Market brief 21/09/2023

VIETNAM STOCK MARKET

1,212.74

1D -1.09%

YTD 20.42%

1,219.19

1D -1.25%

YTD 21.29%

251.87

1D -1.16%

YTD 22.68%

92.39

1D -1.03%

YTD 28.95%

-374.33

1D 0.00%

YTD 0.00%

26,783.26

1D 15.91%

YTD 210.86%

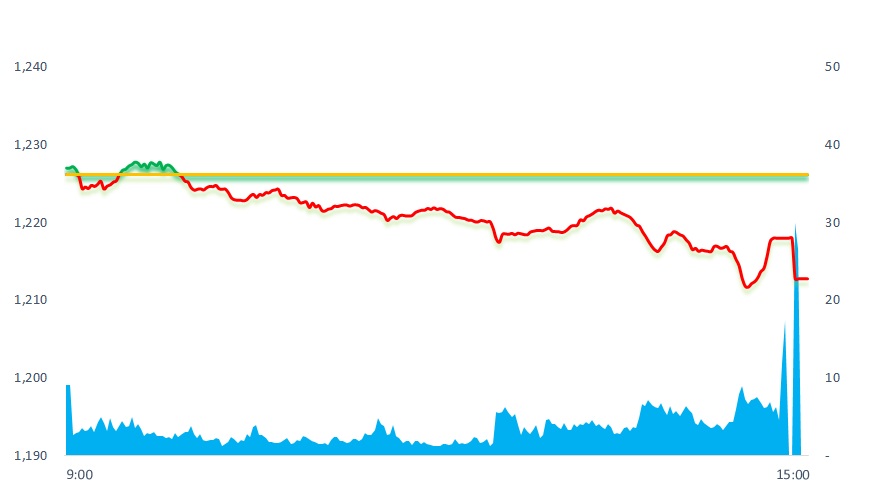

The stock market traded in a narrow range at the beginning session, then turned down from about 10am. During the remaining time, the index's losing expanded and by the end of the session, VNIndex almost lost all the points it gained yesterday.

