Market Brief 12/12/2023

VIETNAM STOCK MARKET

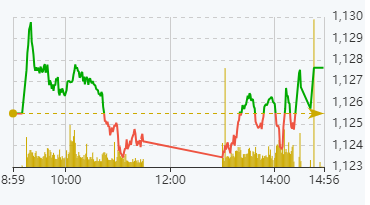

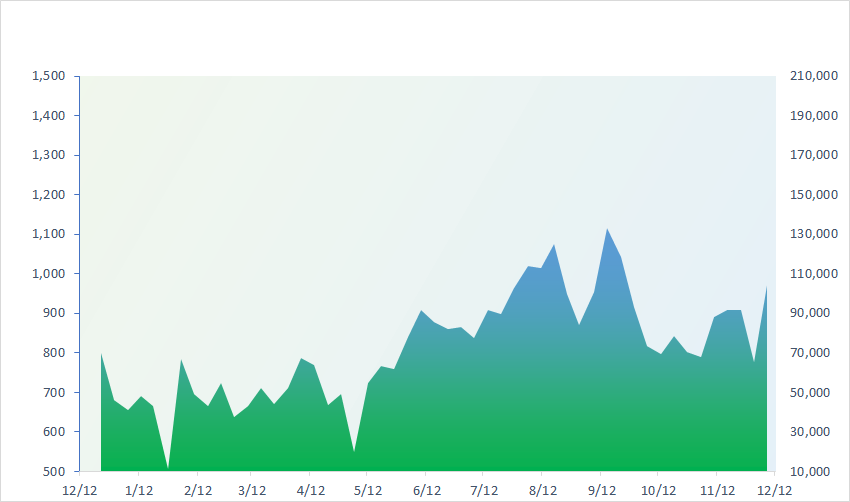

1,127.63

1D 0.19%

YTD 11.97%

231.71

1D 0.15%

YTD 12.86%

1,121.21

1D 0.35%

YTD 11.54%

85.35

1D -0.15%

YTD 19.12%

-267.59

1D 0.00%

YTD 0.00%

15,890.41

1D -4.78%

YTD 84.43%

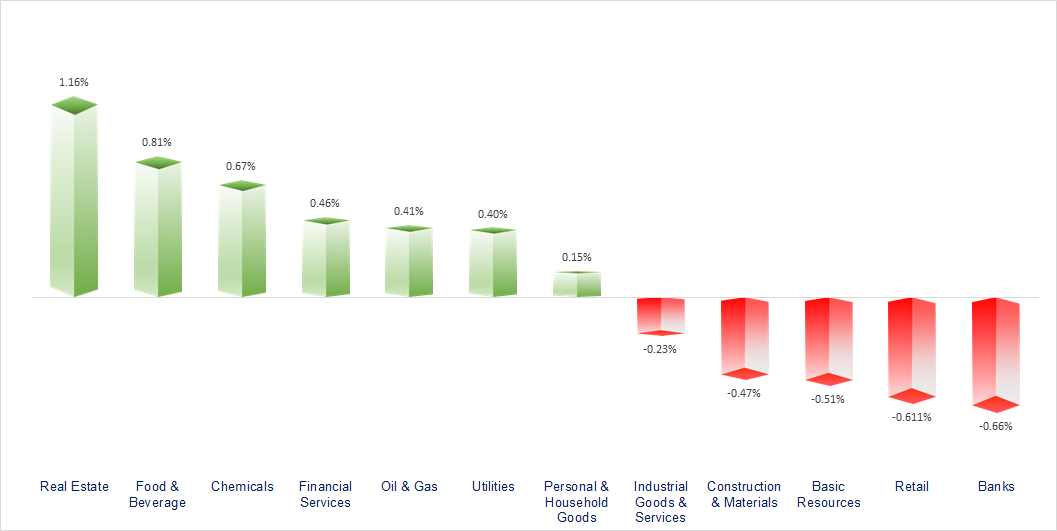

The market continued to move sideways in a narrow range of +/-2 points as investors waited for US inflation data and results from the Fed's meeting this week. Basic resources was the most positive sector today, while beverage services and oil and gas were negative.

