Market Brief 15/11/2023

VIETNAM STOCK MARKET

1,122.50

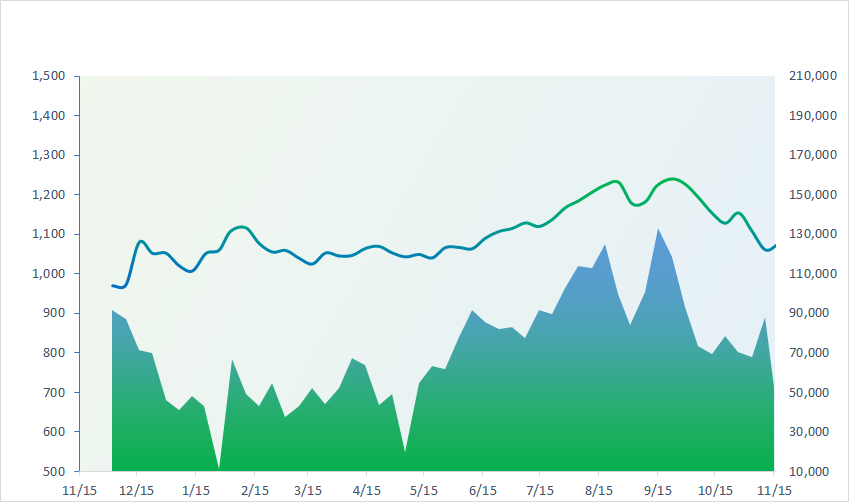

1D 1.15%

YTD 11.46%

1,131.90

1D 1.13%

YTD 12.61%

227.88

1D 0.20%

YTD 10.99%

87.00

1D 0.40%

YTD 21.42%

186.30

1D 0.00%

YTD 0.00%

22,502.28

1D 15.98%

YTD 161.17%

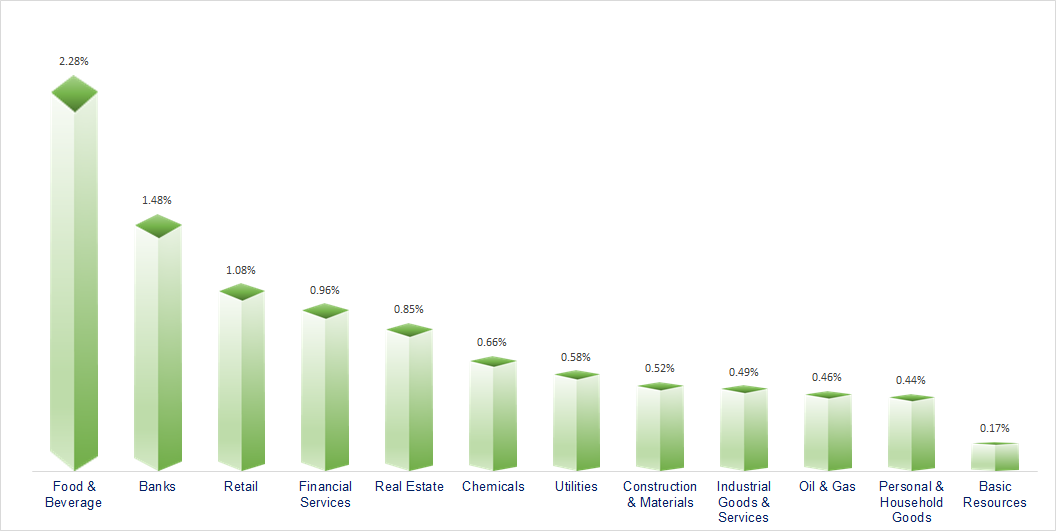

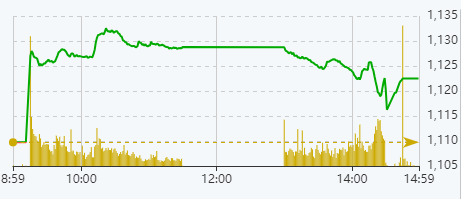

Since the opening, the market jumped more than 20 points. Although there was weakness in the afternoon session, the green color still maintained until the end of the session. Almost all industries increased today, the most positive were food and beverages, banking.