ETF & DERIVATIVES

21,040

1D -0.99%

YTD 21.41%

14,390

1D -1.37%

YTD 20.72%

15,000

1D -1.06%

YTD 20.19%

18,520

1D -2.99%

YTD 31.81%

19,630

1D -1.60%

YTD 36.79%

27,430

1D -0.83%

YTD 22.46%

16,330

1D -1.03%

YTD 26.10%

1,221

1D -0.89%

YTD 0.00%

1,215

1D -1.37%

YTD 0.00%

1,212

1D -1.41%

YTD 0.00%

1,210

1D -1.25%

YTD 0.00%

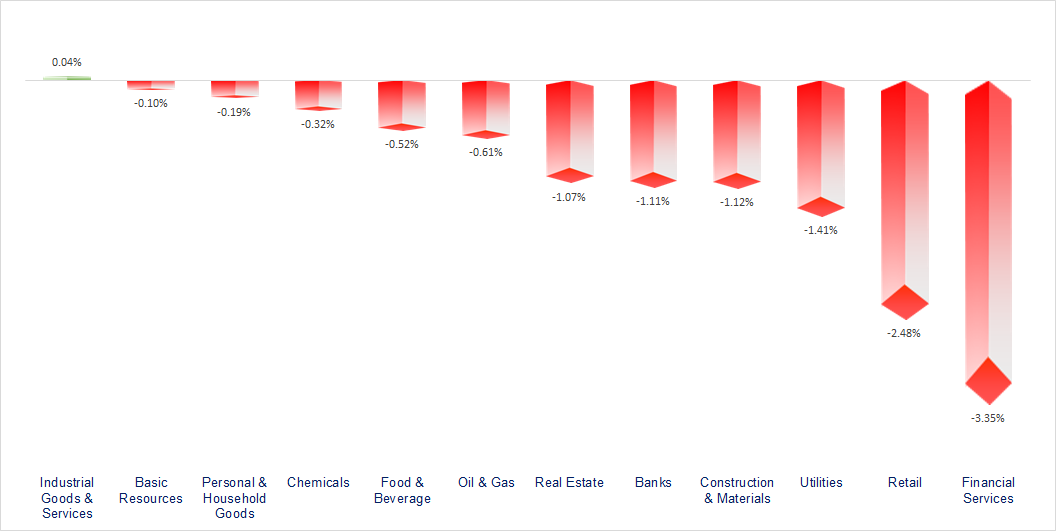

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

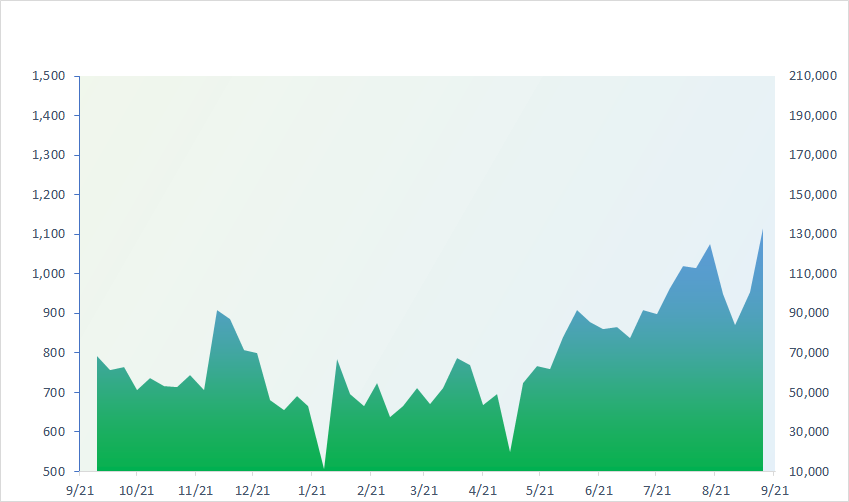

VNINDEX (12M)

GLOBAL MARKET

0

1D 32571.03

YTD -0.013709818

0

1D 3084.7

YTD -0.007678772

0

1D 9981.67

YTD -0.009013687

0

1D 17655.41

YTD -0.01287013

0

1D 2514.97

YTD -0.017490058

0

1D 66230.24

YTD -0.008541809

0

1D 3202.81

YTD -0.012088217

0

1D 1514.26

YTD 0.004217786

0

1D 93.69

YTD 0.006553502

0

1D 1924.34

YTD -0.000737371

Most Asian stocks fell on Thursday. Technology stocks were hit hard, after stocks in the same industry in the US fell last night. Tech-heavy markets such as South Korea's Kospi, Hong Kong's Hang Seng and Nikkei 225 were the worst performers on the day, falling between 0.77% and 1.37%.

VIETNAM ECONOMY

0.16%

1D (bps) 1

YTD (bps) -481

5.50%

YTD (bps) -190

2.20%

1D (bps) 5

YTD (bps) -259

2.51%

1D (bps) 6

YTD (bps) -239

24,535

1D (%) 0.34%

YTD (%) 3.26%

26,346

1D (%) -0.76%

YTD (%) 2.68%

3,400

1D (%) -0.06%

YTD (%) -2.44%

According to the bidding results on September 21, the State Bank issued VND9,995 billion of T-bills with the winning interest rate reaching 0.69%/year. The winning interest rate for treasury bills is currently higher than the average interbank interest rate (latest announced on September 19, 2023 is 0.15%)

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Credit growth as of September 15 only reached 5.56%;

- Wheat imports from the US increased dramatically;

- Singaporean businesses want to invest VND6,100 billion in Hai Duong;

- The Fed decided to keep interest rates unchanged at a 22-year high, signaling another increase this year;

- Foreign investors continued to sell USD3.8 billion of Chinese stocks, the index fell to a 10-month low;

- Hedge funds could send US bonds into chaos.

VN30

BANK

87,000

1D -1.14%

5D -2.36%

Buy Vol. 2,338,289

Sell Vol. 2,487,691

45,200

1D -1.09%

5D -3.32%

Buy Vol. 1,791,276

Sell Vol. 1,861,644

31,700

1D -1.09%

5D -4.52%

Buy Vol. 12,787,185

Sell Vol. 9,180,319

34,300

1D -0.15%

5D -1.72%

Buy Vol. 7,406,645

Sell Vol. 5,594,652

21,650

1D -1.14%

5D -3.35%

Buy Vol. 20,165,527

Sell Vol. 18,626,838

18,950

1D -1.30%

5D -1.04%

Buy Vol. 21,775,156

Sell Vol. 25,602,288

17,550

1D -1.68%

5D 0.29%

Buy Vol. 11,733,959

Sell Vol. 13,260,810

19,050

1D -2.31%

5D 0.26%

Buy Vol. 9,363,999

Sell Vol. 13,687,358

32,350

1D -2.71%

5D 1.73%

Buy Vol. 54,168,499

Sell Vol. 48,304,197

20,650

1D -1.67%

5D -4.84%

Buy Vol. 12,193,648

Sell Vol. 14,943,648

22,400

1D -0.22%

5D -0.22%

Buy Vol. 10,986,664

Sell Vol. 10,375,007

12,050

1D -1.23%

5D -2.03%

Buy Vol. 36,533,788

Sell Vol. 41,049,499

26,500

1D 0.00%

5D 0.76%

Buy Vol. 2,393,146

Sell Vol. 2,421,013

With the preferential interest rates offered by banks in recent times, borrowing money from banks to pay off debt from other banks is considered a great opportunity for borrowers who are "burdened" with high interest rates. However, in reality, implementing loan procedures is not easy and the costs incurred are very large, if added to the interest rate, it is not low.