ETF & DERIVATIVES

19,300

1D 0.05%

YTD 11.37%

13,310

1D 1.60%

YTD 11.66%

13,860

1D 0.51%

YTD 11.06%

17,180

1D 1.06%

YTD 22.28%

18,330

1D 0.22%

YTD 27.74%

25,570

1D 0.27%

YTD 14.15%

15,150

1D 0.20%

YTD 16.99%

1,119

1D 0.16%

YTD 0.00%

1,118

1D 0.30%

YTD 0.00%

1,113

1D 0.02%

YTD 0.00%

1,110

1D -0.08%

YTD 0.00%

CHANGE IN PRICE BY SECTOR

INTRADAY VNINDEX

VNINDEX (12M)

GLOBAL MARKET

32,843.70

1D 0.16%

YTD 25.86%

3,003.44

1D 0.40%

YTD -2.78%

9,625.26

1D -0.08%

YTD -12.62%

16,374.50

1D 1.07%

YTD -17.22%

2,535.27

1D 0.39%

YTD 13.36%

69,559.88

1D -0.51%

YTD 14.33%

3,098.51

1D 0.27%

YTD -4.70%

1,371.55

1D -0.68%

YTD -17.89%

76.44

1D 0.45%

YTD -11.02%

1,984.39

1D -0.77%

YTD 8.66%

Most Asian stocks rallied as investors waited for US CPI data to be released tonight. Japan's Nikkei 225 index continued its strong upward momentum from Monday. Japan's wholesale inflation slowed sharply in November as fuel and commodity prices fell, data showed a sign of easing cost-push pressure in the world's third-largest economy. The data underscores the Bank of Japan's view commodity-driven inflation will gradually dissipate and shifts the market's focus to whether domestic demand will be strong enough for the central bank to phase out stimulus.

VIETNAM ECONOMY

0.15%

YTD (bps) -482

4.80%

YTD (bps) -260

1.98%

1D (bps) 5

YTD (bps) -281

2.34%

1D (bps) -12

YTD (bps) -256

24,436

1D (%) 0.05%

YTD (%) 2.85%

26,911

1D (%) 0.26%

YTD (%) 4.88%

3,451

1D (%) 0.03%

YTD (%) -0.98%

Domestic gold prices continued to decrease sharply compared to the end of yesterday. Within 2 days, gold prices decreased by nearly 1 million VND/tael. At Saigon Jewelry Company, SJC gold price decreased by 150,000 VND/tael to 72.6-73.6 million VND/tael since opening. Meanwhile, at Phu Nhuan Jewelry (PNJ), SJC gold price also decreased by 200,000 VND/tael.

EVENT CALENDAR

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

No event for this day

SELECTED NEWS

- Gold price today: SJC gold has mixed movements with world gold, falling deeply to 500,000 VND/tael;

- Accumulated for 11 months, budget revenue reached more than VND1,537 triilion;

- Prime Minister Pham Minh Chinh welcomed Party General Secretary and President Xi Jinping;

- Oil prices could drop 50% if OPEC+ increases production in 2024;

- Bitcoin recovered to nearly USD42,000 after the sharpest decline in 4 months;

- ECB may reduce interest rates from March 2024.

VN30

BANK

84,200

1D 0.00%

5D -1.41%

Buy Vol. 2,187,183

Sell Vol. 2,299,644

41,900

1D 1.21%

5D 5.67%

Buy Vol. 2,094,350

Sell Vol. 1,947,738

27,000

1D 0.56%

5D 1.89%

Buy Vol. 6,887,316

Sell Vol. 6,582,968

31,050

1D 0.65%

5D 3.33%

Buy Vol. 4,857,846

Sell Vol. 3,900,597

19,450

1D 0.26%

5D 1.57%

Buy Vol. 14,727,385

Sell Vol. 13,193,331

18,250

1D 0.55%

5D 1.11%

Buy Vol. 10,002,157

Sell Vol. 11,725,333

18,800

1D 0.27%

5D 1.90%

Buy Vol. 9,070,017

Sell Vol. 10,544,999

17,350

1D 0.00%

5D 1.76%

Buy Vol. 5,257,682

Sell Vol. 5,929,306

28,000

1D 0.54%

5D 0.72%

Buy Vol. 20,829,487

Sell Vol. 15,490,027

19,200

1D 0.00%

5D 0.26%

Buy Vol. 5,019,311

Sell Vol. 5,433,044

22,500

1D 0.45%

5D 1.58%

Buy Vol. 5,826,885

Sell Vol. 6,902,506

11,100

1D -0.45%

5D 1.37%

Buy Vol. 38,544,436

Sell Vol. 49,502,948

22,650

1D 0.00%

5D -0.22%

Buy Vol. 1,521,687

Sell Vol. 2,056,315

VIB: Vietnam International Commercial Joint Stock Bank (VIB) has closed a medium-long-term syndicated loan worth USD280 million. The agreement has been signed among VIB as the borrower and 13 leading financial institutions around the world, including United Overseas Bank Limited (UOB) as the Coordinator and Mandated Lead Arranger and Book-runner (MLAB), Mashreqbank PSC as Facility Agent and MLAB, Maybank as MLAB, and 10 other esteemed financial institutions which joined as credit partners.