ETF & DERIVATIVES

19,560

1D 1.35%

YTD 12.87%

13,410

1D 1.06%

YTD 12.50%

14,000

1D 1.52%

YTD 12.18%

17,030

1D 0.24%

YTD 21.21%

18,700

1D 1.80%

YTD 30.31%

25,660

1D 1.62%

YTD 14.55%

15,190

1D 1.40%

YTD 17.30%

1,134

1D 1.25%

YTD 0.00%

1,130

1D 1.29%

YTD 0.00%

1,130

1D 1.60%

YTD 0.00%

1,127

1D 1.45%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

33,519.70

1D 2.52%

YTD 28.46%

3,072.83

1D 0.55%

YTD -0.53%

10,077.96

1D 0.72%

YTD -8.52%

18,079.00

1D 3.92%

YTD -8.61%

2,486.67

1D 2.20%

YTD 11.19%

65,659.49

1D 1.12%

YTD 7.92%

3,132.12

1D 0.94%

YTD -3.67%

1,415.17

1D 2.24%

YTD -15.28%

81.97

1D -0.75%

YTD -4.59%

1,970.88

1D 0.41%

YTD 7.92%

Asian stocks also rebounded strongly when US inflation decreased and investors raised expectations that Fed will soon reduce interest rates in 2024. In addition, a series of positive news was announced to help boost interest rates, such as data on industrial output and strong retail sales in China. Bloomberg News has reported that China plans to provide 1 trillion yuan (USD137 billion) to support the housing market.

VIETNAM ECONOMY

0.30%

1D (bps) -26

YTD (bps) -467

5.00%

YTD (bps) -240

2.23%

1D (bps) 7

YTD (bps) -256

2.63%

1D (bps) 14

YTD (bps) -227

24,510

1D (%) 0.25%

YTD (%) 3.16%

26,818

1D (%) -1.14%

YTD (%) 4.52%

3,423

1D (%) 0.29%

YTD (%) -1.78%

On November 15, the exchange rate simultaneously dropped sharply to VND100 at banks. At Vietcombank, the exchange rate has decreased by VND100 to VND24,110 on the buying side and VND24,450 on the selling side. BIDV also adjusted VND75 to VND24,130 for buying and VND24,430 for selling.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Lending interest rates continue to decrease at many banks;

- Minister of Finance Ho Duc Phoc chaired the Investment Promotion Conference in the US;

- The Ministry of Transport supports Dong Nai in implementing Bien Hoa airport planning;

- Iron ore prices hit 8-month high thanks to expectations of China's real estate bailout package;

- Oil market less tight than expected on supply gain, IEA says;

- UBS: Fed will cut interest rates by nearly 300 bps in 2024 as the US economy shrinks.

VN30

BANK

87,700

1D 1.98%

5D -2.01%

Buy Vol. 5,015,094

Sell Vol. 5,078,657

44,150

1D 2.67%

5D 2.91%

Buy Vol. 2,292,149

Sell Vol. 2,789,490

30,200

1D 1.34%

5D 3.25%

Buy Vol. 10,425,099

Sell Vol. 10,252,383

31,550

1D 0.16%

5D -0.79%

Buy Vol. 5,157,885

Sell Vol. 8,599,894

19,950

1D 1.79%

5D -1.97%

Buy Vol. 26,521,211

Sell Vol. 34,034,757

18,550

1D 0.54%

5D 1.09%

Buy Vol. 22,502,364

Sell Vol. 32,859,849

18,900

1D 0.80%

5D 0.53%

Buy Vol. 15,542,960

Sell Vol. 16,556,504

17,700

1D 1.72%

5D 2.61%

Buy Vol. 18,061,691

Sell Vol. 19,465,458

30,000

1D 0.00%

5D 0.00%

Buy Vol. 29,966,621

Sell Vol. 42,586,218

19,650

1D 0.26%

5D 1.29%

Buy Vol. 8,929,205

Sell Vol. 11,061,920

23,250

1D 2.42%

5D 1.97%

Buy Vol. 42,605,379

Sell Vol. 52,109,275

11,550

1D 0.87%

5D 1.76%

Buy Vol. 59,434,004

Sell Vol. 80,541,680

23,500

1D 1.51%

5D -5.81%

Buy Vol. 3,022,375

Sell Vol. 2,809,607

TCB: In the first 9 months of the year, TCB and MBB were two leading banks in terms of salaries paid. On average, each month, TCB paid about 45.2 million VND/employee. Big 4 such as Vietcombank, BIDV and VietinBank ranked 3rd, 4th and 6th respectively. ACB, TPB, SHB, VIB and STB were remaining banks in the top 10.