OIL & GAS

106,500

1D -2.29%

5D 0.47%

Buy Vol. 1,463,318

Sell Vol. 1,369,585

12,700

1D -0.78%

5D -0.39%

Buy Vol. 11,670,149

Sell Vol. 15,499,134

39,800

1D 0.25%

5D 1.25%

Buy Vol. 1,738,193

Sell Vol. 4,132,612

Today, gasoline prices increased by 720-870VND/liter. Kerosene increased by VND630. Similarly, diesel and mazut increased by VND540 and VND140 respectively.

VINGROUP

52,200

1D -2.43%

5D -5.95%

Buy Vol. 15,118,188

Sell Vol. 17,667,624

50,200

1D -0.99%

5D 2.45%

Buy Vol. 8,612,346

Sell Vol. 10,347,119

28,150

1D 0.18%

5D -2.60%

Buy Vol. 5,179,885

Sell Vol. 5,760,140

VIC: After 2 years of construction, VinES Ha Tinh factory has started official production from the end of August 2023 with the product being a battery pack for the VF6 car line.

FOOD & BEVERAGE

78,000

1D -0.38%

5D -1.76%

Buy Vol. 4,335,165

Sell Vol. 4,234,333

78,800

1D -1.13%

5D 0.25%

Buy Vol. 2,764,946

Sell Vol. 2,848,293

80,000

1D -0.62%

5D -6.10%

Buy Vol. 923,767

Sell Vol. 811,321

From September 8 to 15, VanEck Vectors Vietnam ETF (VNM ETF) bought more than 2 million SAB shares, increasing the proportion of this stock in the portfolio to 2.32%.

OTHERS

44,350

1D -0.56%

5D -1.88%

Buy Vol. 676,495

Sell Vol. 873,244

44,350

1D -0.56%

5D -1.88%

Buy Vol. 676,495

Sell Vol. 873,244

99,300

1D -0.10%

5D 0.30%

Buy Vol. 1,399,488

Sell Vol. 1,392,031

96,800

1D -1.73%

5D 0.94%

Buy Vol. 6,332,057

Sell Vol. 6,149,175

54,200

1D -2.87%

5D -5.41%

Buy Vol. 14,753,142

Sell Vol. 17,343,079

23,200

1D 0.43%

5D 5.45%

Buy Vol. 9,391,073

Sell Vol. 10,221,375

34,750

1D -4.66%

5D -2.52%

Buy Vol. 75,502,792

Sell Vol. 83,918,016

28,400

1D 0.00%

5D 2.16%

Buy Vol. 70,819,191

Sell Vol. 89,619,815

HPG: Hoa Phat Group proposed planning Bai Goc port in Phu Yen. According to the proposal, Bai Goc port planning includes: Port size, capacity, breakwater, steel factory size and will be divided into functional areas: Oil port, steel factory service port, general port, public service wharf.