OIL & GAS

78,200

1D -0.13%

5D 1.31%

Buy Vol. 11,887,282

Sell Vol. 10,427,438

11,600

1D 0.00%

5D -0.28%

Buy Vol. 1,248,300

Sell Vol. 1,218,986

35,450

1D -0.56%

5D 3.39%

Buy Vol. 4,254,265

Sell Vol. 6,333,210

GAS: In 2023, PV Gas's revenue and profit are expected to exceed 22% and 77% of the yearly plan, respectively.

VINGROUP

44,250

1D 0.45%

5D 1.36%

Buy Vol. 10,870,464

Sell Vol. 13,884,879

41,050

1D 0.12%

5D 3.50%

Buy Vol. 5,826,527

Sell Vol. 7,108,667

23,650

1D 0.00%

5D 1.91%

Buy Vol. 4,217,608

Sell Vol. 5,247,799

VIC: Wall Street Journal reported that VinFast received a lot of support from the US Government and authorities in North Carolina.

FOOD & BEVERAGE

69,400

1D -0.86%

5D 7.82%

Buy Vol. 5,750,046

Sell Vol. 5,370,566

66,200

1D -1.93%

5D 1.56%

Buy Vol. 688,487

Sell Vol. 711,640

65,000

1D -0.76%

5D 1.74%

Buy Vol. 725,981

Sell Vol. 765,721

At the end of the December 12 session, shares of MSN and VNM were sold the most by foreign investors with a value of VND64 billion and VND61 billion, respectively.

OTHERS

64,400

1D -1.08%

5D 0.75%

Buy Vol. 575,636

Sell Vol. 785,367

40,100

1D 0.12%

5D 0.75%

Buy Vol. 575,636

Sell Vol. 785,367

104,500

1D 0.29%

5D -0.57%

Buy Vol. 1,103,345

Sell Vol. 1,006,840

96,800

1D 1.89%

5D 2.11%

Buy Vol. 7,426,798

Sell Vol. 6,838,954

42,500

1D 0.00%

5D 6.25%

Buy Vol. 9,693,575

Sell Vol. 11,488,847

20,350

1D 0.00%

5D -1.21%

Buy Vol. 3,005,565

Sell Vol. 4,266,459

32,600

1D -0.31%

5D -2.10%

Buy Vol. 27,110,156

Sell Vol. 31,213,963

27,950

1D 1.64%

5D 2.57%

Buy Vol. 58,025,188

Sell Vol. 77,748,362

HPG: Vietnam Steel Association (VSA) said finished steel production reached 2.45 million tons in November, up 3% compared to October and up 34% over the same period in 2022. Steel consumption output reached 2.5 million tons, up 13% over the previous month and up 30% over the same period in 2022.

Market by numbers

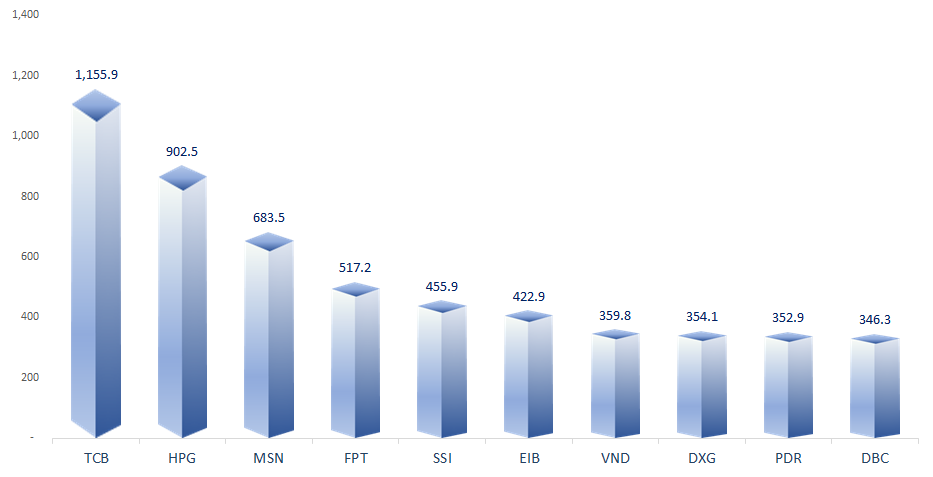

TOP MOST TRADED TICKERS (VOLUME - IN MILLION)