OIL & GAS

11,750

1D 1.26%

5D 2.17%

Buy Vol. 16,442,593

Sell Vol. 23,101,269

34,000

1D -0.84%

5D -0.58%

Buy Vol. 2,115,225

Sell Vol. 2,856,998

45,400

1D 1.49%

5D 5.58%

Buy Vol. 8,767,066

Sell Vol. 13,218,073

POW: In November, PV Power expects total revenue from factories to be VND2,710 billion, up 21% compared to October and down 1.7% compared to November 2022.

VINGROUP

41,450

1D 1.00%

5D 1.10%

Buy Vol. 15,117,895

Sell Vol. 15,290,406

24,100

1D 1.10%

5D 1.69%

Buy Vol. 6,816,245

Sell Vol. 8,829,226

70,700

1D 0.42%

5D -0.98%

Buy Vol. 7,422,916

Sell Vol. 6,490,404

VRE: Vincom Retail plans to open an additional 160,000 m2 of retail floor space in 2024.

FOOD & BEVERAGE

65,800

1D 2.61%

5D 3.13%

Buy Vol. 7,175,874

Sell Vol. 5,874,924

63,200

1D 5.11%

5D -2.92%

Buy Vol. 2,078,781

Sell Vol. 2,036,834

62,000

1D 1.94%

5D 4.03%

Buy Vol. 1,057,001

Sell Vol. 987,712

MSN: Masan is one of stocks with the strongest gain affecting VNIndex today, with an increase of 5.1%.

OTHERS

40,900

1D 3.33%

5D -0.24%

Buy Vol. 905,477

Sell Vol. 1,217,352

40,900

1D 0.25%

5D -0.24%

Buy Vol. 905,477

Sell Vol. 1,217,352

108,700

1D 0.83%

5D -3.81%

Buy Vol. 1,284,342

Sell Vol. 1,261,867

92,400

1D -0.22%

5D -0.22%

Buy Vol. 3,600,153

Sell Vol. 7,204,334

41,900

1D 0.96%

5D 5.81%

Buy Vol. 15,719,157

Sell Vol. 21,743,538

19,850

1D 0.76%

5D 0.76%

Buy Vol. 5,043,797

Sell Vol. 7,274,977

31,950

1D 0.63%

5D 5.45%

Buy Vol. 43,824,052

Sell Vol. 57,524,598

27,000

1D 0.00%

5D 0.19%

Buy Vol. 71,419,511

Sell Vol. 82,364,972

FPT: FPT Software has just announced a strategic partnership with Silicon Valley's AITOMATIC, a leader in Industrial Generative Artificial Intelligence (AI). This partnership enables both companies to promote Industrial AI – the applications of AI to industrial use cases – to their customers worldwide.