Market by numbers

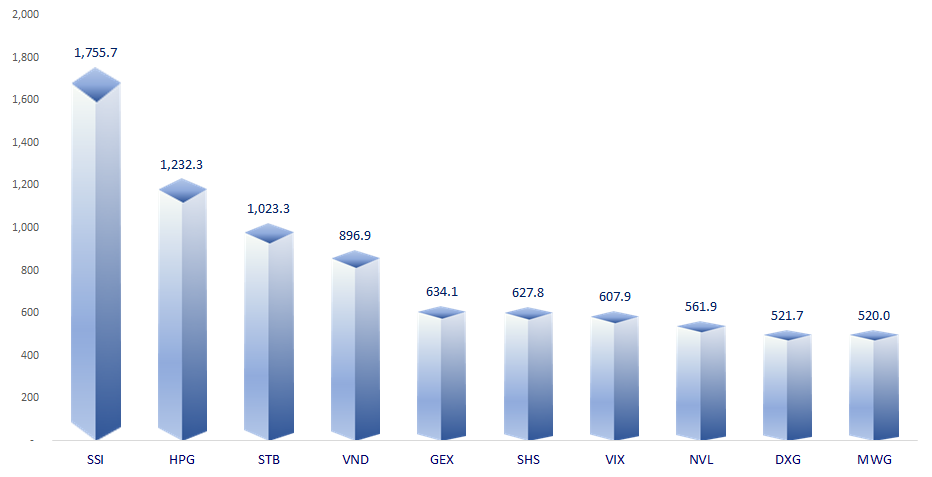

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

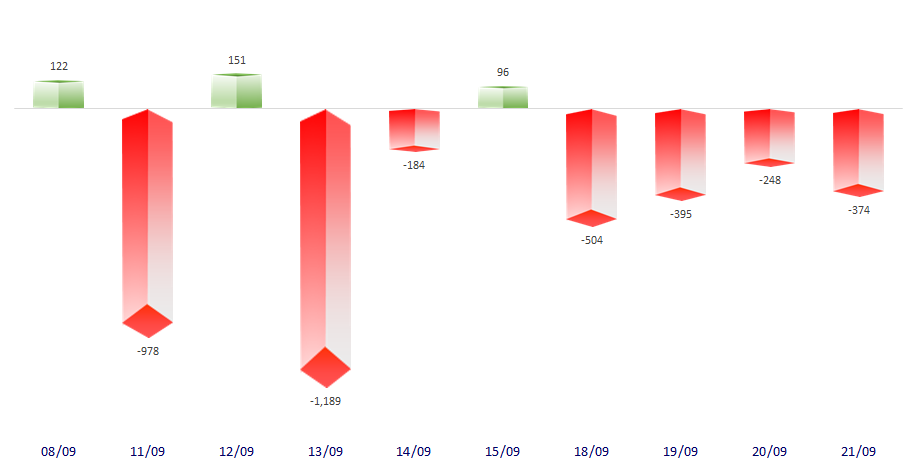

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

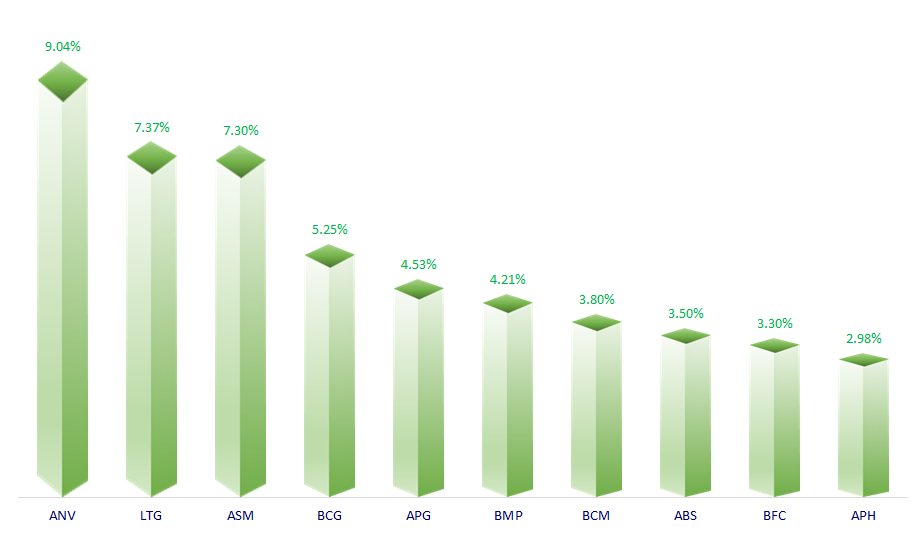

TOP INCREASES 3 CONSECUTIVE SESSIONS

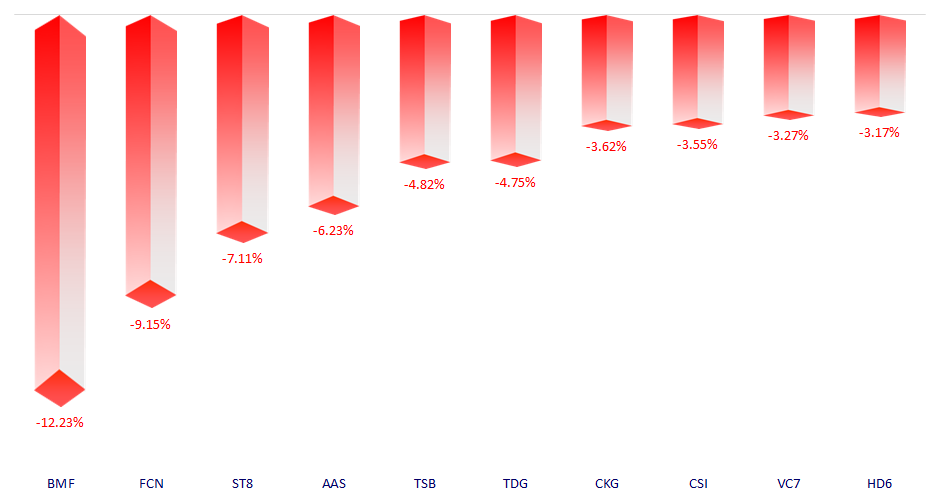

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.