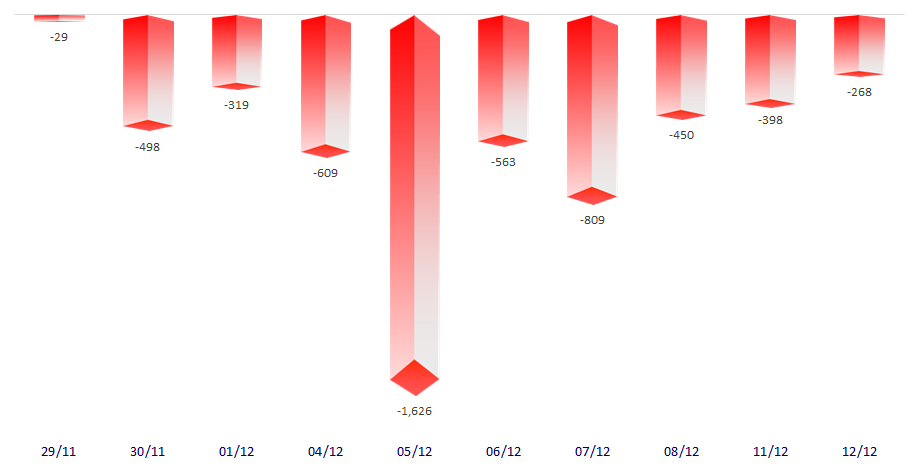

FOREIGN NET FLOW 10 NEAREST SESSIONS (BILLION VND)

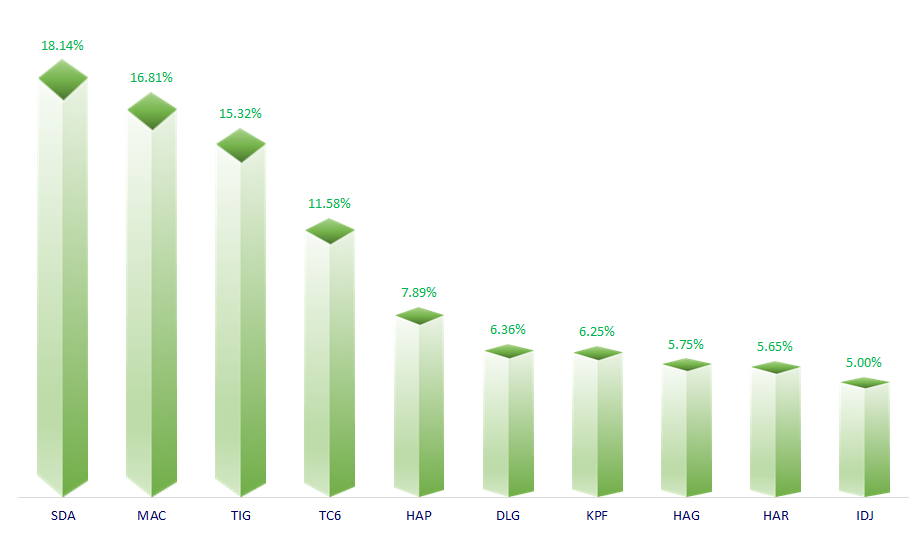

TOP INCREASES 3 CONSECUTIVE SESSIONS

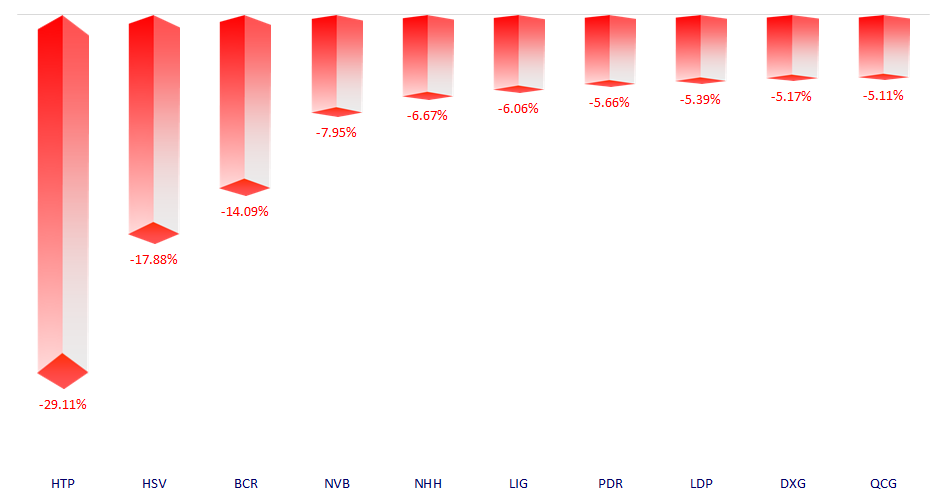

TOP DECREASES 3 CONSECUTIVE SESSIONS

Pinetree Securities Corporation

-

Zalo OA: Chứng khoán Pinetree

-

Fanpage: Chứng khoán Pinetree

-

Youtube channel: Pinetree Securities

The posts are using photos and images from freepik and other free image stock websites.