Market by numbers

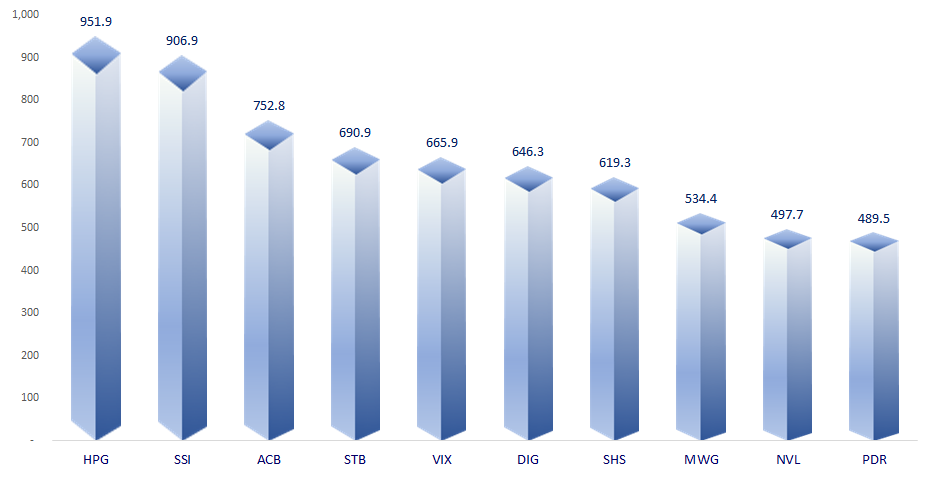

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

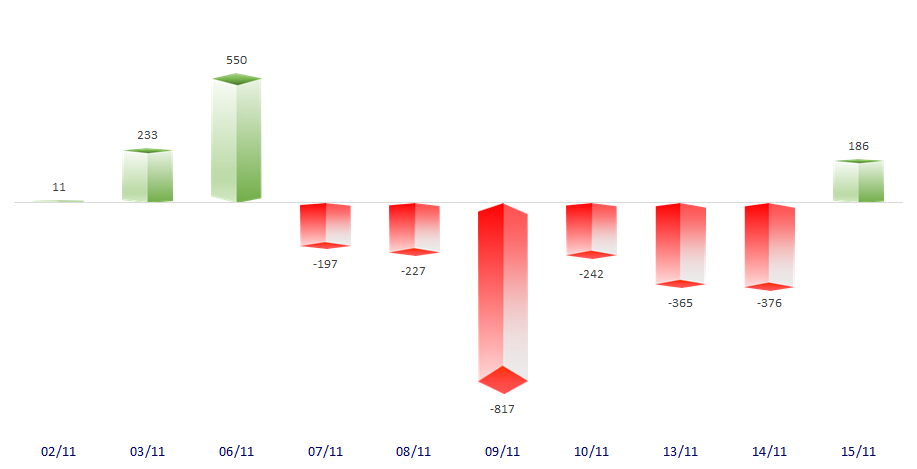

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

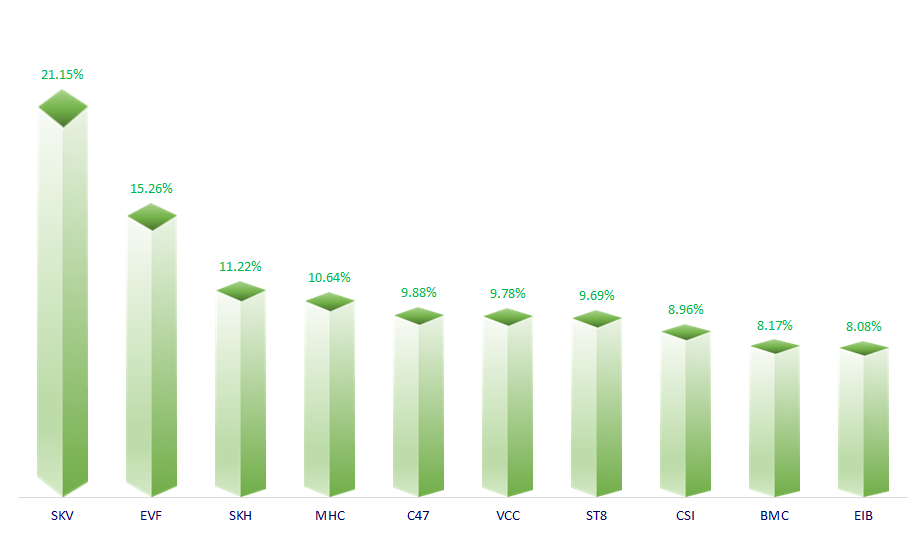

TOP INCREASES 3 CONSECUTIVE SESSIONS

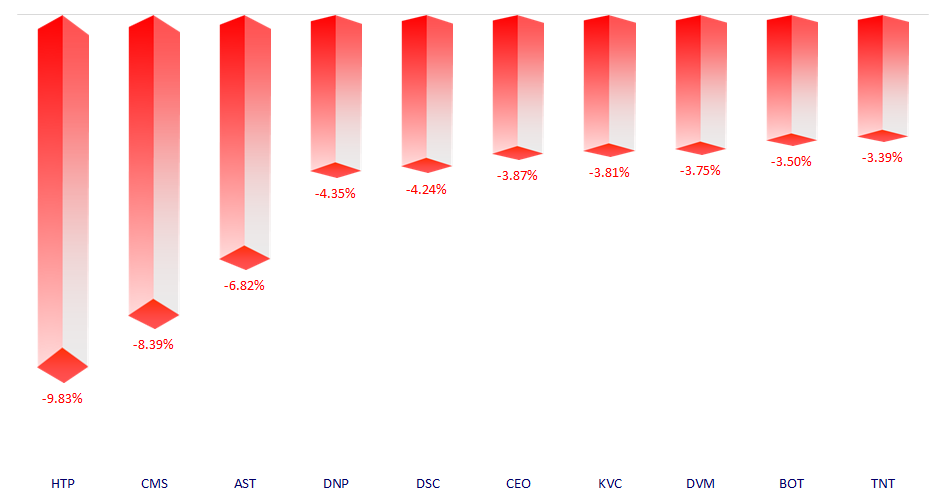

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.