). The largest issuance value belongs to ACB with three issuances, total par value of VND6,500 billion, interest rate 6.5%/year.

OIL & GAS

102,200

1D -0.68%

5D 3.65%

Buy Vol. 1,228,662

Sell Vol. 992,880

12,850

1D -0.39%

5D 0.39%

Buy Vol. 17,659,187

Sell Vol. 20,396,618

39,400

1D 0.13%

5D 2.20%

Buy Vol. 1,821,888

Sell Vol. 2,186,523

POW: POW recorded revenue of VND 1,796 billion in August, down more than 22% MoM. Accumulated revenue in 8 months is estimated at VND19,920 billion.

VINGROUP

59,100

1D -2.80%

5D -4.83%

Buy Vol. 43,258,400

Sell Vol. 43,907,330

54,000

1D -2.00%

5D -1.28%

Buy Vol. 14,543,259

Sell Vol. 15,409,416

29,600

1D -2.31%

5D -2.31%

Buy Vol. 8,394,248

Sell Vol. 11,397,411

VIC: VinFast has just announced that it has issued bond batch VIFCB2325003 with a total value of VND2,000 billion. This bond lot has a term of 20 months, maturing on March 31, 2025.

FOOD & BEVERAGE

80,000

1D 0.63%

5D 2.83%

Buy Vol. 5,341,234

Sell Vol. 4,318,104

81,800

1D -0.24%

5D 0.37%

Buy Vol. 5,825,498

Sell Vol. 4,920,867

160,600

1D 0.06%

5D 1.65%

Buy Vol. 609,250

Sell Vol. 671,406

VNM: The impact of sugar price on Vinamilk is not too strong because the proportion of sugar in the cost price at Vinamilk accounts for only 2-3%.

OTHERS

45,650

1D -0.22%

5D 1.00%

Buy Vol. 930,726

Sell Vol. 1,460,067

45,650

1D -0.22%

5D 1.00%

Buy Vol. 930,726

Sell Vol. 1,460,067

101,400

1D 0.40%

5D 3.47%

Buy Vol. 1,305,287

Sell Vol. 1,204,006

97,600

1D -0.31%

5D 0.93%

Buy Vol. 3,639,652

Sell Vol. 4,146,211

55,500

1D 0.91%

5D 3.16%

Buy Vol. 12,200,403

Sell Vol. 14,334,484

22,700

1D 1.34%

5D 3.89%

Buy Vol. 6,140,715

Sell Vol. 7,453,080

33,750

1D 0.30%

5D 1.05%

Buy Vol. 34,225,588

Sell Vol. 31,134,760

28,750

1D 0.35%

5D 4.17%

Buy Vol. 65,655,635

Sell Vol. 63,411,352

HPG: In August 2023, Hoa Phat Group produced 686,000 tons of crude steel, an increase of 8% over the previous month and 20% over the same period last year. Sales output of construction steel, steel billets, and hot rolled steel coils (HRC) reached 558,000 tons, equivalent to July. Of which, Hoa Phat construction steel recorded 306,000 tons, the highest since the beginning of the year and an increase of 18% compared to July.

Market by numbers

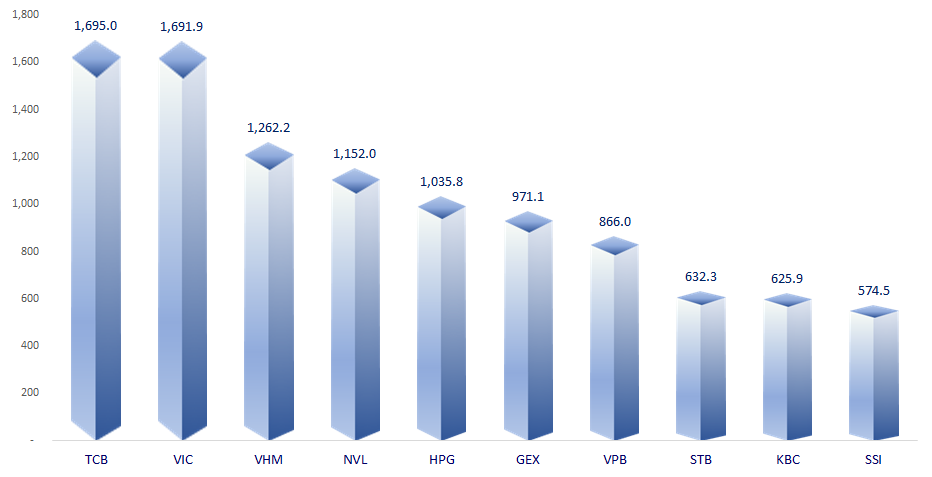

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

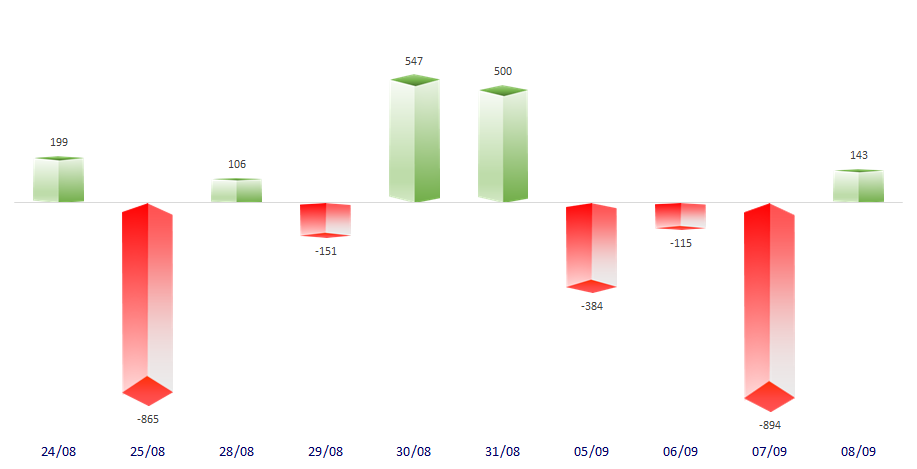

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

TOP INCREASES 3 CONSECUTIVE SESSIONS

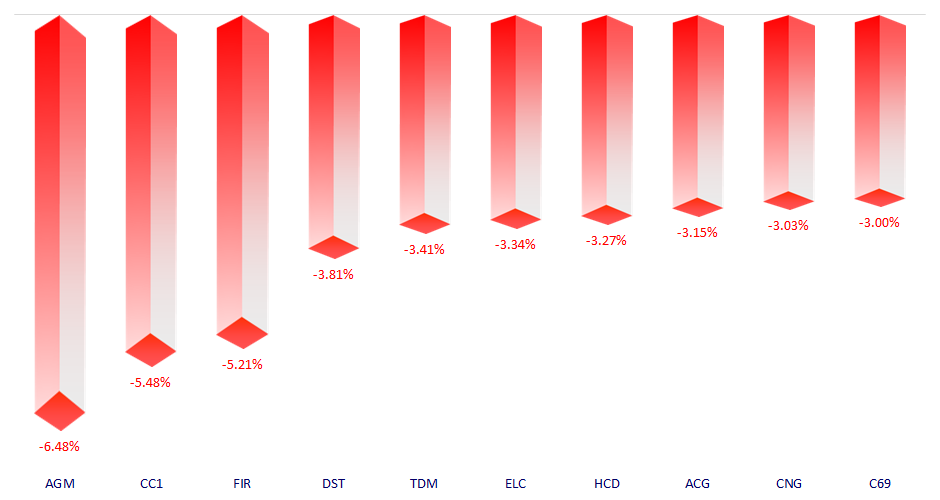

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.